New York Certificate of Redemption

Definition and meaning

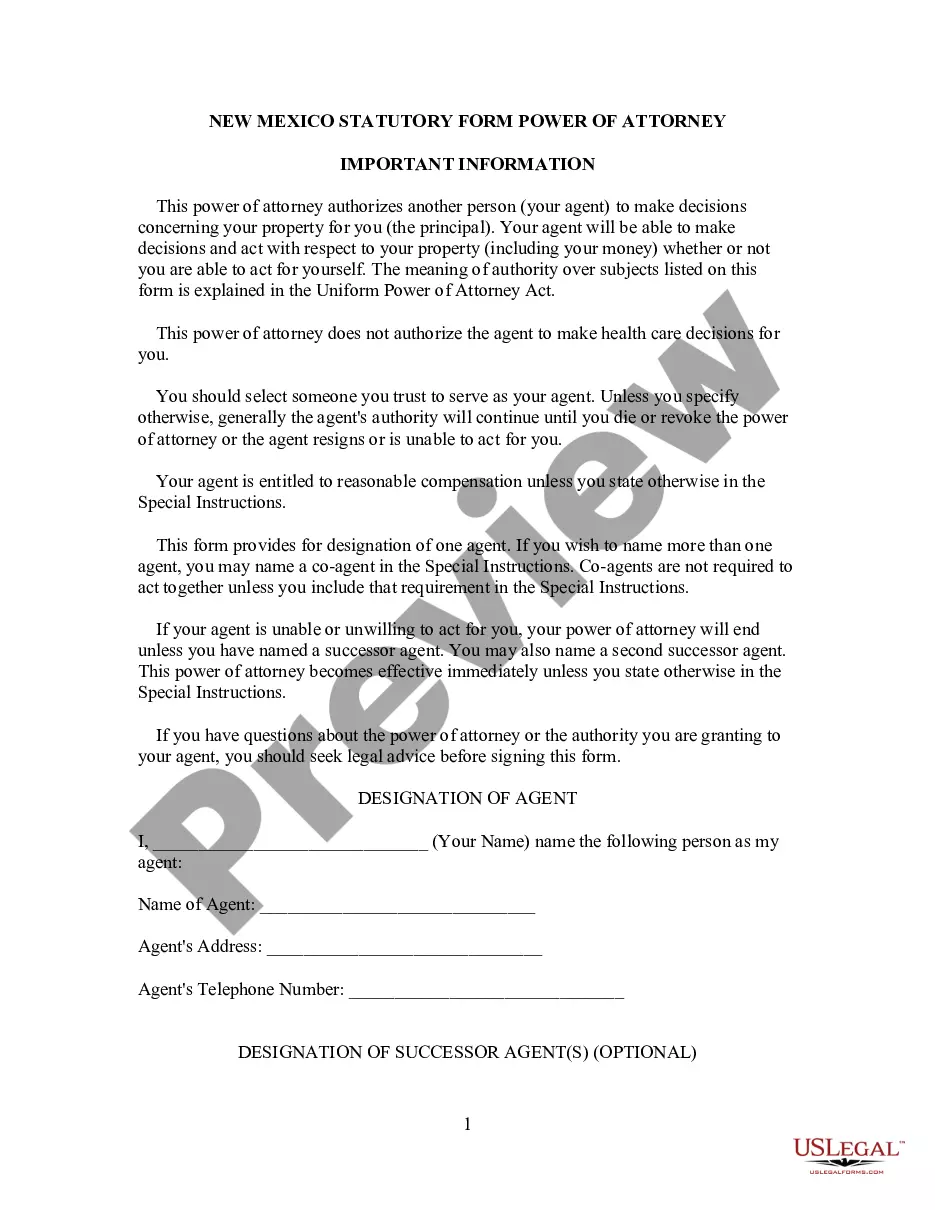

The New York Certificate of Redemption is a legal document that confirms the payment of outstanding tax amounts on a property that has been subject to a tax lien. It serves as proof that the property owner has redeemed their property from foreclosure actions by settling their tax liabilities. This certificate is crucial for restoring clear title to the property and is filed with the County Clerk's Office.

