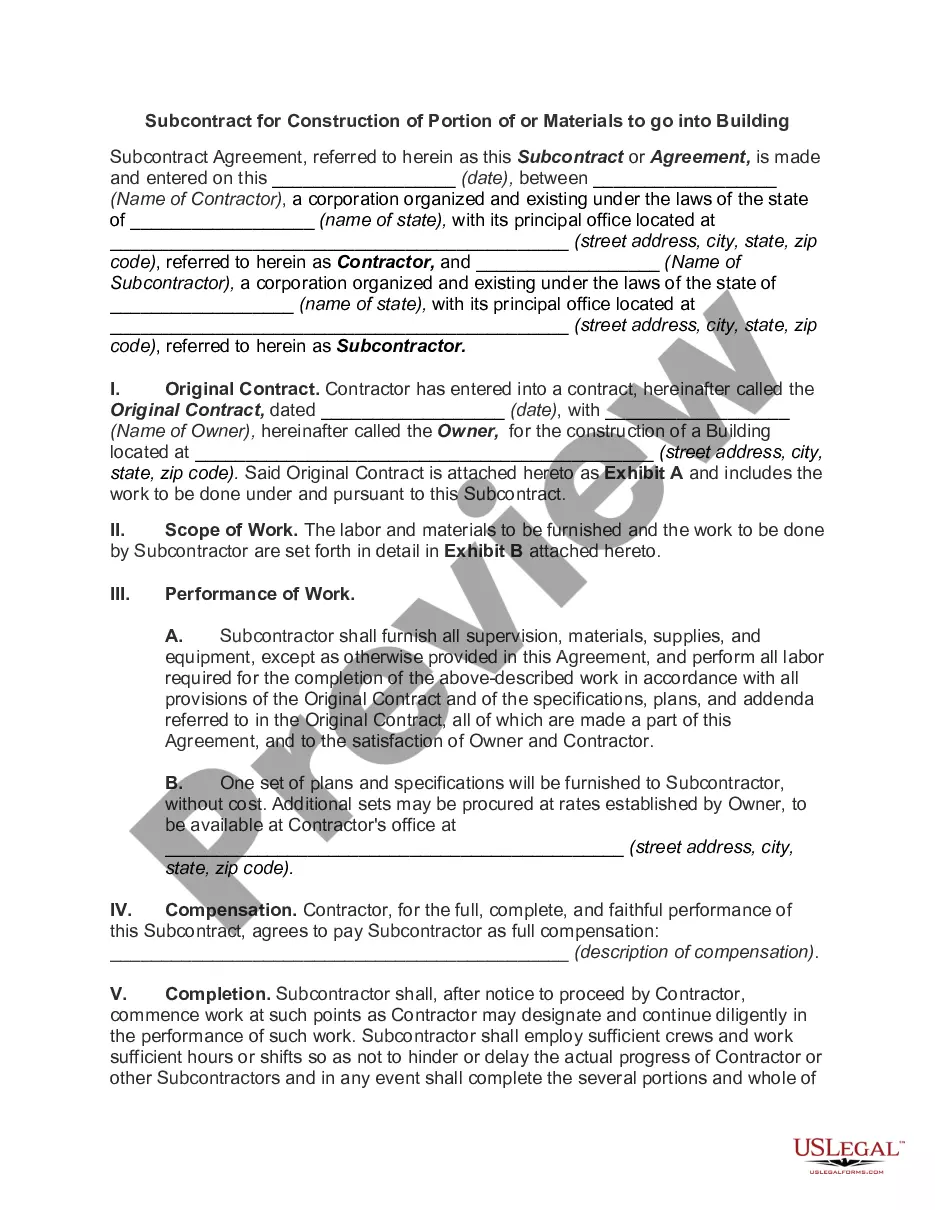

New York Subcontract for Construction of Portion of or Materials to go into Building

Description

How to fill out Subcontract For Construction Of Portion Of Or Materials To Go Into Building?

If you need to finish, acquire, or print valid document templates, utilize US Legal Forms, the largest selection of legal forms, available online.

Take advantage of the site's simple and user-friendly search to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords. Utilize US Legal Forms to obtain the New York Subcontract for Construction of Portion of or Materials to enter Building with just a few clicks.

Every legal document template you purchase is yours indefinitely. You can access every form you acquired within your account. Click on the My documents section to select a form to print or download again.

