Ohio Revocation of Living Trust

Overview of this form

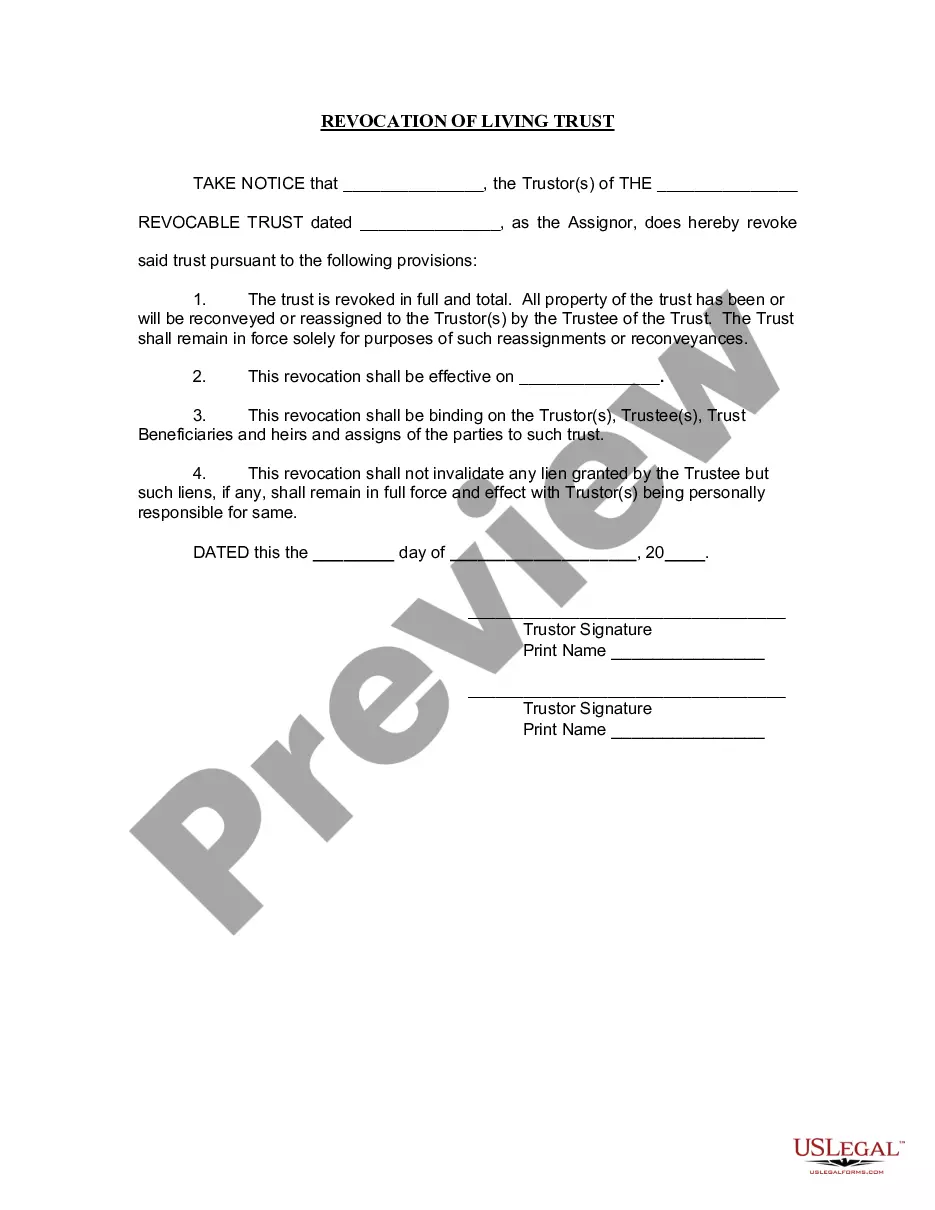

The Revocation of Living Trust form is a legal document used to formally annul a living trust established during a person's lifetime. Unlike other estate planning forms, this document explicitly declares the complete revocation of a specific living trust, allowing for the return of trust property to the original trustors. It ensures that all parties involved in the trust acknowledge the revocation and sets a clear effective date.

Key parts of this document

- Identification of the Trustor(s) and the specific living trust being revoked.

- Declaration of full and total revocation of the living trust.

- Provisions regarding the reconveyance or reassignment of trust property to the Trustor(s).

- Effective date of the revocation.

