Idaho Partial Release of Property From Deed of Trust for Corporation

What this document covers

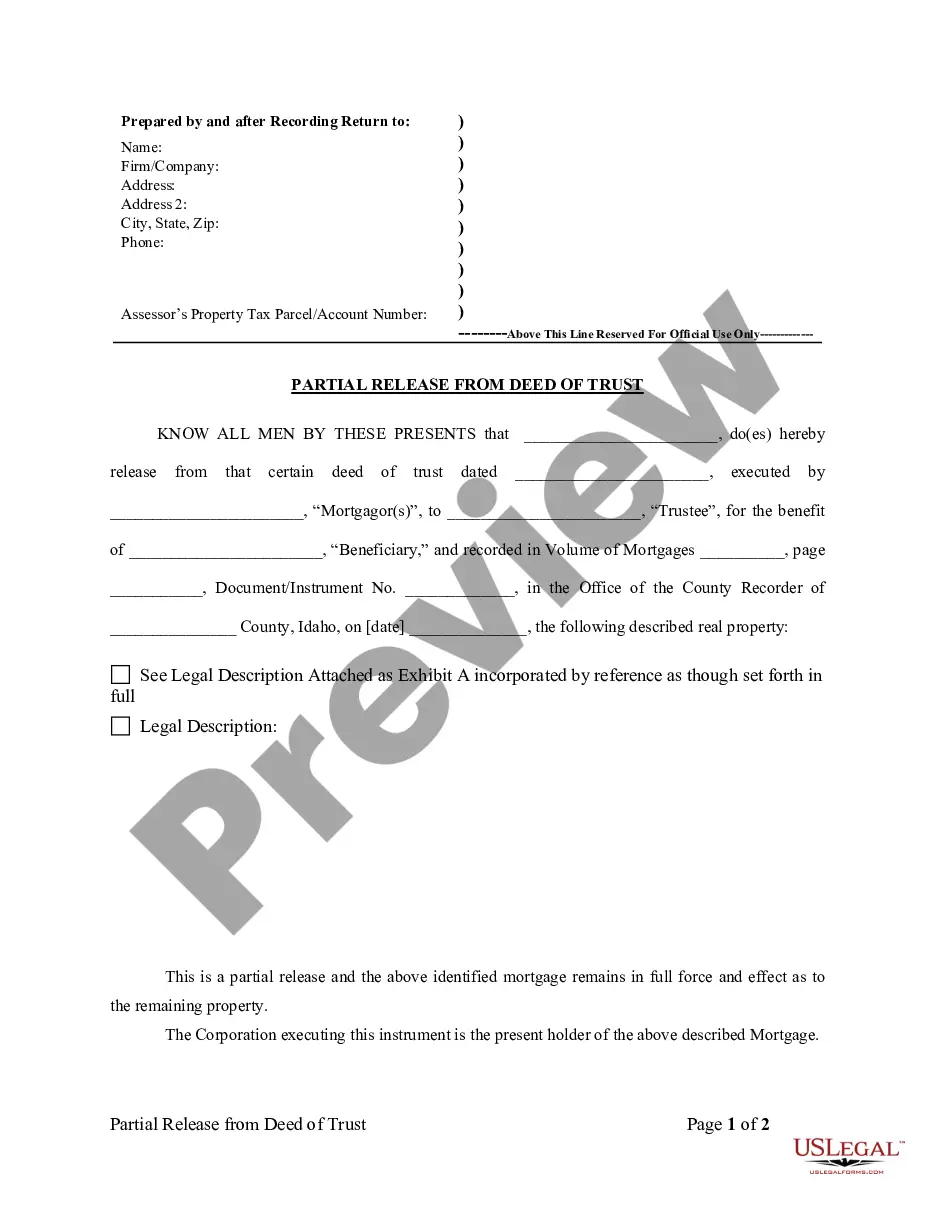

The Partial Release of Property From Deed of Trust for Corporation form is a legal document used to release a portion of the property secured by a deed of trust from the obligations of that deed. This form is distinct from a complete release as it only pertains to part of the property, making it ideal for corporations that need to secure funding against specific assets while retaining ownership of the rest. This ensures clarity in property transactions and helps protect the corporation's interests.

Form components explained

- Legal description of the property being released.

- Effective date of the release.

