Ohio Financial Power of Attorney

Description

Definition and meaning

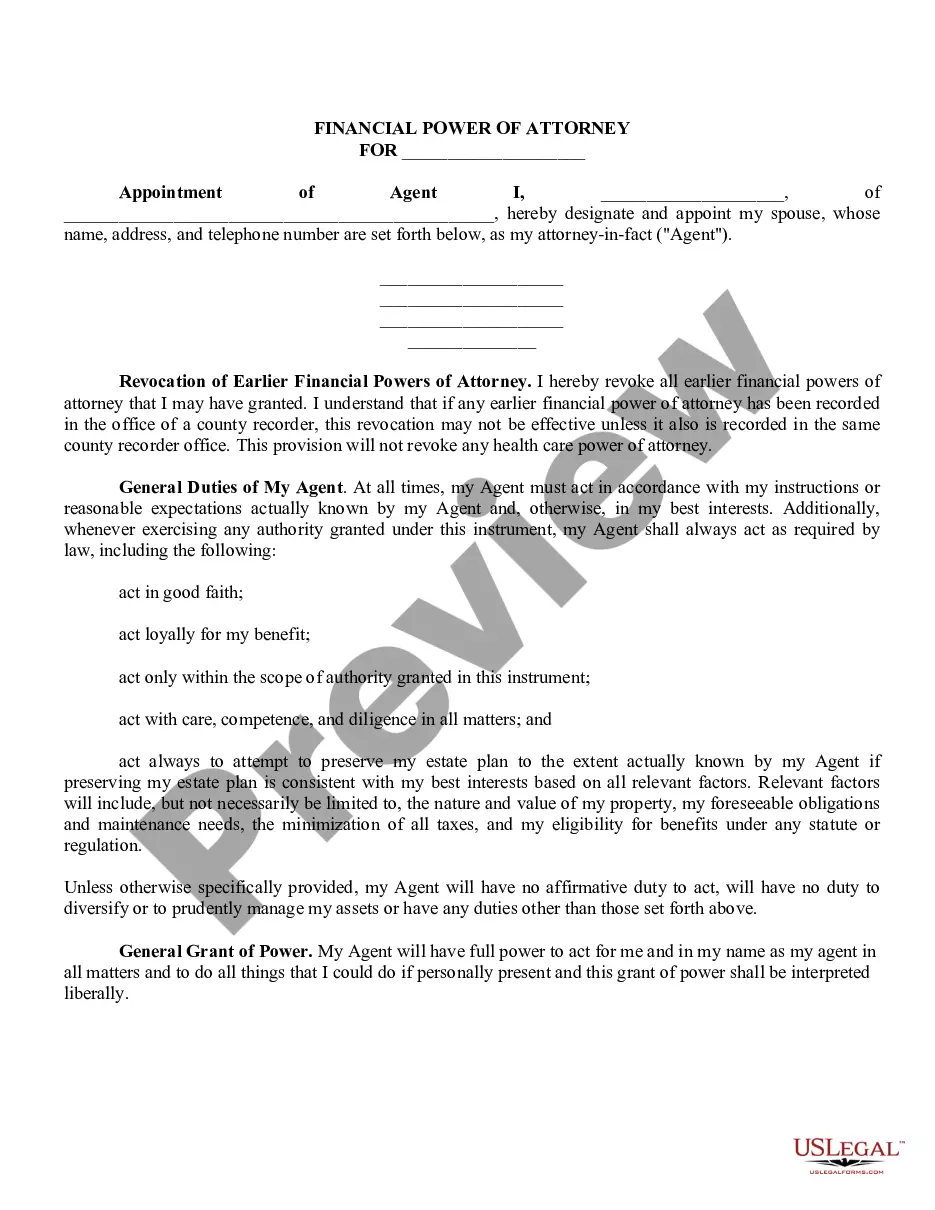

The Ohio Financial Power of Attorney is a legal document that allows a person (the principal) to grant authority to another individual (the agent) to make financial decisions on their behalf. This document can be essential in situations where the principal is unable to manage their finances due to health issues or other circumstances. The appointed agent acts in the best interest of the principal and must adhere to the powers granted by the document.

How to complete a form

Completing the Ohio Financial Power of Attorney requires careful attention to detail. Follow these steps:

- Begin by clearly identifying the principal and the agent by providing their full names and addresses.

