Tennessee Agreement between Co-lessees as to Payment of Rent and Taxes

Description

How to fill out Agreement Between Co-lessees As To Payment Of Rent And Taxes?

You may invest hrs on-line looking for the legal papers format that meets the state and federal specifications you need. US Legal Forms gives a huge number of legal types which can be analyzed by professionals. It is simple to download or printing the Tennessee Agreement between Co-lessees as to Payment of Rent and Taxes from the assistance.

If you already possess a US Legal Forms account, you are able to log in and then click the Acquire option. Next, you are able to full, revise, printing, or signal the Tennessee Agreement between Co-lessees as to Payment of Rent and Taxes. Each legal papers format you get is yours permanently. To obtain another duplicate for any obtained form, proceed to the My Forms tab and then click the related option.

If you are using the US Legal Forms web site the very first time, stick to the basic directions beneath:

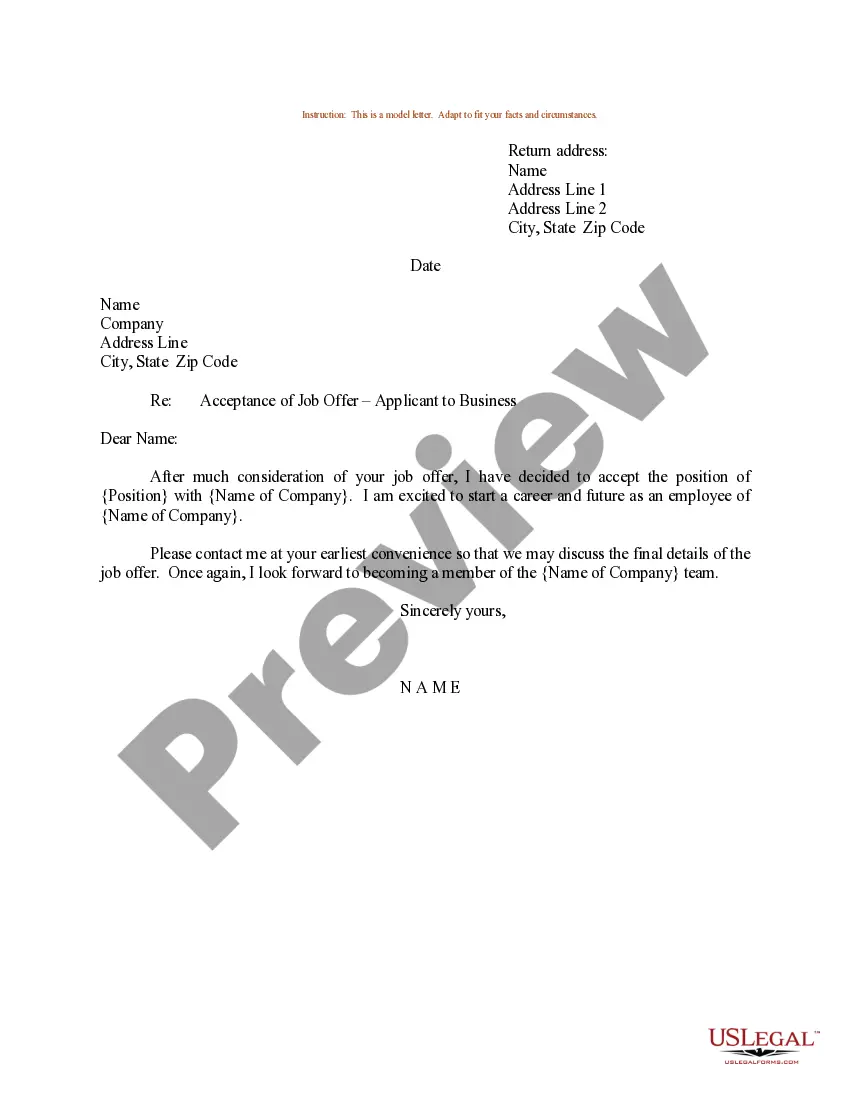

- Very first, make certain you have chosen the best papers format for that area/metropolis of your choosing. Read the form outline to make sure you have picked the proper form. If available, utilize the Review option to look with the papers format at the same time.

- If you wish to find another model of the form, utilize the Look for area to get the format that meets your needs and specifications.

- After you have found the format you would like, click Purchase now to proceed.

- Select the pricing program you would like, type in your references, and register for your account on US Legal Forms.

- Full the purchase. You may use your Visa or Mastercard or PayPal account to pay for the legal form.

- Select the format of the papers and download it to the system.

- Make modifications to the papers if necessary. You may full, revise and signal and printing Tennessee Agreement between Co-lessees as to Payment of Rent and Taxes.

Acquire and printing a huge number of papers templates using the US Legal Forms web site, that provides the largest collection of legal types. Use expert and condition-certain templates to take on your organization or specific requirements.

Form popularity

FAQ

Definition and Examples of Lessor A lessor in an agreement to rent something is generally the person who owns the asset. Usually, a lessor issues a lease agreement to allow a lessee, the person using the asset, to live in a property or drive a car for a period of months or years.

You cannot be evicted without notice. The landlord cannot change the locks or shut off your utilities to make you leave. Most of the time, a landlord needs to go to court before evicting you.

A lease agreement is an arrangement between two parties ? lessor and lessee, by which the lessor allows the lessee the right to use a property owned or managed by the lessor for a specified period of time, in exchange for periodic payment of rentals. The agreement does not provide ownership rights to the lessee.

Lessors and lessees enter into a binding contract, known as the lease agreement, that spells out the terms of their arrangement. While any sort of property can be leased, the practice is most commonly associated with residential or commercial real estate?a home or office.

For example, if a car dealership leases a vehicle to someone, the car is the asset. The person renting the car is the lessee and the dealership is the lessor. The lessee pays the dealership, or lessor, for the right to use the vehicle for an agreed-upon amount of time.

Under ASC 842, there are three types of lessor leases: Direct Financing ? lessors are required to establish a lease receivable and interest income. Sales Type ? lessors are required to establish a lease receivable and interest income. ... Operating ? lessors recognize income on a straight-line basis.

Here are our top 8 sections to include in your commercial property proposal: Lease Term or Lease Type: ... Rent Obligations: ... Security Deposit: ... Permitted Use or Exclusive Use Clauses: ... Maintenance and Utilities: ... Personal Guarantee: ... Amendments, Modifications, or Termination Clauses: ... Subleases:

What Is a Lessor? A lessor is essentially someone who grants a lease to someone else. As such, a lessor is the owner of an asset that is leased under an agreement to a lessee. The lessee makes a one-time payment or a series of periodic payments to the lessor in return for the use of the asset.