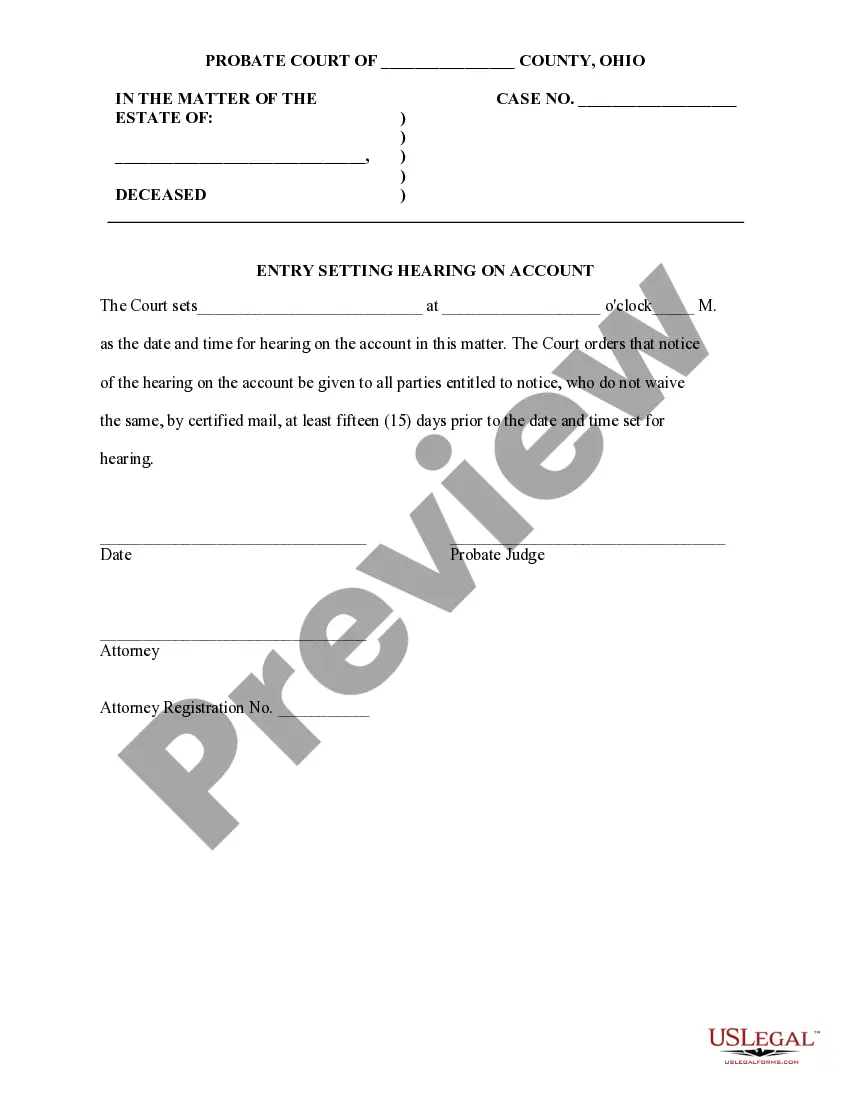

Ohio Entry Setting Account For Hearing is a program that provides financial assistance for Ohioans who have hearing loss and need hearing aids or assistive listening devices. This program is administered by the Ohio Department of Aging and is funded by the Ohio Development Services Agency. It is available to individuals who meet certain eligibility requirements and provides a maximum benefit of up to $4,000 for hearing aids and up to $2,500 for assistive listening devices. There are two types of Ohio Entry Setting Account For Hearing: a traditional account and an Individual Development Account. The traditional account is available to any Ohioan who meets the eligibility requirements, while the Individual Development Account is limited to those who participate in the Ohio Department of Aging’s Senior Community Service Employment Program. Both accounts allow individuals to set aside tax-free dollars to pay for hearing aids or assistive listening devices.

Ohio Entry Setting Account For Hearing

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Ohio Entry Setting Account For Hearing?

How much time and resources do you normally spend on drafting official documentation? There’s a greater way to get such forms than hiring legal specialists or spending hours searching the web for a proper template. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the Ohio Entry Setting Account For Hearing.

To get and complete a suitable Ohio Entry Setting Account For Hearing template, adhere to these simple steps:

- Look through the form content to ensure it complies with your state requirements. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your needs, find another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Ohio Entry Setting Account For Hearing. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally reliable for that.

- Download your Ohio Entry Setting Account For Hearing on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most reliable web services. Join us today!

Form popularity

FAQ

The inventory shall contain a statement of all debts and accounts belonging to the deceased that are known to the executor or administrator and specify the name of the debtor, the date, the balance or thing due, and the value or sum that can be collected on the debt, in the judgment of the appraisers.

No probate at all is necessary if the estate is worth less than $5,000 or the amount of the funeral expenses, whichever is less. In that case, anyone (except the surviving spouse) who has paid or is obligated to pay those expenses may ask the court for a summary release from administration.

If the executor or administrator distributes any part of the assets of the estate within three months after the death of the decedent, the executor or administrator shall be personally liable only to those claimants who present their claims within that three-month period.

The final account of an Ohio probate estate is required to include an itemized statement of all receipts of the administrator or executor during the accounting period, as well as accounting for all of the disbursements and distributions made by the executor or administrator during the accounting period.

Conducting a Probate Proceeding Proving that the decedent's will is valid. Gather and inventory the decedent's assets. Seek appraisal for the assets. Pay off any debts and taxes owed by the decedent. Distribute any remaining property under the direction of the will or state laws.

You don't have to have will to transfer your car after you die. A Transfer on Death (TOD) is a legal document that can transfer your car without a will. This means that your car will not have to go through the probate court. Going through the probate court can cost your loved ones time and money after you are gone.

Non-Probate Property in Ohio Real estate held in joint or survivorship form. Assets and property with a transfer-on-death designation. Insurance proceeds with a named beneficiary. Payable-on-death bank accounts. Assets held in trust.