New York Schedule of Fees

Description

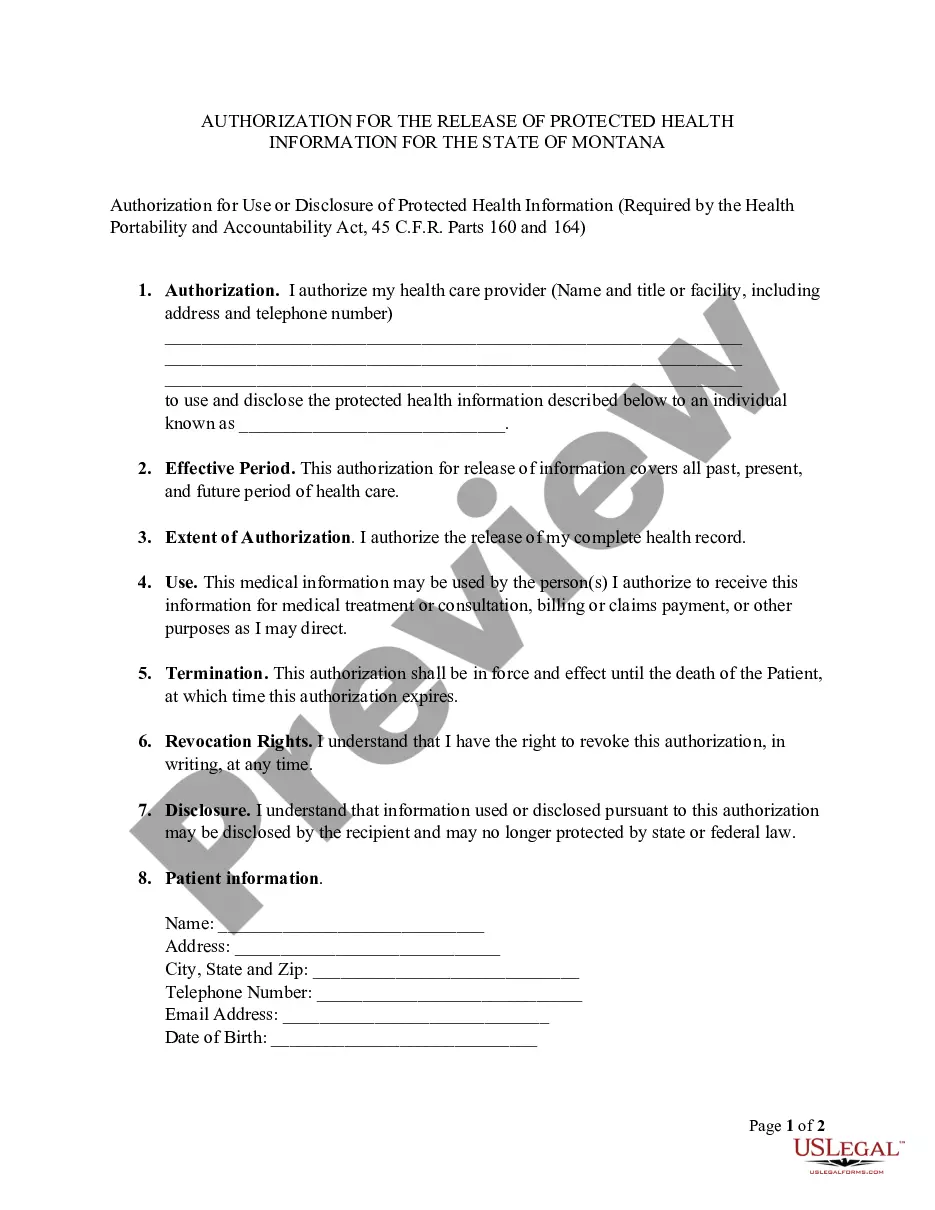

How to fill out Schedule Of Fees?

It is possible to invest several hours on-line looking for the legitimate file format that meets the federal and state needs you will need. US Legal Forms provides a huge number of legitimate varieties that are analyzed by experts. It is possible to obtain or produce the New York Schedule of Fees from your service.

If you have a US Legal Forms account, you may log in and click the Obtain button. Next, you may full, change, produce, or indication the New York Schedule of Fees. Every legitimate file format you acquire is the one you have forever. To acquire yet another copy for any obtained kind, visit the My Forms tab and click the related button.

If you work with the US Legal Forms web site initially, follow the straightforward instructions beneath:

- Initially, be sure that you have chosen the best file format to the area/town that you pick. See the kind explanation to make sure you have chosen the correct kind. If available, make use of the Preview button to appear with the file format as well.

- If you wish to locate yet another edition of your kind, make use of the Research discipline to find the format that meets your needs and needs.

- Upon having identified the format you need, click Acquire now to proceed.

- Pick the costs plan you need, type your references, and sign up for your account on US Legal Forms.

- Full the transaction. You should use your bank card or PayPal account to pay for the legitimate kind.

- Pick the formatting of your file and obtain it to the system.

- Make modifications to the file if needed. It is possible to full, change and indication and produce New York Schedule of Fees.

Obtain and produce a huge number of file themes making use of the US Legal Forms website, which offers the greatest variety of legitimate varieties. Use specialist and state-specific themes to take on your company or specific requires.

Form popularity

FAQ

Domestic and foreign business corporations are required by Section 408 of the Business Corporation Law to file a Biennial Statement every two years with the New York Department of State.

All LLCs opened in NY are required to file an annual report. The report is currently filed every two years, as a biennial report. However, this may change over time and it's important to stay in good standing with the state with maintain annual compliance in case this requirement will change.

A list or table, whether ordered or not, showing fixed fees for goods or services. The actual set of fees to be charged.

The fee for filing the Articles of Organization is $200. The fee may be paid by cash, check, money order, MasterCard, Visa or American Express. Checks and money orders should be made payable to the ?Department of State.? Do not send cash through the mail.

While many states require these filings annually (i.e., ?annual reports?), several require these types of reports biennially (every two years) rather than every year. A biennial report allows the state's Secretary of State office (or comparable government office) to keep up to date with a company's vital information.

The Official New York Workers' Compensation Medical Fee Schedule may be purchased from OptumInsight 360 by writing to PO Box 88050, Chicago, IL 60680-9920, by calling (800) 464-3649 option 1 or online at , keyword New York, or - ...

A biennial statement is a document that all businesses, both foreign and domestic, must file every two years as required by the Business Corporation Law and the Limited Liability Company Law.

If you do not file your report within the one-month filing period, the Department of State will determine your company to be delinquent. There are no penalties for filing a late New York biennial report to remove your delinquent status.