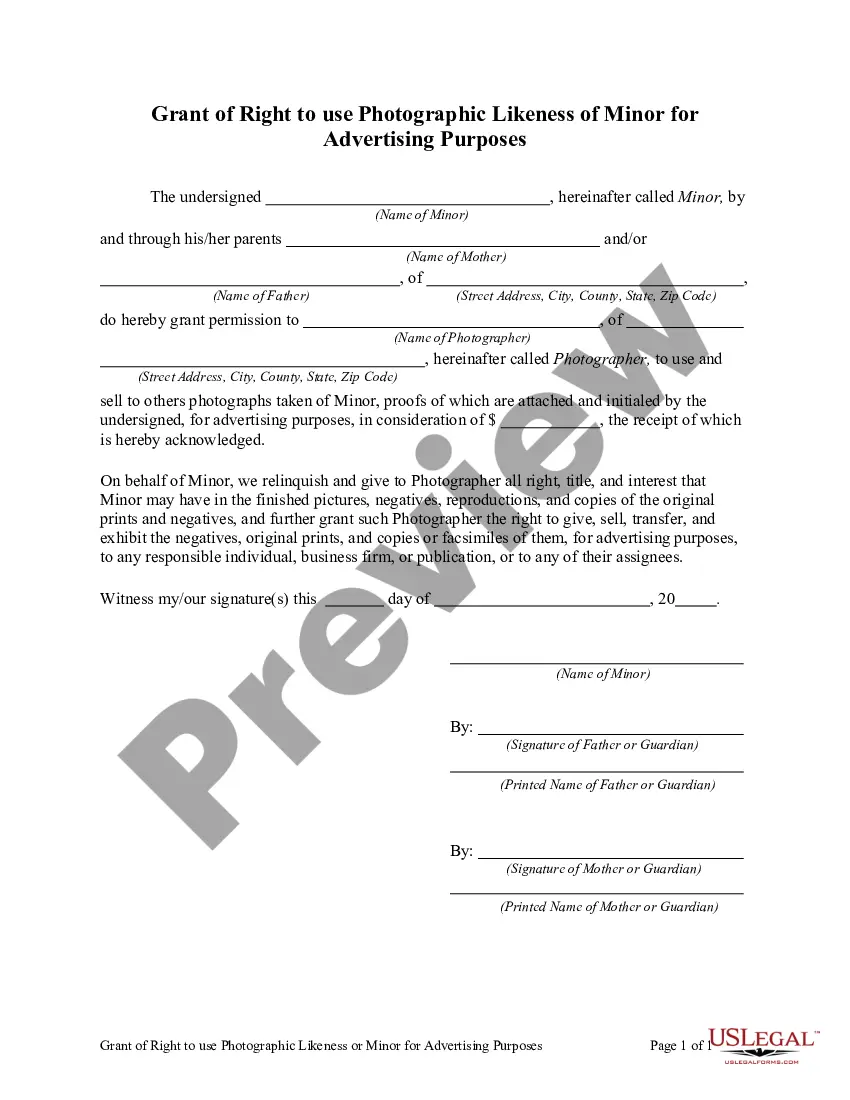

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

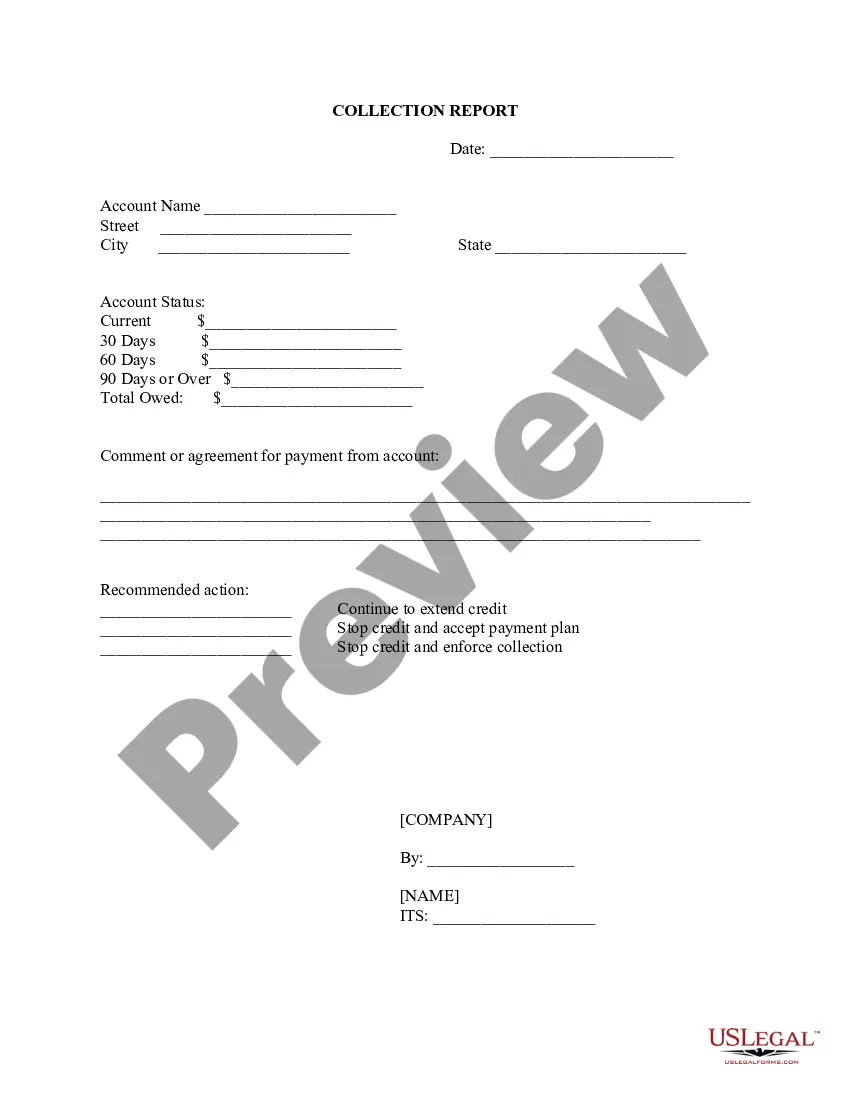

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

You can spend hours online searching for the legal document template that fits the state and federal criteria you require.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can download or print the Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust from the service.

If available, utilize the Review button to browse the document template as well.

