District of Columbia Pledge of Personal Property as Collateral Security

Description

As the pledge is for the benefit of both parties, the pledgee is bound to exercise only ordinary care over the pledge. The pledgee has the right of selling the pledge if the pledgor make default in payment at the stipulated time. In the case of a wrongful sale by a pledgee, the pledgor cannot recover the value of the pledge without a tender of the amount due.

How to fill out Pledge Of Personal Property As Collateral Security?

Have you ever been in a circumstance where you require paperwork for either commercial or personal purposes nearly every day.

There are numerous legitimate document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the District of Columbia Pledge of Personal Property as Collateral Security, specifically designed to meet state and federal requirements.

Select the pricing plan you prefer, complete the necessary information to create your account, and process the payment using your PayPal or credit card.

Choose a suitable file format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the District of Columbia Pledge of Personal Property as Collateral Security template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct region/state.

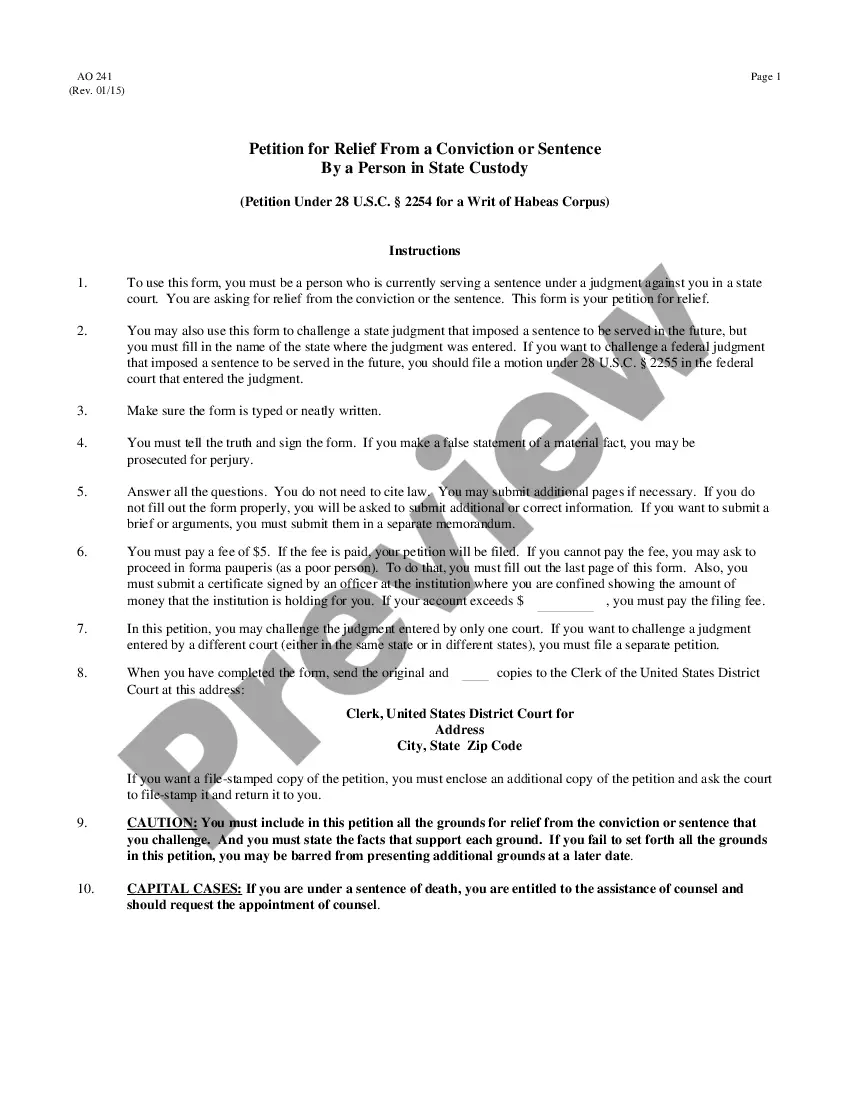

- Use the Preview button to review the document.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to locate the document that suits your needs.

- Once you identify the right form, click Get now.

Form popularity

FAQ

Using your property as collateral can provide you with the financial support you need. To begin with the District of Columbia Pledge of Personal Property as Collateral Security, you must identify your personal property and its value. After that, you can work with a lender to formalize the agreement, which typically requires documentation to ensure legality. For a seamless experience, consider utilizing platforms like uslegalforms, which offers resources and templates to help you navigate the process effectively.

A pledge of personal property as collateral for a debt is commonly known as a security interest. This agreement establishes a legal claim over the property, should the borrower default on the debt. The District of Columbia Pledge of Personal Property as Collateral Security offers a structured framework for creating and enforcing these security interests, giving you peace of mind as you pursue financial opportunities.

The act of pledging something as collateral is referred to as a 'pledge.' This legally binding agreement provides the lender with rights to the collateral if the borrower defaults. By using the District of Columbia Pledge of Personal Property as Collateral Security, you can effectively secure loans while maintaining ownership of your pledged assets.

To create a security interest in personal property, you need a security agreement specifying the collateral and the terms. This agreement must be signed by both parties to be enforceable. The District of Columbia Pledge of Personal Property as Collateral Security streamlines this process and helps ensure you meet all necessary legal requirements.

Yes, personal property can indeed be used as collateral in secured transactions. This offers a valuable opportunity for individuals and businesses to leverage their assets for loans or credit. The District of Columbia Pledge of Personal Property as Collateral Security allows for various personal assets to be pledged, ensuring that you can access funding without sacrificing ownership.

Under the Uniform Commercial Code (UCC), various types of property can serve as collateral, including goods, accounts receivable, and fixtures. Personal property is commonly used, making the District of Columbia Pledge of Personal Property as Collateral Security especially relevant for individuals and businesses seeking financing. Understanding these options helps you choose the best collateral for your needs.

The process of creating a security interest in collateral is known as attachment. This process typically requires a written agreement, identification of the collateral, and the rights of the parties involved. In the context of the District of Columbia Pledge of Personal Property as Collateral Security, ensuring proper documentation is essential for establishing enforceable rights.

Holding someone's personal property as collateral is not inherently illegal; however, it must adhere to the provisions outlined in the District of Columbia Pledge of Personal Property as Collateral Security. The arrangement requires the consent of the owner, and both parties must understand their rights and obligations. To navigate this process properly, you may want to refer to legal resources or platforms like uslegalforms for guidance on forming a valid agreement.

Using your property as collateral is a straightforward process involving the District of Columbia Pledge of Personal Property as Collateral Security. First, determine the value of the property you wish to pledge. Then, formalize the agreement in writing, specifying the conditions and obligations. Consider utilizing services from uslegalforms to draft a legally binding document, ensuring your interests are secured throughout the process.

Certain items cannot be accepted as collateral under the District of Columbia Pledge of Personal Property as Collateral Security. Generally, items that lack tangible value or cannot be legally owned by the pledger may not qualify. Additionally, property subject to liens or encumbrances typically cannot be pledged. It is always best to consult with legal experts or platforms like uslegalforms to ensure compliance and make informed decisions.