Oklahoma Complex Will with Credit Shelter Marital Trust for Large Estates

Description

How to fill out Oklahoma Complex Will With Credit Shelter Marital Trust For Large Estates?

In terms of submitting Oklahoma Complex Will with Credit Shelter Marital Trust for Large Estates, you most likely think about an extensive process that requires getting a suitable form among a huge selection of similar ones after which being forced to pay a lawyer to fill it out to suit your needs. In general, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific template in just clicks.

In case you have a subscription, just log in and click on Download button to find the Oklahoma Complex Will with Credit Shelter Marital Trust for Large Estates form.

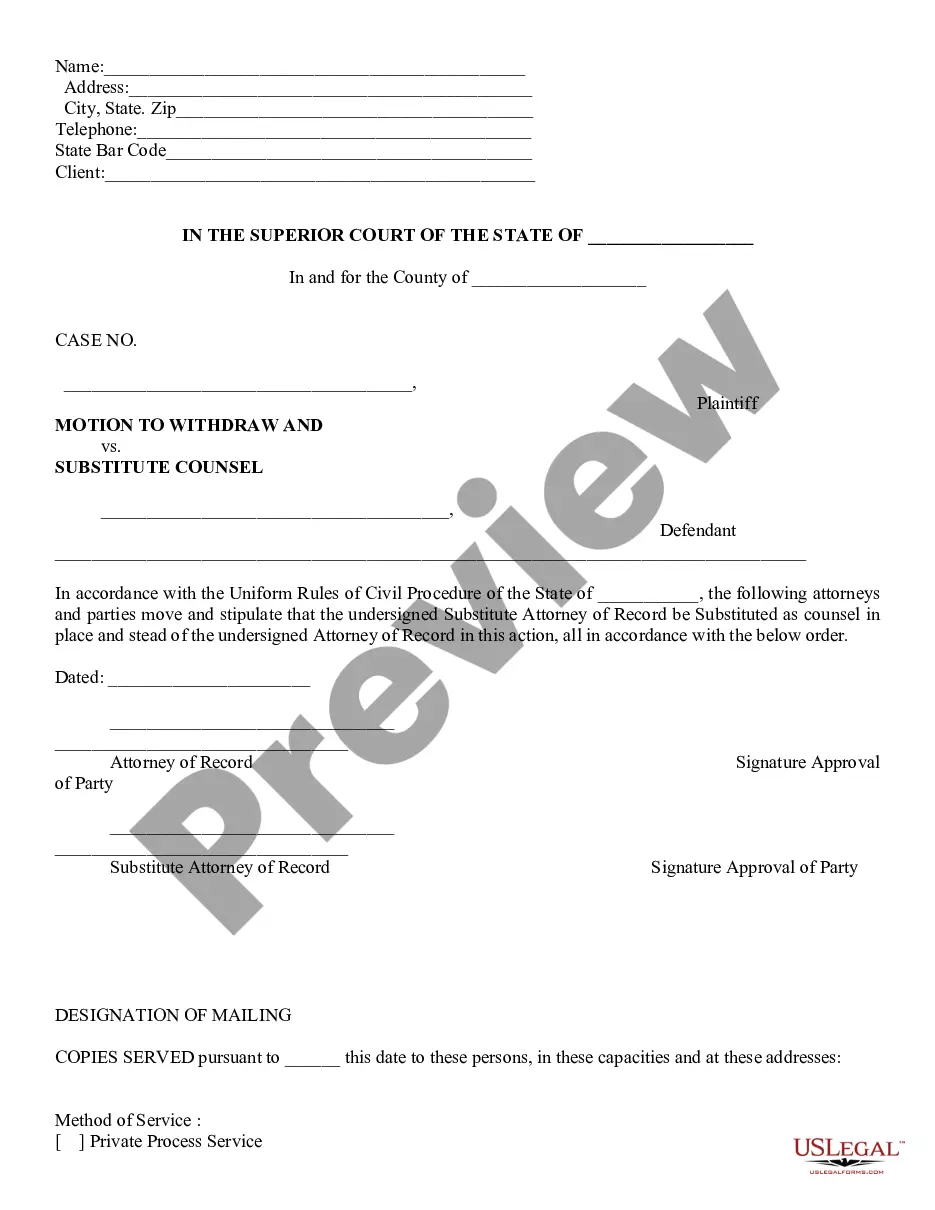

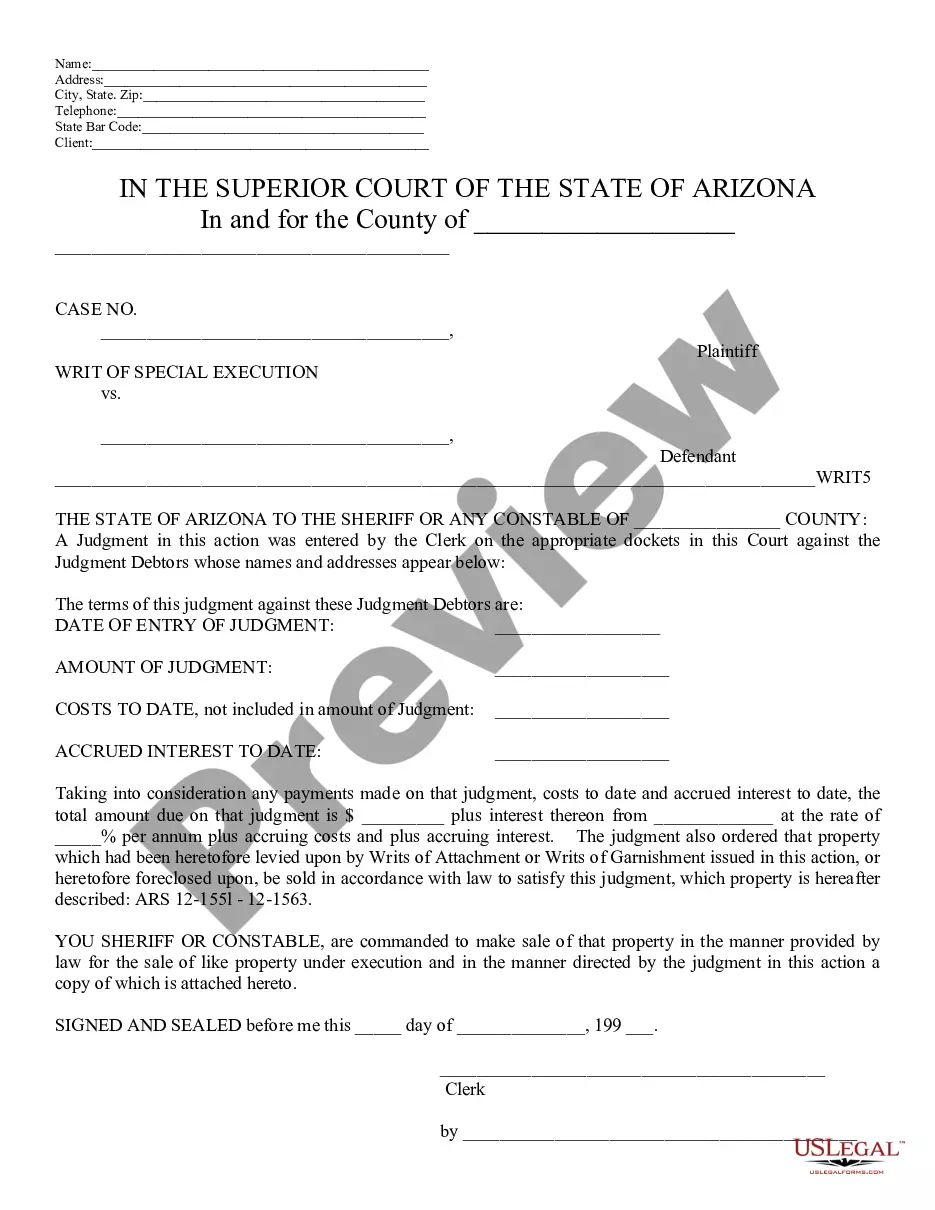

If you don’t have an account yet but need one, stick to the step-by-step manual listed below:

- Make sure the document you’re downloading applies in your state (or the state it’s required in).

- Do this by reading the form’s description and also by clicking on the Preview option (if offered) to view the form’s content.

- Simply click Buy Now.

- Pick the suitable plan for your financial budget.

- Join an account and select how you want to pay: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Professional lawyers work on drawing up our templates so that after downloading, you don't need to worry about modifying content material outside of your personal information or your business’s information. Join US Legal Forms and get your Oklahoma Complex Will with Credit Shelter Marital Trust for Large Estates document now.

Form popularity

FAQ

