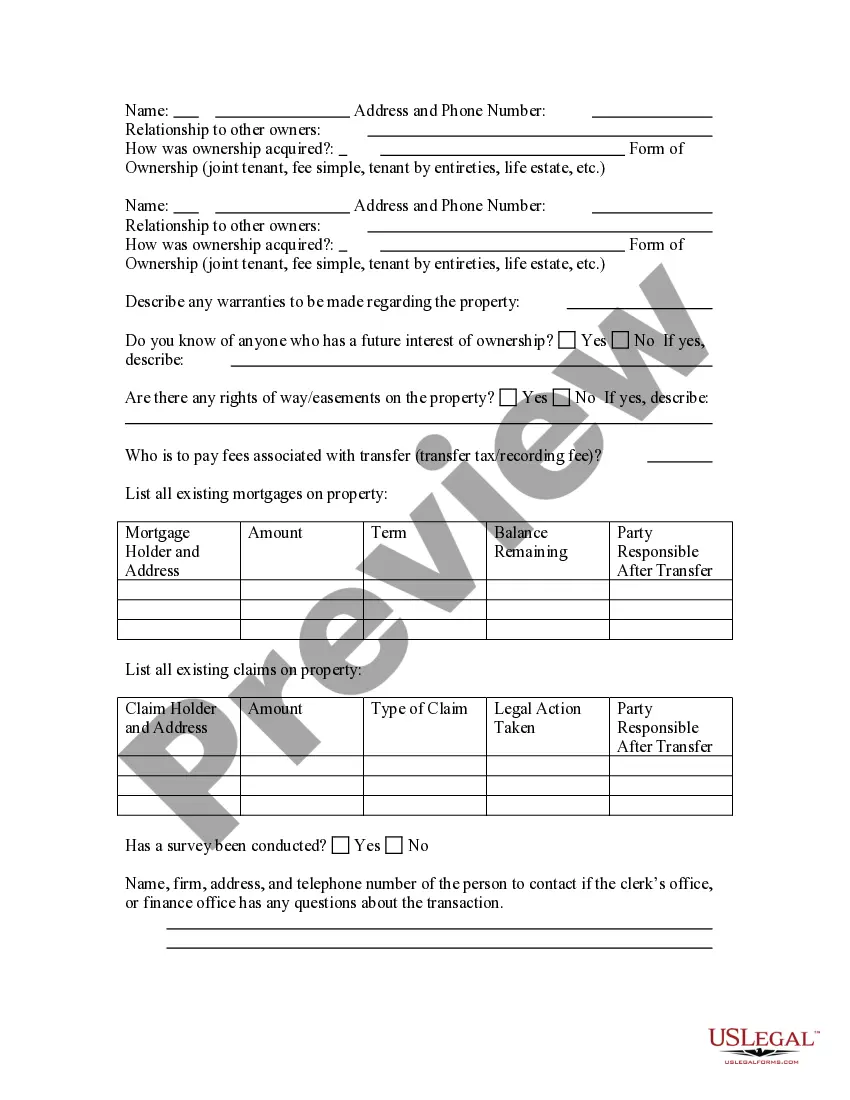

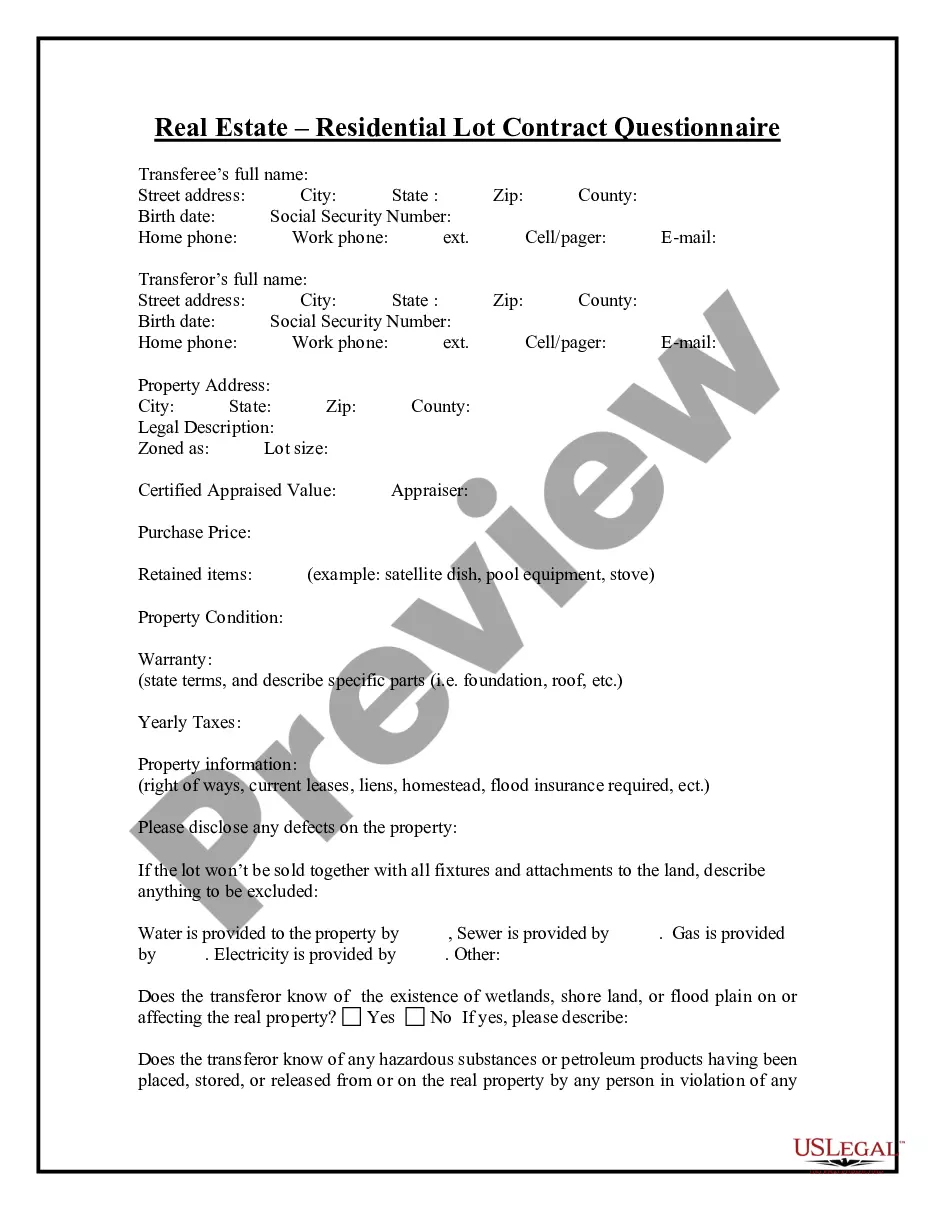

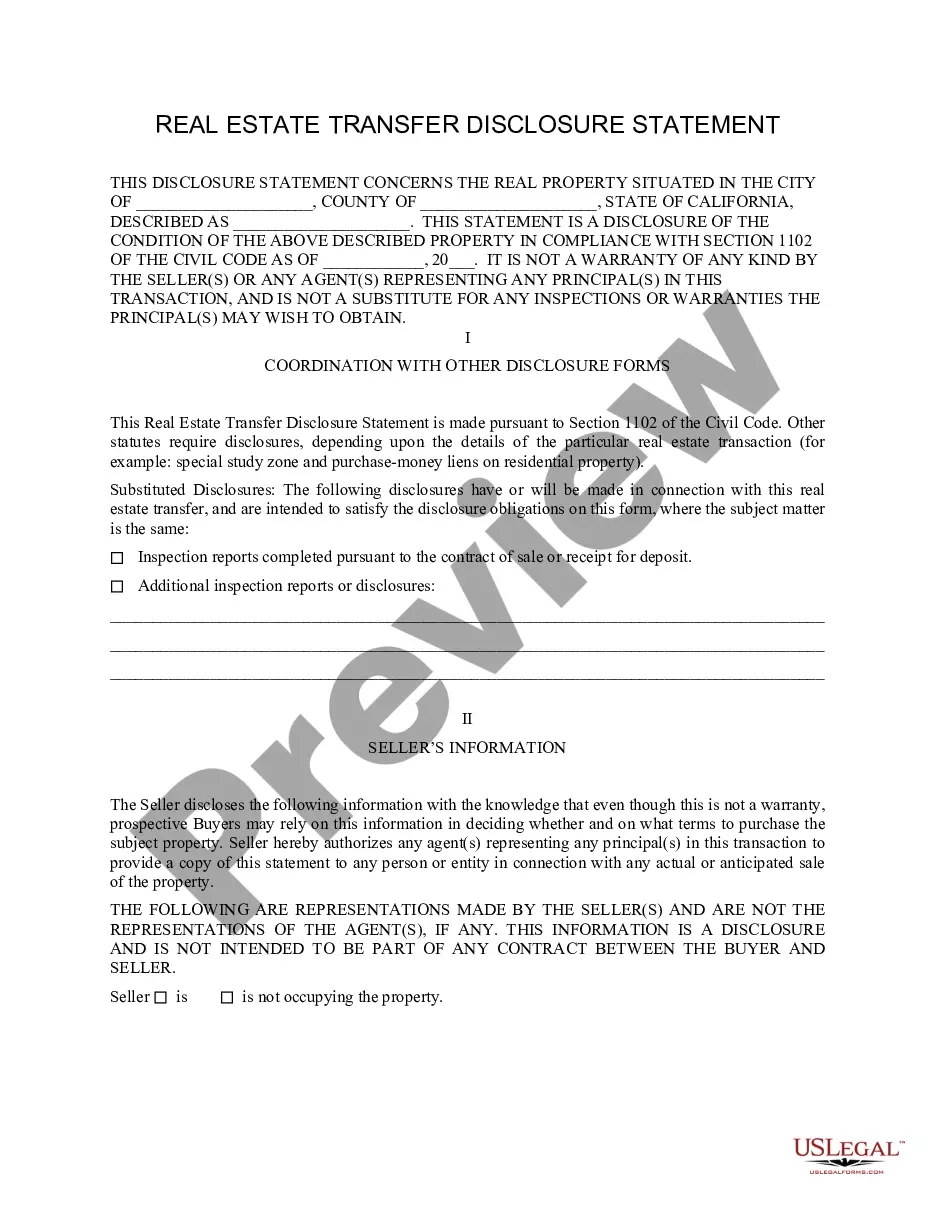

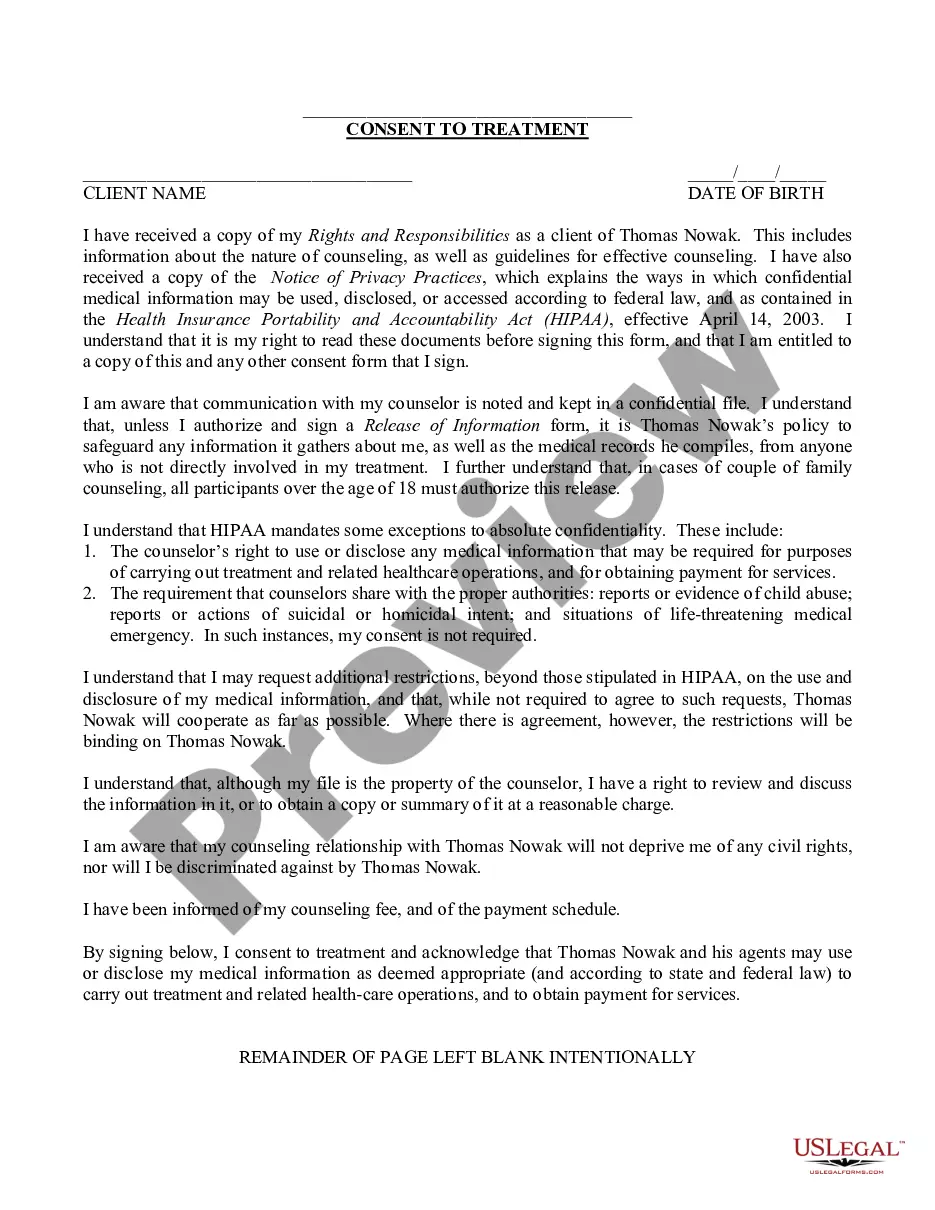

US Legal Forms - one of the largest libraries of authorized kinds in the USA - delivers a wide array of authorized record templates you are able to down load or printing. Making use of the site, you can find thousands of kinds for company and personal functions, sorted by classes, states, or keywords.You can find the newest versions of kinds such as the New York Deed Transfer Questionnaire within minutes.

