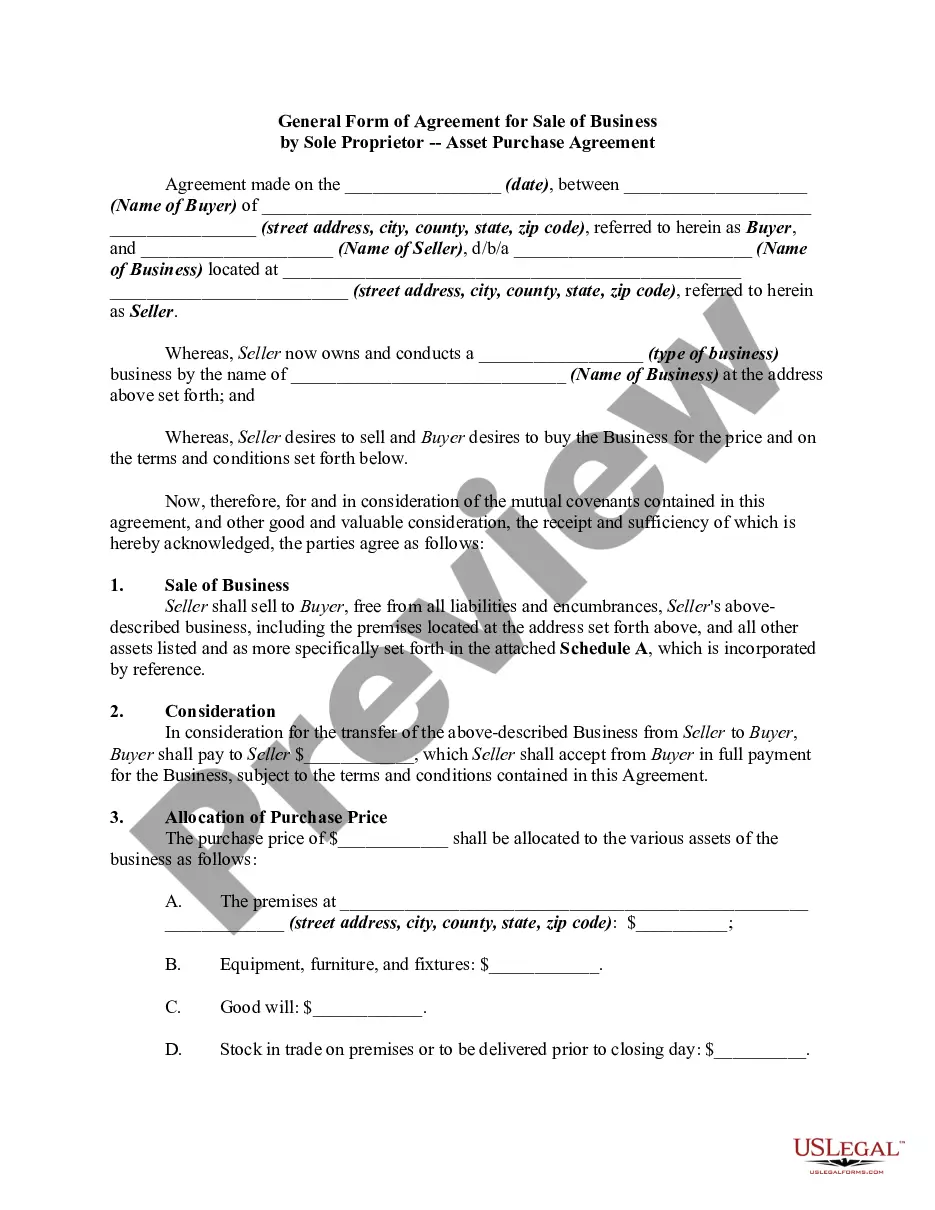

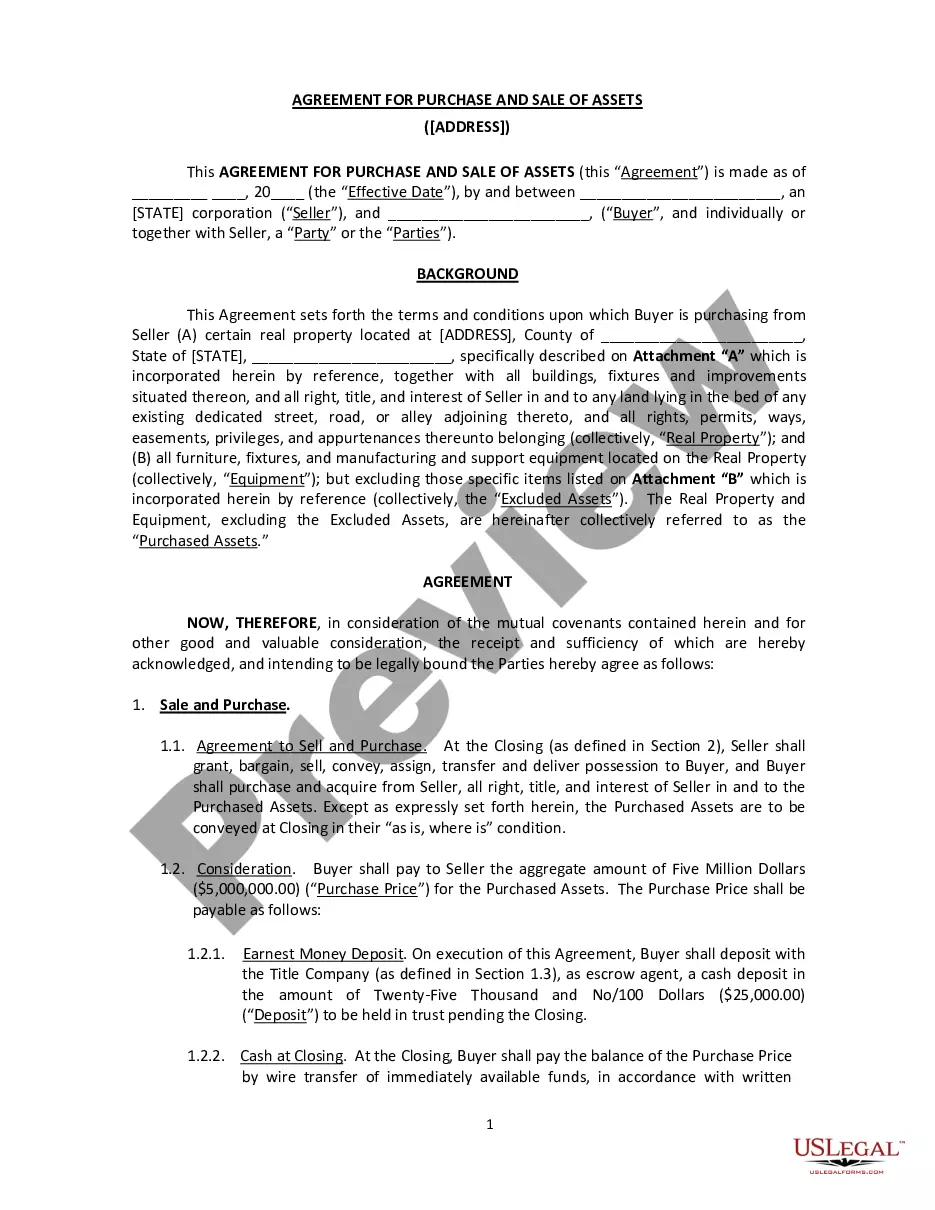

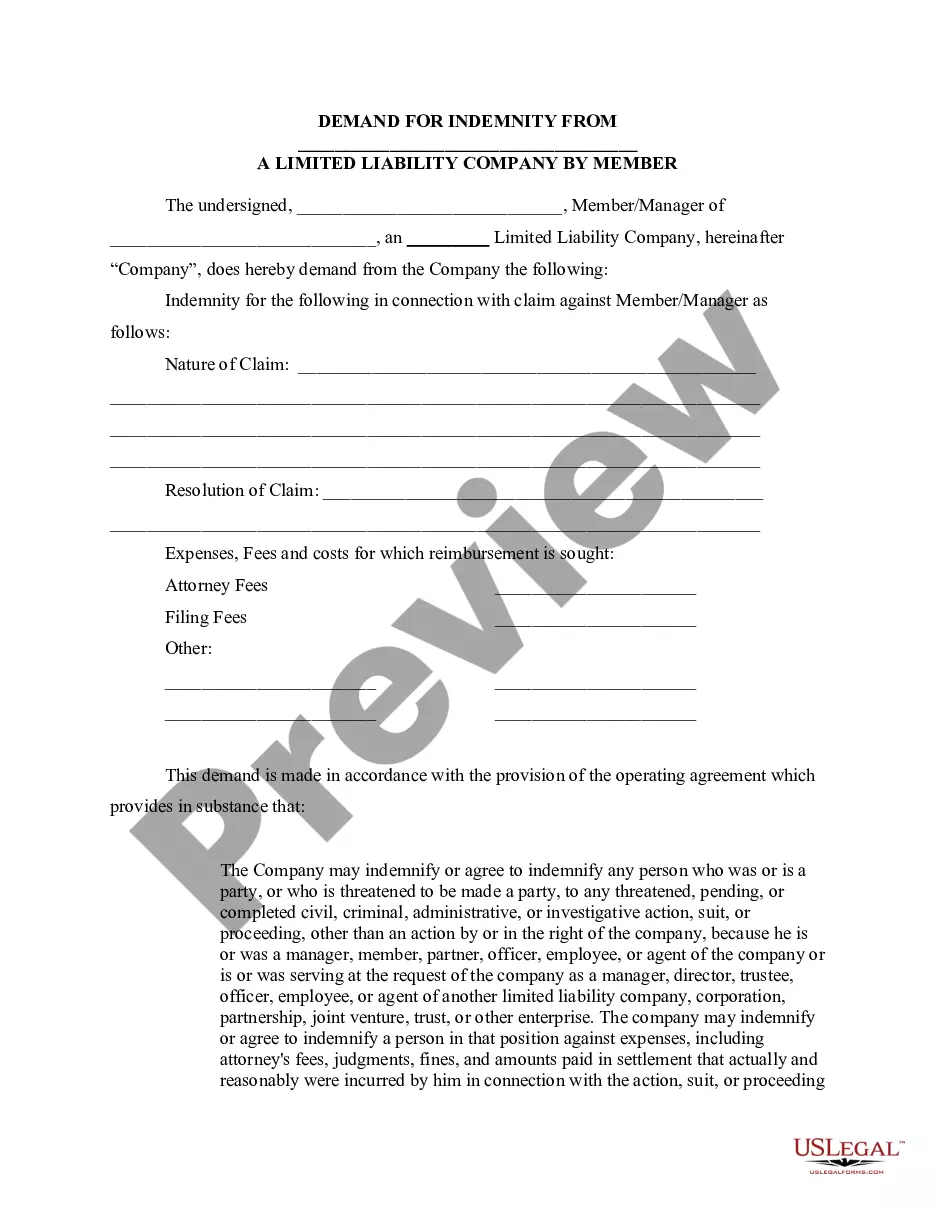

New York Asset Sale Agreement

Description

How to fill out Asset Sale Agreement?

It is feasible to spend numerous hours online trying to locate the valid document format that meets the federal and state requirements you will need.

US Legal Forms offers a wide array of valid templates that are reviewed by experts.

You can conveniently obtain or print the New York Asset Sale Agreement from their service.

If available, use the Review button to browse the template as well.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, print, or sign the New York Asset Sale Agreement.

- Every valid document format you receive is yours indefinitely.

- To obtain another copy of any acquired form, visit the My documents section and click on the respective button.

- If you are using the US Legal Forms site for the first time, follow these simple instructions below.

