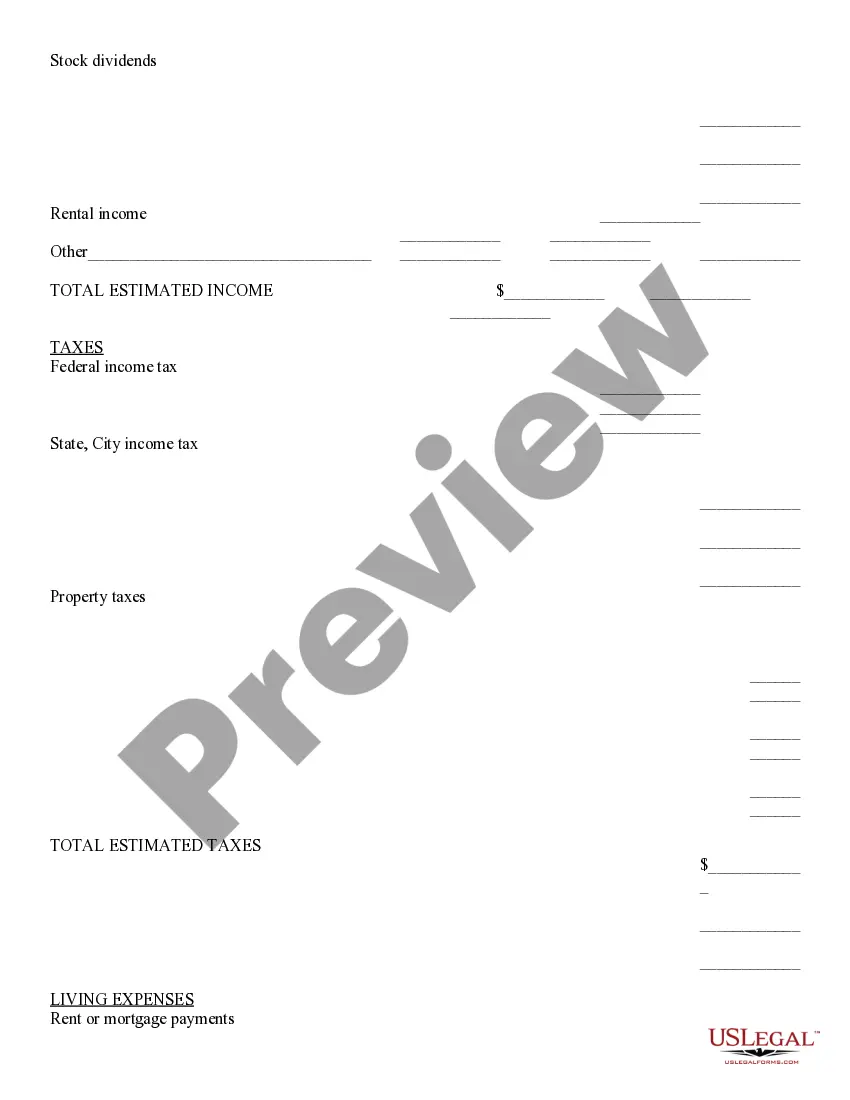

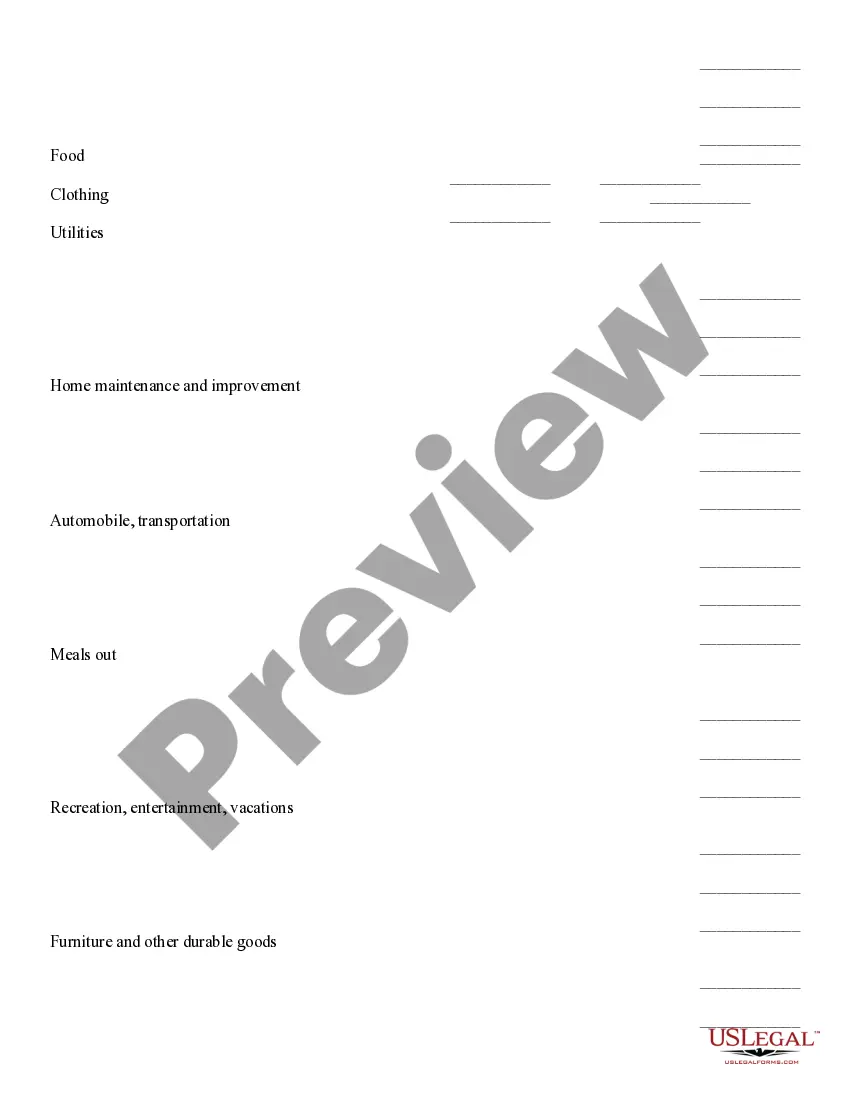

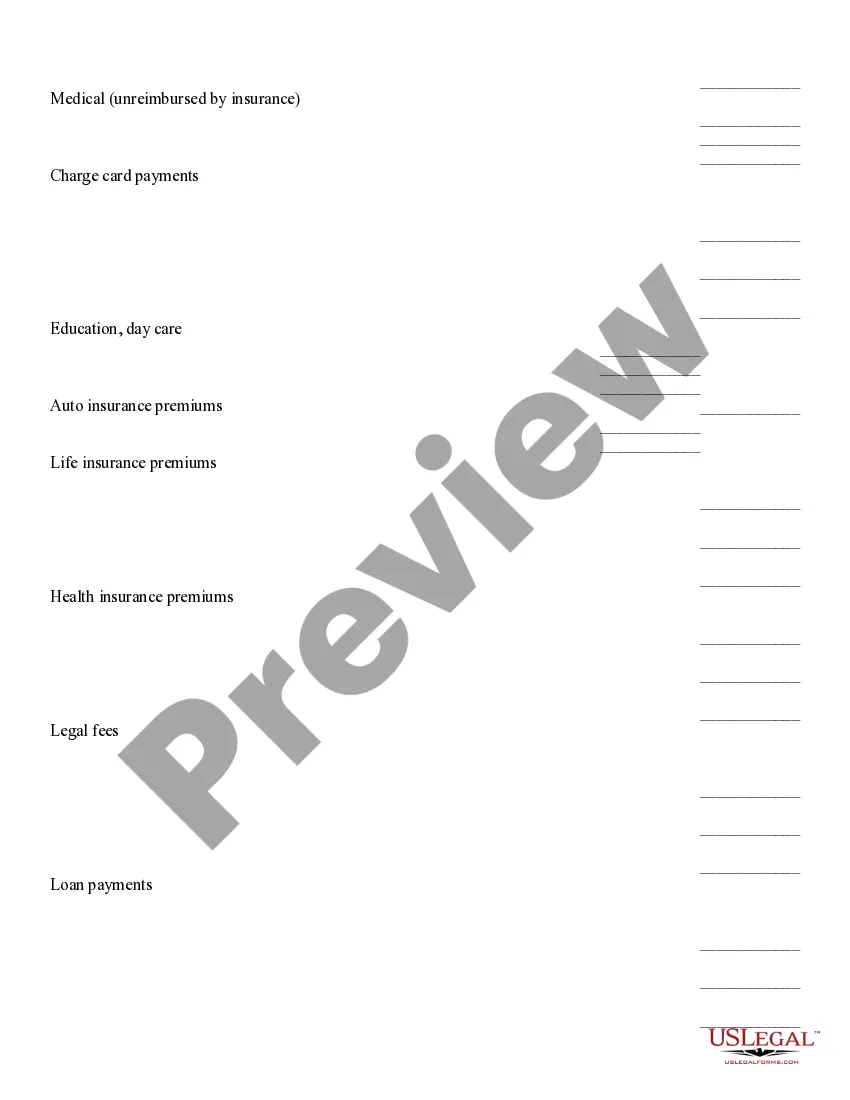

Ohio Retirement Cash Flow

Description

How to fill out Retirement Cash Flow?

Are you currently in a scenario where you need documents for either business or personal purposes every day.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, such as the Ohio Retirement Cash Flow, designed to comply with state and federal regulations.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Ohio Retirement Cash Flow whenever necessary; just click the desired form to download or print the document template. Use US Legal Forms, which has one of the largest selections of legal documents, to save time and minimize errors. The service provides professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Ohio Retirement Cash Flow template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

