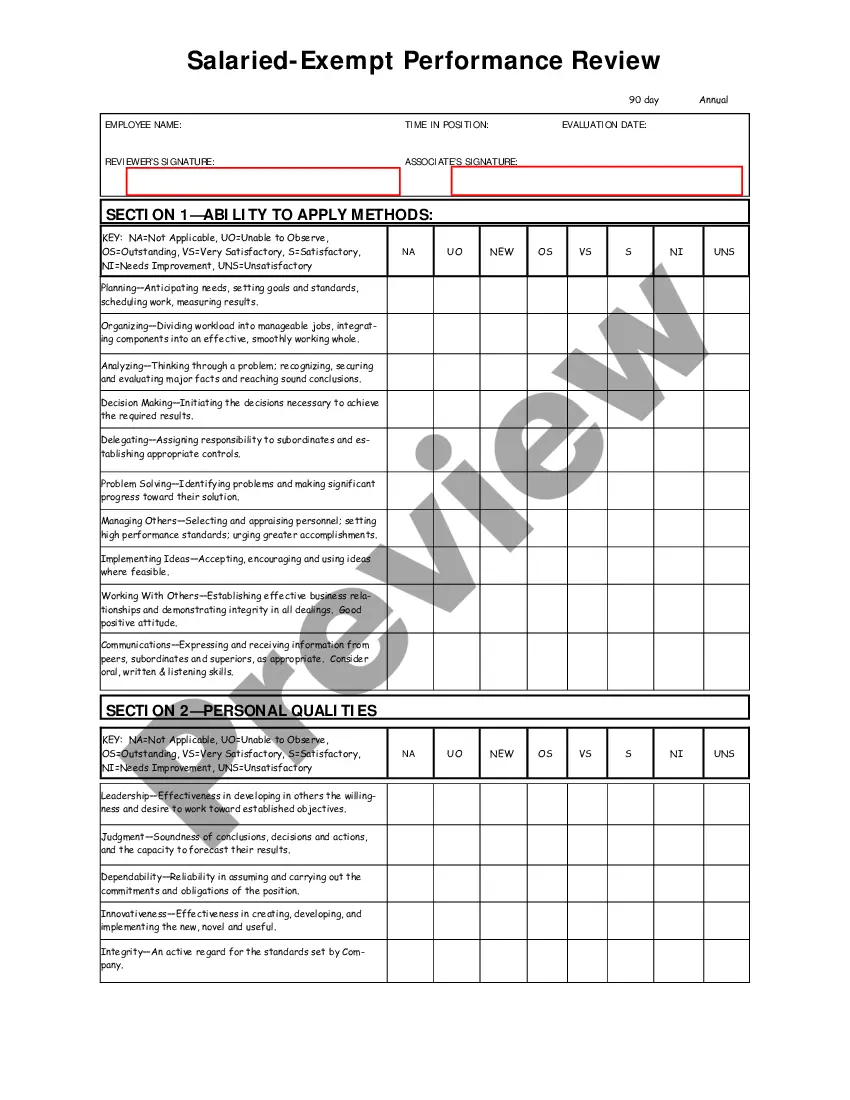

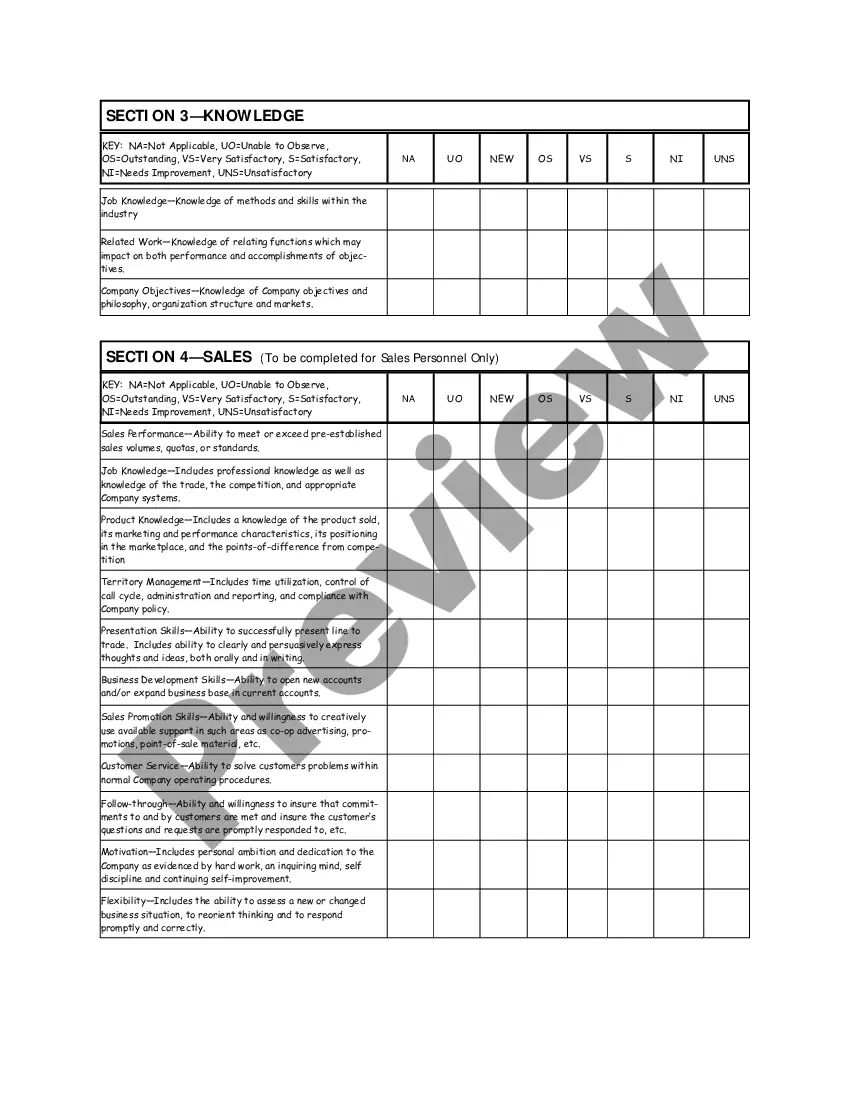

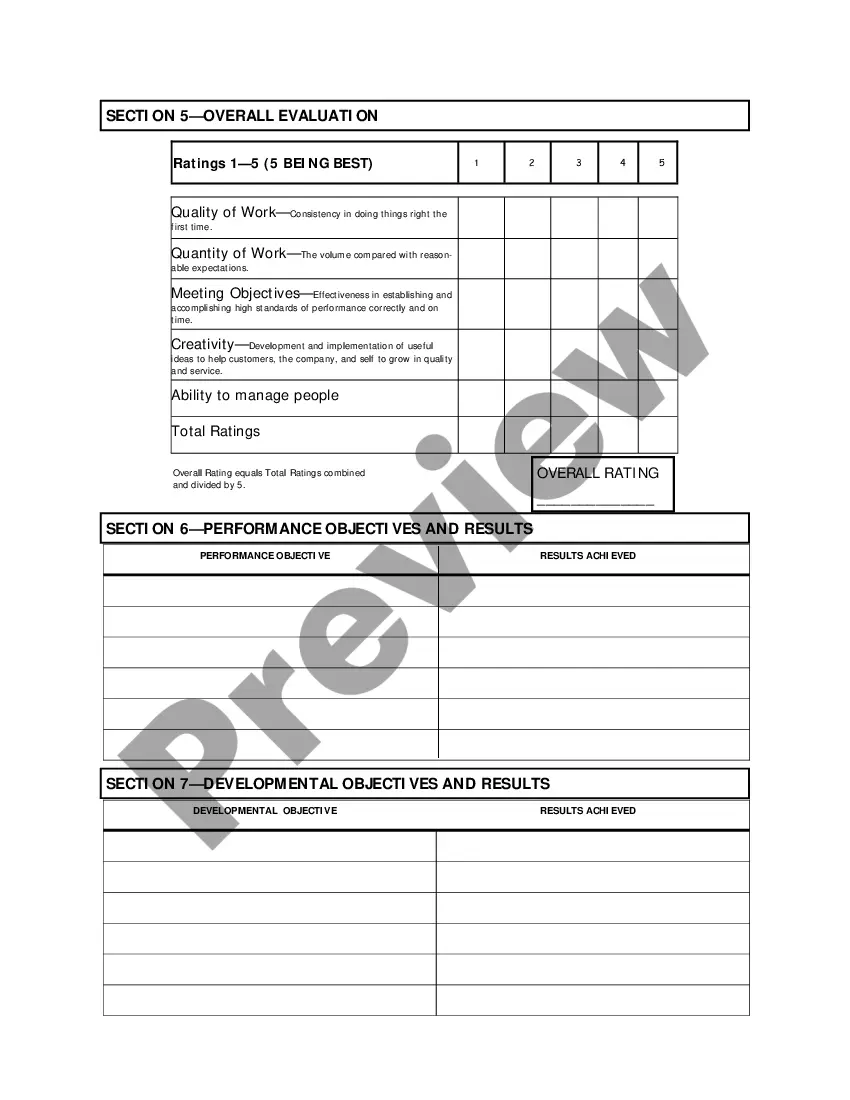

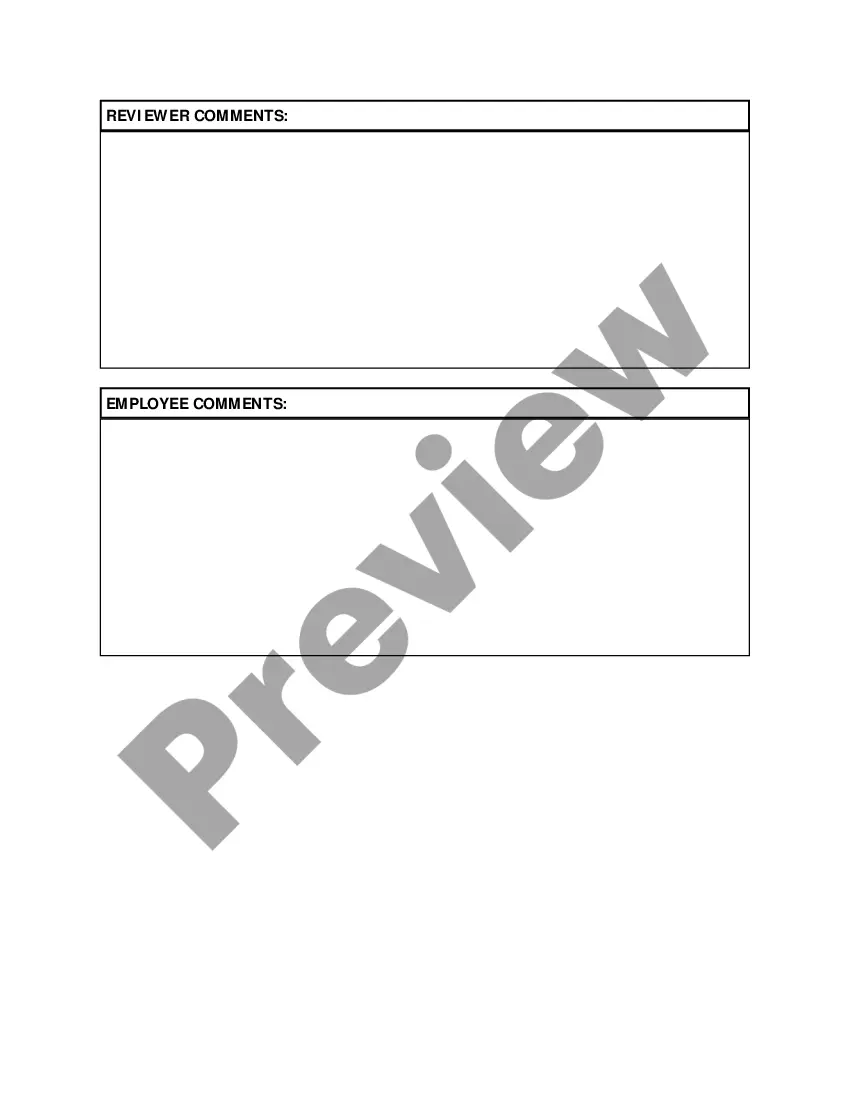

New York Salary - Exempt Employee Review and Evaluation Form

Description

How to fill out Salary - Exempt Employee Review And Evaluation Form?

Are you currently in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legally recognized document templates available online, but locating reliable versions can be challenging.

US Legal Forms provides a vast array of document templates, such as the New York Salary - Exempt Employee Review and Evaluation Form, that are designed to comply with federal and state regulations.

You can view all the document templates you have purchased in the My documents section.

You can retrieve a new copy of the New York Salary - Exempt Employee Review and Evaluation Form at any time, just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the New York Salary - Exempt Employee Review and Evaluation Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/state.

