New York Personal Guaranty - General

Description

How to fill out Personal Guaranty - General?

Locating the appropriate legal document template can be challenging.

Naturally, there exists a multitude of templates accessible online, but how can you locate the specific legal type you need.

Utilize the US Legal Forms website. The service offers a plethora of templates, such as the New York Personal Guaranty - General, suitable for both business and personal purposes.

If the form does not meet your requirements, utilize the Search field to find the right form.

- All forms are vetted by professionals and comply with federal and state regulations.

- If you are already registered, sign in to your account and select the Acquire option to obtain the New York Personal Guaranty - General.

- Use your account to browse the legal forms you have previously purchased.

- Navigate to the My documents tab of your account to download another version of the document you desire.

- For new users of US Legal Forms, here are simple steps to follow.

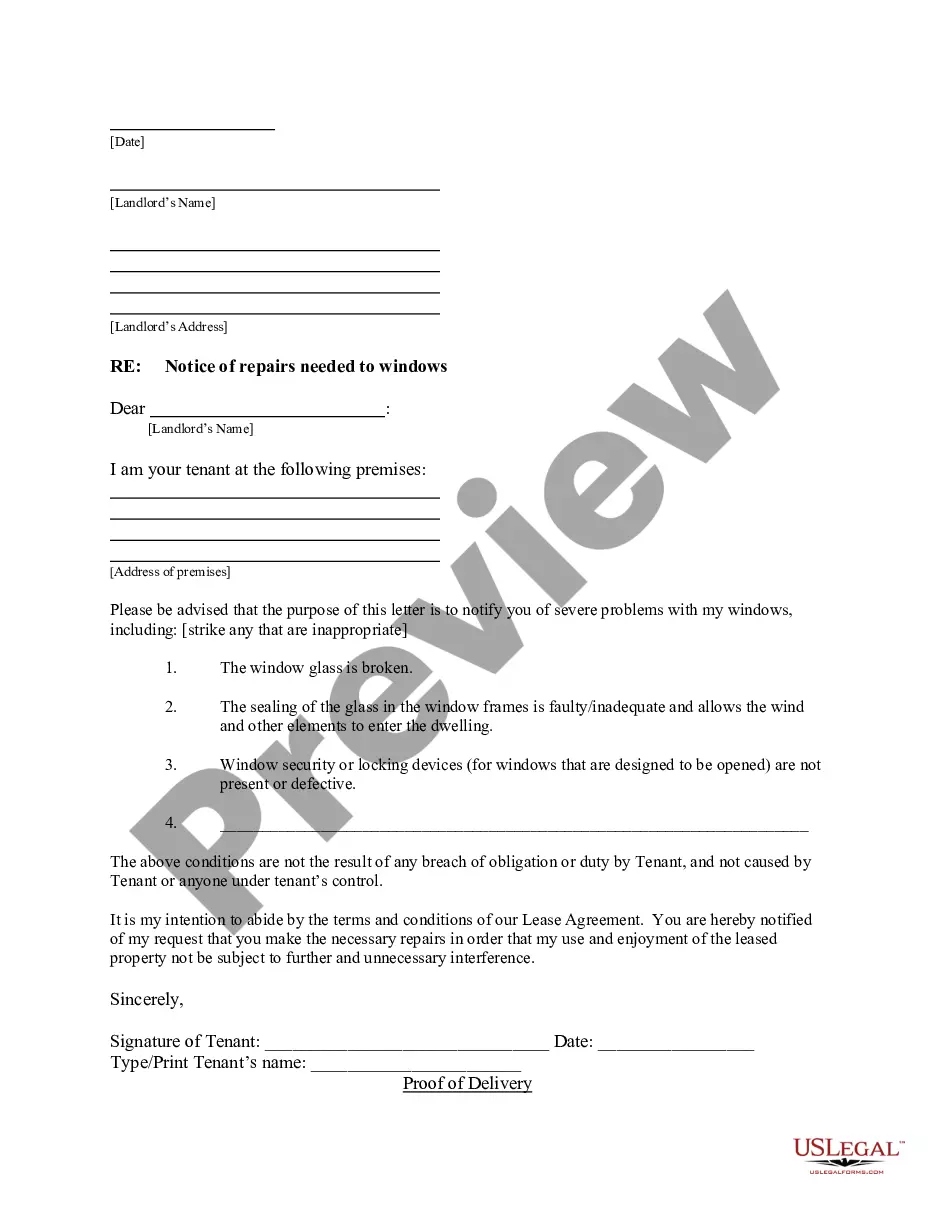

- First, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and check the form description to confirm it is suitable for your needs.

Form popularity

FAQ

Guaranty law in New York State defines the legal obligations of a guarantor, ensuring that agreements are honored when conditions are met. It emphasizes the necessity for clarity in terms, boundaries of liability, and enforceability. Guarantees must be written and signed to hold legal weight. Engaging with platforms like uslegalforms can help ensure compliance with these laws.

In New York, a personal guaranty does not typically need to be notarized to be effective. However, having it notarized can provide additional verification and can serve as robust evidence if a dispute arises. Notarization may also add to the overall credibility of the document. It’s advisable to consult legal resources to confirm the best practices for your specific situation.

Yes, a personal guarantee can hold up in court if it satisfies legal requirements. Courts typically enforce guarantees that are clear, documented, and signed willingly by the guarantor. However, potential weaknesses in terms or consent could lead to challenges in enforceability. Understanding the legal nuances can strengthen your position in case of disputes.

The strength of a personal guarantee lies in its clarity and the capacity of the guarantor to fulfill obligations. A strong guarantee includes specific terms, defined responsibilities, and clear conditions of default. Factors such as the guarantor’s financial stability also contribute to its strength. Engaging a reliable platform, like uslegalforms, can help create a robust guarantee.

A personal guarantee is binding once signed by the guarantor and the terms are agreed upon. It creates a legal obligation for the guarantor to fulfill the contract's financial requirements if the primary party defaults. This binding nature often comes into play during legal disputes, emphasizing the importance of understanding the terms. Clarity in the guarantee ensures that both parties know their responsibilities.

In New York, a personal guarantee is generally enforceable if it meets legal standards. This means it must be clear, specific, and must have the consent of the guarantor. Courts usually uphold properly drafted guarantees unless there are valid reasons to challenge them. Therefore, having a well-structured document is key to ensure enforceability.

A personal guarantee may be invalid if it lacks essential components, such as the signatory's capacity or consent. Additionally, if the agreement does not clearly outline specific terms, it can lead to its invalidity. An unclear or incomplete contract can result in disputes over enforceability. It's crucial to ensure that all elements are fully articulated to uphold its legality.

In New York City, the income requirement for a guarantor usually depends on the specific lease terms or landlord policies. Generally, a guarantor should have an annual income of at least 80 to 100 times the monthly rent. This ensures that they can cover financial obligations if needed. It’s essential to check with your landlord to confirm their specific criteria.

As a guarantor, you generally need to fill out sections detailing your identity, financial status, and your agreement to guarantee. Ensure that you understand all terms before signing. The New York Personal Guaranty - General form provides a clear structure, making it easier for you to provide all required information accurately.

Filling out a personal guarantee requires you to provide your personal information, along with a detailed description of what you are guaranteeing. Be clear and concise about your obligations under the agreement. Moreover, using a reliable source for the New York Personal Guaranty - General can help you understand the implications and responsibilities you are undertaking.