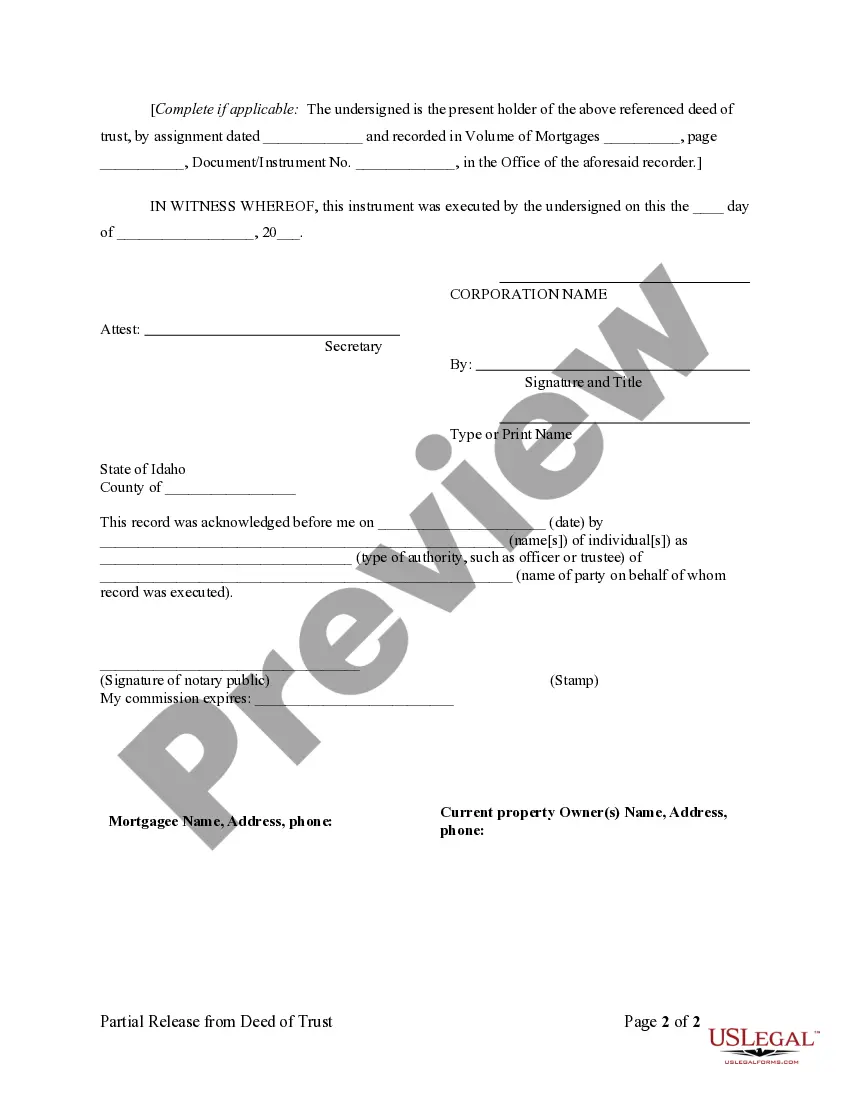

- Signatures of authorized representatives from the corporation.

- Witness or notary acknowledgment section.

- Reference to the original deed of trust.

When to use this document

This form is used in scenarios where a corporation intends to release a part of its property from a deed of trust. This typically occurs when a corporation has satisfied part of its debt obligations or wishes to refinance specific assets while maintaining ownership of the remaining property. Situations may include selling a portion of the property, modifying loan agreements, or acquiring additional financing using remaining secured assets as collateral.

Who can use this document

Eligible users of this form include:

- Corporations seeking to manage their property assets.

- Corporate real estate managers handling real estate transactions.

- Legal professionals representing corporations in property matters.

- Financial officers of corporations involved in refinancing or securing loans.

Completing this form step by step

- Identify the parties involved, including the corporation and the lender.

- Specify the property in detail using the legal description.

- Enter the date on which the release will take effect.

- Have authorized representatives of the corporation sign the document.

- If required, ensure the form is notarized or witnessed as appropriate.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Mistakes to watch out for

- Failing to provide a complete legal description of the property.

- Not obtaining the necessary signatures from authorized representatives.

- Missing the effective date or entering an incorrect date.

- Neglecting to have the document notarized when required.

Advantages of online completion

- Quick access to a legally compliant template drafted by licensed attorneys.

- Easy customization to suit specific business needs.

- Convenient downloading and printing options available.

- Cost-effective solution compared to hiring legal counsel for simple releases.

Form popularity

FAQ

As you stated in your question, it is recorded among the land records, and your lender keeps the original. When you pay off the loan, the lender will return the deed of trust with the promissory note. This document is rather lengthy and quite legalistic.

A deed of trust acts as an agreement between youthe homebuyerand your lender. It states not just that you'll repay the loan, but that a third party called the trustee will hold legal title to the property until you do. A deed of trust is the security for your loan, and it's recorded in the public records.

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.

A Deed of Trust is a three party document prepared, signed and recorded to secure repayment of a loan. The Borrower (property owner) is named as Trustor, the Lender is called the Beneficiary, and a third party is called a Trustee.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia,

A mortgage only involves two parties the borrower and the lender.A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid. In the event of default on the loan, the trustee is responsible for starting the foreclosure process.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

A deed conveys ownership; a deed of trust secures a loan.

Idaho is one of a handful of states that use deeds of trust as the primary form of financing purchases of real property. A deed of trust, similar to a mortgage, is a security instrument that, along with a promissory note, sets out the terms for repaying the loan used to purchase the property.