Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New York Bartering Contract or Exchange Agreement

Description

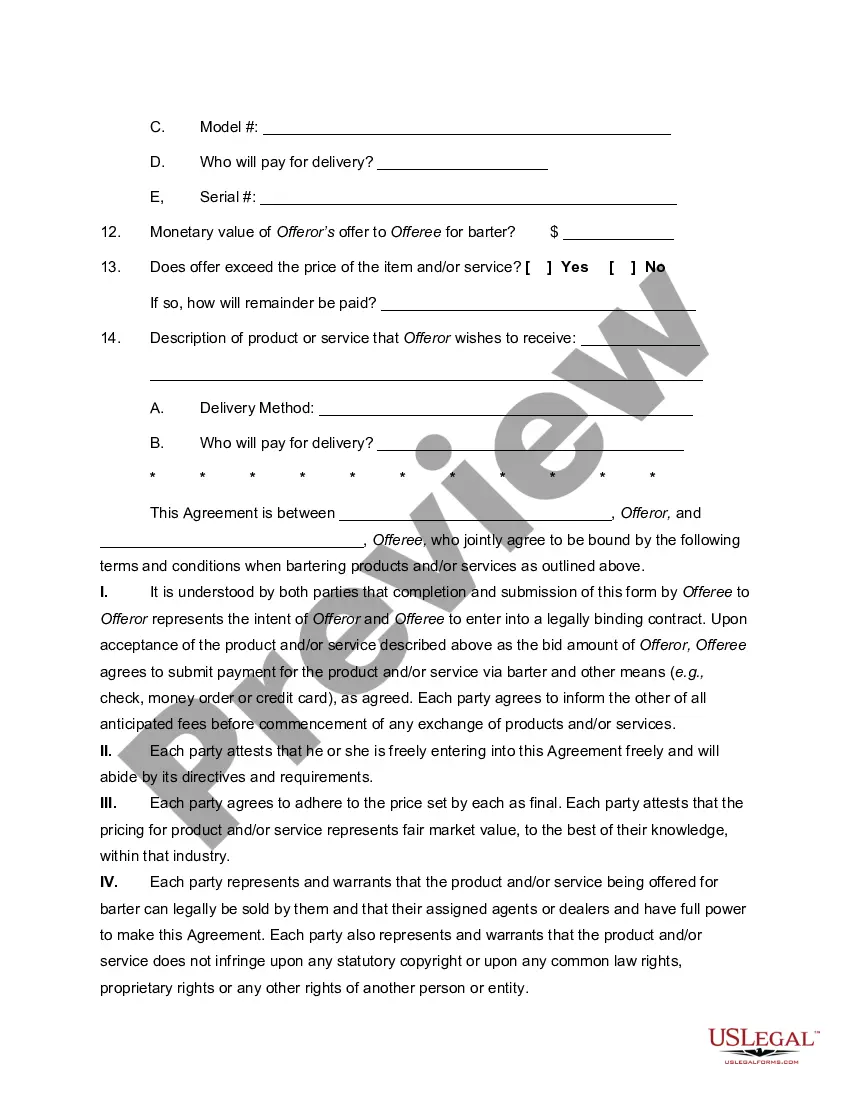

How to fill out Bartering Contract Or Exchange Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can purchase or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the New York Bartering Contract or Exchange Agreement within moments.

If you currently hold a monthly subscription, Log In and obtain the New York Bartering Contract or Exchange Agreement from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously acquired forms in the My documents section of your account.

Proceed with the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form onto your device. Make modifications. Complete, edit, print, and sign the downloaded New York Bartering Contract or Exchange Agreement.

Each format you added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the New York Bartering Contract or Exchange Agreement with US Legal Forms, one of the most extensive collections of legal document templates. Access thousands of professional and state-specific templates that meet your business or personal demands and preferences.

- Ensure you have selected the correct form for the city/region.

- Click the Preview button to review the form`s content.

- Read the form description to make sure you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

Writing a barter agreement involves outlining the terms of the exchange clearly and concisely. Start by detailing the items or services being traded, assign a fair market value, and include the terms of the exchange. Using a New York Bartering Contract or Exchange Agreement template can simplify this process and ensure all important details are included.

