Ohio Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

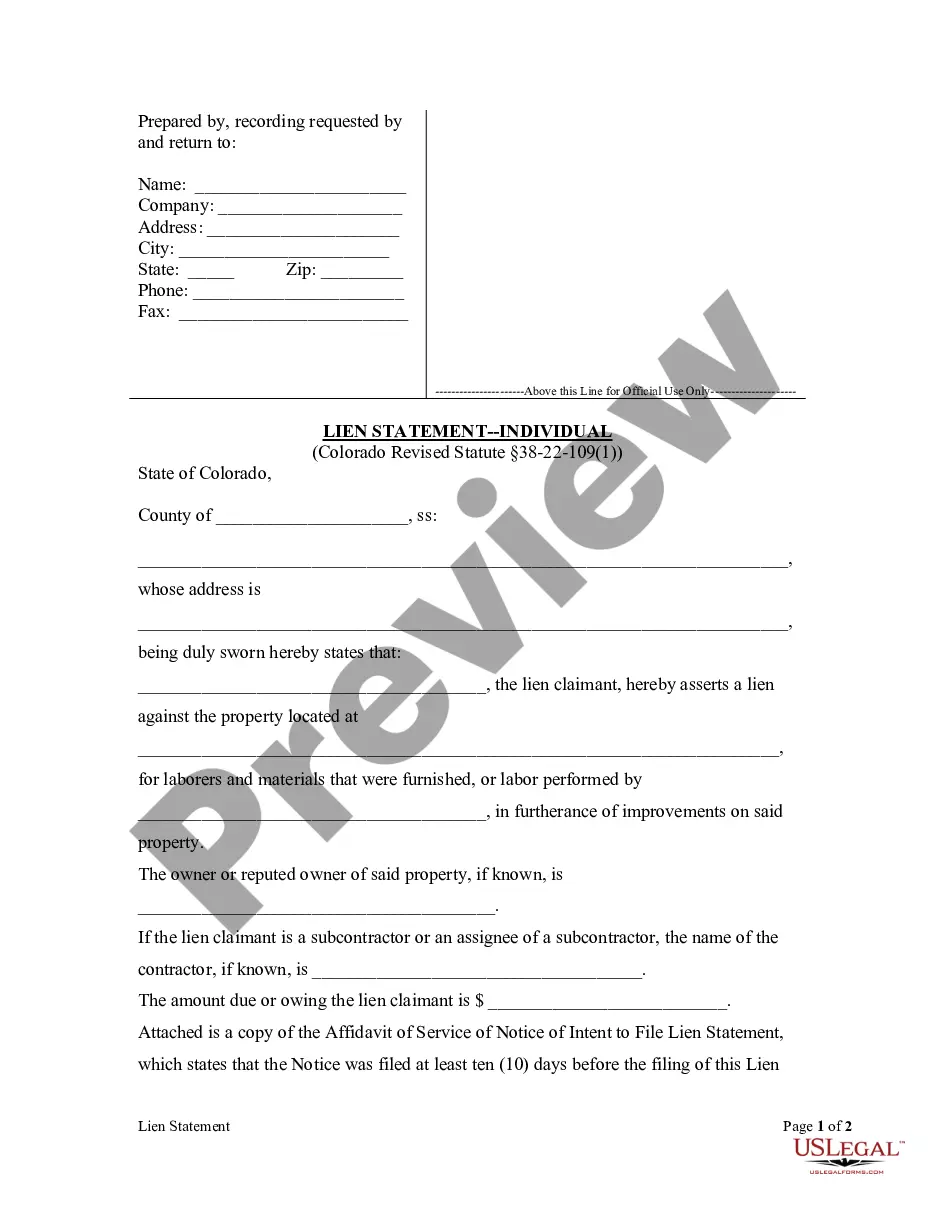

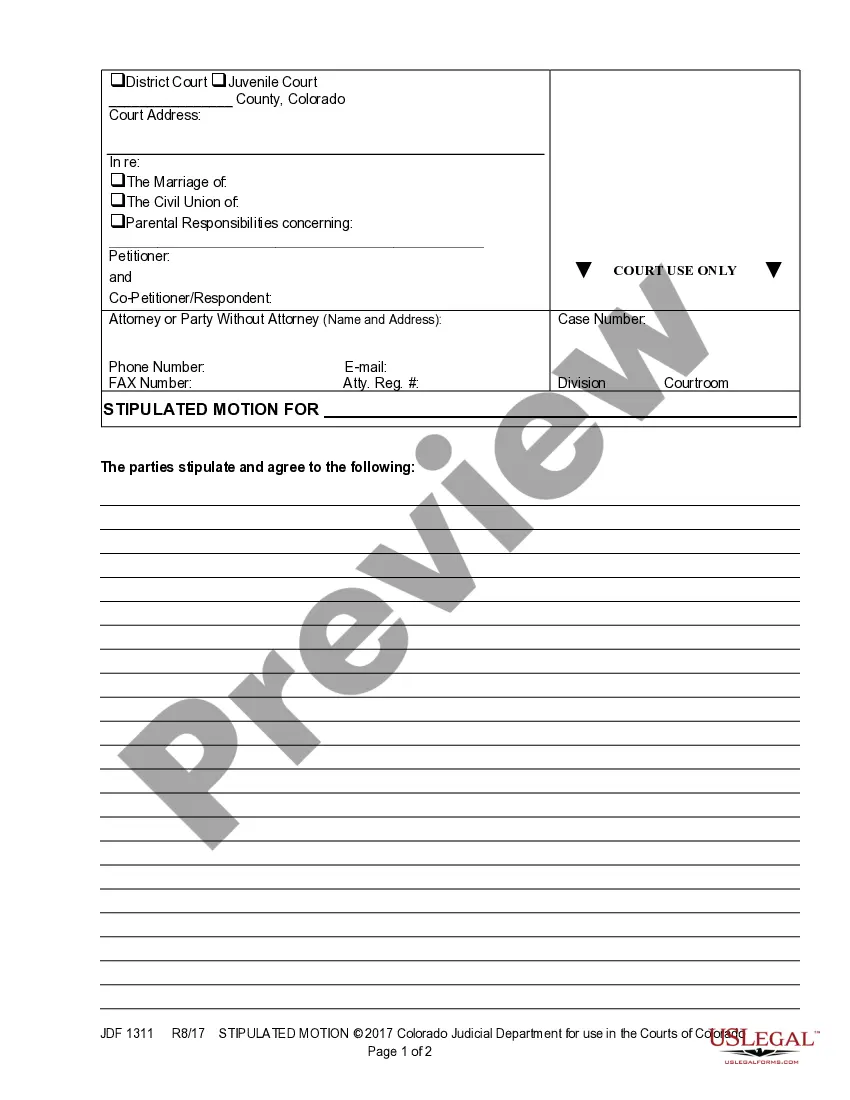

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

It is feasible to spend numerous hours online looking for the official document format that satisfies the federal and state requirements you need.

US Legal Forms offers a vast array of official templates that are vetted by experts.

You can download or print the Ohio Acknowledgment by Charitable or Educational Institution of Receipt of Gift from their service.

If available, utilize the Review button to examine the document format as well. If you wish to retrieve an additional version of your template, take advantage of the Search field to locate the format that fits your needs and specifications. Once you have found the format you desire, click Acquire now to proceed. Choose the pricing plan you require, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the official document. Select the format of your document and download it to your device. Make alterations to your document if necessary. You can complete, modify, sign, and print the Ohio Acknowledgment by Charitable or Educational Institution of Receipt of Gift. Access and print a multitude of document templates using the US Legal Forms website, which provides the largest collection of official templates. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the Ohio Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

- Every official document format you acquire is yours indefinitely.

- To obtain an additional copy of any downloaded template, visit the My documents section and click the corresponding button.

- If you are utilizing the US Legal Forms site for the first time, follow the simple instructions provided below.

- First, ensure you have selected the correct document format for the county/city of your choice.

- Review the document outline to make sure you have chosen the appropriate template.

Form popularity

FAQ

An example of a written acknowledgment for a charitable contribution might include a letter that states, 'Thank you for your generous donation of $500 to our organization on January 15, 2023. We confirm that no goods or services were exchanged for this contribution.' This type of acknowledgment not only fulfills IRS requirements but also aligns with the Ohio Acknowledgment by Charitable or Educational Institution of Receipt of Gift, reinforcing your commitment to transparency and compliance.

A contemporaneous written acknowledgment of a charitable gift is a document that confirms the receipt of a donation and is provided to the donor within a specific timeframe, typically before they file their tax returns. This acknowledgment serves to validate the donor's contribution and includes necessary details such as the donor's name, amount donated, and any conditions attached to the gift. This practice is crucial in relation to the Ohio Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