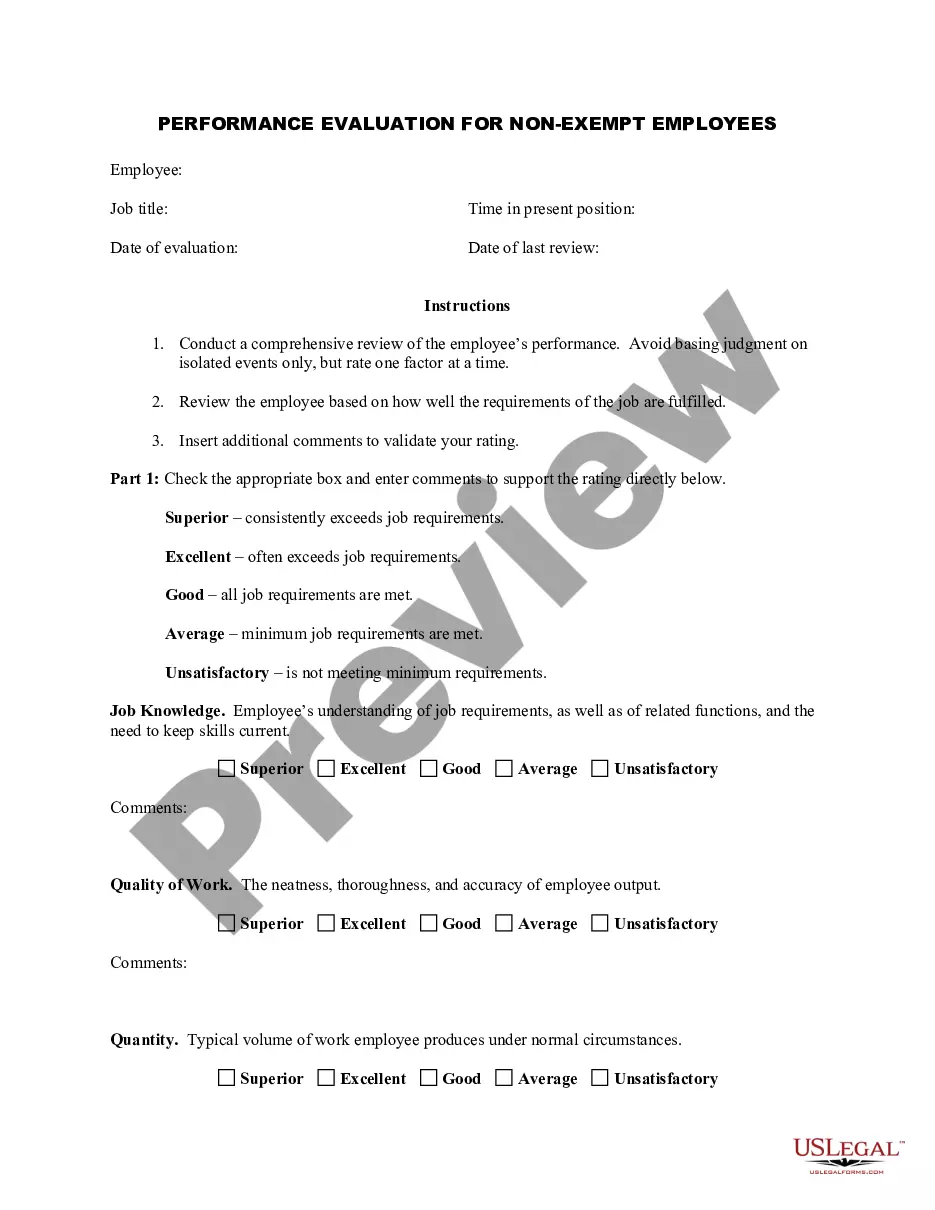

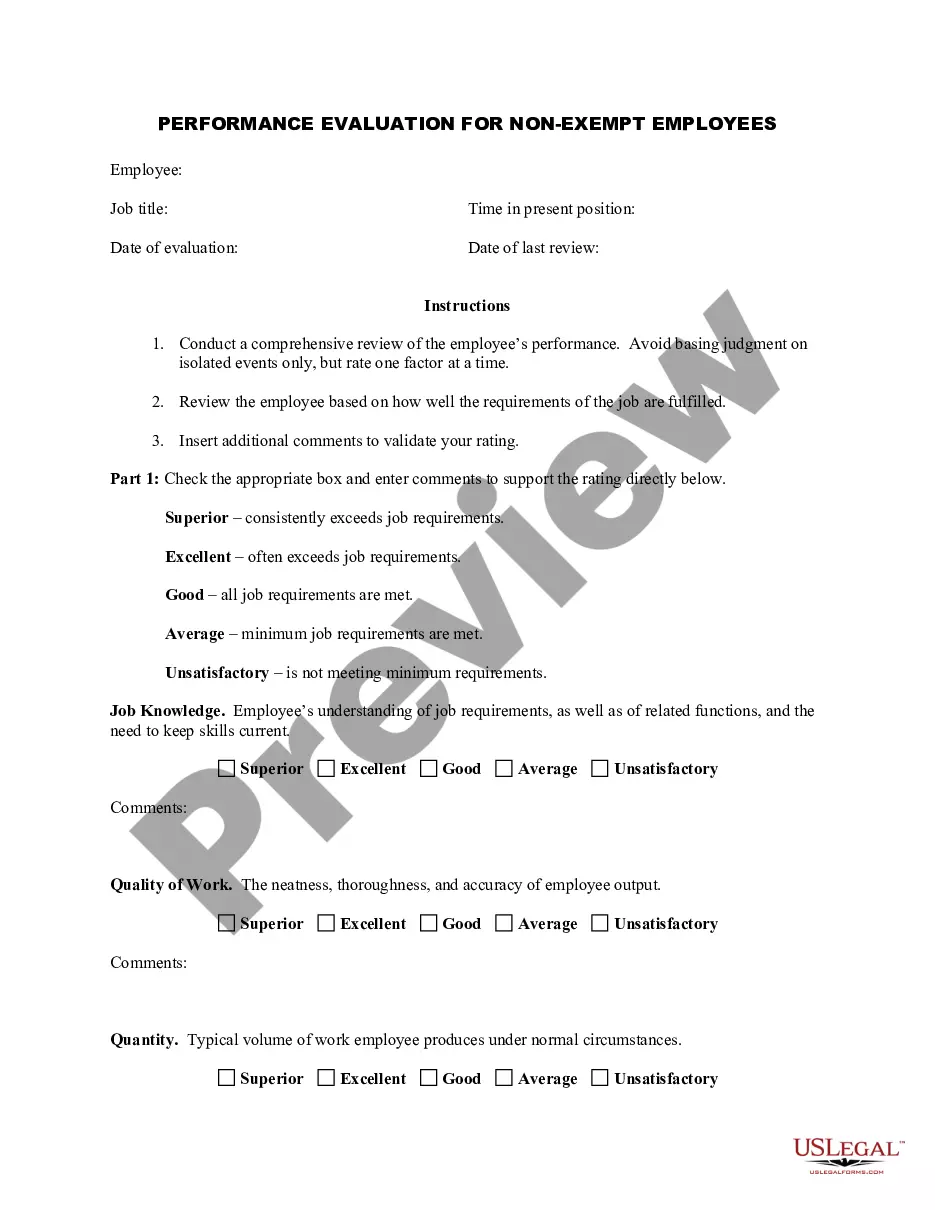

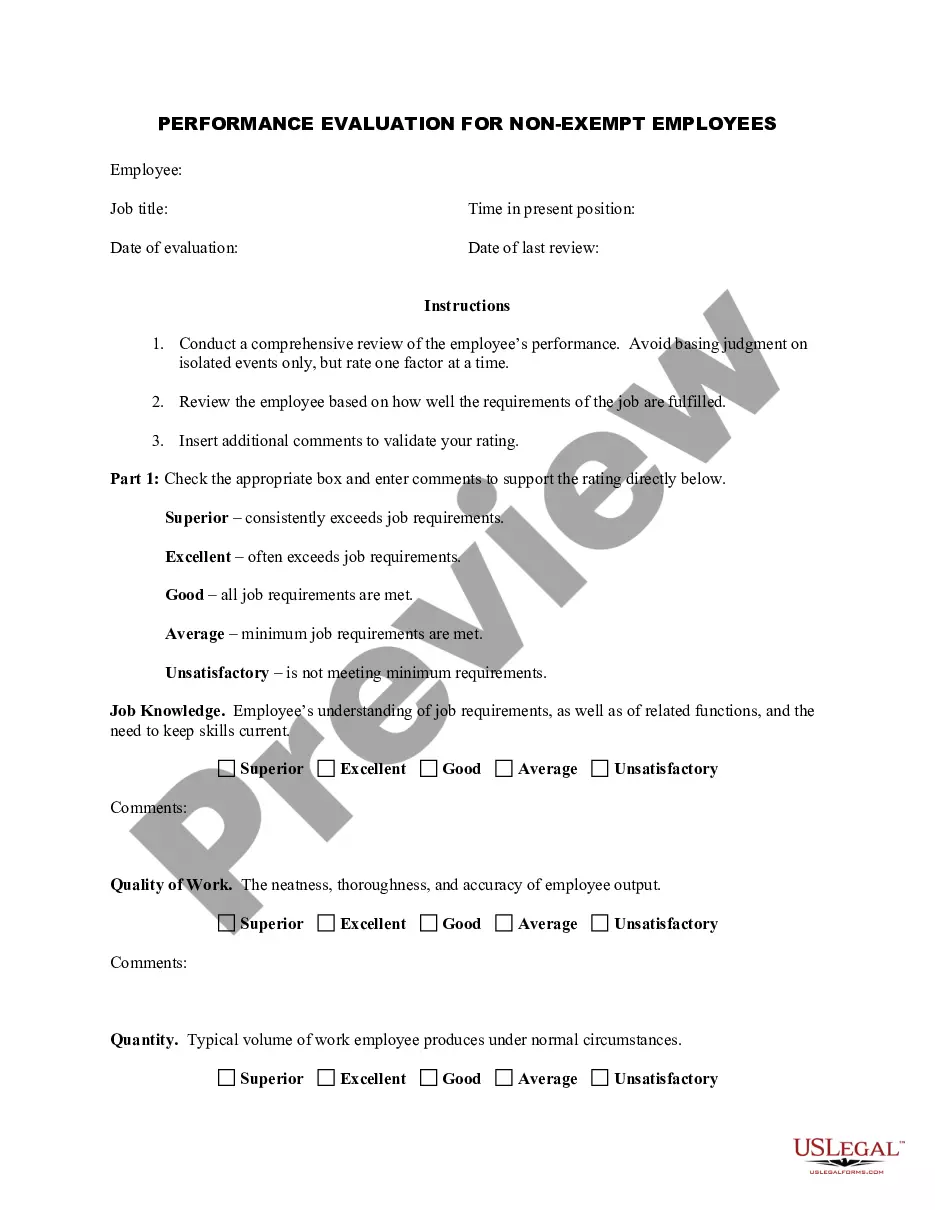

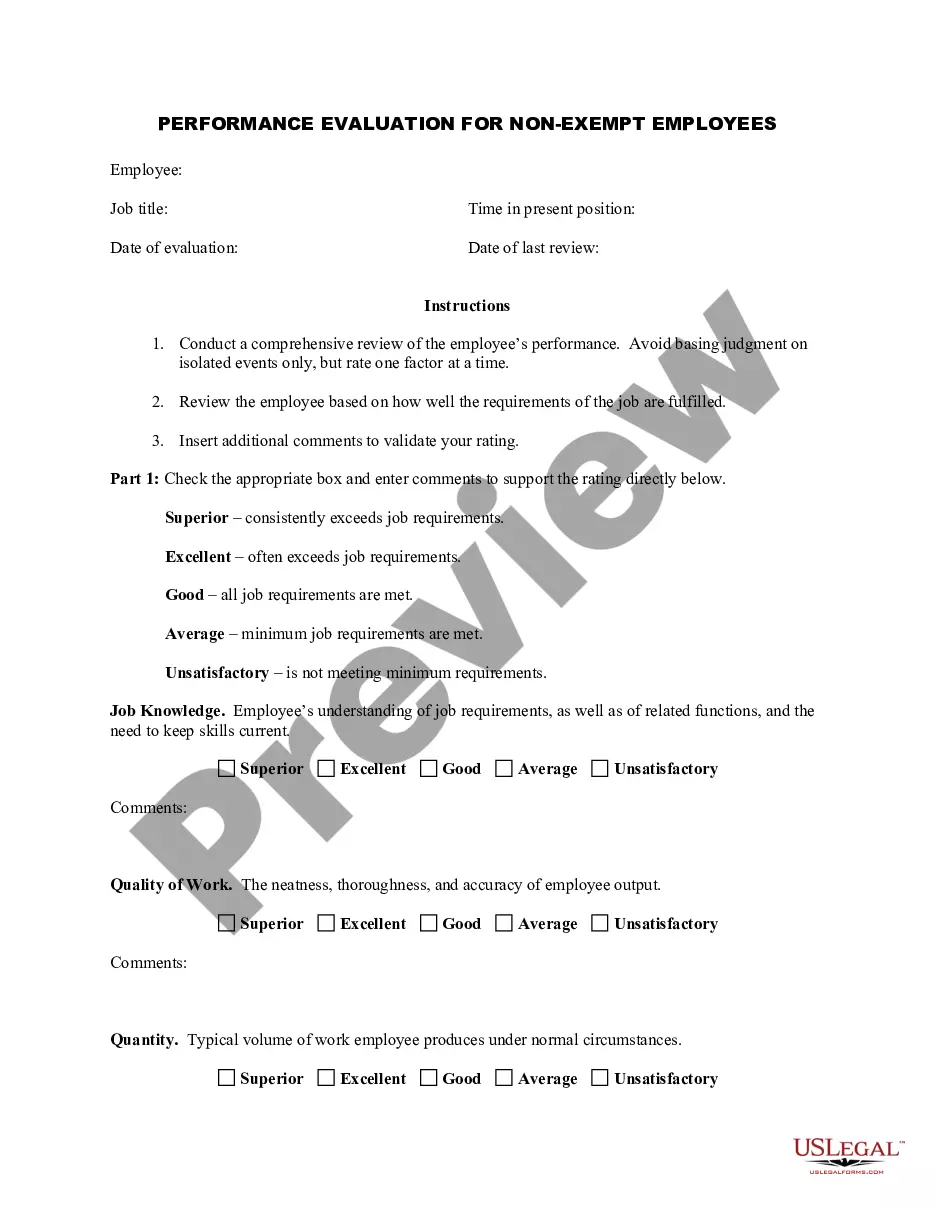

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the right document.

- If the form is not what you are looking for, utilize the Search box to find the form that meets your needs.

- Once you find the right form, click Get now.

- Select the pricing plan you want, provide the required information to create your account, and complete the transaction with your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

In New York, there is no maximum number of hours that salaried employees can work, provided they are classified as exempt. However, it is vital for employers to ensure that their policies align with labor laws and employee well-being. Regular evaluations using the New York Salary - Exempt Employee Review and Evaluation Form can foster a transparent conversation about workload and help maintain a healthy work-life balance.

