New York Loan Modification Agreement - Multistate

Description

How to fill out Loan Modification Agreement - Multistate?

You can spend time on-line trying to find the authorized document format that meets the federal and state specifications you require. US Legal Forms supplies a large number of authorized varieties that are reviewed by pros. It is possible to download or print the New York Loan Modification Agreement - Multistate from our services.

If you have a US Legal Forms account, it is possible to log in and click the Down load button. Afterward, it is possible to comprehensive, change, print, or sign the New York Loan Modification Agreement - Multistate. Each authorized document format you purchase is the one you have permanently. To acquire yet another copy of any acquired form, check out the My Forms tab and click the related button.

If you are using the US Legal Forms site the very first time, stick to the basic recommendations beneath:

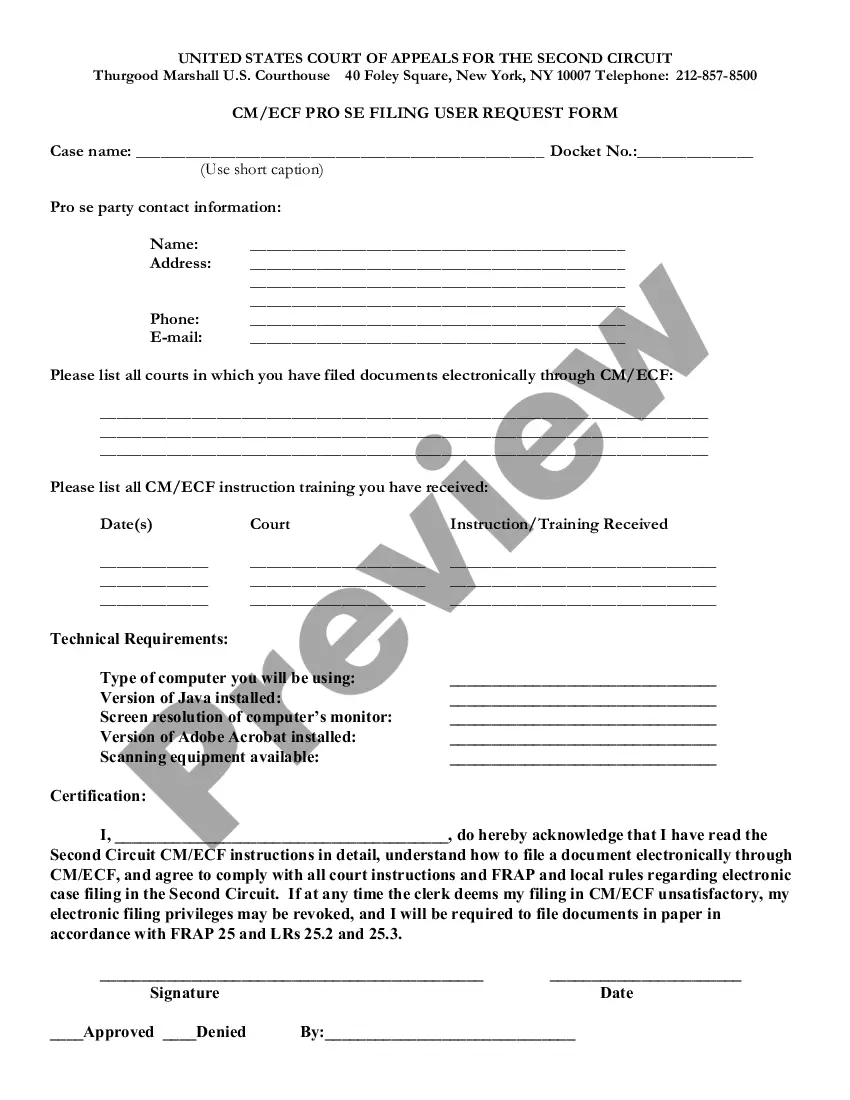

- Very first, make sure that you have chosen the correct document format to the area/area of your choice. See the form information to make sure you have picked out the appropriate form. If accessible, make use of the Preview button to appear through the document format too.

- If you wish to discover yet another model from the form, make use of the Look for area to find the format that suits you and specifications.

- Once you have identified the format you need, click on Buy now to proceed.

- Pick the pricing plan you need, key in your qualifications, and register for your account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal account to purchase the authorized form.

- Pick the formatting from the document and download it for your system.

- Make adjustments for your document if required. You can comprehensive, change and sign and print New York Loan Modification Agreement - Multistate.

Down load and print a large number of document layouts while using US Legal Forms web site, which offers the greatest assortment of authorized varieties. Use skilled and state-specific layouts to handle your organization or personal needs.