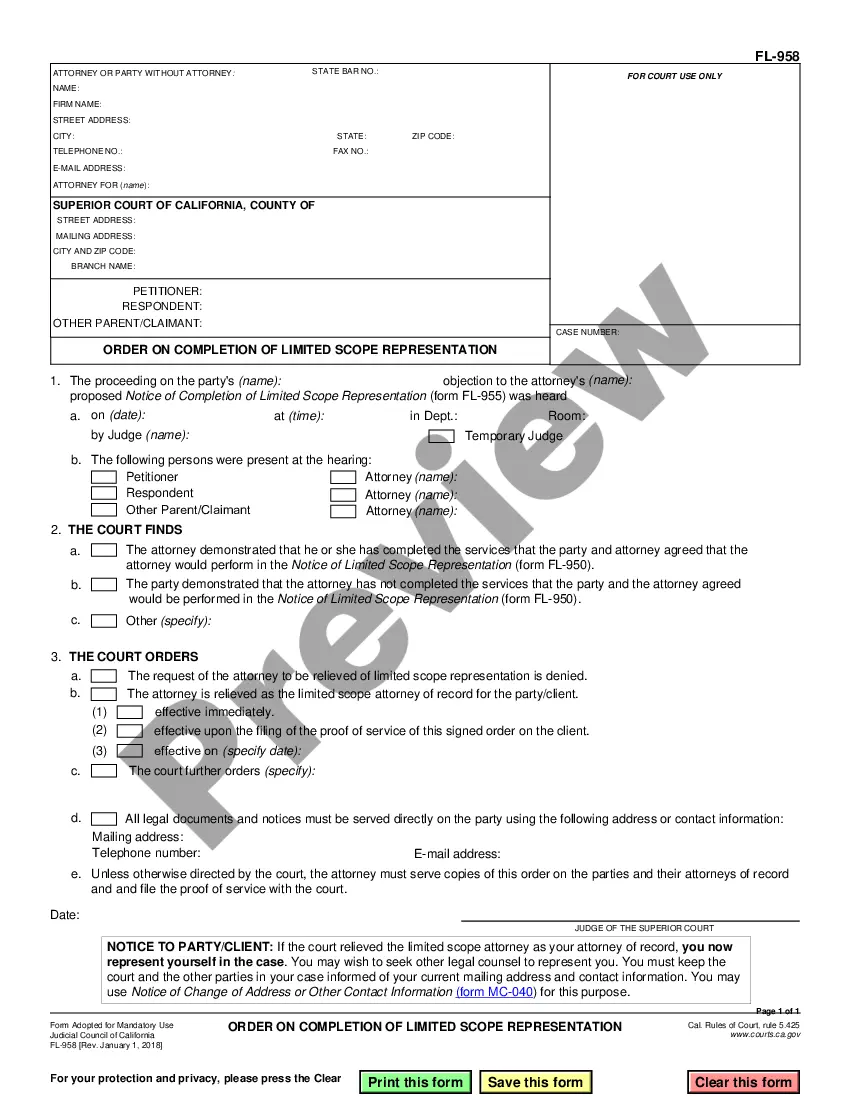

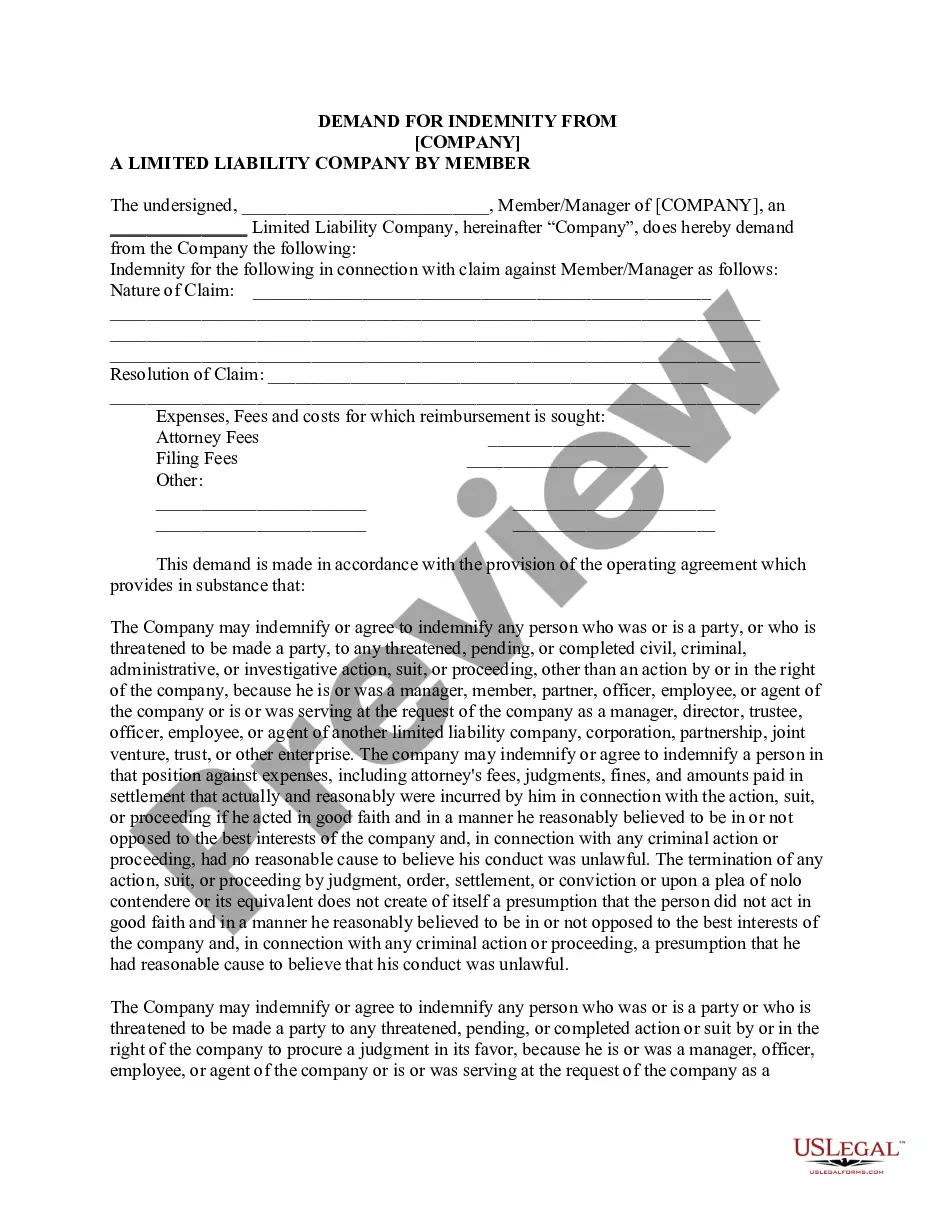

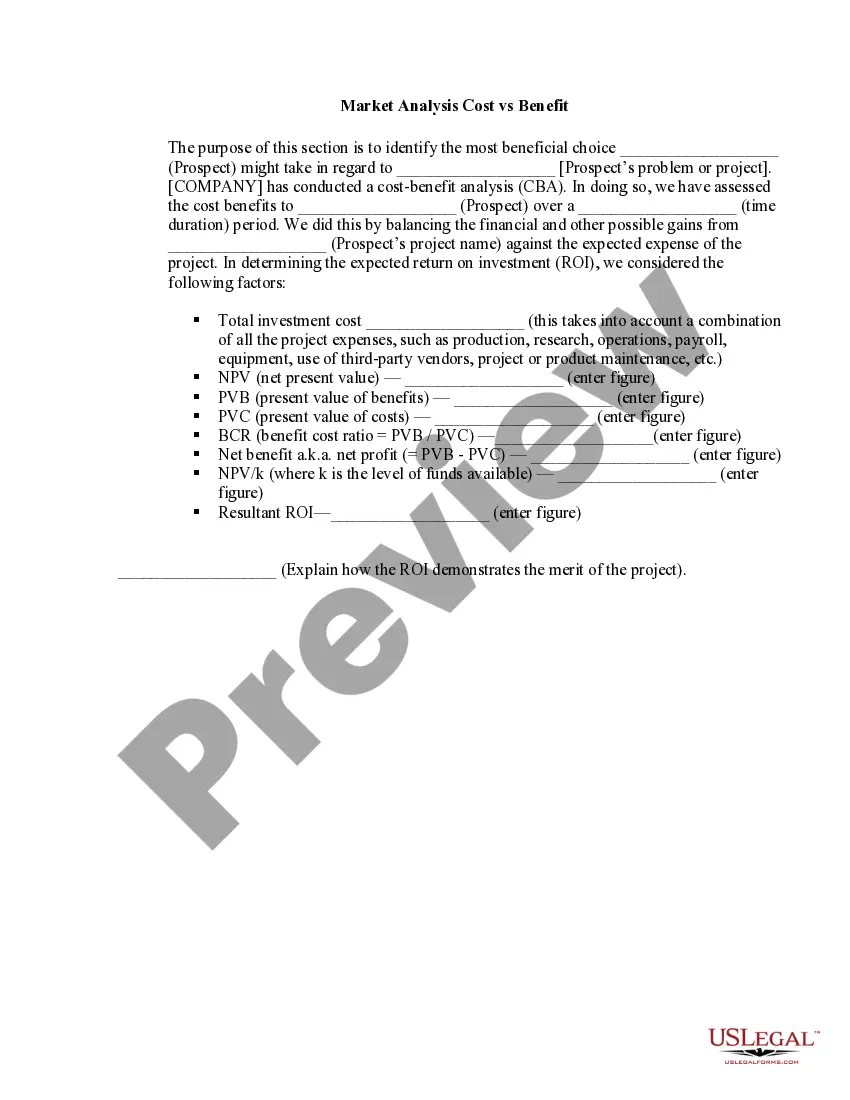

- Select the form you need and ensure it is for the correct city/county.

- Utilize the Review button to examine the form.

- Read the description to make sure you have selected the right document.

- If the form is not what you need, use the Search box to find the form that meets your requirements.

- Once you find the correct form, click Buy now.

Form popularity

FAQ

Pension payments are made for the rest of your life, no matter how long you live, and can possibly continue after death with your spouse. Lump-sum payments give you more control over your money, allowing you the flexibility of spending it or investing it when and how you see fit.

If you choose to have your withdrawal paid directly to you: Your payment will be taxed in the year it is issued. STRS Ohio will withhold federal tax at a rate of 20%. If you receive the payment before age 59-1/2, you may have to pay a 10% tax penalty for an early withdrawal.

