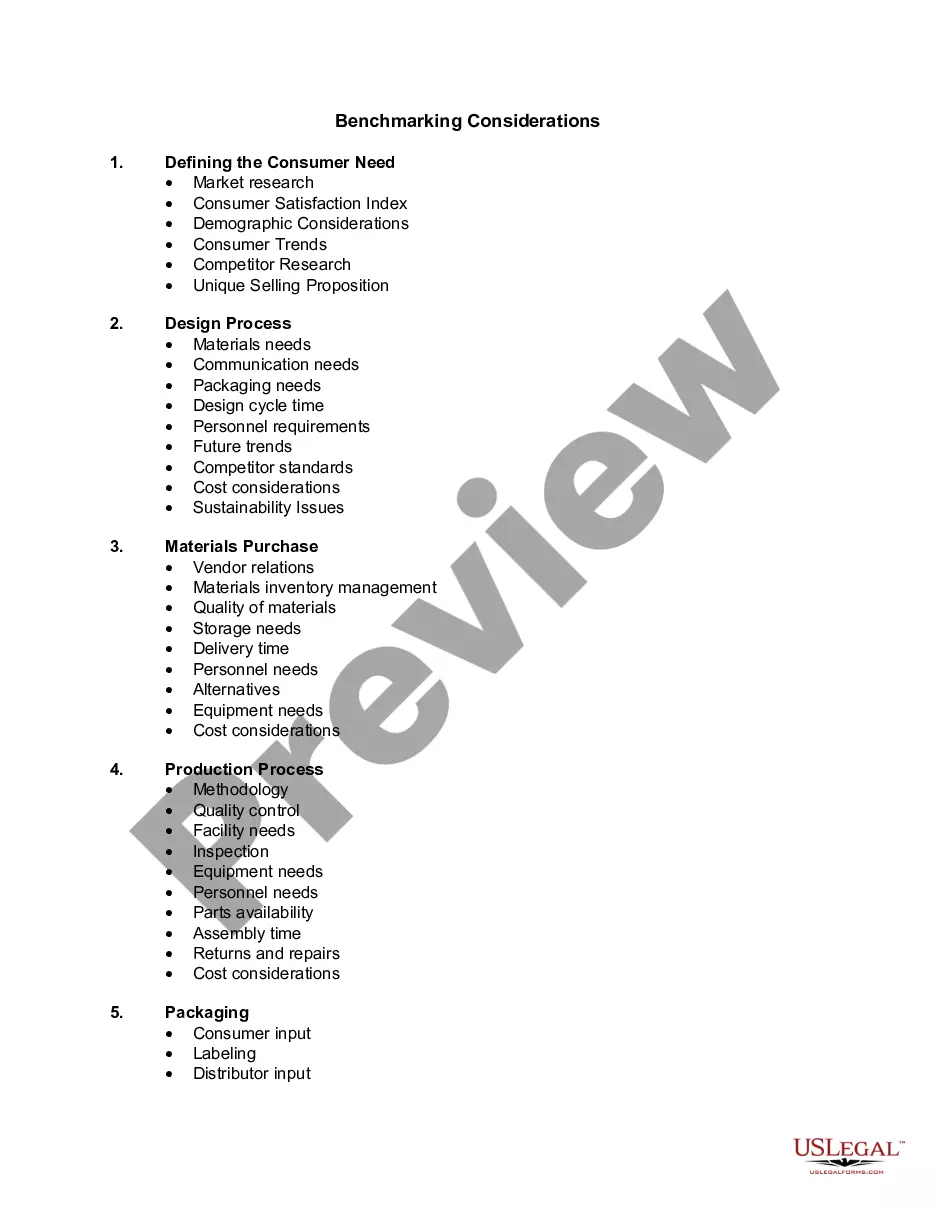

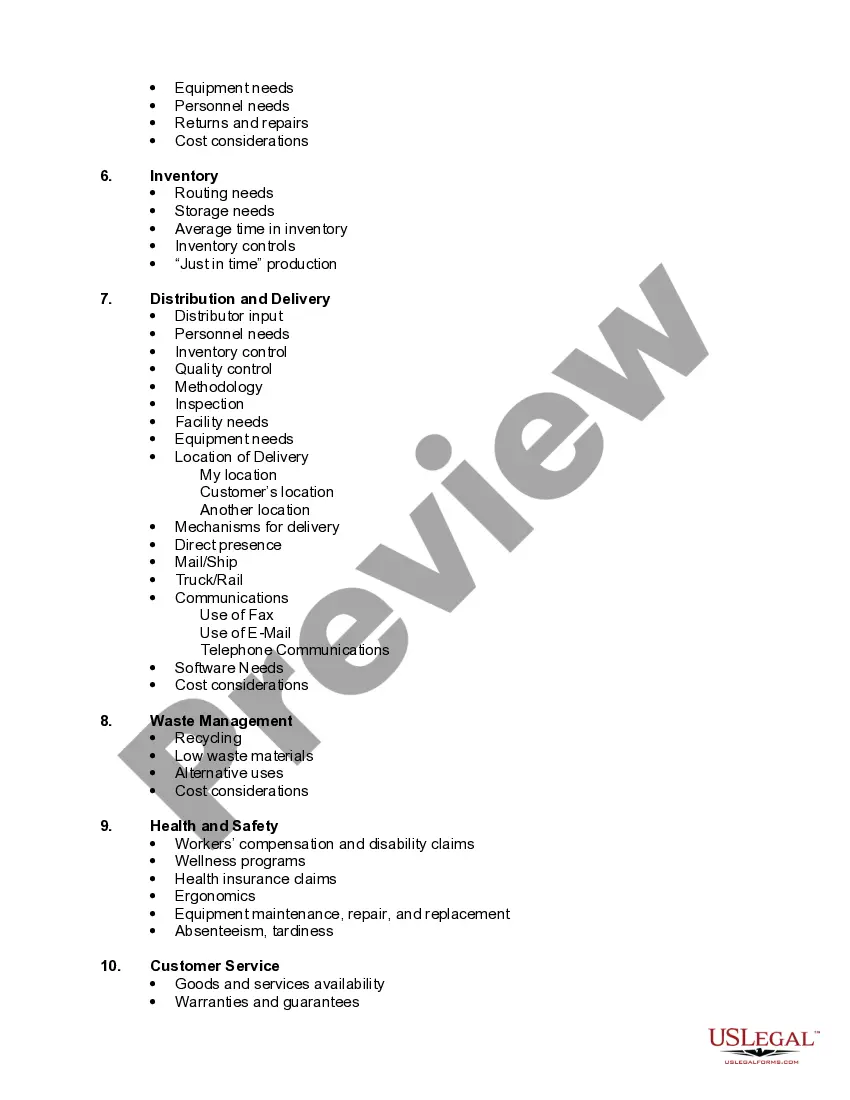

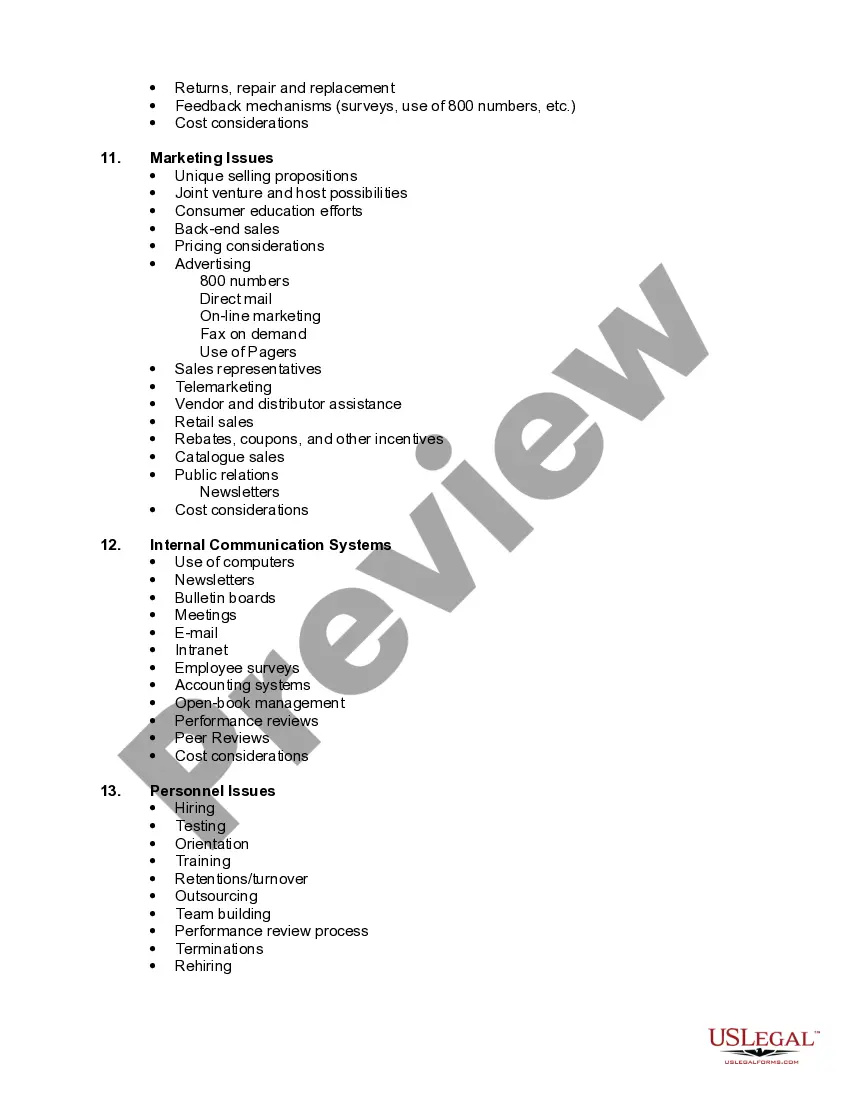

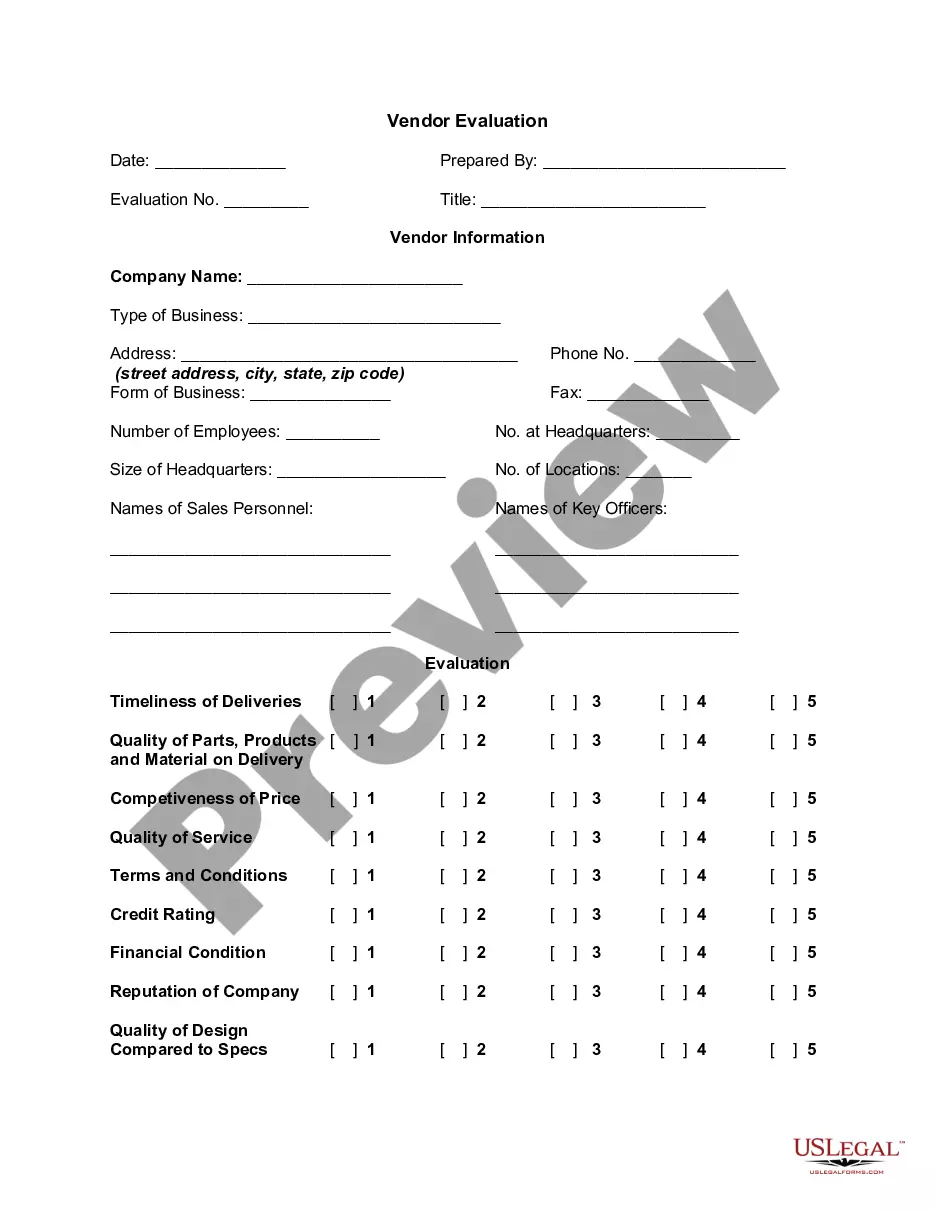

Puerto Rico Benchmarking Considerations

Description

How to fill out Benchmarking Considerations?

Are you in a position where you require documents for potential business or specific purposes almost every day.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Puerto Rico Benchmarking Considerations, designed to comply with state and federal regulations.

When you find the appropriate form, click Purchase now.

Choose the pricing plan you want, fill out the required information to create your account, and pay for your order using PayPal or a credit card. Select a convenient document format and download your version. Access all the document templates you have purchased through the My documents section. You can get another copy of the Puerto Rico Benchmarking Considerations whenever needed by simply opening the required form to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Puerto Rico Benchmarking Considerations template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

