New York Accounts Receivable - Assignment

Description

How to fill out Accounts Receivable - Assignment?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal document templates that you can obtain or print. By using the website, you can discover numerous forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the New York Accounts Receivable - Assignment in seconds.

If you already possess a subscription, Log In and obtain the New York Accounts Receivable - Assignment from your US Legal Forms collection. The Download button will be visible on every form you view. You have access to all previously saved forms within the My documents section of your account.

If you wish to use US Legal Forms for the first time, here are easy steps to get started: Ensure you have selected the correct form for your city/state. Click the Review button to examine the form’s content. Check the form details to confirm that you have chosen the right form. If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select the payment plan you prefer and provide your credentials to register for an account. Process the payment. Use a credit card or PayPal account to complete the transaction. Choose the file format and download the form onto your device. Make modifications. Fill out, edit, print, and sign the saved New York Accounts Receivable - Assignment. Every template you added to your account has no expiration date and is yours indefinitely. So, if you wish to obtain or print another copy, just go to the My documents section and click on the form you want.

- Access the New York Accounts Receivable - Assignment with US Legal Forms, one of the most extensive libraries of legal document templates.

- Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

Consent to assignment of receivables is the approval given by the original debtor to allow a business to transfer its rights to collect payments to another party. This is crucial in New York Accounts Receivable - Assignment, as it ensures that the debtor acknowledges the new creditor. Without this consent, the assignment may not be legally enforceable. To navigate these requirements, consider using US Legal Forms for reliable documentation and advice.

An assignment under New York law involves the legal transfer of rights or property from one party to another. In the case of New York Accounts Receivable - Assignment, this means a business can assign its receivables to a third party for collection. Such assignments must comply with state regulations to protect both parties involved. Using resources from US Legal Forms can help ensure that all legal requirements are met.

The 5 C's of accounts receivable management are Character, Capacity, Capital, Collateral, and Conditions. These factors help businesses assess the creditworthiness of their customers in New York. By considering these elements, companies can make informed decisions about extending credit and managing their accounts receivable more effectively.

To file a UCC 1 in New York, you must complete the UCC Financing Statement form accurately. This filing is crucial for securing your interest in receivables under New York Accounts Receivable - Assignment. You can submit the form online or by mail to the New York Department of State. Utilizing USLegalForms can streamline this process, providing you with the necessary templates and guidance to ensure a successful filing.

Assignment of receivables would mean sale of the lease rentals, not the asset. In that case, the leased asset still remains the property of the assignor ? that is, the assignor has retained the residual interest in the asset. However, it would be different if the lessor sells the asset that has been leased out.

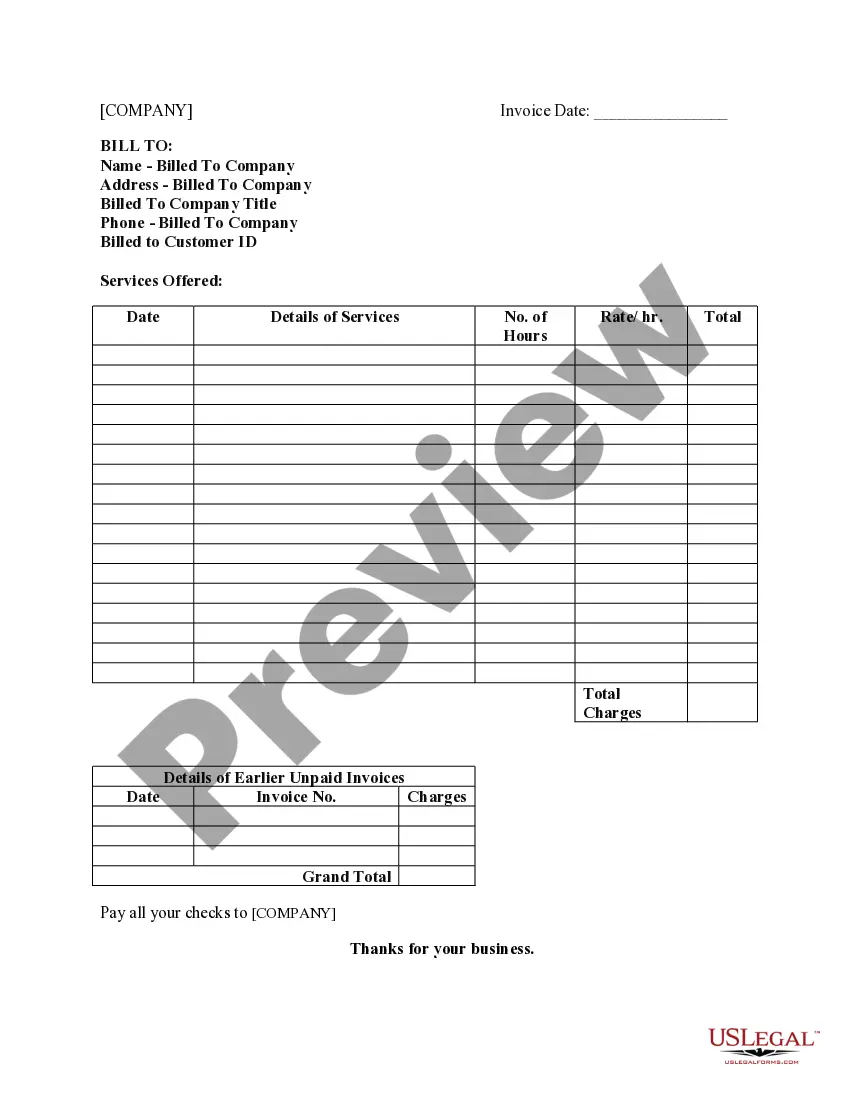

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

Firstly, factoring is a financial service of selling and purchasing, which implies consideration, unlike assignment, which may take place either with or without consideration. In addition, non-matured or future accounts receivable can be subject to factoring.

Accounts receivable financing, also known as invoice financing, is slightly different to factoring. The main difference is that you retain ownership of the invoices and the responsibility of collecting payments on them.

The company retains title to and is responsible for collecting accounts receivable, not the lender whereas, in factoring receivables, businesses opt to sell or assign its account receivable (or a specific invoice) to a factoring company in exchange for cash at a discount to its face value.

What are the journal entries for assigning Accounts Receivable as collateral for a loan? The entry to record assignment of Accounts Receivable as collateral would be a credit to cash, and a debit to assign Accounts Receivable. The cash account is debited because the company gave up the assigned receivables.