Massachusetts Seller's Affidavit of Nonforeign Status

Description

How to fill out Seller's Affidavit Of Nonforeign Status?

Are you currently within a situation where you will need documents for either enterprise or individual functions virtually every day? There are tons of lawful papers layouts available online, but finding kinds you can rely is not effortless. US Legal Forms delivers a large number of kind layouts, such as the Massachusetts Seller's Affidavit of Nonforeign Status, that happen to be created to fulfill federal and state demands.

When you are already knowledgeable about US Legal Forms web site and possess a merchant account, basically log in. After that, you can down load the Massachusetts Seller's Affidavit of Nonforeign Status template.

Should you not have an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you need and ensure it is for that correct city/state.

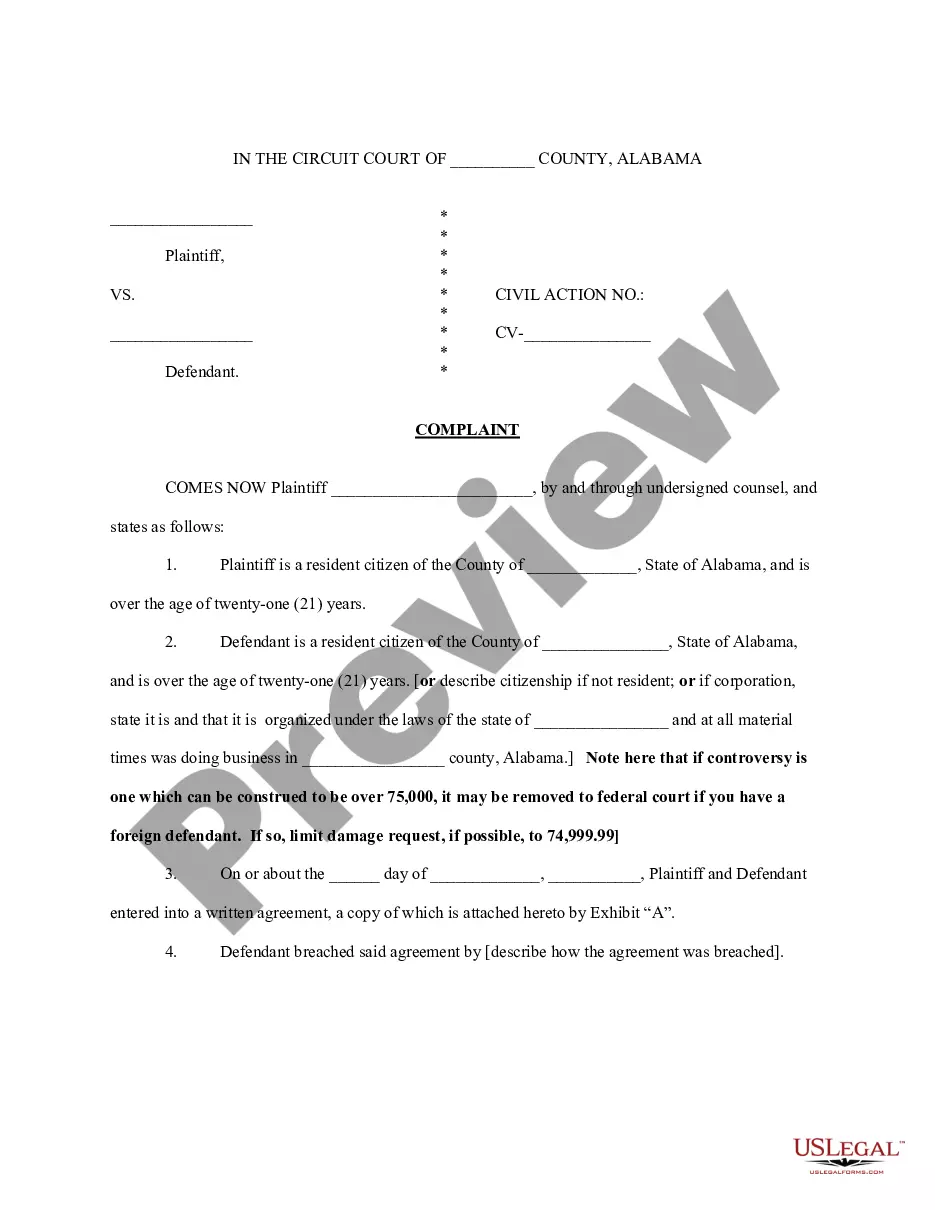

- Utilize the Review key to analyze the shape.

- Read the description to actually have selected the correct kind.

- If the kind is not what you are trying to find, use the Look for area to find the kind that suits you and demands.

- Once you find the correct kind, simply click Buy now.

- Opt for the prices program you need, submit the desired info to create your bank account, and pay money for your order using your PayPal or bank card.

- Decide on a practical file formatting and down load your copy.

Find each of the papers layouts you may have bought in the My Forms food list. You can get a further copy of Massachusetts Seller's Affidavit of Nonforeign Status at any time, if possible. Just select the necessary kind to down load or produce the papers template.

Use US Legal Forms, the most extensive selection of lawful kinds, in order to save time as well as steer clear of blunders. The assistance delivers expertly produced lawful papers layouts that can be used for a selection of functions. Create a merchant account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

Qualified Substitute is the Default. The seller will then manually complete Paragraph 3B and provide the form to the title or escrow company acting as the qualified substitute. The title or escrow company may use C.A.R. Form QS, or its own form, to satisfy its obligation to notify the buyer.

The Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) establishes that persons purchasing U.S. real property interests from foreign individuals must withhold 10% of the gross amount realized on the transaction.

Certification of Non-Foreign Status FIRPTA is the Foreign Investment in Real Property Act. If you are selling real estate in the United States, the IRS requires certain disclosures to avoid non-U.S. Persons from escape U.S. Tax on the sale of U.S. Real Estate.

With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign.

The Seller's Affidavit of Non-Foreign Status ( AS-14) is used to document the exemption if the Seller is not a NRA. This can be signed by a: US citizen; US green card holder; or. Non-citizen who meets the substantial presence test (based on the number of days actually present in the US).