Ohio Sample Letter for Compromise on a Debt

Description

How to fill out Sample Letter For Compromise On A Debt?

Are you currently in a situation where you frequently require documents for either professional or personal purposes.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, including the Ohio Sample Letter for Compromise on a Debt, designed to meet state and federal requirements.

Once you find the correct form, click on Buy now.

Select the pricing plan you prefer, fill out the necessary details to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Ohio Sample Letter for Compromise on a Debt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for the correct city/region.

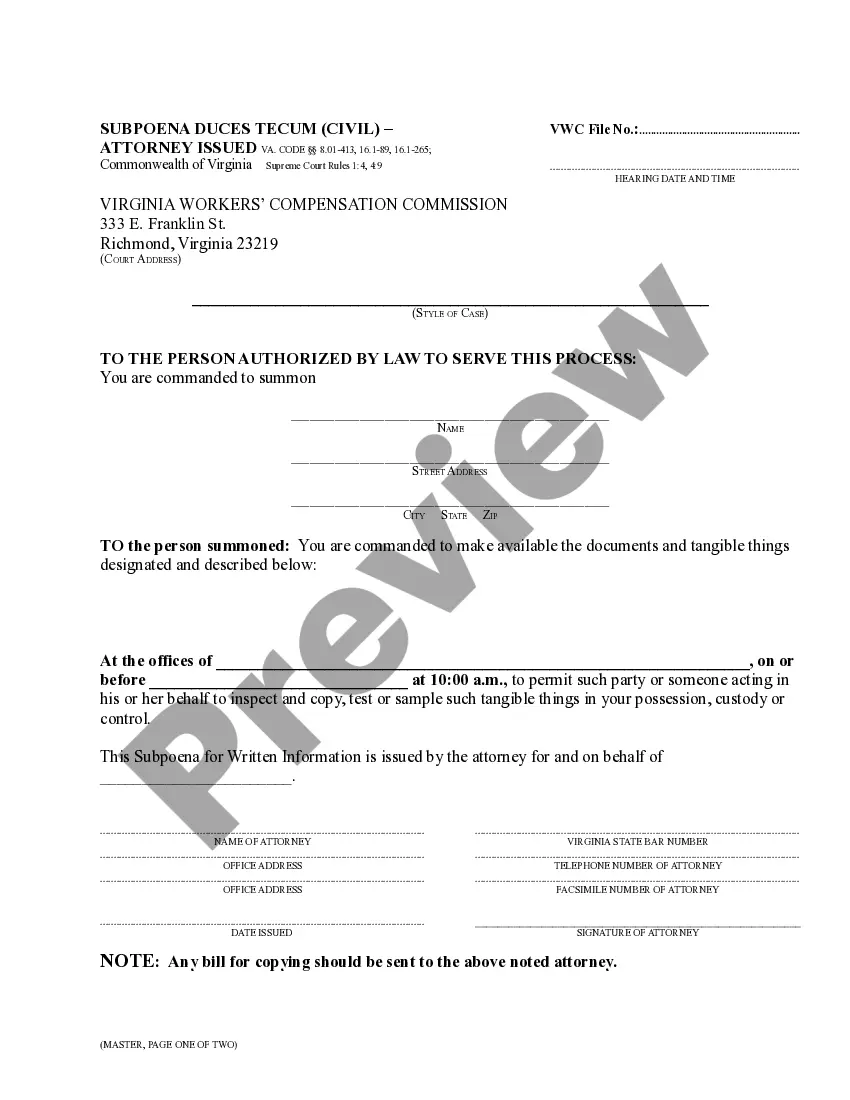

- Use the Preview button to examine the form.

- Read the description to ensure you have chosen the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that fits your needs and specifications.

Form popularity

FAQ

A dispute letter for a debt is a formal document where you outline your reasons for disputing a debt. In these letters, you can include details such as inaccuracies in the amount owed or the legitimacy of the debt itself. You might combine this letter with an Ohio Sample Letter for Compromise on a Debt to offer a solution or payment arrangement. This approach not only addresses the dispute but also seeks to resolve the matter amicably.

Debt collectors cannot harass you or use threatening behavior to collect debts. They also cannot disclose your debt status to third parties without your consent. Understanding these prohibitions empowers you to take control of your situation. If you face harassment, consider utilizing an Ohio Sample Letter for Compromise on a Debt to formally address the situation while protecting your rights.

The 7 7 7 rule refers to specific guidelines that limit the actions debt collectors can take. Under this rule, collectors must wait at least seven days after initial contact before making further attempts to collect a debt. This helps to give you time to respond or consider using an Ohio Sample Letter for Compromise on a Debt to negotiate terms. Knowing these rules helps protect your rights while dealing with debt.

To write an answer to a summons for debt, clearly state your defenses, respond to each claim made, and include any relevant facts. Ensure that you follow court requirements for formatting and submission. Timeliness is key, so file your answer as soon as possible. Consider using an Ohio Sample Letter for Compromise on a Debt if you're planning to negotiate a resolution alongside your answer.

Typically, you might offer between 30% to 70% of your outstanding debt. Your offer should depend on factors such as your financial capacity and the debt's age. Research the creditor’s history with settlements to gauge an appropriate figure. Utilize an Ohio Sample Letter for Compromise on a Debt to present your settlement offer professionally.

When negotiating a debt settlement, express your willingness to resolve the debt while stating a reasonable offer. Clearly outline your financial situation and why your offer is fair. Establishing a respectful tone encourages cooperation. Use an Ohio Sample Letter for Compromise on a Debt as a guide to articulate your proposal clearly.

Responding to a debt collector's lawsuit requires prompt action. File an answer outlining all relevant defenses and possibly counterclaims. It's beneficial to review the debt's validity. If you wish to negotiate a settlement, reference an Ohio Sample Letter for Compromise on a Debt to draft your communication effectively.

To respond to a summons in Ohio, you must file an answer with the court and serve the plaintiff or their attorney. Be sure to include your defense or any counterclaims in your response. It’s crucial to do this within the timeframe specified in the summons. Utilize an Ohio Sample Letter for Compromise on a Debt if your response involves negotiating with the creditor.

To write a letter requesting proof of debt, clearly state your name, contact information, and the details of the debt you are questioning. Reference the Right to Request Validation and mention your intention to dispute the debt formally. An Ohio Sample Letter for Compromise on a Debt can serve as a useful template to ensure you ask for all necessary documentation. Being precise in your request not only clarifies your position but also prompts the creditor to provide you with the needed information.

A debt relief letter is a formal request to a creditor to agree to reduce the amount owed or offer some form of debt forgiveness. It typically includes your personal details and a clear explanation of your financial hardship. Using an Ohio Sample Letter for Compromise on a Debt can help you express your request in a compelling manner. This document is crucial in negotiating terms that facilitate financial relief.