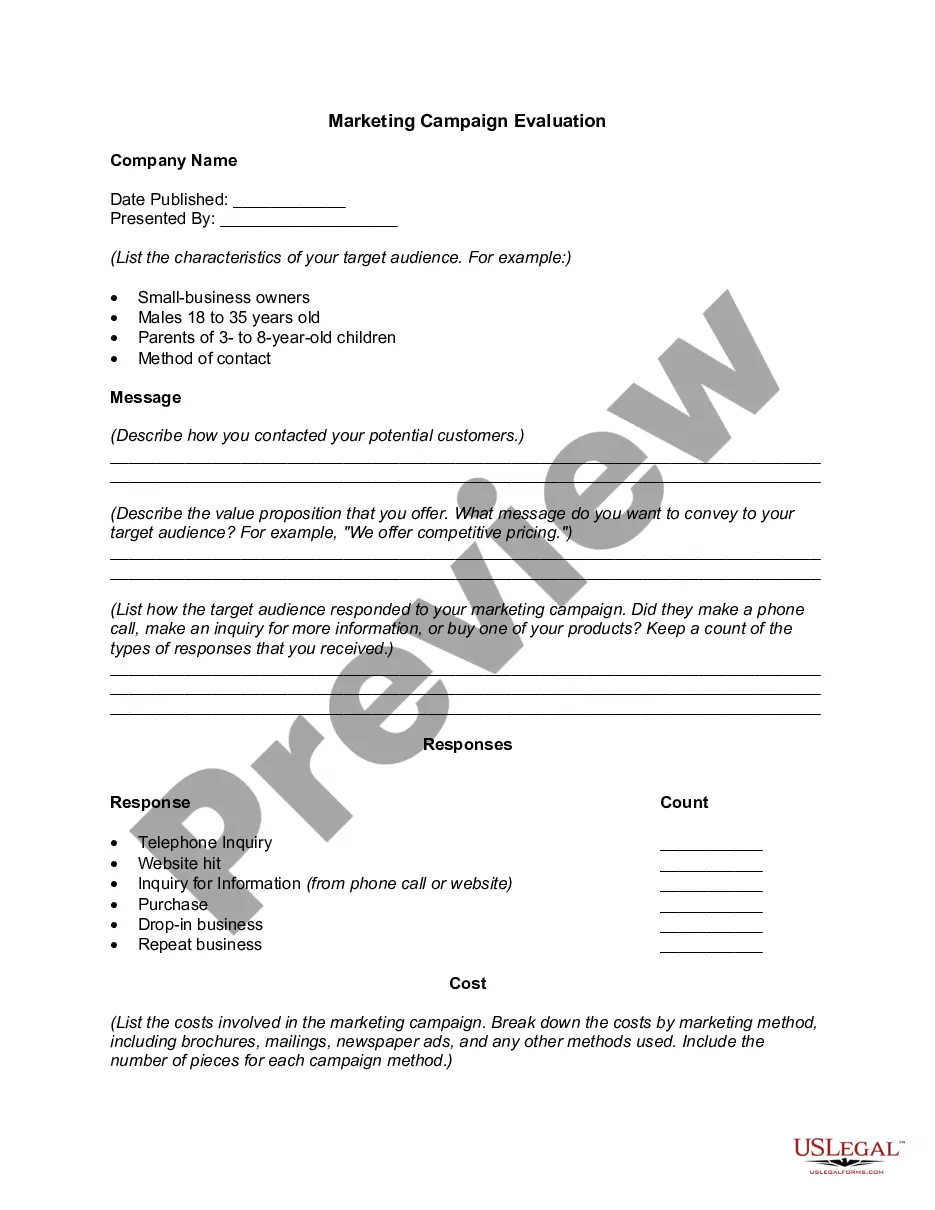

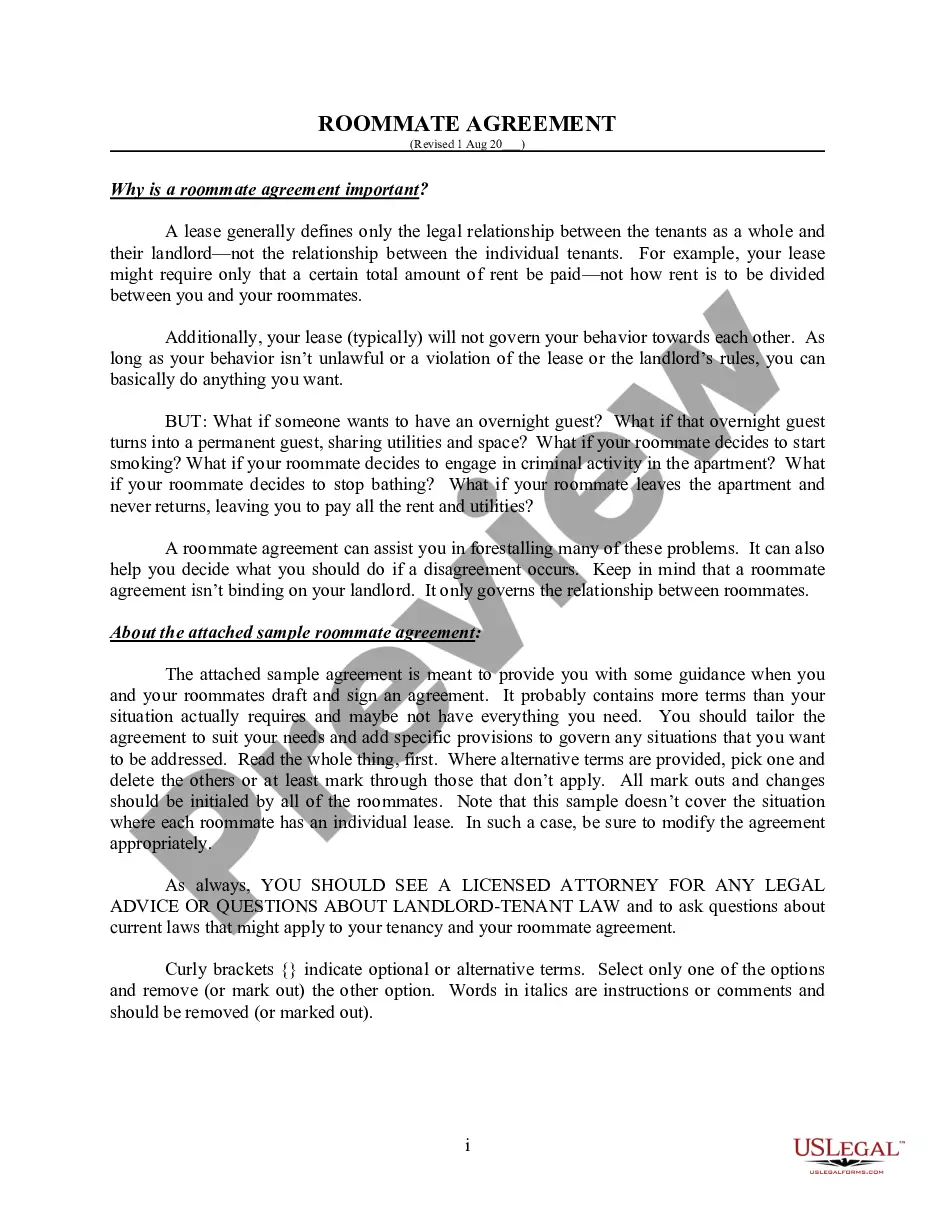

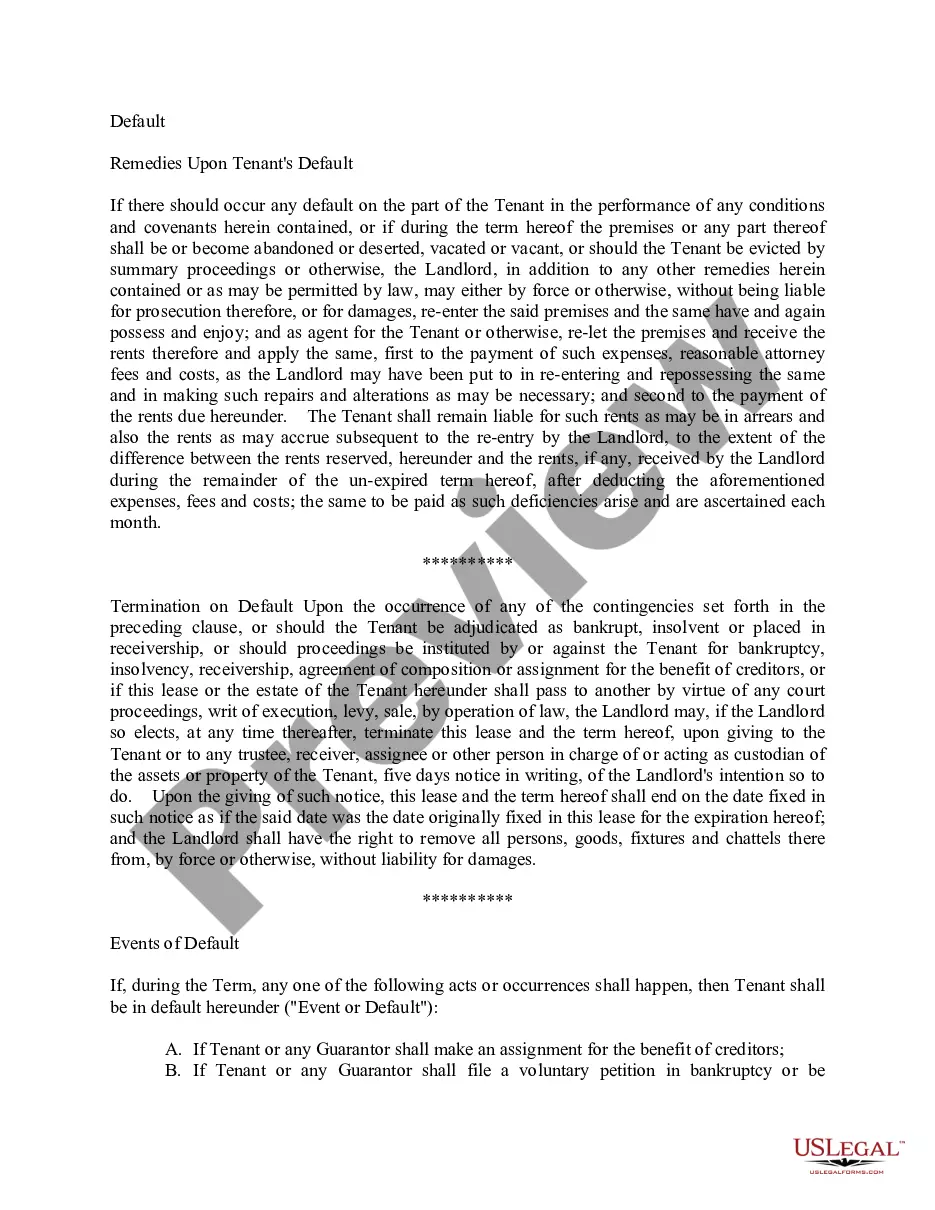

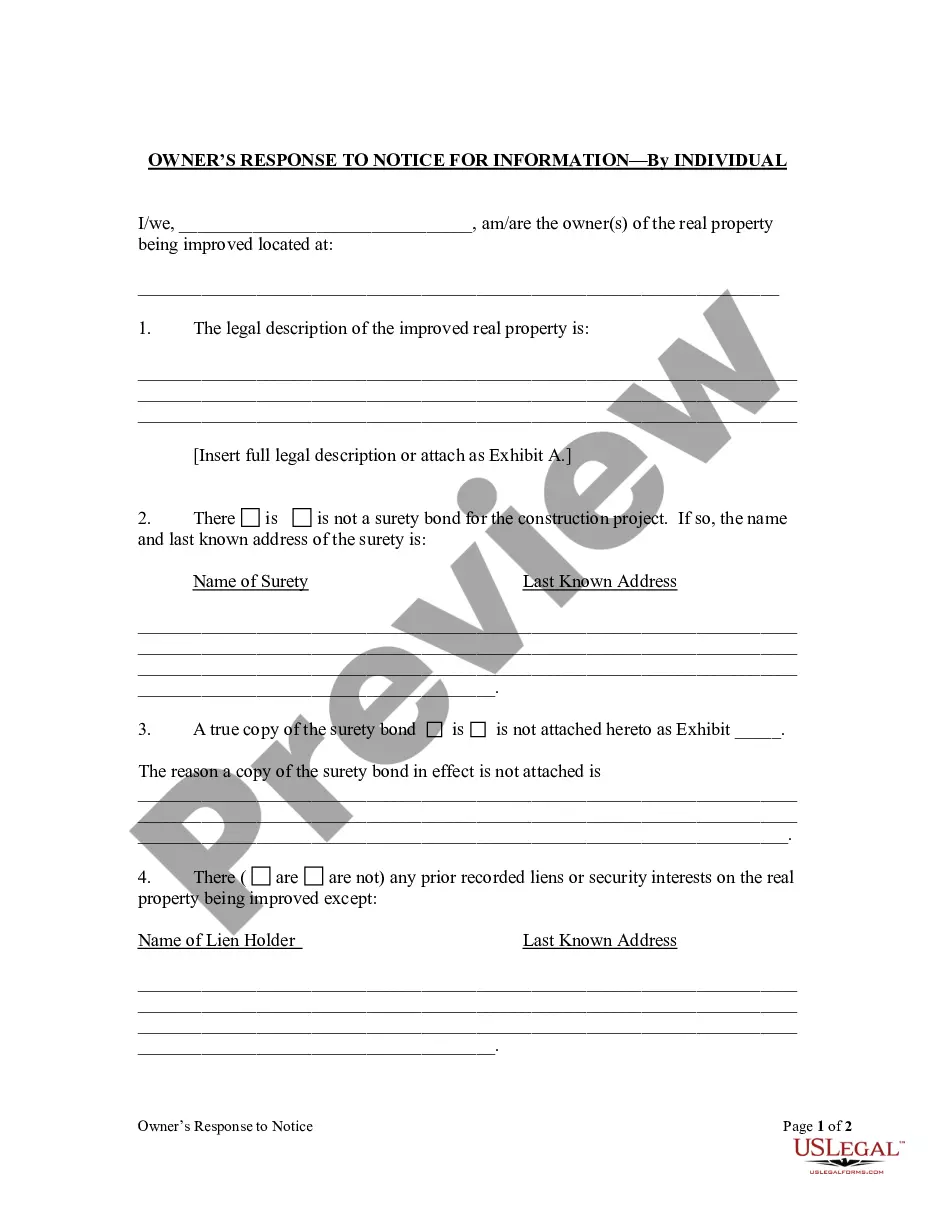

- Use the Preview button to examine the form.

- Review the summary to ensure you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and criteria.

Form popularity

FAQ

Yes, Puerto Rico does count for the substantial presence test, but with specific conditions. If you are present in Puerto Rico for a significant number of days, it can impact your tax residency status. Thus, staying informed about these rules is crucial when considering Puerto Rico Benchmarking Considerations for effective tax planning.

Yes, a US company is allowed to do business in Puerto Rico, benefiting from a friendly business environment and potential tax incentives. However, it must register with the local government and follow specific compliance