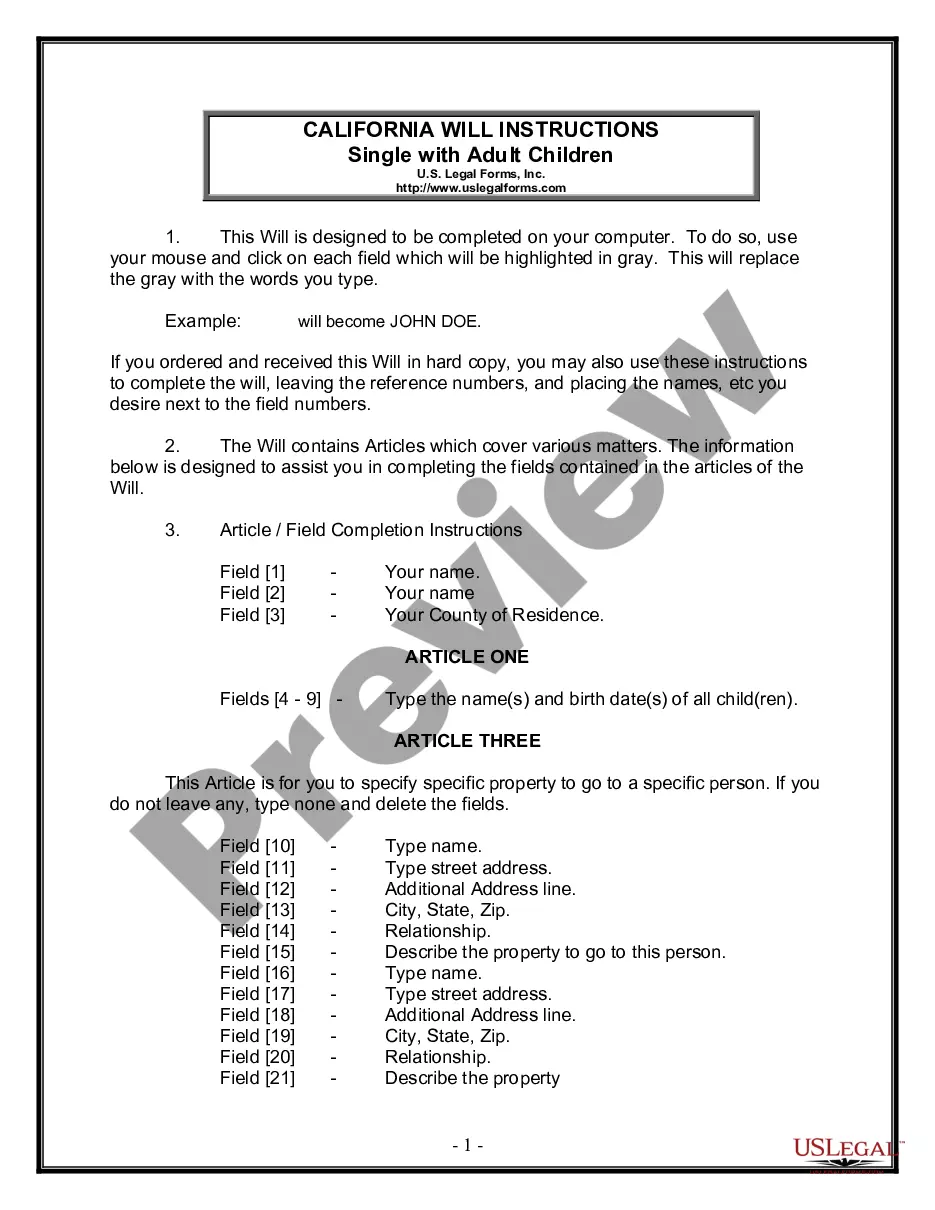

How to complete the form

To complete the New York Certificate of Redemption, follow these steps:

- Obtain the necessary details regarding your property, including the serial number, tax account number, and property address.

- Fill out your name and contact information accurately.

- Clearly state the payment details for the outstanding tax amounts.

- Sign and date the form at the designated space.

- Submit the certificate to the County Clerk's Office for processing.

Who should use this form

This form is intended for property owners in New York who have received a notice regarding a tax lien against their property. It is particularly relevant for those who have paid their outstanding taxes and wish to prevent further foreclosure actions or restore their property title.

Legal use and context

The New York Certificate of Redemption is primarily utilized in the context of tax lien foreclosures. Under the provisions of the In Rem Tax Foreclosure Act, this certificate must be filed after taxes have been paid to ensure that the unpaid tax liens are officially canceled and the property is redeemed.

Key components of the form

The Certificate of Redemption typically includes the following key components:

- Property details: Serial number, tax account number, and address.

- Owner information: Name and contact details of the property owner.

- Payment details: Amount paid to redeem the property.

- Signature of the senior delinquent tax collector.

Common mistakes to avoid when using this form

When completing the New York Certificate of Redemption, be wary of the following common mistakes:

- Providing incorrect property details, which could delay processing.

- Failing to include the required payment information.

- Not signing the document, which would render it invalid.

- Not submitting the form to the correct County Clerk's Office.

Form popularity

FAQ

Generally, the redemption period expires two years after the lien date (that is, when the tax or other legal charges became a lien). However, local law may provide a longer redemption period (N.Y. Real Prop. Tax Law § 1110).

A tax lien sale certificate is a document proving that the holder has purchased a property in a tax lien sale auction.

A redeemable tax deed is something in between a tax lien and tax deed. When you go to a redeemable tax deed sale, you are actually purchasing the deed to the property.The owner can redeem the property by paying the amount that was bid for the deed at the tax sale plus a hefty penalty or interest.

Property taxes are considered delinquent for purposes of this program under either of the following circumstances: The taxes remain unpaid one year after the last date on which they could have been paid without interest.

New York is an average state for tax lien certificates and a good state for tax deed sales, but rules vary and some municipalities have their own sales. New York Tax Lien Auctions are usually in April or August but can vary; New York Tax Deed Sales occur throughout the year.

What does it mean if a property is redeemed? Redeemed properties are those in which the delinquent taxes are paid prior to the issuance of the Tax Deed. If the delinquent taxes are paid prior to the start of the sale, the property will not be offered for sale.

What Is a Tax Lien Certificate? A tax lien certificate is a certificate of claim against a property that has a lien placed upon it as a result of unpaid property taxes. 1feff Tax lien certificates are generally sold to investors through an auction process.

The owner of a property up for auction at our annual tax sale has the right to pay off all defaulted taxes, penalties, fees, and/or costs to avoid a sale. This is called right to redemption.The term REDEEMED means all defaulted taxes, penalties, fees, and/or costs have been paid in full.

A certificate of redemption is an official acknowledgment that a property owner has paid off in full all delinquent property taxes, penalties, fees and interest owed on the property.