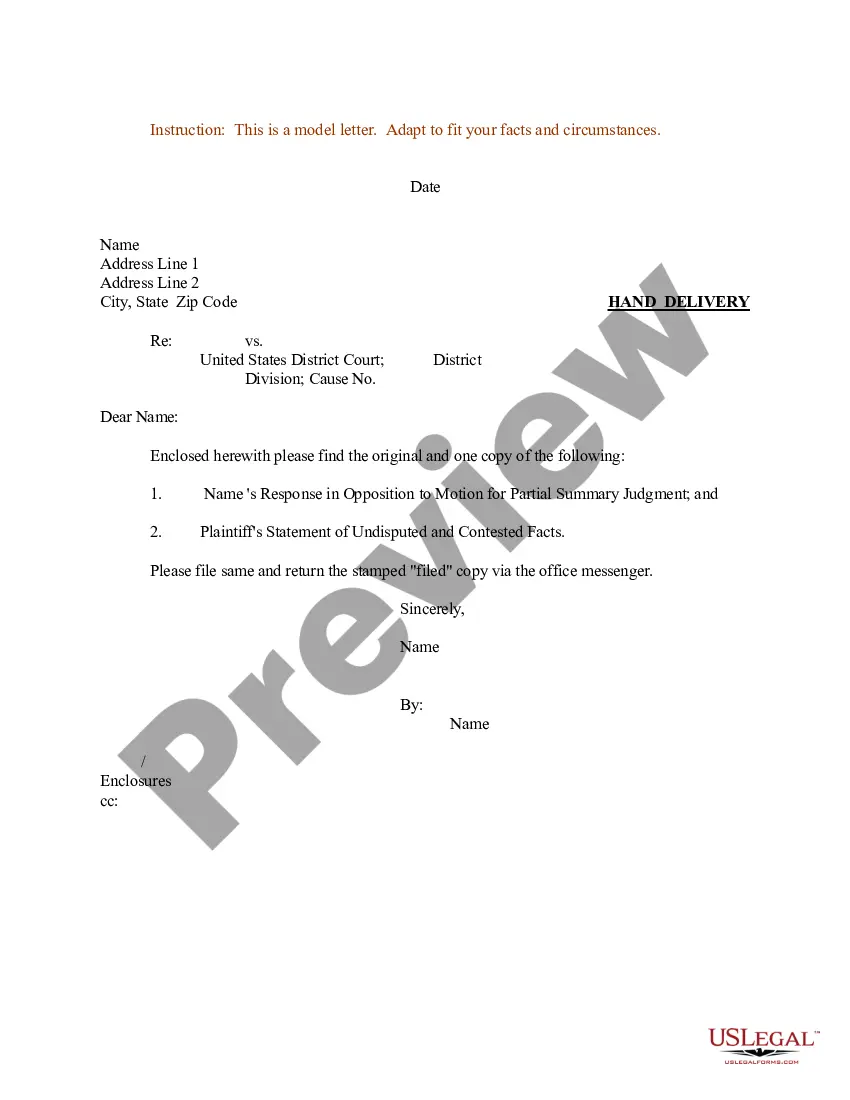

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- Next, you can complete, modify, print, or sign the Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust.

- Each legal document template you obtain is yours forever.

- To receive another version of any purchased form, go to the My documents tab and click on the corresponding button.

