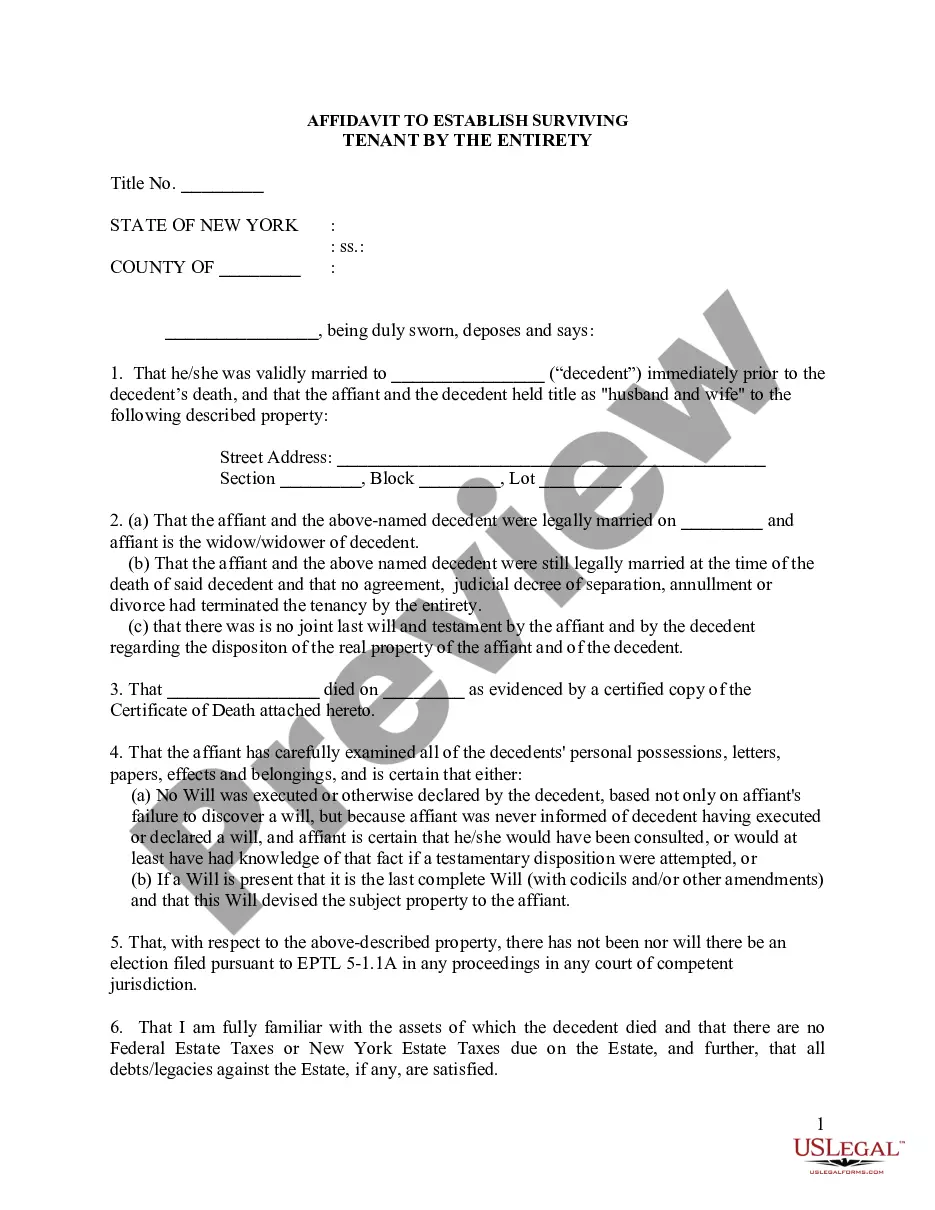

The New York Affidavit to Establish Surviving Tenant by the Entirety is a special form of joint tenancy in which the surviving tenant automatically inherits the deceased tenant’s share of the property. This form of joint tenancy is only available to married couples and provides the surviving spouse with the right to the entire property, without having to go through probate. There are two types of New York Affidavit to Establish Surviving Tenant by the Entirety: voluntary and involuntary. The voluntary affidavit is used when both tenants agree to the arrangement and sign the affidavit. The involuntary affidavit is used when one tenant is deceased and the other tenant wants to secure their rights to the property. Both forms require a notarized signature from the surviving tenant and must be filed with the county clerk. Once filed, the affidavit is legally binding and grants the surviving spouse the sole right to the property.

New York Affidavit to Establish Surviving Tenant by the Entirety

Description

How to fill out New York Affidavit To Establish Surviving Tenant By The Entirety?

Handling legal paperwork requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your New York Affidavit to Establish Surviving Tenant by the Entirety template from our service, you can be sure it meets federal and state regulations.

Working with our service is straightforward and quick. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your New York Affidavit to Establish Surviving Tenant by the Entirety within minutes:

- Make sure to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the New York Affidavit to Establish Surviving Tenant by the Entirety in the format you prefer. If it’s your first time with our service, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the New York Affidavit to Establish Surviving Tenant by the Entirety you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

The name of the Grantor and the date that the trust instrument execution date. Contact information for each Trustee, including name, address, county of residence, and phone number. Certified copy of the death certificate of the Grantor. Any other pertinent information from the trust instructions.

California Affidavit of Surviving Spouse Information Section 100(a) of the California Probate Code states that when a married person dies, one-half of the couple's community property belongs to the surviving spouse and the other half stays in the decedent's name, ostensibly for probate distribution.

If Property is a Joint Tenancy, New York Laws Can Allow Probate Avoidance. When property is owned as a joint tenancy with rights of survivorship, this means that the co-owners are automatically going to inherit the property if any one of the owners passes away.

California Affidavit of Surviving Spouse Information Section 100(a) of the California Probate Code states that when a married person dies, one-half of the couple's community property belongs to the surviving spouse and the other half stays in the decedent's name, ostensibly for probate distribution.

If parties hold title as joint tenants and one is deceased, the survivor may file an Affidavit of Death of Joint Tenant. It may be advisable to consult an attorney due to the legal aspects involving a change in ownership of real property. The above forms can be purchased at most office supply or stationery stores.

HOW DO I RECORD AN AFFIDAVIT? Take a certified copy of the death certificate of the deceased joint tenant and your affidavit to the recorder's office in the county where the real property is located. The recorder's office also requires a Preliminary Change of Ownership Report (PCOR) when filing the affidavit.

Where it is held as joint tenants, on the death of one of the owners, the property becomes owned by the other joint owner. For example, Joe owns a property as a joint tenant with his dad, Stan. When Stan dies, the property automatically passes to Joe as sole owner.

What Is an Affidavit of Survivorship? An Affidavit of Survivorship is a sworn oath in the form of a legal document. Within this document, a surviving owner of a jointly-owned property states they have rights of survivorship to the property.