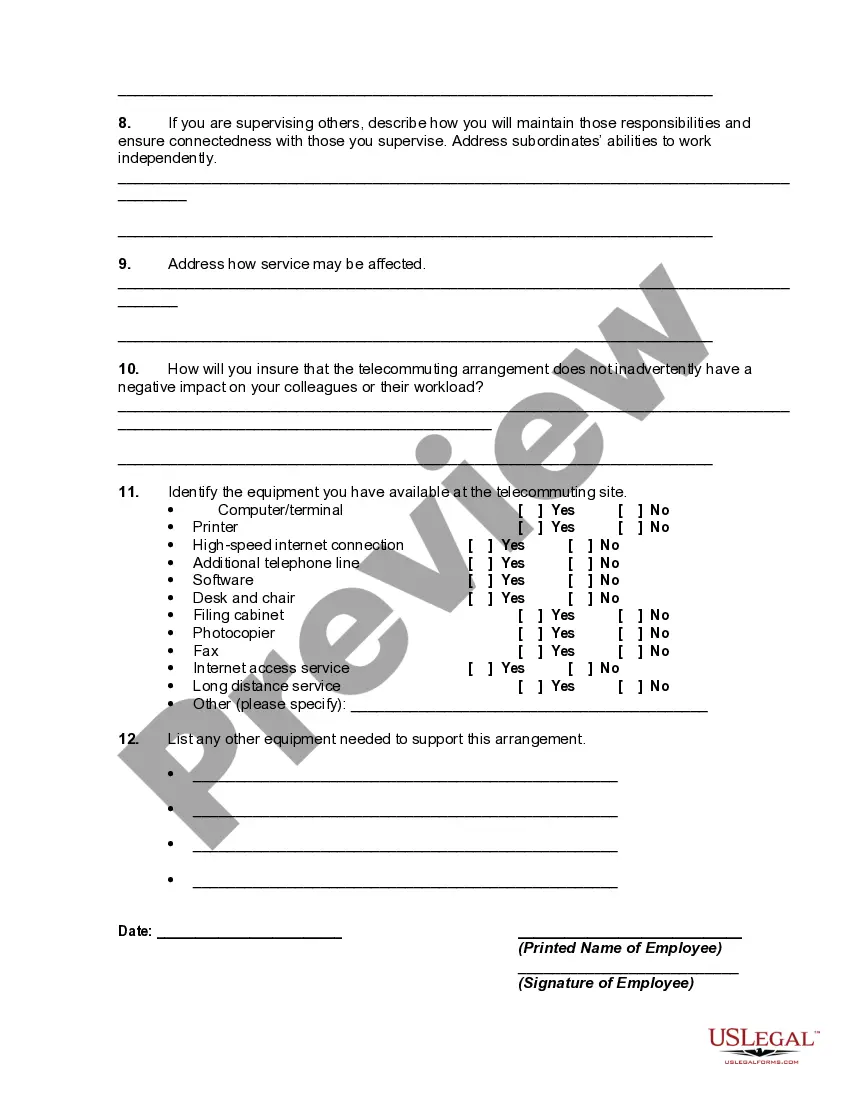

New York Telecommuting Worksheet

Description

How to fill out Telecommuting Worksheet?

It is feasible to spend hours online searching for the legal document format that meets the requirements of your state and federal regulations.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

You can download or print the New York Telecommuting Worksheet from the platform.

If available, utilize the Preview button to review the document format as well.

- If you already have a US Legal Forms account, you can sign in and click on the Download button.

- After that, you can complete, edit, print, or sign the New York Telecommuting Worksheet.

- Every legal document format you obtain is yours permanently.

- To access another copy of the downloaded form, go to the My documents section and click on the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your region/city of choice.

- Review the form details to make sure you have chosen the right one.

Form popularity

FAQ

Table of ContentsAvoid or Defer Income Recognition.Max Out Your 401(k) or Similar Employer Plan.If You Have Your Own Business, Set Up and Contribute to a Retirement Plan.Contribute to an IRA.Defer Bonuses or Other Earned Income.Accelerate Capital Losses and Defer Capital Gains.Watch Trading Activity In Your Portfolio.More items...

You are subject to New York State tax on income you received from New York sources while you were a nonresident and all income you received while you were a New York State resident. You may have to pay income tax as a resident even if you are not considered a resident for other purposes.

All wages and any other compensation for services performed in the United States are generally considered to be from sources in the United States.

YES. If you live in Jersey City or anywhere in New Jersey and commute to New York, you have to file in both states. In fact, if you are commuting, your employer is required to withhold your New York taxes and even report your wages earned to New Jersey.

The State of New York income tax is 4% to 8.82%. A single person making the Long Island median household income of $112,365 would pay about $6,170 per year in state income taxes. If you live on Long Island but work in New York City, you may be subject to an additional NYC income tax of 3.078% to 3.876%.

All of that is considered NY source income because it is from a business, trade, profession, or occupation carried on in New York State. Unemployment received from NY is also taxable to NY (and Connecticut). On the NY return, it will be 100% New York source portion.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

This would be the income earned in New York or attributed to New York, for instance, interest you received when you were a resident of New York.

New York source income includes income derived from or connected with a business, trade, profession, or occupation carried on in New York State.

As a non-resident, you only pay tax on New York source income, which includes earnings from work physically performed in New York State, and income from real property. You are not liable for city tax.