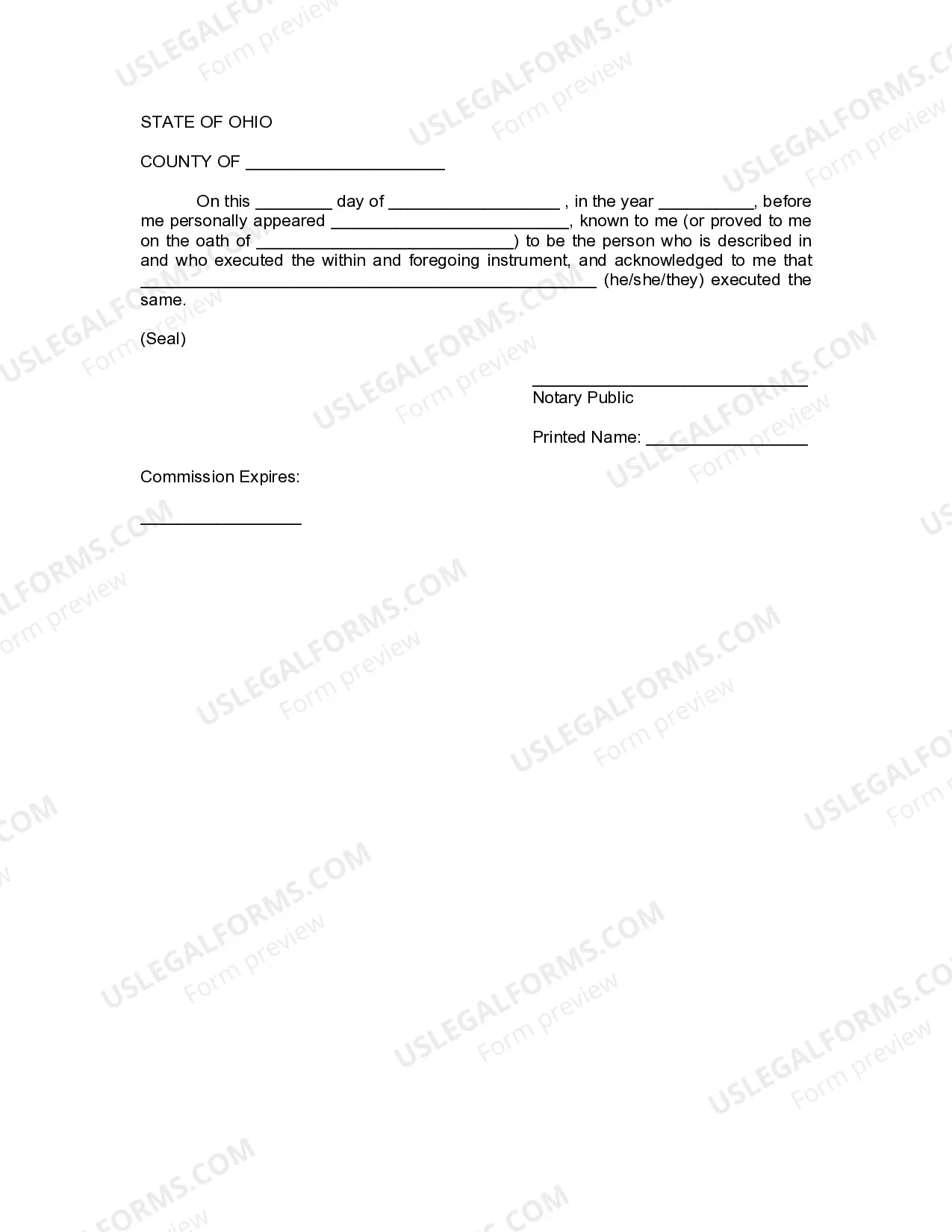

- Signature lines for the Trustor(s) and acknowledgment by a notary public.

When to use this document

This form is necessary when you want to terminate a living trust that is no longer serving your estate planning needs. Common reasons for using the Revocation of Living Trust include a change in financial situations, the desire to redistribute assets, or the creation of a new trust. It ensures that your wishes regarding your assets are clear and legally enforceable.

Intended users of this form

- Individuals who have created a living trust and wish to revoke it.

- Trustors who need to reassign assets back to themselves.

- Anyone involved in the administration of a living trust, such as trustees or beneficiaries, who requires formal documentation of the revocation.

Steps to complete this form

- Identify the Trustor(s) and provide details about the living trust being revoked.

- Clearly state the effective date of the revocation.

- Sign the document in front of a notary public to ensure validity.

- Make sure all involved parties receive a copy of the signed revocation.

Is notarization required?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include the correct name of the living trust being revoked.

- Not providing an effective date for the revocation.

- Omitting the signatures of all required Trustors.

- Neglecting to have the document notarized, when required.

Benefits of using this form online

- Convenience of instant access and the ability to download from anywhere.

- Editable templates that allow you to personalize the document to your needs.

- Reliable resources drafted by licensed attorneys ensuring legal accuracy.

Looking for another form?

Form popularity

FAQ

In some states, your trustee must submit a formal accounting of the trust's operation to all beneficiaries.Trustees can sometimes waive this requirement if all beneficiaries agree in writing. In either case, after the report is made, the trust's assets can be distributed and the trust can be dissolved.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

According to Ohio law, if the revocable trust instrument doesn't provide for a way to revoke or amend, the settlor can revoke or amend the trust in any way that manifests "clear and convincing" evidence of their intentexcept by a will or codicil.

The terms of an irrevocable trust may give the trustee and beneficiaries the authority to break the trust. If the trust's agreement does not include provisions for revoking it, a court may order an end to the trust. Or the trustee and beneficiaries may choose to remove all assets, effectively ending the trust.

A revocation of a will generally means that the beneficiaries will no longer receive the specified property or financial assets. A beneficiary may have been depending on the trust property for various reasons. If the revocation occurs at a certain time, it can cause legal conflicts in many cases.

Although the period for challenging the validity of a will can be limited to three months, a longer period (usually two years) is allowed for challenging the validity of a revocable trust. The cost of defending the validity of a will, where the executor acts in good faith, is payable from the probate estate.

One of the most common reasons for revoking a trust, for example, is a divorce, if the trust was created as a joint document with one's soon-to-be ex-spouse.A revocable trust may also be revoked if the grantor wants to appoint a new trustee or change the provisions of the trust completely.

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

Specifically, a trust can be terminated if all the beneficiaries consent and the court concludes that the continuance of the trust is not necessary to achieve any material purpose of the trust. Upon ordering such a termination, the court must distribute the property as agreed by the beneficiaries.