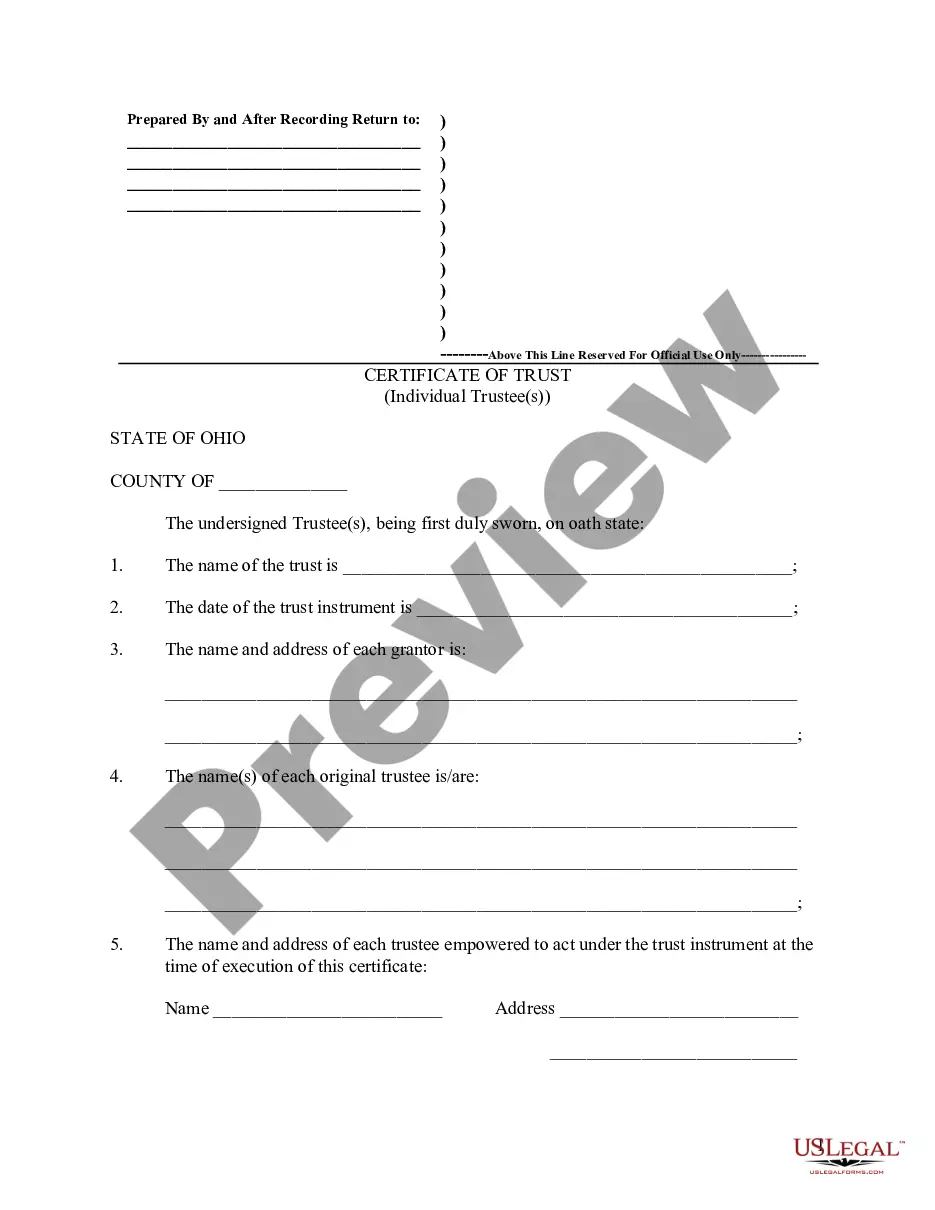

This is a certificate of trust for filing evidence of a trust without having to record the entire trust document. The individual trustee may present a certification of trust to

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Ohio Certificate of Trust by Individual

