Ohio Revocable Trust for House

Description

How to fill out Revocable Trust For House?

If you wish to acquire, download, or print authorized record templates, utilize US Legal Forms, the largest collection of legal documents available online.

Employ the site's easy and user-friendly search feature to locate the documents you require.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you desire and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the Ohio Revocable Trust for Property with just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and then click the Download button to find the Ohio Revocable Trust for Property.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

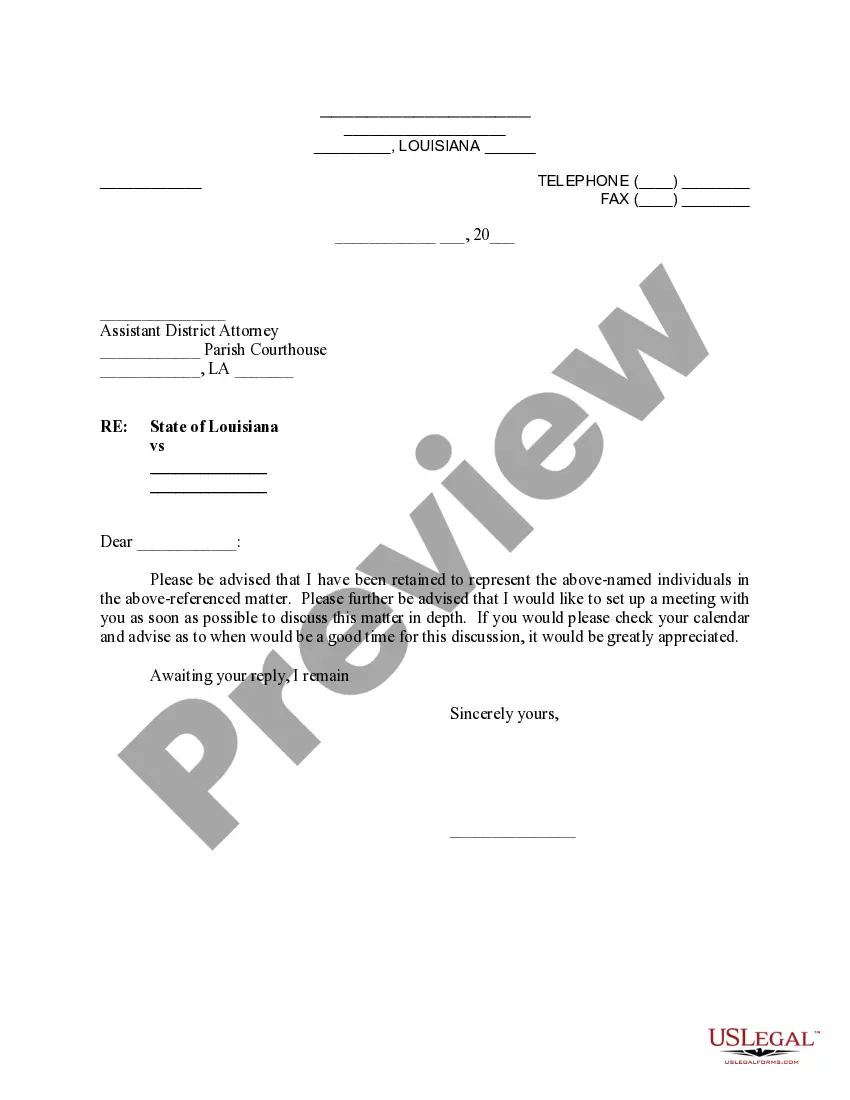

- Step 2. Use the Review option to examine the form's contents. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form format.

Form popularity

FAQ

Placing your house in an Ohio Revocable Trust for House can offer several advantages, such as avoiding probate and ensuring a smooth transfer of property upon your passing. It allows you to maintain control over the property while providing clarity for your heirs. Additionally, a revocable trust can simplify the management of your assets should you become incapacitated. To find tailored solutions, explore resources available on USLegalForms, which can help you make informed decisions.

Having an Ohio Revocable Trust for House does not protect your home from Medicaid claims if you need long-term care. As the trust is revocable, you still retain control over it, meaning Medicaid can consider the house as an asset when determining your eligibility for benefits. It is essential to understand that Medicaid may seek to recover costs from your estate after your death. To navigate these complex rules, consider using a reputable platform like USLegalForms for guidance.

To place your house in an Ohio Revocable Trust for House, you typically need to draft the trust document and transfer the property title. This process often involves filing specific legal paperwork and ensuring compliance with state laws. Platforms like uslegalforms can simplify this process with valuable resources and documents.

An Ohio Revocable Trust for House is highly recommended for managing property effectively. This type of trust allows you to maintain control while providing benefits like avoiding probate. Selecting the right trust is vital for protecting your assets and ensuring smooth transitions for your heirs.

One major mistake parents often make is not clearly defining the terms or beneficiaries of their Ohio Revocable Trust for House. Vague instructions can lead to confusion or disputes among heirs. It is essential to seek guidance to construct a trust that accurately reflects your intentions.

Not all assets should be in an Ohio Revocable Trust for House. Generally, assets like retirement accounts, life insurance policies, and certain investments might be better managed outside of a trust. It is wise to consult an expert to ensure your estate plan aligns with your financial goals.

Yes, you can place your house in an Ohio Revocable Trust for House even if it has a mortgage. However, the lender may require notification about the transfer. It is crucial to review the mortgage documents for any specific clauses regarding the assignment of your property to a trust.

While an Ohio revocable trust offers benefits, it also has some disadvantages. For instance, creating and managing a trust can involve legal fees and additional paperwork. Additionally, you may lose certain tax benefits associated with homeownership. It’s crucial to weigh these factors and consult with a legal professional or use USLegalForms to determine the best course of action for your situation.

To place your house in an Ohio revocable trust, begin by creating the trust document, detailing the terms and designating a trustee. Next, you will need to transfer the title of your home into the trust’s name, which generally involves a deed transfer. Once completed, ensure you file any required paperwork with the county recorder's office. For guidance throughout this process, consider using USLegalForms as a reliable resource.

Putting a house in an Ohio revocable trust can provide flexibility and control over your property. It allows you to manage your home during your lifetime and specifies how it will be handled after your passing. This type of trust can help avoid probate, saving your loved ones time and costs. Moreover, it allows you to modify or revoke the trust at any time, ensuring it meets your needs.