New York Worksheet - Contingent Worker

Description

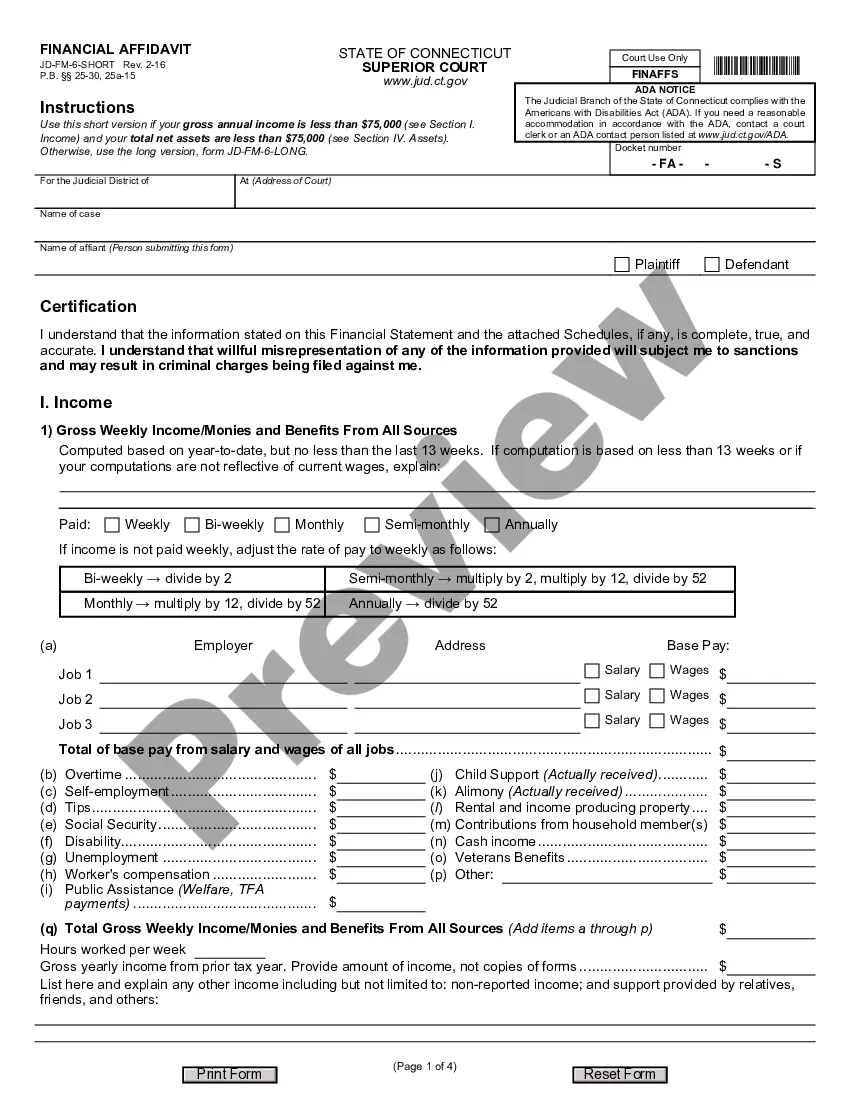

How to fill out Worksheet - Contingent Worker?

You might spend hours online searching for the legal document template that meets the federal and state criteria you need.

US Legal Forms offers a wide array of legal forms that are evaluated by experts.

You can download or print the New York Worksheet - Contingent Worker from the services provided.

If available, use the Review button to browse the document template as well.

- If you possess a US Legal Forms account, you may Log In and then click the Download button.

- Subsequently, you can complete, edit, print, or sign the New York Worksheet - Contingent Worker.

- Every legal document template you obtain is yours permanently.

- To retrieve an additional copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- Should you be using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city of your choice.

- Check the form details to confirm that you have chosen the right template.

Form popularity

FAQ

A contingent worker is someone who works for an organization without being hired as their employee. Contingent workers may provide their services under a contract, temporarily, or on an as-needed basis.

Instead of receiving a W-2 for tax filing purposes, contract employees receive Form 1099. This is the form you submit along with Form 1040 for filing your taxes. Unlike an employee who has payroll taxes deducted from his paycheck, a contract employee is responsible for paying his own taxes.

Pros. Delegating projects to contingent workers is much more cost effective for business owners than hiring employees. When working with contingent workers, businesses don't have to provide health benefits, vacation leave, sick days or extra payment for working overtime.

A contingent worker is someone who is hired for a fixed period of time, often on a project basis. Examples of contingent workers are freelancers, consultants, part-timers, on-call workers, independent contractors, and people in other types of alternative work arrangements.

Who are contingent workers? Independent contractors, on-call workers, freelancers, contract workers, and any other type of individual hired on a per-project basis are examples of contingent staffing. In most cases, contingent workers have specialized skills, like an accountant or electrician.

1099 Independent ContractorsThese contingent workers are self-employed and are not employees; therefore, companies are not responsible for the withholding, collecting or paying of taxes nor any other payments afforded full-time employees or Temporary W2 workers.

For instance, contingent workers' tax liability and reporting fall under a 1099-M instead of a W-2. The worker is responsible for the employment taxes generally covered by an organization for a traditional employee.

Contingent Worker. A contingent worker is one who has no explicit or implicit contract for long-term employment. About 5 percent of the U.S. workforce is made up of contingent workers.

As a category, contingent workers may include temporary employees, part-time employees, independent contract workers, employees of the temporary help industry ("temps"), consultants, seasonal employees, and interns. In contrast, full-time, permanent employees frequently are referred to as core employees.