Description

Key Concepts & Definitions

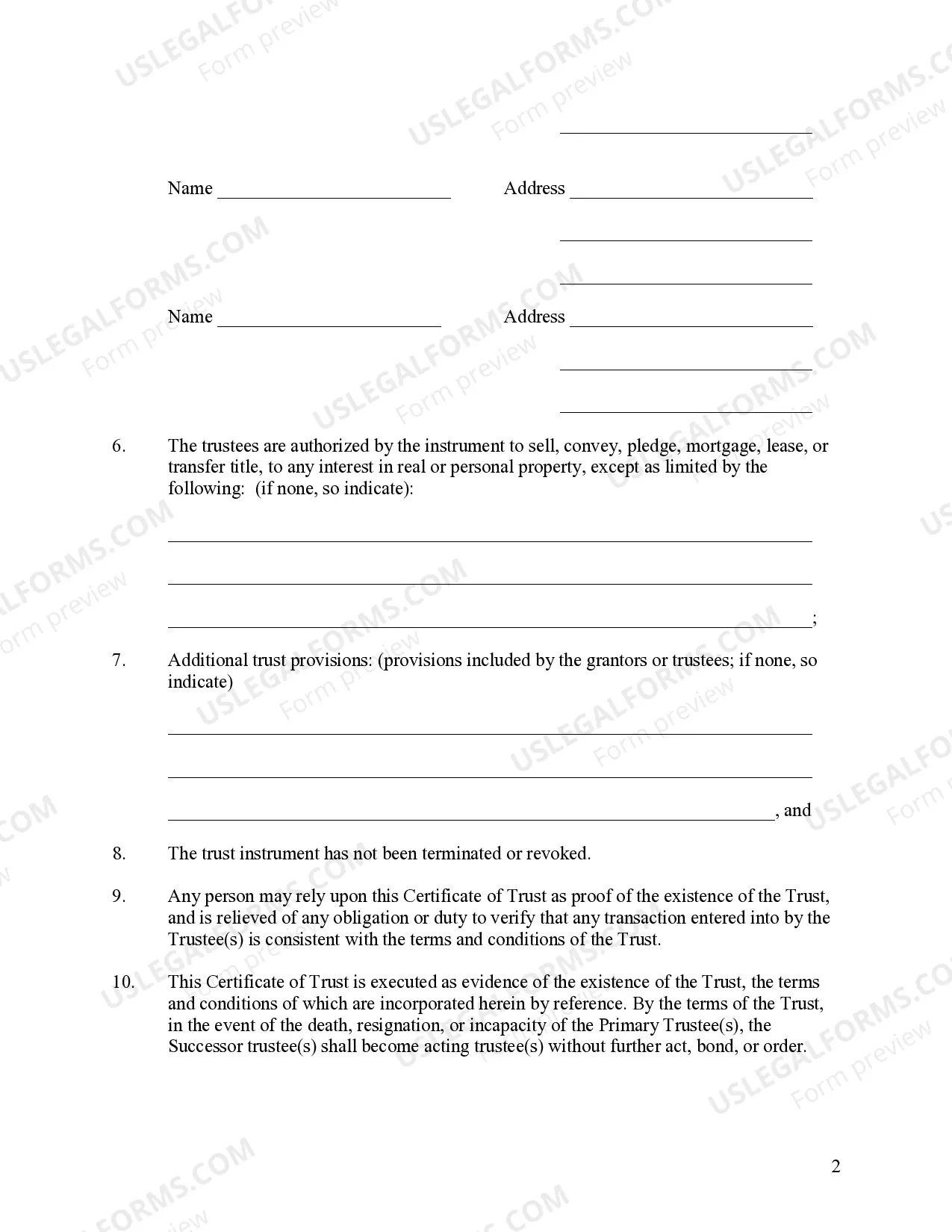

Ohio Certificate of Trust by Individual: A legal document used in Ohio to certify the details of a trust arrangement. This certificate is used to provide necessary information about the trust, such as the trustee's authority, without revealing the private details contained in the trust documents.

Step-by-Step Guide

- Determine Need: Assess if a certificate of trust is necessary for your transaction, typically required in real estate and financial transactions.