- Specify the powers being granted to the agent, which may include managing bank accounts, paying bills, or making investment decisions.

- Include any limitations or specific instructions to guide the agent's decisions.

- Sign the document in the presence of a notary public to ensure its validity.

Who should use this form

This form is ideal for individuals in Ohio who want to ensure their financial matters are handled according to their wishes in the event of incapacitation. It is particularly useful for:

- Individuals with chronic health conditions.

- Older adults who may face declining mental or physical abilities.

- Anyone traveling or spending extended time away from home.

Benefits of using this form online

Utilizing an online platform to create your Ohio Financial Power of Attorney offers several advantages:

- Accessibility: Users can access the form anytime and anywhere, making it convenient to fill out.

- Guidance: Online forms often come with helpful instructions and tips, reducing the risk of mistakes.

- Cost-effective: Many online services provide affordable options for generating legal documents compared to traditional legal assistance.

Key components of the form

The Ohio Financial Power of Attorney includes several essential components to ensure clarity and effectiveness:

- Identification of Parties: Clear identification of the principal and agent.

- Scope of Authority: Detailed description of the powers granted to the agent.

- Durability Clause: Specifies whether the power of attorney remains effective if the principal becomes incapacitated.

- Signature and Notarization: Proper execution requirements for validity.

Common mistakes to avoid when using this form

When completing the Ohio Financial Power of Attorney, consider these common pitfalls:

- Failing to properly identify the principal and agent, which can lead to confusion and invalidation.

- Not clearly outlining the powers granted, leading to ambiguity in agent authority.

- Neglecting to sign and notarize the document, which is crucial for its enforcement.

How to fill out Ohio Financial Power Of Attorney?

When it comes to filling out Ohio Financial Power of Attorney, you most likely visualize a long procedure that involves getting a suitable sample among a huge selection of similar ones and then being forced to pay an attorney to fill it out to suit your needs. On the whole, that’s a sluggish and expensive option. Use US Legal Forms and select the state-specific template in a matter of clicks.

If you have a subscription, just log in and then click Download to find the Ohio Financial Power of Attorney sample.

If you don’t have an account yet but want one, keep to the step-by-step guide below:

- Be sure the file you’re getting applies in your state (or the state it’s required in).

- Do so by reading the form’s description and by visiting the Preview option (if offered) to find out the form’s information.

- Click Buy Now.

- Pick the suitable plan for your budget.

- Subscribe to an account and select how you want to pay out: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Get the file on your device or in your My Forms folder.

Skilled lawyers draw up our samples to ensure after downloading, you don't have to worry about editing content outside of your individual details or your business’s information. Sign up for US Legal Forms and receive your Ohio Financial Power of Attorney document now.

Form popularity

FAQ

Once you have discussed your agreement with your agent, both of you must now sign the document. Ohio law requires your power of attorney agreement to be notarized. Most banks offer notary public services for free or a small fee.

An Ohio Power of Attorney is now presumed to be durable meaning it survives the incapacity of the principal.It is important that your Power of Attorney is notarized and witnessed by two disinterested witnesses.

The Ohio legislature has not approved a form for a healthcare POA but has established some requirements. It must be dated, signed by the principal at the end of the document, either signed by two witnesses or notarized, and include a specified statement regarding who can be an attorney in fact.

After the principal's name, write by and then sign your own name. Under or after the signature line, indicate your status as POA by including any of the following identifiers: as POA, as Agent, as Attorney in Fact or as Power of Attorney.

Choose an agent. An attorney-in-fact or agent is an adult who can make your financial choices when you can't. Fill out the FPOA form. Read it carefully and initial next to the rights you want your agent to have. Sign the form. Sign the form.

Power of Attorney broadly refers to one's authority to act and make decisions on behalf of another person in all or specified financial or legal matters.Durable POA is a specific kind of power of attorney that remains in effect even after the represented party becomes mentally incapacitated.

An Ohio Power of Attorney is now presumed to be durable meaning it survives the incapacity of the principal.It is important that your Power of Attorney is notarized and witnessed by two disinterested witnesses.

A solicitor or the NSW Trustee and Guardian can prepare a power of attorney for you.The form must be witnessed by a barrister, solicitor, registrar of the Local Court, an employee of the NSW Trustee and Guardian or trustee company, a qualified overseas lawyer or a licenced conveyancer.