regulations. These factors play a significant role in Puerto Rico Benchmarking Considerations for evaluating business strategies.

Proving Puerto Rican residency typically involves documentation such as utility bills, tax returns, or a driver's license showing your address in Puerto Rico. You may also need to maintain records of your physical presence to comply with the 183-day rule. Addressing these needs is vital when it comes to Puerto Rico Benchmarking Considerations for tax and residency verification.

A US LLC can indeed conduct business in Puerto Rico, thanks to the legal frameworks in place. Before starting operations, an LLC must register with the Puerto Rican government and adhere to local regulations. This approach is part of the overall Puerto Rico Benchmarking Considerations for those looking to expand their business footprint.

Certainly, US companies can hire employees in Puerto Rico. Companies must comply with local labor laws, including wage standards and benefits. Navigating these regulations is key to promoting fair practices, and it aligns with Puerto Rico Benchmarking Considerations for effective workforce management.

Yes, US companies can operate in Puerto Rico, which is considered a US territory. They benefit from incentives and tax credits designed to attract mainland businesses. When considering Puerto Rico Benchmarking Considerations, businesses find that operating here can lead to financial advantages and expansion opportunities.

The 183-day rule in Puerto Rico is essential for establishing residency. It states that individuals must spend at least 183 days in Puerto Rico within a tax year to be considered residents for tax purposes. Understanding this rule is crucial for Puerto Rico Benchmarking Considerations, especially if you are evaluating your tax obligations or benefits.

Yes, the Global Intangible Low-Taxed Income (GILTI) provisions do apply to businesses operating in Puerto Rico. This tax issue can significantly affect how companies assess their operations and compliance. Therefore, understanding GILTI is crucial for any proper Puerto Rico benchmarking considerations.

Yes, Puerto Rico generally follows US GAAP for accounting and financial reporting. This alignment makes it easier for companies to benchmark against U.S. standards. Incorporating US GAAP principles is a central aspect of Puerto Rico benchmarking considerations.

Puerto Rico bank accounts are not classified as foreign for U.S. residents, but there are specific reporting requirements for U.S. citizens. Understanding these guidelines is key to compliance. This knowledge is beneficial when addressing Puerto Rico benchmarking considerations.