- Gather Information: Compile details about the trust, including the trust's name, date, trustees, and powers granted to the trustees.

- Prepare the Certificate: Using Ohio's legal guidelines, draft the certificate including all statutory required details.

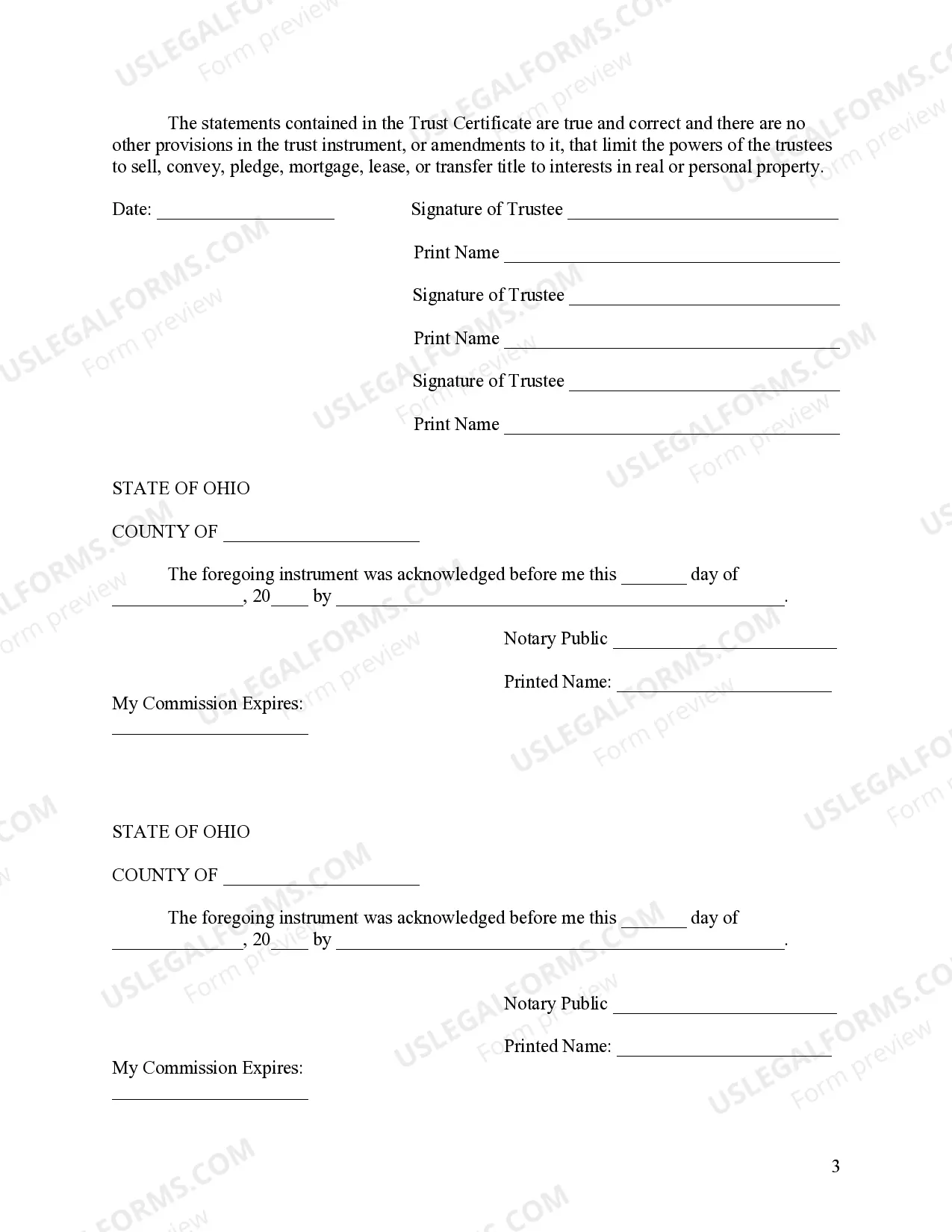

- Notarization: Have the certificate signed by the trustee in the presence of a notary public to validate the signature.

- Record or Present: Present or record the certificate with the relevant institution or agency that requires the trust's certification.