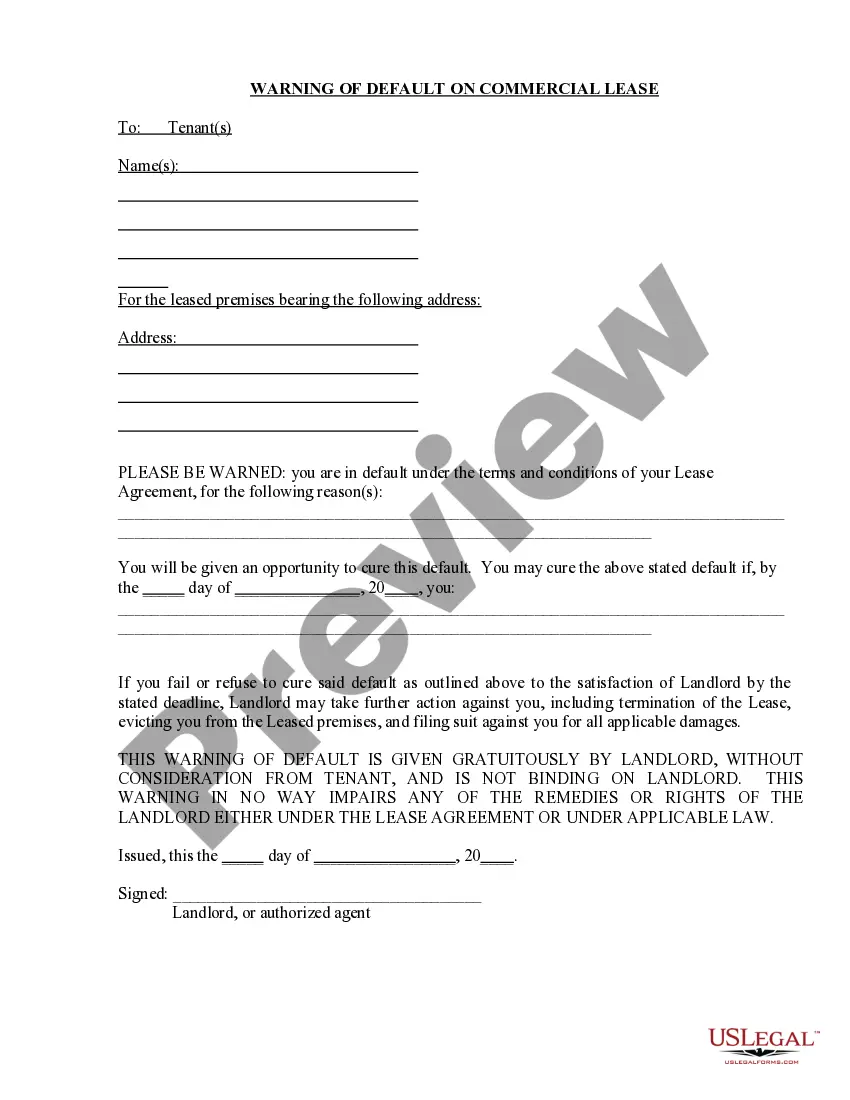

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Check the form description to make sure you have chosen the right one.

Form popularity

FAQ

The distribution of income from a trust refers to the process where the trustee allocates earnings from the trust's assets to designated beneficiaries. In the context of Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust, this process allows beneficiaries to receive a specified percentage of the trust's income regularly. Understanding this distribution is essential for managing financial expectations and planning for future needs. If you want to ensure compliance and clarity in your trust arrangements, consider using US Legal Forms to help with the necessary documents.

Absolutely, beneficiaries can request to see the trust document in Ohio. This request is a right that allows beneficiaries to understand the trust's terms, including how an Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust impacts them. The trustee is obligated to respond to these requests in a timely manner. For assistance and detailed documentation, US Legal Forms is a helpful resource.

Yes, the executor must provide beneficiaries with a copy of the will in Ohio. This ensures that beneficiaries understand their entitlements and rights, particularly when it comes to understanding any trust provisions like the Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust. Clear communication is key in this process. If you encounter issues, turn to US Legal Forms for guidance and documentation support.

Generally, trusts are not public records in Ohio unless mandated by specific legal proceedings. However, certain aspects of trusts, such as the Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust, may require disclosure to beneficiaries. For privacy, you should consult legal professionals to understand your rights regarding trust disclosure. US Legal Forms can assist you in navigating any legal paperwork related to trust management.

Beneficiaries are indeed entitled to obtain a copy of the trust in Ohio. This ensures transparency and allows beneficiaries to be aware of their rights and distributions, which might include an Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust. The trustee is responsible for sharing this vital information. If you need authoritative assistance, US Legal Forms offers resources to help clarify these rights.

Yes, beneficiaries in Ohio have the right to receive a copy of the trust document. This entitlement extends to understanding how the trust operates, especially concerning the Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust. The trustee should provide this information to keep beneficiaries informed. If you have difficulty accessing this information, US Legal Forms can support you with necessary legal documents.

To apportion income to Ohio, you must determine the source of the income and its allocation. For the Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust, the income generated from the trust must be reported accordingly. Ensure you follow the state's tax rules and guidelines. If you need help, consider using US Legal Forms for accurate forms and resources.

The beneficiary income of a trust refers to the earnings distributed to individuals entitled to receive funds from the trust. This income can include interest, dividends, or rental income generated by the trust's assets. When considering an Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust, it's crucial to understand how these distributions impact both the beneficiary's finances and the overall trust management. Utilizing platforms like US Legal Forms can streamline the process, ensuring compliance and clarity in defining beneficiary income within your trust.

Yes, income from a trust is generally taxable to the beneficiary in Ohio. This income must be reported on the beneficiary's individual tax return. The specifics can depend on the nature of the income distributed as outlined by the Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust. Using resources like uslegalforms can help clarify these tax liabilities for beneficiaries.

To report a beneficiary's income, you need to file the appropriate tax forms, typically Form 1041 for trust income. Beneficiaries must receive a Schedule K-1, which details their share of the income. Ensuring accurate reporting is crucial, especially with an Ohio Assignment by Beneficiary of a Percentage of the Income of a Trust. Consulting with tax professionals can streamline this process and ensure compliance.