New York Request for Accounting of Disclosures of Protected Health Information

Description

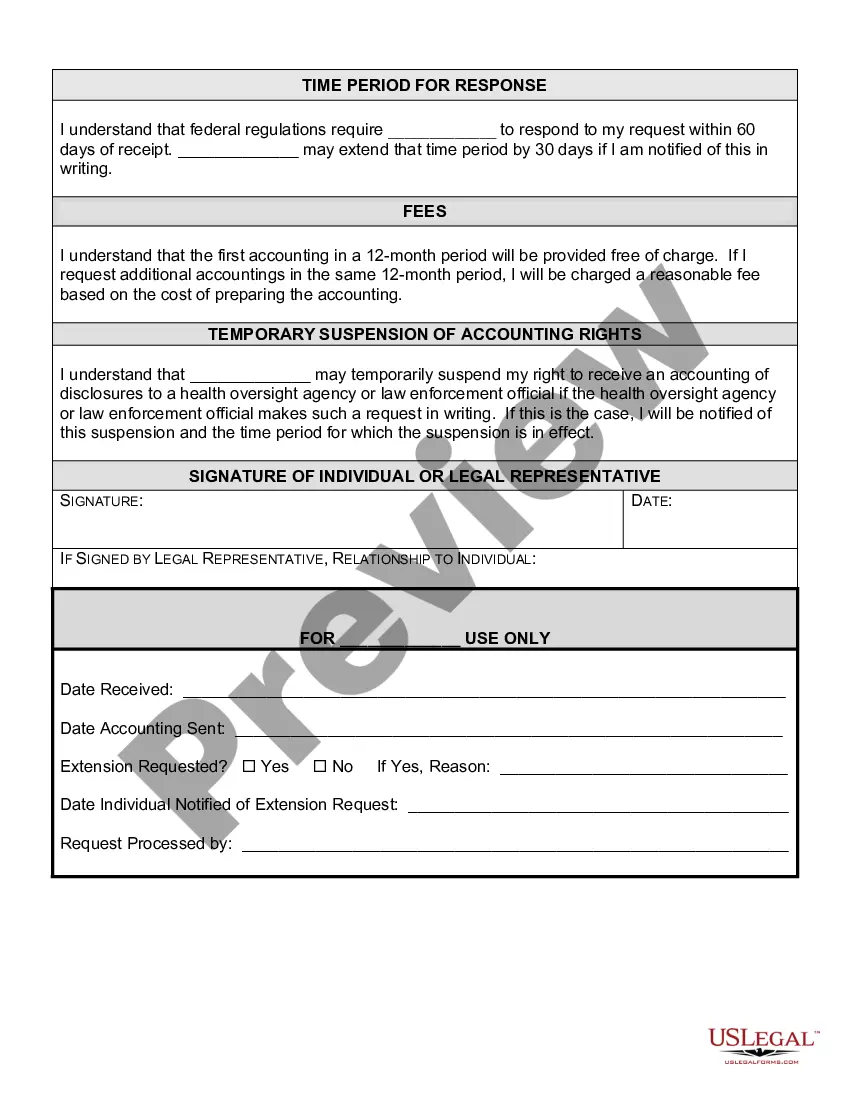

How to fill out Request For Accounting Of Disclosures Of Protected Health Information?

Are you presently in a circumstance that requires documents for both business and personal reasons each time.

There are many legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms offers numerous template options, such as the New York Request for Accounting of Disclosures of Protected Health Information, that are designed to comply with federal and state regulations.

Once you find the correct form, click on Purchase now.

Select the pricing plan you wish, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the New York Request for Accounting of Disclosures of Protected Health Information template.

- If you lack an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/state.

- Utilize the Preview button to review the form.

- Check the description to make sure you have selected the right form.

- If the form isn’t what you seek, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

HIPAA Disclosure Accounting or Accounting of Disclosures (AOD) is the action or process of keeping records of disclosures of PHI for purposes other than Treatment, Payment, or Healthcare Operations. You are required by law to provide patients a list of all the disclosures of their PHI that you have made outside of TPO.

For each disclosure, the accounting must include: (1) The date of the disclosure; (2) the name (and address, if known) of the entity or person who received the protected health information; (3) a brief description of the information disclosed; and (4) a brief statement of the purpose of the disclosure (or a copy of the

HIPAA Disclosure Accounting or Accounting of Disclosures (AOD) is the action or process of keeping records of disclosures of PHI for purposes other than Treatment, Payment, or Healthcare Operations. You are required by law to provide patients a list of all the disclosures of their PHI that you have made outside of TPO.

Other instances necessitating Accounting of Disclosures (AOD) include: Those Required by Law (Court Orders, subpoenas, state reporting, emergencies) Public Health Activities (Prevention of disease, public health investigations) Victims of abuse, neglect, or domestic violence.

The use and disclosure of PHI for purposes of TPO is allowed without a specific Authorization from the patient. Treatment means the provision, coordination and management of health care and related services by one or more health care providers.

When releases occur that are pursuant to Accounting of Disclosures, the log must include certain elements like: the date of the disclosure; the name and address of the organization / person who received the PHI; a brief description of the PHI disclosed; and.

Disclosures that Commonly Qualify for AccountingAn accounting is required if the disclosure is made and no authorization from the patient or patient's personal representative is obtained: In response to a subpoena or other judicial or administrative proceeding if not accompanied by a patient authorization.

HIPAA enables patients to learn to whom the covered entity has disclosed their PHI. This is called an accounting of disclosures. The accounting will cover up to six years prior to the individual's request date and will include disclosures to or by business associates of the covered entity.

Designated record sets include medical records, billing records, payment and claims records, health plan enrollment records, case management records, as well as other records used, in whole or in part, by or for a covered entity to make decisions about individuals. See 45 CFR 164.501.

Under the HIPAA Privacy Rule, a covered entity must act on an individual's request for access no later than 30 calendar days after receipt of the request.