New York Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

If you wish to obtain full, download, or print legitimate document templates, utilize US Legal Forms, the finest selection of legal forms, which are accessible online.

Utilize the website's straightforward and user-friendly search to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After locating the form you need, click the Buy now button. Select your preferred pricing plan and provide your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the transaction.

- Utilize US Legal Forms to access the New York Door Contractor Agreement - Self-Employed in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the New York Door Contractor Agreement - Self-Employed.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct region/state.

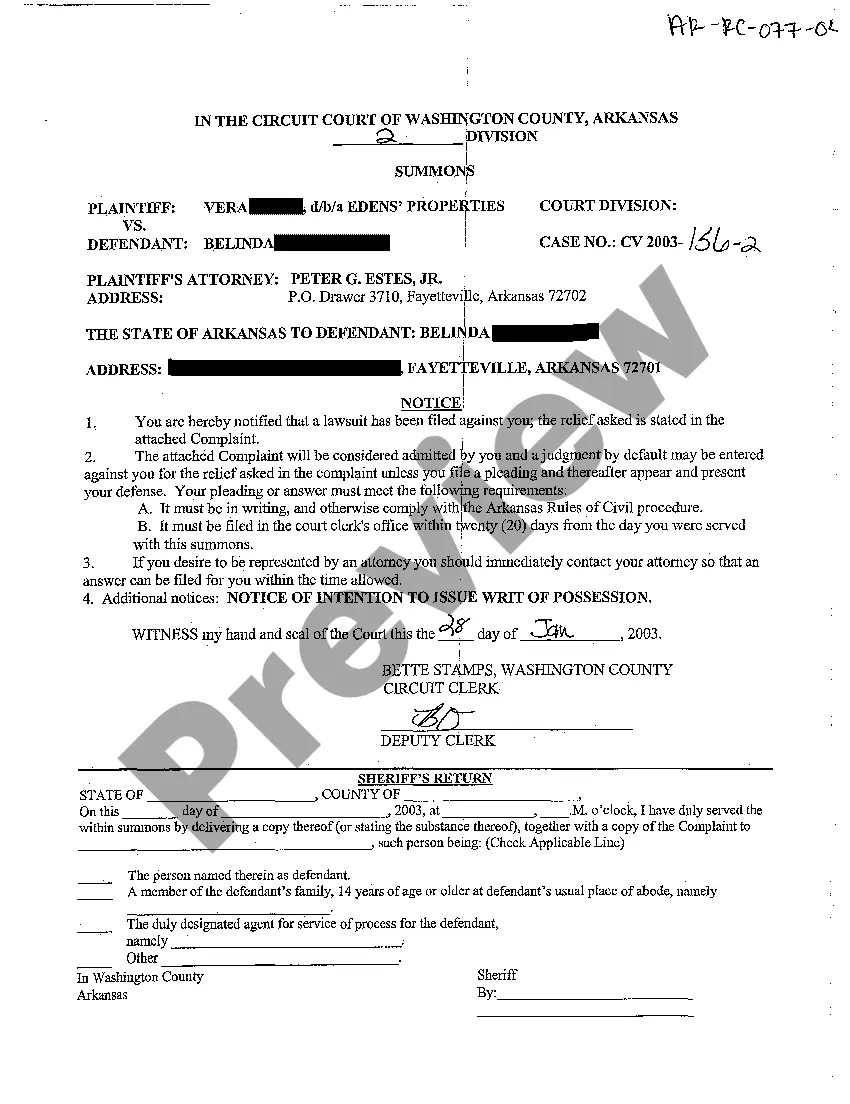

- Step 2. Use the Preview feature to review the form's content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In New York, independent contractors are generally not required to carry workers' compensation insurance unless they have employees. However, having coverage can protect you from potential work-related injuries. If you are an independent contractor working under a New York Door Contractor Agreement - Self-Employed, consider discussing your insurance needs with a professional to safeguard your business.

Absolutely, an independent contractor is a type of self-employed individual. They manage their own business, choose their clients, and set their working hours. As an independent contractor, it's essential to have a well-drafted New York Door Contractor Agreement - Self-Employed to outline the terms of your services effectively, ensuring clarity for both you and your clients.

Yes, an independent contractor falls under the self-employed category. This person operates their own business, providing services directly to clients rather than working for an employer. If you’re in this position, crafting a solid New York Door Contractor Agreement - Self-Employed is crucial to clarify your responsibilities and protect your interests.

The terms self-employed and independent contractor are often used interchangeably, but there are subtle differences. Saying you are self-employed emphasizes your overall business operation. On the other hand, independent contractor highlights the contractual nature of your work. Regardless of the term you choose, ensuring your New York Door Contractor Agreement - Self-Employed is clear will benefit your business.

Yes, receiving a 1099 form typically indicates that you are self-employed. This form is used to report income earned outside of traditional employment and reflects your status as an independent contractor. It's important to recognize this status when dealing with your taxes or creating a New York Door Contractor Agreement - Self-Employed. Ensure you keep good records of your income and expenses.

To protect yourself as an independent contractor, it's important to establish a comprehensive agreement with your clients. This New York Door Contractor Agreement - Self-Employed should outline your services, payment terms, and liability clauses. Additionally, consider obtaining insurance that covers your work to mitigate potential risks. Taking these steps can provide peace of mind in your independent work.

A person is considered self-employed when they work for themselves instead of being employed by a company. They earn income directly from clients or customers and manage their own business operations. This status gives you the flexibility to create your schedule and make decisions about your work. If you're crafting a New York Door Contractor Agreement - Self-Employed, understanding this qualification is essential.

Several factors qualify you as an independent contractor, including the ability to set your own hours, manage your own business operations, and work for multiple clients simultaneously. Your independence in choosing how you complete tasks plays a key role in defining your status. A New York Door Contractor Agreement - Self-Employed further reinforces your classification, providing necessary structure and clarity in your business endeavors.

Documenting your business activities and maintaining clear communication with clients can substantiate your status as an independent contractor. Additionally, using a New York Door Contractor Agreement - Self-Employed not only clarifies your responsibilities but also serves as tangible proof of your professional standing. This agreement helps both parties understand their roles and the working dynamics.

To determine if you are an independent contractor or an employee, consider factors such as the level of control the employer has over your work, your business's independence, and how you receive payment. If you have more autonomy and set your own hours, you likely fit the independent contractor model. The New York Door Contractor Agreement - Self-Employed can also guide you in defining your role clearly within a professional context.