New York Withheld Delivery Notice

Description

How to fill out Withheld Delivery Notice?

You can spend hours online trying to locate the legal form template that meets the requirements of your state and federal regulations.

US Legal Forms offers a vast selection of legal documents that have been reviewed by professionals.

It is easy to download or print the New York Withheld Delivery Notice from the platform.

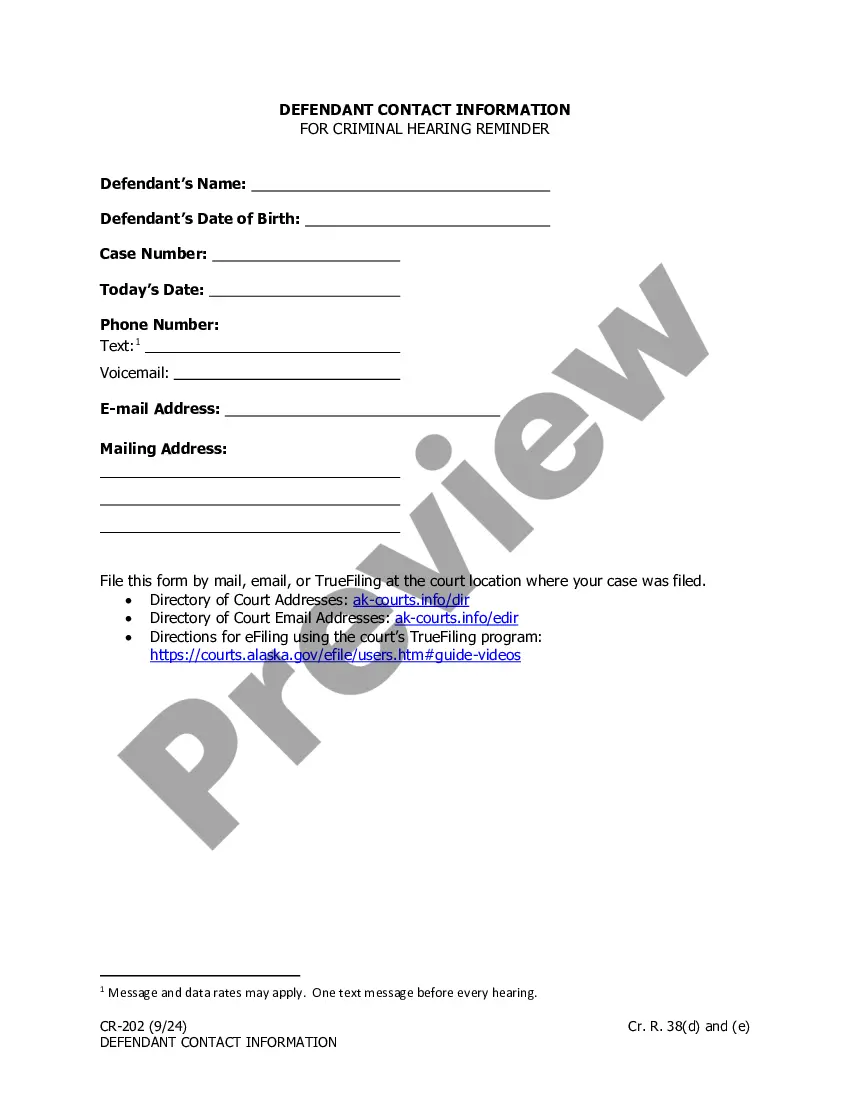

If applicable, utilize the Review button to preview the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, edit, print, or sign the New York Withheld Delivery Notice.

- Each legal document template you acquire is yours indefinitely.

- To obtain an additional copy of a purchased form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Read the form description to verify that you have chosen the right template.

Form popularity

FAQ

If you're an employer, you can Web File Form NYS-45 through your Business Online Services account....You can use NYS-45 Web File to report:Part A - Unemployment insurance (UI) Information,Part B - Withholding tax (WT) information, and.Part C - Employee wage and withholding information.

All employers required to withhold tax from wages must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, each calendar quarter. If you withhold less than $700 during a calendar quarter, remit taxes withheld with your quarterly return, Form NYS-45.

NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return. All employers required to withhold tax from wages must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, each calendar quarter.

Form NYS-1If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45. If you have more than one payroll within a week (Sunday through Saturday), you are not required to file until after the last payroll in the week.

The PTET is an optional tax that partnerships or New York S corporations may annually elect to pay on certain income for tax years beginning on or after January 1, 2021.

The partnerships and New York S corporations must maintain copies of Form IT-2658-E for their records. Estimated tax payments are only required for partners and shareholders who are C corporations or nonresident individuals.

(1/19) Quarterly Combined Withholding, Wage Reporting, And Unemployment Insurance Return-Attachment.

An employer must deduct and withhold New York State personal income tax on all wages paid to an employee who is a nonresident of New York State for services performed in New York State.

The Form IT-204-IP provided to you by your partnership lists your distributive share of any credits, credit components, credit factors, recapture of credits, and any other information reported by the partnership during the tax year. You need this information when completing your individual income tax return.

Under Section 1127 of the City Charter, if you are a City employee who lives outside the City and you were hired after January 4, 1973, as a condition of employment you agreed to pay to the City an amount equal to a City personal income tax on residents, computed and determined as if you were a resident of the City.