- Firstly, ensure that you have selected the correct format for the county/city of your choice.

- Review the form details to confirm that you have selected the right document.

Form popularity

FAQ

The purchaser has paid a sum of Rs............... as earnest money on...................... (the receipt of which sum, the vendor hereby acknowledges) and the balance amount of consideration will be paid at the time of execution of conveyance deed. 3. The sale shall be completed within a period of.........

In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

What is a Definitive Agreement? A definitive agreement may be known by other names such as a purchase and sale agreement, a stock purchase agreement or an asset purchase agreement. Regardless of its name, it is the final agreement that spells out details agreed upon by buyer and seller.

In an asset sale the target's contracts are transferred to the buyer by means of assigning the contracts to the buyer. The default rule is generally that a party to a contract has the right to assign the agreement to a third party (although the assigning party remains liable to the counter-party under the agreement).

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

Working capital is a large part of any company's assets and is the life blood that allows a business to operate. Whether a transaction is an asset or stock sale, working capital is always included in any valuation and sale, and must be delivered at the time of closing.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

In an asset sale, you retain the legal entity of the business and only sell the business' assets. For example, say you run a rental car company owned by Harry Smith Pty Ltd. You decide that you need to sell 50% of your fleet to upgrade your vehicles and want to sell those vehicles in one transaction to one buyer.