Risk Analysis

- Non-Compliance Risk: Incorrect or missing information can lead to legal challenges or transaction delays.

- Privacy Concerns: Disclosing too much information might breach trust confidentiality.

- Forgery Risk: Unauthenticated or improperly notarized certificates can be subject to forgery accusations.

Pros & Cons

- Pros:

- Facilitates transparency in financial and real estate transactions.

- Prevents the need to disclose full trust agreements, thus protecting sensitive information.

- Cons:

- Risks of non-compliance if not properly executed.

- Potential privacy issues if not carefully handled.

Best Practices

- Seek Legal Advice: Consult with a legal expert familiar with Ohio trust law to ensure compliance and the correct drafting of the document.

- Verify Information: Double-check all trust details included in the certificate for accuracy.

- Maintain Records: Keep copies of the notarized certificate for record-keeping and future needs.

- Omitting Required Information: Always include all the elements required by Ohio law such as settlor name, trustee name, and extent of trustee powers.

- Lack of Notarization: Ensure the certificate is properly notarized to avoid questions about its authenticity.

FAQ

- What is the main purpose of an Ohio certificate of trust? The main purpose is to provide proof of the trustees authority and the existence of the trust without revealing detailed trust documents.

- Who should obtain an Ohio certificate of trust? Any trustee involved in transactions or activities that require proof of the trusts existence and their authority.

Summary

The Ohio certificate of trust by an individual is a critical document used to verify the existence and particulars of a trust without exposing sensitive details. Properly preparing and managing this document is essential for trustees in Ohio to ensure smooth legal transactions and compliance with state laws.

How to fill out Ohio Certificate Of Trust By Individual?

In terms of submitting Ohio Certificate of Trust by Individual, you probably imagine an extensive process that requires getting a perfect sample among countless very similar ones then needing to pay out legal counsel to fill it out to suit your needs. On the whole, that’s a slow and expensive option. Use US Legal Forms and choose the state-specific template within clicks.

For those who have a subscription, just log in and click on Download button to have the Ohio Certificate of Trust by Individual sample.

In the event you don’t have an account yet but need one, keep to the step-by-step guideline listed below:

- Make sure the file you’re saving is valid in your state (or the state it’s needed in).

- Do it by reading the form’s description and also by visiting the Preview function (if available) to view the form’s content.

- Click on Buy Now button.

- Choose the proper plan for your budget.

- Sign up for an account and choose how you would like to pay out: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Get the document on the device or in your My Forms folder.

Skilled legal professionals work on creating our templates to ensure after saving, you don't have to bother about editing content outside of your personal info or your business’s information. Sign up for US Legal Forms and receive your Ohio Certificate of Trust by Individual sample now.

Form popularity

FAQ

Under O.R.C. 5301.255, the memorandum of trust is a document that certifies a trustee has the authority to act on behalf of an existing trust. The trustee is the person or entity who holds title to a trust's assets on behalf of a settlor.

Once a declaration of trust has been executed, subsequent declarations can be issued to confirm current terms or amend the existing agreement. Depending on the jurisdiction, the declaration of trust can also be referred to as a trust agreement or a trust document.

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.

The declaration of trust is your trust. The certificate of trust is not needed but can help keep things private and provide a easier way to open bank or stock accounts...

A: An affidavit of trust and a certificate of trust are essentially the same thing. At least they serve the same functions. Simply put, an affidavit of trust is an abbreviated version of the trust agreement that provides general information about the terms of the trust.

A Certificate of Trust is recorded in the Official Records of the county in which any trust real property is located. It aids in clearing title to the property. Generally, where the trust owns no real property, there is no need to record a Certificate...

A trust document isn't required to be filed. If you are transferring real estate into a trust, a deed will need oo be filed at the county recorder's office.The declaration will detail the terms and conditions of the living trust, including who will serve as the Trustee.

If you have a trust in Michigan, state law provides that you can register the trust. Registering a Michigan trust is not required (except for certain charitable trusts, as discussed below). Even for non-charitable trusts, there are good reasons that a trust should be registered.