The Traditional Pension Plan is a defined benefit plan that provides fixed, monthly lifetime retirement benefits. Your benefit is determined by a formula that rewards you for working longer the more years you work, the bigger your monthly payment.

OPERS members contribute to a pension in lieu of Social Security. Their employers also contribute to their retirement account, in varying amounts depending on the job the employees perform.

Ohio is a tax-friendly state for retirees. Even though the state does tax income from pensions or retirement accounts (like a 401(k) or an IRA), there are credits available. And, Social Security retirement benefits are fully exempt from state income taxes.

Generally, retirement income included in federal adjusted gross income is subject to Ohio income tax. Ohio then provides a credit based on the taxpayer's retirement income. However, some types of retirement income are deductible in determining Ohio adjusted gross income, and thus are not subject to tax.

1 Does Ohio tax retirement income? Generally, retirement income included in federal adjusted gross income is subject to Ohio income tax.

Ohio is moderately tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are fully taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.90%.

With a graded vesting schedule, your company's contributions must vest at least 20% after two years, 40% after three years, 60% after four years, 80% after five years and 100% after six years. If enrollment is automatic and employer contributions are required, they must vest within two years.

The Traditional Pension Plan is a defined benefit plan that provides fixed, monthly lifetime retirement benefits. Your benefit is determined by a formula that rewards you for working longer the more years you work, the bigger your monthly payment.