New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions

Description

How to fill out Reimbursement For Expenditures - Resolution Form - Corporate Resolutions?

In case you need to finalize, acquire, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Take advantage of the site’s user-friendly and straightforward search feature to find the documents you need.

Various templates for business and personal use are categorized by type and state, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Select the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and hit the Download button to acquire the New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

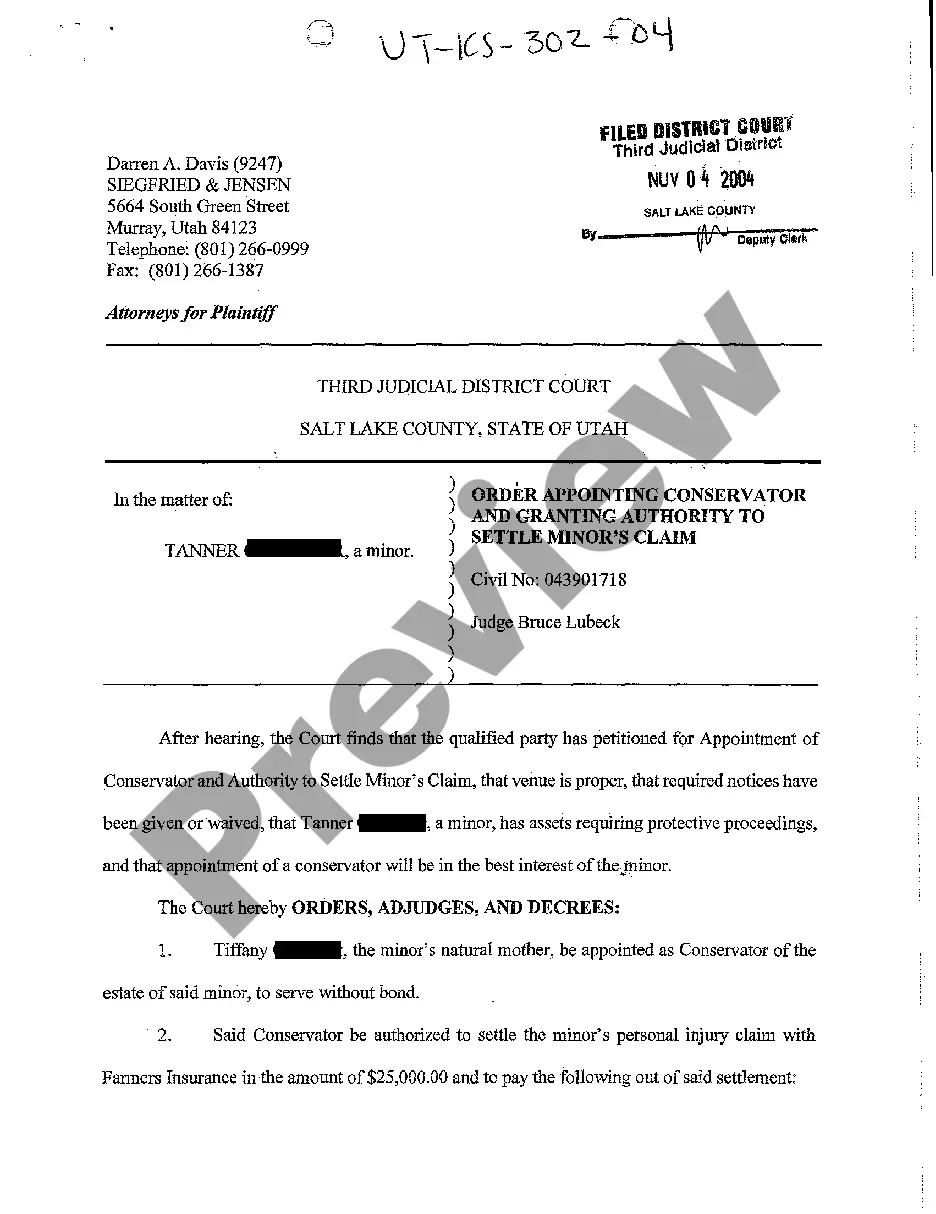

- Step 2. Use the Preview option to review the form’s contents. Don’t forget to read through the overview.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to discover other examples of the legal form template.

Form popularity

FAQ

In New York, failing to file a biennial statement on time can result in a monetary penalty. Specifically, late filers may face fines that can add up to several hundred dollars. Additionally, persistent late filings can lead to administrative dissolution of your business. To avoid such penalties, consider using the New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions available on the UsLegalForms platform to ensure your business stays compliant.

To complete a corporate resolution, ensure that you’ve accurately filled out all sections of the resolution form. You should review your document for any inaccuracies before including signatures from the authorized individuals. After signature collection, keep the completed resolution on file, as it is an important official record. The New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions provides a structured format to facilitate this process effectively.

When filling out a company resolution to open a bank account, start by documenting the name of the bank and the account type you wish to open. Clearly state the purpose of opening the account and list the authorized signers. Utilizing the New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can help you to formalize this decision properly, ensuring that all requirements are met and recorded.

To fill out a resolution form, begin by writing the name of your organization and the resolution's date at the top. Clearly describe the action to be approved and make sure to include all necessary details, such as the names of those authorizing the resolution. Applying the New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions ensures that you cover all required elements comprehensively.

A corporate resolution for a transaction is a formal document that authorizes a specific action related to company affairs, such as entering into contracts or completing financial transactions. This resolution confirms that the decision was made in accordance with company guidelines and is officially documented. Using the New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can streamline the process of drafting these resolutions.

The format of writing a resolution typically starts with a title that identifies it as a corporate resolution. Follow this with an explanatory paragraph outlining the context of the resolution. Next, include detailed bullet points that specify the decisions being made. Conclude with a statement of approval and a space for signatures. Using the New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions template makes this easier.

Filling out a corporate resolution form involves entering the company's name, the date, and the explicit action being authorized. Be precise about the details of the decision, including how it aligns with the company’s bylaws. Utilize the New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions as a guide to ensure compliance with legal requirements. After entering the necessary information, signatures should be collected from the authorized individuals.

To write a corporate resolution for an LLC, start by clearly defining the purpose of the resolution. Include essential details such as the date, name of the company, and the specific decision being made. Make sure to list the names of members or managers involved in the resolution. Finally, conclude with a signature line for the authorized individuals to validate the New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

Limits on lobbying in New York include restrictions on the types of expenditures and activities that lobbyists can undertake. These limits aim to promote ethical practices in advocacy and prevent undue influence in government. Understanding these limits is crucial for effective compliance. You can find comprehensive guidance to navigate these complexities within our resources related to New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

The lobbying threshold in NY is a critical metric that determines when an individual or organization must officially register as a lobbyist. The thresholds can differ based on the type of organization and the scope of activities engaged. It's essential to stay informed about these requirements to ensure compliance with state laws. For detailed information regarding this threshold, our platform offers insights on New York Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.