To acknowledge receipt of a donation, create a written letter or receipt that details the donor's name, the date of the donation, and the value of the contribution. It's essential to include a statement confirming that the donor received no goods or services in return for the donation. This practice aligns with the Ohio Acknowledgment by Charitable or Educational Institution of Receipt of Gift, providing clarity and assurance to your donors.

To acknowledge a gift from a donor-advised fund, you should provide a formal written acknowledgment that meets IRS requirements. This acknowledgment should include the name of the donor, the amount of the gift, and a statement that no goods or services were provided in exchange for the donation. By following these guidelines, you ensure compliance with the Ohio Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

Sample Donor Acknowledgement Letter for Cash Donation Dear [DONOR NAME], Thank you for your generous donation to [ORGANIZATION NAME], a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code ([EIN #]). On [DATE], you made a contribution of [AMOUNT] in support of our mission.

Let's say you received $10,000 worth of legal services, here's how you could record that donation: Record the $10,000 donation to a revenue account (example: ?In-Kind Gift Revenue: Service?) Then, record the expense side of the transaction in its appropriate functional expense account (example: ?Professional Services?)

A donation acknowledgment letter (sometimes called a donation receipt or thank-you letter) is an email or paper that recognizes a charitable contribution. At a bare minimum, it's a confirmation receipt to your donors acknowledging you've received their donation.

A gift of stock is a donation of property. If a charity receives a gift of publicly traded stock, the charity should send the donor an acknowledgement letter that describes the stock (i.e., ?Thank you for your donation of 100 shares of XYZ Corporation?) but does not place a monetary value on the shares.

Generic donation thank you quotes ?Thank you so much for your donation. ... ?We know you have a lot of choices when it comes to donating, and we are so grateful that you chose to donate to our cause. ... ?We have a lot of work to do, and your generous donation helps us get that important work done.?

Here is a simple example of an acknowledgment statement to an in-kind donation: ?Thank you for your contribution of [detailed description of goods/services] that [name nonprofit] received on ____ [date of receipt]. No goods or services were provided in exchange for your contribution.