The trust qualifies for the marital deduction. In a QTIP trust, the surviving spouse must receive all income generated by the trust property for life, paid at least annually.After the surviving spouse's death, the property passes to the remainder beneficiaries of the trust, who usually are the children of the couple.

Key points. Death after 75 doesn't mean that a spousal bypass trust is no longer relevant. It is the government's intention that from a tax perspective the new rules mean that the position would be broadly the same for the beneficiary of a bypass trust, as those receiving benefits directly from the pension.

A bypass trust, or AB trust, is a legal arrangement that allows married couples to avoid estate tax on certain assets when one spouse passes away.The first part is the marital trust, or A trust. The second is a bypass, family or B trust. The marital trust is a revocable trust that belongs to the surviving spouse.

A marital trust starts as a revocable living trust. A surviving spouse can be its trustee.

A Trust (or Marital Trust) It is a trust that takes advantage of the unlimited marital deduction in order to avoid estate taxes at the time of the first spouse's death in the event that the first spouse's individual estate is more than the individual exemption amount.

A marital trust is a type of irrevocable trust that allows you to transfer assets to a surviving spouse tax free. It can also shield the estate of the surviving spouse before the remaining assets pass on to your children.

Yes, the surviving spouse may serve as trustee of the credit shelter trust.All of the assets in the credit shelter trust, including any appreciation in value during the surviving spouse's lifetime, pass free of estate tax to the beneficiaries.

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.