California Pledge of Personal Property as Collateral Security

Description

As the pledge is for the benefit of both parties, the pledgee is bound to exercise only ordinary care over the pledge. The pledgee has the right of selling the pledge if the pledgor make default in payment at the stipulated time. In the case of a wrongful sale by a pledgee, the pledgor cannot recover the value of the pledge without a tender of the amount due.

How to fill out Pledge Of Personal Property As Collateral Security?

Selecting the optimal legal document template can be quite a challenge. Clearly, there are numerous templates accessible online, but how do you locate the legal form you require? Turn to the US Legal Forms website. This service offers a vast collection of templates, such as the California Pledge of Personal Property as Collateral Security, which you can utilize for both business and personal purposes. All forms are vetted by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to access the California Pledge of Personal Property as Collateral Security. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a first-time user of US Legal Forms, here are some straightforward instructions for you to follow.

US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to obtain professionally crafted documents that comply with state regulations.

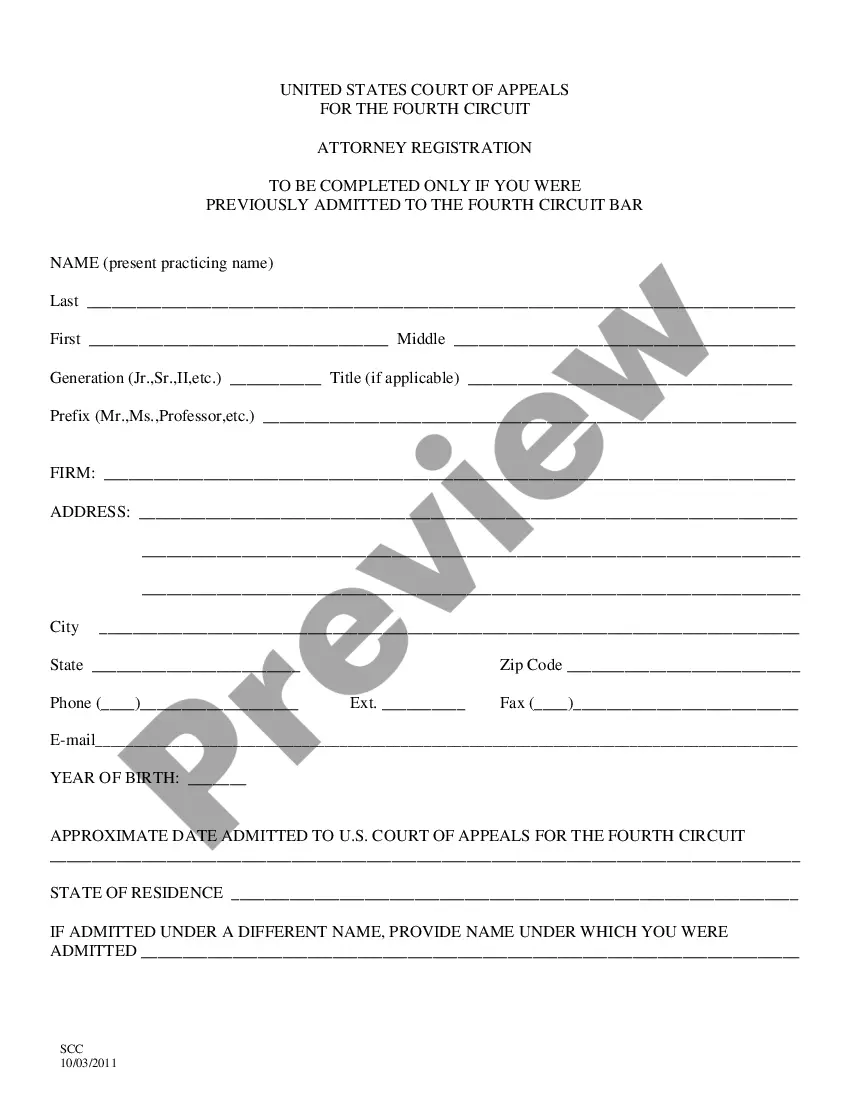

- First, ensure you have selected the correct form for your city/region. You can browse the form using the Preview button and review the form details to confirm it is appropriate for you.

- If the form does not meet your requirements, make use of the Search field to find the correct form.

- Once you are confident that the form is suitable, click the Buy now button to obtain the form.

- Choose the pricing plan you need and provide the required information. Create your account and complete your order with your PayPal account or Visa or Mastercard.

- Select the file format and download the legal document template to your device.

- Complete, modify, and print, then sign the finalized California Pledge of Personal Property as Collateral Security.

Form popularity

FAQ

Not all personal items qualify under the California Pledge of Personal Property as Collateral Security. Typically, non-transferable items such as real estate, machinery that is grounded, or personal items that hold no market value cannot be accepted. Additionally, items that are essential for daily living, like clothing or personal effects, usually do not qualify. To learn more about what items can or can't be used, uslegalforms can guide you through the specifics.

When you pledge real estate as collateral without giving up possession, it is known as a 'hypothecation.' This arrangement allows you to retain use of the property while securing financing. It's particularly beneficial for individuals who wish to leverage their assets for loans without selling them. The California Pledge of Personal Property as Collateral Security covers similar mechanisms for personal property.

A pledge of property to secure a debt is a legal agreement where the borrower uses an asset as a guarantee for repayment. In this situation, the lender gains a claim to the property should the borrower default. This method of securing loans is common and provides reassurance to lenders. Choosing the California Pledge of Personal Property as Collateral Security can enhance your borrowing experience.

The term for pledging something as collateral is called 'collateralization.' In this process, you provide specific assets to secure a debt obligation. This arrangement offers the lender a form of security in case the borrower defaults. The California Pledge of Personal Property as Collateral Security often employs this method, making it a vital tool in financing.

Holding someone's personal property as collateral is legal as long as both parties agree to the terms and conditions. In California, the agreement must comply with state laws governing personal property. The California Pledge of Personal Property as Collateral Security is a formal way to secure loans, ensuring the lender has a claim to the asset if the borrower defaults. Always consult legal advice to understand your rights and obligations.

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).

A type of security: the delivery of possession of an asset as security until payment. Possession may be actual or constructive, for example, handing over the keys to the store where the pledged goods are kept. Ownership remains with the pledgor.

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan.

To pledge assets as collateral (or Pledging) is the act of offering assets as collateral to secure loans. Assets pledged can be in the form of security holdings and act as assurance for recovering the borrowed amount should a borrower fail to pay up.