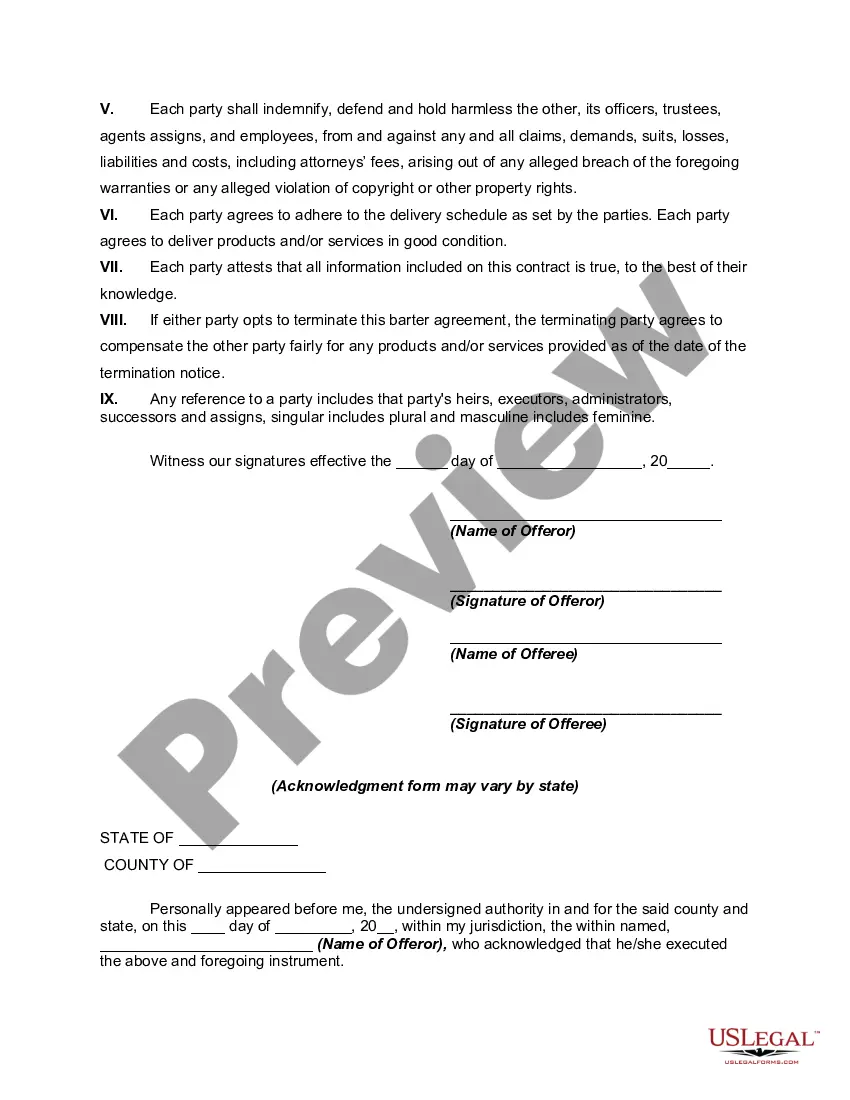

Bartering is legal in the United States, as long as both parties adhere to local regulations and report income appropriately. However, individuals should ensure they comply with tax laws related to barter transactions. A clear New York Bartering Contract or Exchange Agreement can help facilitate legal compliance and protect both parties involved.

An example of a barter agreement could be a plumber who fixes a restaurant's plumbing in exchange for meals over the course of a month. The New York Bartering Contract or Exchange Agreement would detail the services provided and the value of the meals received, ensuring clarity and accountability for both parties.

Yes, bartering does count as income and is subject to taxation. When you exchange a service or product, the fair market value of what you receive is considered taxable income. To ensure compliance and properly track your bartering transactions, you may want to use a New York Bartering Contract or Exchange Agreement.

A contract of barter is a legally binding document outlining the terms of a trade between parties. It specifies what items or services are being exchanged and establishes the value of the goods or services involved. Utilizing a New York Bartering Contract or Exchange Agreement can help protect both parties and clarify the trade process.

Writing an agreement between a buyer and a seller requires a clear understanding of the transaction details. Begin by specifying the items being exchanged and their values, along with payment terms, in a comprehensive New York Bartering Contract or Exchange Agreement. Be sure to outline the rights and responsibilities of both parties, which fosters a transparent relationship. Tools like those available on uslegalforms can assist you in drafting an effective agreement.

Bartering income should be reported on your tax return just like any other form of income. You will document the fair market value of the goods or services you received in the New York Bartering Contract or Exchange Agreement. This value is typically reported on Schedule C for self-employed individuals or other appropriate tax forms. Keeping accurate records helps you comply with tax regulations and avoid potential issues.

Writing an agreement deal involves clearly outlining the terms of the exchange between parties. Start by detailing the goods or services being traded, along with their respective values, in a New York Bartering Contract or Exchange Agreement. Make sure to include the responsibilities and obligations of each party, as well as provisions for dispute resolution. This clarity helps prevent misunderstandings and ensures a smooth transaction.

To effectively file proceeds from broker and barter exchange transactions, you should first determine the value of the goods or services exchanged. This information is then reported on your tax return, as it is considered income. The New York Bartering Contract or Exchange Agreement ensures that all parties involved maintain accurate records, simplifying this reporting process. Utilizing platforms like uslegalforms can provide you with templates that help you keep track of these transactions.

To record a barter transaction, document the details of the exchange, including the items or services involved, their estimated values, and the date of the transaction. Maintaining a copy of the New York Bartering Contract or Exchange Agreement can also be beneficial for reference. Accurate record-keeping will aid in future evaluations and help with tax reporting requirements.