The New York Exempt Vehicle Certificate is a document issued by the New York State Department of Motor Vehicles (DMV) that exempts a vehicle from certain state taxes and fees. These certificates are available for certain types of vehicles, such as those owned by charitable organizations, government agencies, and vehicles used for commercial purposes. Types of New York Exempt Vehicle Certificates include: • Charitable Exempt Vehicle Certificate: Issued to vehicles owned by a charitable organization or institution, and used exclusively for charitable purposes. • Government Exempt Vehicle Certificate: Issued to vehicles owned by the US government, the state of New York, or its political subdivisions. • Commercial Exempt Vehicle Certificate: Issued to vehicles used exclusively for commercial purposes. • Dealer Exempt Vehicle Certificate: Issued to vehicle dealers for vehicles sold or leased to customers. • Disabled Exempt Vehicle Certificate: Issued to vehicles owned by disabled persons.

New York Exempt Vehicle Certificate

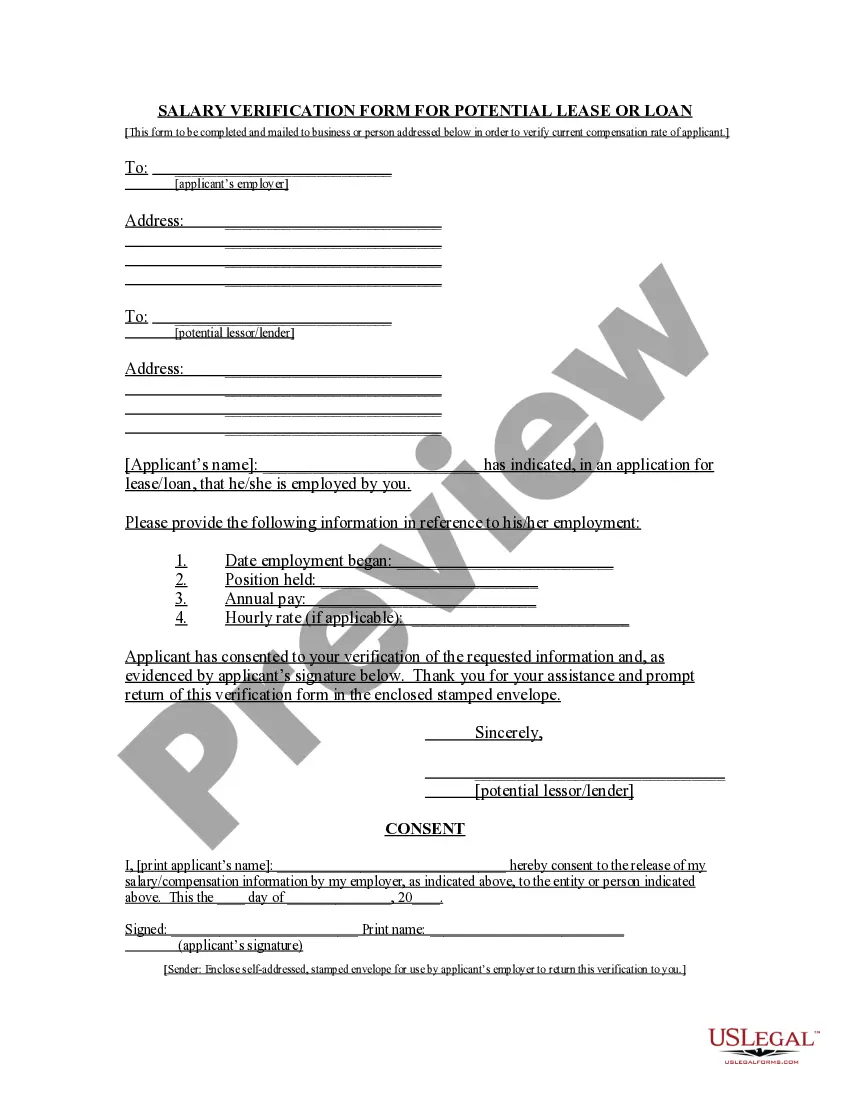

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New York Exempt Vehicle Certificate?

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state laws and are checked by our experts. So if you need to fill out New York Exempt Vehicle Certificate, our service is the best place to download it.

Obtaining your New York Exempt Vehicle Certificate from our library is as simple as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they find the proper template. Later, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a brief guideline for you:

- Document compliance check. You should attentively review the content of the form you want and check whether it suits your needs and complies with your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find a suitable blank, and click Buy Now when you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your New York Exempt Vehicle Certificate and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

An exemption from withholding is only good for one year. Employees must give you a new W-4 each year to keep or end the exemption. If the exemption expires, withhold federal income tax ing to the employee's Form W-4 information.

Exemptions from Withholding You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and. You do not expect to have a New York income tax liability for this year.

Exempt Colors Exempt from certification colors do not require additional batch by batch testing but have also been thoroughly evaluated by the FDA.

To apply for SCHE, you must send proof of income for all owners and spouses, no matter where they reside. You should submit proof of your 2021 income, but if it is unavailable, you can submit proof of your income in 2020. Proof of income from all owners and spouses must be from the same tax year.

If the person making the purchase pays with personal funds, the exemption from sales tax does not apply, even if the person will receive reimbursement from the organization. Like any business, nonprofit organizations generally must collect sales tax on all sales of taxable goods and services.

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

Businesses can apply for certificates that exempt them from paying sales tax on certain items. These certificates are issued by the New York State Department of Taxation and Finance (DTF). Businesses complete the certificate, and provide it to the vendor. The vendor keeps the certificate and makes a sale without tax.

You must keep the exemption certificate for at least three years from the due date of the sales tax return on which the last sale using the exemption certificate was reported. For more information, see Tax Bulletin Record-keeping Requirements for Sales Tax Vendors (TB ST-770).