In New York State, salaried employees are generally not entitled to mandatory lunch breaks, but employers must adhere to specific guidelines. If an employee works a shift that exceeds six hours, they are usually entitled to a meal break of at least 30 minutes. However, this can vary by industry, and it's important for employers to clearly outline their policies. Having a clear New York Salary - Exempt Employee Review and Evaluation Form can help employers track compliance with these requirements.

Begin by reading each section of the employee performance evaluation form carefully. Input relevant information such as goals, achievements, and areas needing development. Make sure to relate your comments to the role's expectations highlighted in the New York Salary - Exempt Employee Review and Evaluation Form.

An example of a performance evaluation can include sections for project contributions, teamwork, and individual growth goals. Summarize each section with ratings and detailed comments that demonstrate progress and setbacks. Utilize insights from the New York Salary - Exempt Employee Review and Evaluation Form to ground your evaluation in job performance standards.

Start by reviewing the employee's job description and previous evaluation notes. During the evaluation, assess performance against established objectives, providing evidence and examples. Ensure that the process aligns with the New York Salary - Exempt Employee Review and Evaluation Form, guiding the creation of a fair and thorough evaluation.

In your employee performance evaluation, include sections on overall performance, achievement of goals, strengths, and areas for improvement. Offer constructive feedback while recognizing accomplishments to provide a balanced view. Highlight specifics related to the New York Salary - Exempt Employee Review and Evaluation Form to give context to your evaluation.