If you currently have a monthly subscription, log in and down load New York Deed Transfer Questionnaire from the US Legal Forms catalogue. The Acquire option will appear on every develop you see. You get access to all in the past acquired kinds within the My Forms tab of your accounts.

In order to use US Legal Forms for the first time, here are easy recommendations to obtain started:

- Be sure to have chosen the right develop for the city/area. Select the Preview option to review the form`s content. See the develop explanation to actually have selected the right develop.

- When the develop does not fit your specifications, take advantage of the Research area towards the top of the display screen to find the one who does.

- When you are satisfied with the shape, validate your decision by simply clicking the Buy now option. Then, choose the pricing program you favor and give your accreditations to register to have an accounts.

- Method the purchase. Make use of your bank card or PayPal accounts to complete the purchase.

- Select the formatting and down load the shape on your product.

- Make modifications. Complete, edit and printing and signal the acquired New York Deed Transfer Questionnaire.

Every web template you added to your money lacks an expiration day which is your own property permanently. So, in order to down load or printing one more version, just proceed to the My Forms segment and then click in the develop you need.

Obtain access to the New York Deed Transfer Questionnaire with US Legal Forms, one of the most extensive catalogue of authorized record templates. Use thousands of specialist and condition-particular templates that satisfy your organization or personal requirements and specifications.