Complete and obtain, and print the New York Subcontract for Construction of Portion of or Materials to enter Building with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

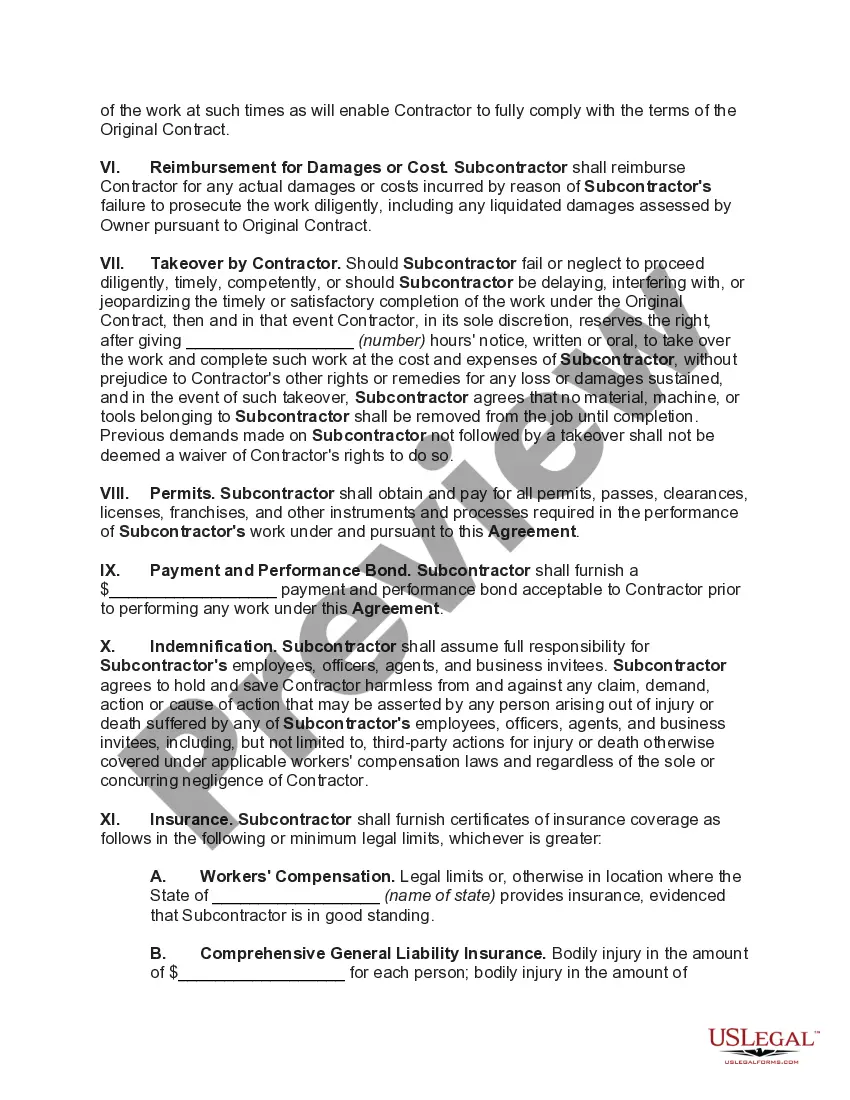

- If you are already a US Legal Forms customer, Log In to your account and click the Download option to access the New York Subcontract for Construction of Portion of or Materials to enter Building.

- You can also view forms you previously purchased in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find additional versions of the legal form design.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, amend, and print or sign the New York Subcontract for Construction of Portion of or Materials to enter Building.

Form popularity

FAQ

Many sellers believe there is a general exemption from sales tax for labor charges. However, in California many types of labor charges are subject to tax. Tax applies to charges for producing, fabricating, or processing tangible personal property for your customers.

If the services performed by the temporary service contractor's employee are not subject to tax under Section 1105(c) of the Tax Law, then no tax is to be collected on the charge for these services.

The disadvantages contractors doing this work lie in costs: The hourly expenses are high, and the professionals are independent in that they don't report to supervisors inside the company. These factors make it challenging to control the costs of these subcontracts.

No tax is due on labor charges for the use of subcontractors in a capital improvement project. Subcontractors are required to pay tax on their purchases of materials.

It Is Cost Efficient and Risk Adverse When your business needs some extra hands on a large project, hiring subcontractors is often much more cost effective than bringing on new, full-time employees. It also helps avoid risk by hiring a reliable and safe firm with substantial niche experience.

A subcontractor is a business or a person that undertakes work for a company as part of a larger project. In undertaking a contract from a contractor, subcontractors carry out work that the contractor can't perform, but remains responsible for. A subcontractor provides his or her services under a contract for service.

Rules To write tight subcontractsStart with successful procurement standards.Execute all subcontracts PRIOR to starting your projects.Help those who help you.Always award to the lowest and complete responsible qualified bidder.Use Contract Scope Checklists to write complete subcontracts.Make sure you have tight clauses.More items...?

Lump Sum. Some subcontractors are paid with a lump sum of money by their employers. For example, a technical writer contracts with a company to write a manual. The company agrees to pay that writer a certain amount of money to write the manual.

Examples of services not subject to sales tax are capital improvements to real property, medical care, education, and personal and professional services.

All charges for materials and labor that you bill to your customer for any repair, maintenance, or installation project, including any expenses or other markups, are taxable.