When crafting performance goals, ensure they are specific, measurable, attainable, relevant, and time-bound. Examples may include increasing project efficiency by 15% over the next quarter or enhancing team collaboration through weekly meetings. Align these goals with the objectives of your New York Salary - Exempt Employee Review and Evaluation Form to ensure they reflect your role effectively.

To complete an employee self-evaluation form, start by reflecting on your job responsibilities and accomplishments. Assess your performance in achieving set goals and identify areas for improvement. It is important to be honest and provide specific examples where applicable, especially when discussing areas related to your New York Salary - Exempt Employee Review and Evaluation Form.

As of the latest updates, the salary exempt threshold in New York is set at $1,125 per week, translating to approximately $58,500 annually. This threshold applies to employees classified as exempt under state labor laws. It is crucial for employers to stay informed about any changes to this threshold to ensure compliance. Implementing the New York Salary - Exempt Employee Review and Evaluation Form can aid in reviewing employee classifications and maintaining adherence to the state regulations.

In New York, laws governing salaried employees establish specific criteria that distinguish exempt from non-exempt roles. Employers must comply with the Fair Labor Standards Act alongside New York State's labor regulations. These laws ensure that salaried employees receive appropriate compensation and that their working conditions meet legal standards. Utilizing tools like the New York Salary - Exempt Employee Review and Evaluation Form can help businesses navigate these complex requirements effectively.