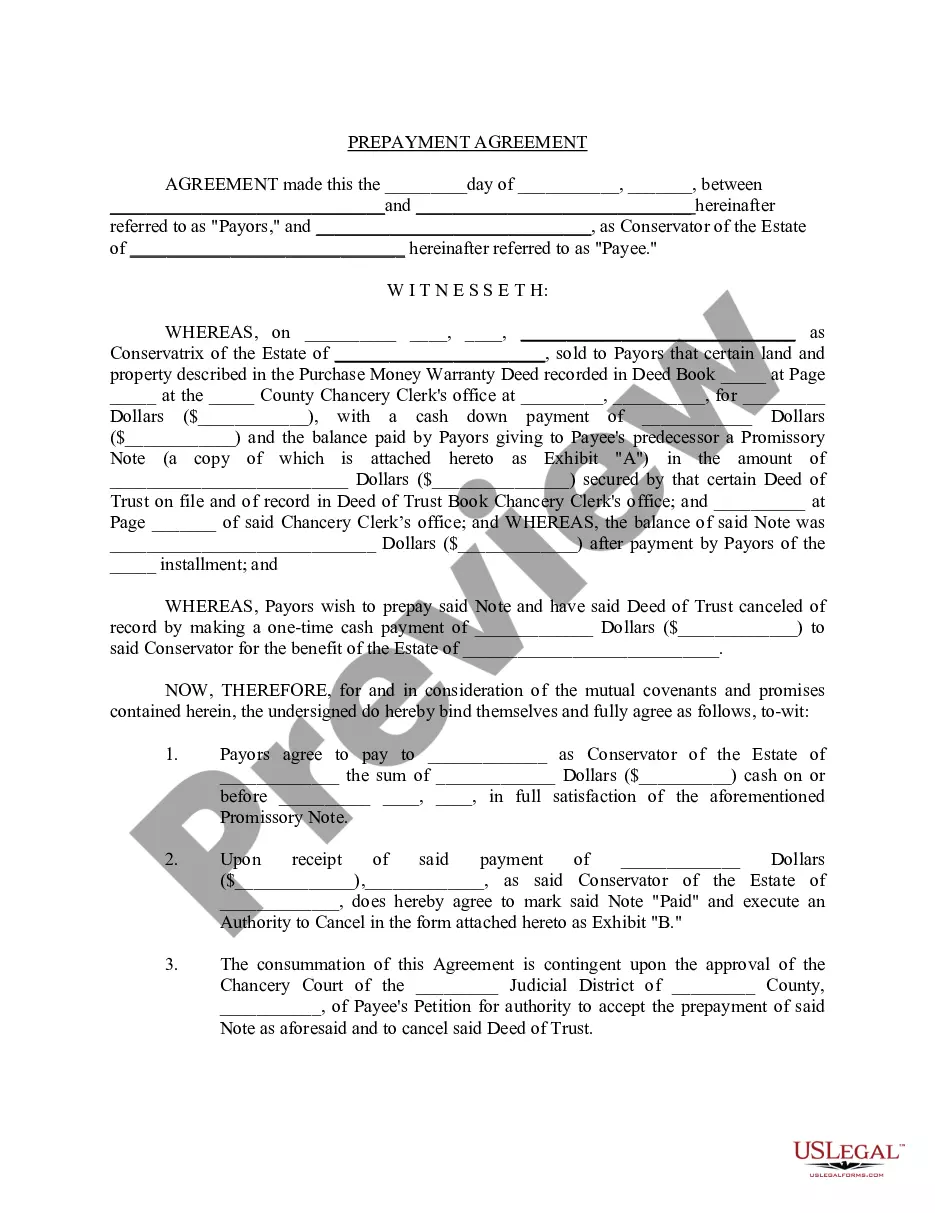

New York Prepayment Agreement

Description

How to fill out Prepayment Agreement?

US Legal Forms - one of many greatest libraries of lawful forms in America - offers a variety of lawful document themes you may down load or print out. Making use of the internet site, you can find 1000s of forms for business and personal reasons, sorted by groups, suggests, or keywords and phrases.You can get the newest models of forms like the New York Prepayment Agreement in seconds.

If you currently have a registration, log in and down load New York Prepayment Agreement from your US Legal Forms catalogue. The Download key will appear on each type you look at. You gain access to all earlier delivered electronically forms in the My Forms tab of your profile.

In order to use US Legal Forms the first time, listed here are basic recommendations to help you get started:

- Make sure you have picked the correct type for your personal town/region. Click the Preview key to examine the form`s information. Read the type information to ensure that you have chosen the right type.

- In case the type does not fit your demands, use the Lookup discipline near the top of the display screen to discover the the one that does.

- If you are happy with the form, confirm your decision by clicking on the Purchase now key. Then, pick the costs plan you favor and provide your qualifications to register on an profile.

- Process the financial transaction. Make use of your Visa or Mastercard or PayPal profile to complete the financial transaction.

- Pick the format and down load the form on your own gadget.

- Make changes. Fill up, change and print out and signal the delivered electronically New York Prepayment Agreement.

Every single web template you put into your bank account does not have an expiry particular date and is also the one you have eternally. So, if you wish to down load or print out another backup, just proceed to the My Forms area and click around the type you want.

Get access to the New York Prepayment Agreement with US Legal Forms, probably the most extensive catalogue of lawful document themes. Use 1000s of skilled and condition-certain themes that meet up with your business or personal requirements and demands.

Form popularity

FAQ

Under New York state law and regulations, state banks and state-licensed lenders can impose prepayment fees only under the following circumstances: 1. For fixed-rate mortgages, they can charge a fee only if the loan is repaid within the first year of its term and the contract provides for it.

What a prepayment clause is. Prepayment clauses are a part of your contract specifying how and when you can pay off a loan. Some may have a prepayment penalty ? a fee for paying off a loan early or making extra payments. This is especially common with auto loans that use precomputed interest.

Borrower shall have the right to prepay the full amount of any unpaid principal and accrued interest due under this Agreement, at any time without any penalty. No Prepayment Penalties. The Loan may be prepaid, in full or in part, at any time prior to the Maturity Date without premium or penalty.

A mortgage prepayment penalty is a fee that some lenders charge when you pay all or part of your mortgage loan off early. The penalty fee is an incentive for borrowers to pay back their principal slowly over a longer term, allowing mortgage lenders to collect interest.

A prepayment penalty clause states that a penalty will be assessed if the borrower significantly pays down or pays off the mortgage, usually within the first five years of the loan. Prepayment penalties serve as protection for lenders against losing interest income.

A prepayment penalty clause states that a penalty will be assessed if the borrower significantly pays down or pays off the mortgage, usually within the first five years of the loan. Prepayment penalties serve as protection for lenders against losing interest income.

If your mortgage has a hard prepayment penalty, paying off your mortgage early might not be the best financial decision. You should ask your lender about the specific fees to determine how much you'll pay in penalty fees versus how much you'll save in interest payments.

The primary benefit of making prepayments is the potential for significant interest savings. Every extra dollar you put towards your mortgage is a dollar less you'll be charged interest on. Over time, these savings can add up to a substantial amount.