Form popularity

FAQ

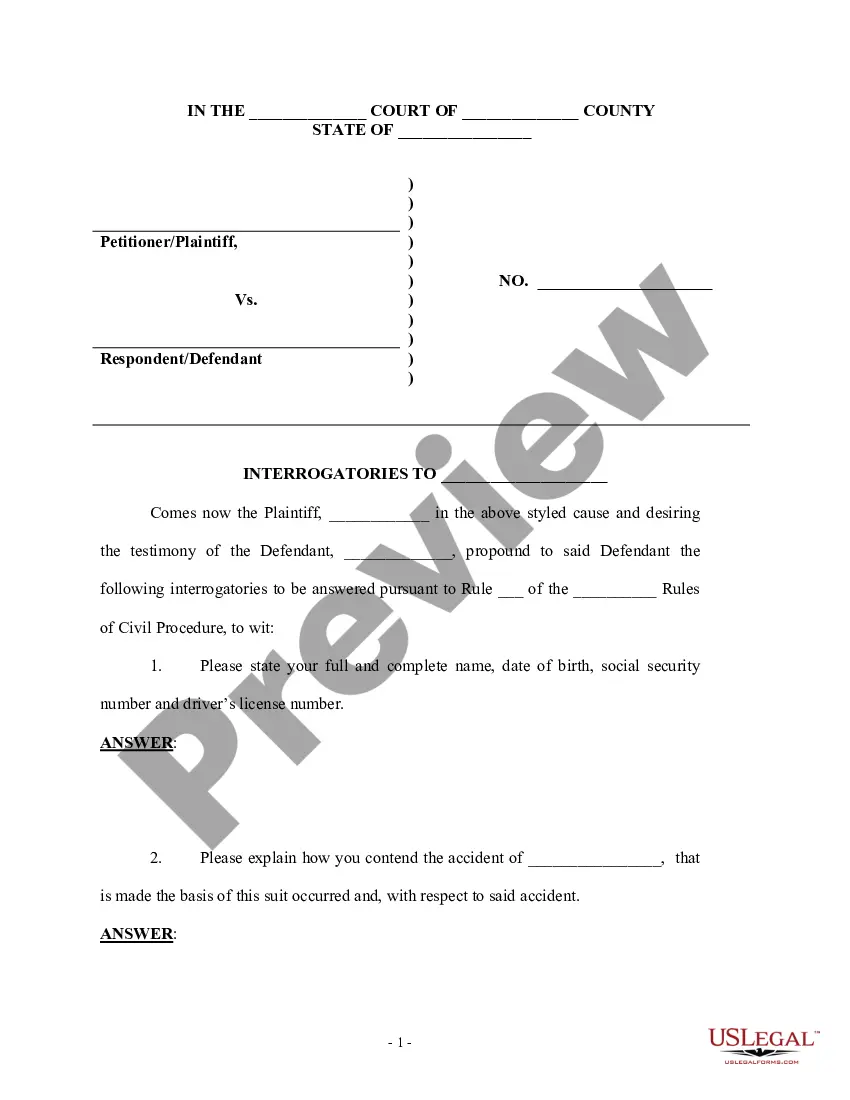

The loan modification process can vary from lender to lender, but in general most programs will require similar steps: Step 1 Gather information about your financial situation. ... Step 2 Reach out to your lender. ... Step 3 Check the qualifications for loan modification. ... Step 4 Complete an application.

Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments. Those missed payments hurt your credit score. A home loan modification does the same.

Conventional loan modification ? For conventional mortgages owned by Fannie or Freddie, you can pursue the Flex Modification program, which can reduce monthly payments by up to 20 percent, extend the loan term up to 40 years and potentially lower the interest rate.

During meetings with your lender, you can negotiate the interest rate, the term of the loan, late fees, and any good faith payment you are prepared to make. Remember that you may not be able to negotiate the principal or any amount that you still owe from before you applied for the loan modification.

Could be reported as a settlement: Because you're changing the terms of your loan, some lenders may report your loan modification to the credit bureaus (Experian, TransUnion and Equifax) as a settlement, which can wreak havoc on your credit scores and remain on your credit reports for several years.

Loan modification is a change made to the terms of an existing loan by a lender. It may involve a reduction in the interest rate, an extension of the length of time for repayment, a different type of loan, or any combination of the three.

Modifications may involve extending the number of years you have to repay the loan, reducing your interest rate, and/or forbearing or reducing your principal balance.

There are guidelines on the number of potential modification requests you can expect to be granted by certain lenders. People with loans backed by the Federal Housing Association (FHA) can generally expect to receive two to three loan modifications, although the FHA will only modify a loan once every two years.