California Pay Rate Change Form

What this document covers

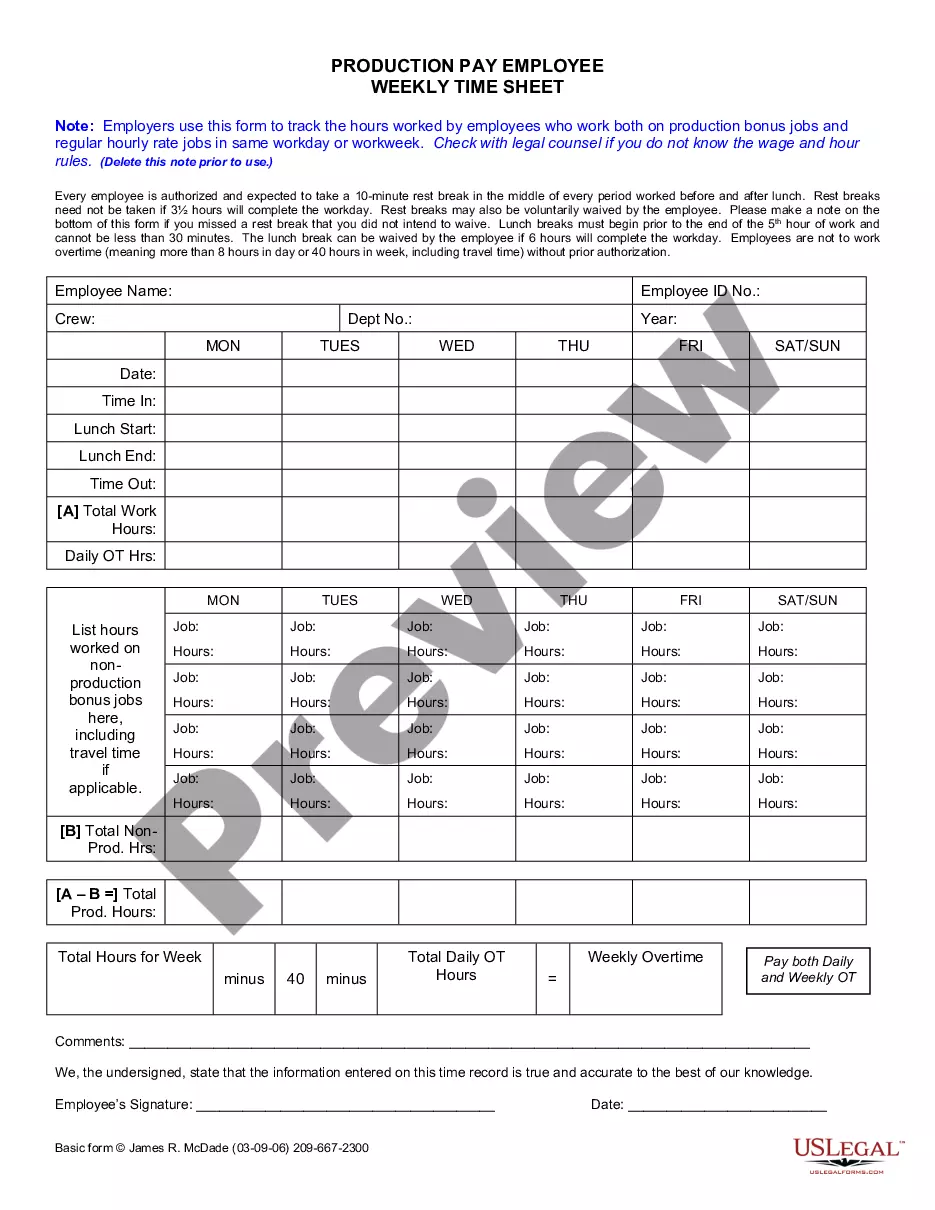

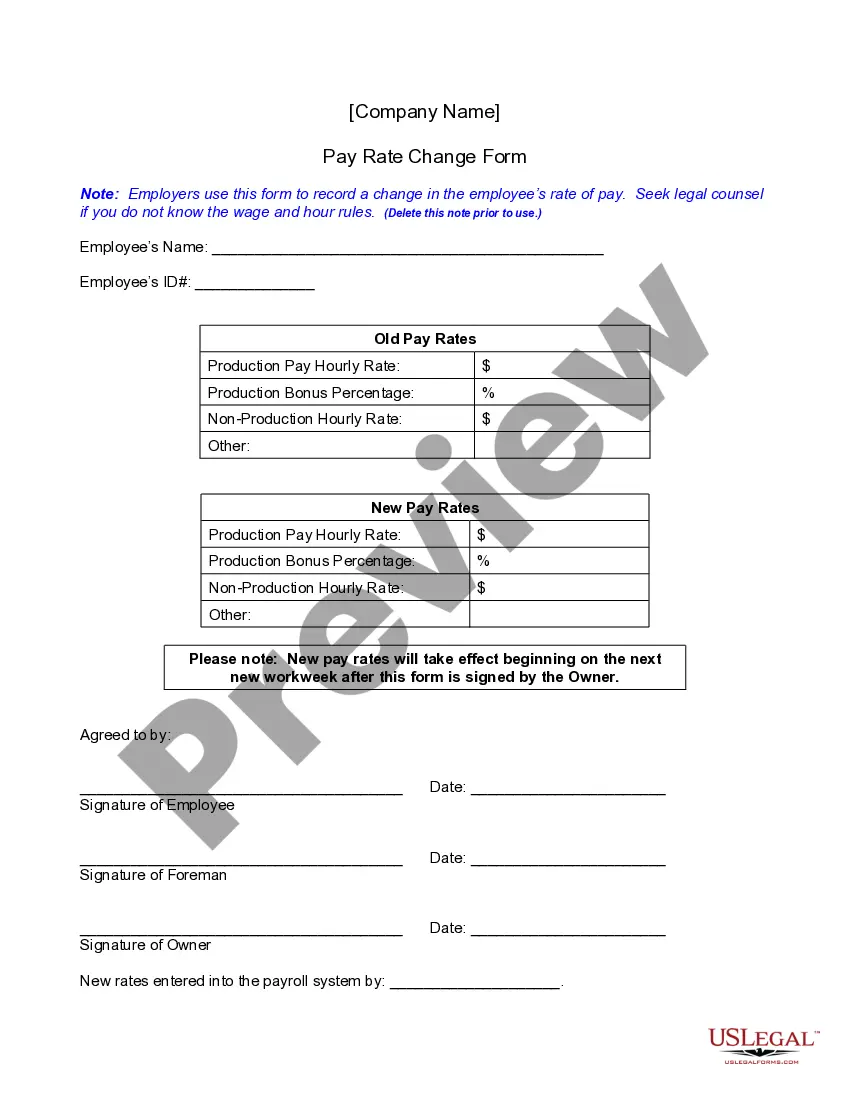

The Pay Rate Change Form is a legal document used by employers to officially record any changes in an employee's rate of pay. This form serves to ensure that both the employer and employee agree on the new pay rates, which can include production pay, bonuses, and non-production rates. By using this specific form, employers can maintain clear records, which is essential for compliance with wage and hour laws. Unlike informal notifications, this form provides a structured approach to documenting pay adjustments.

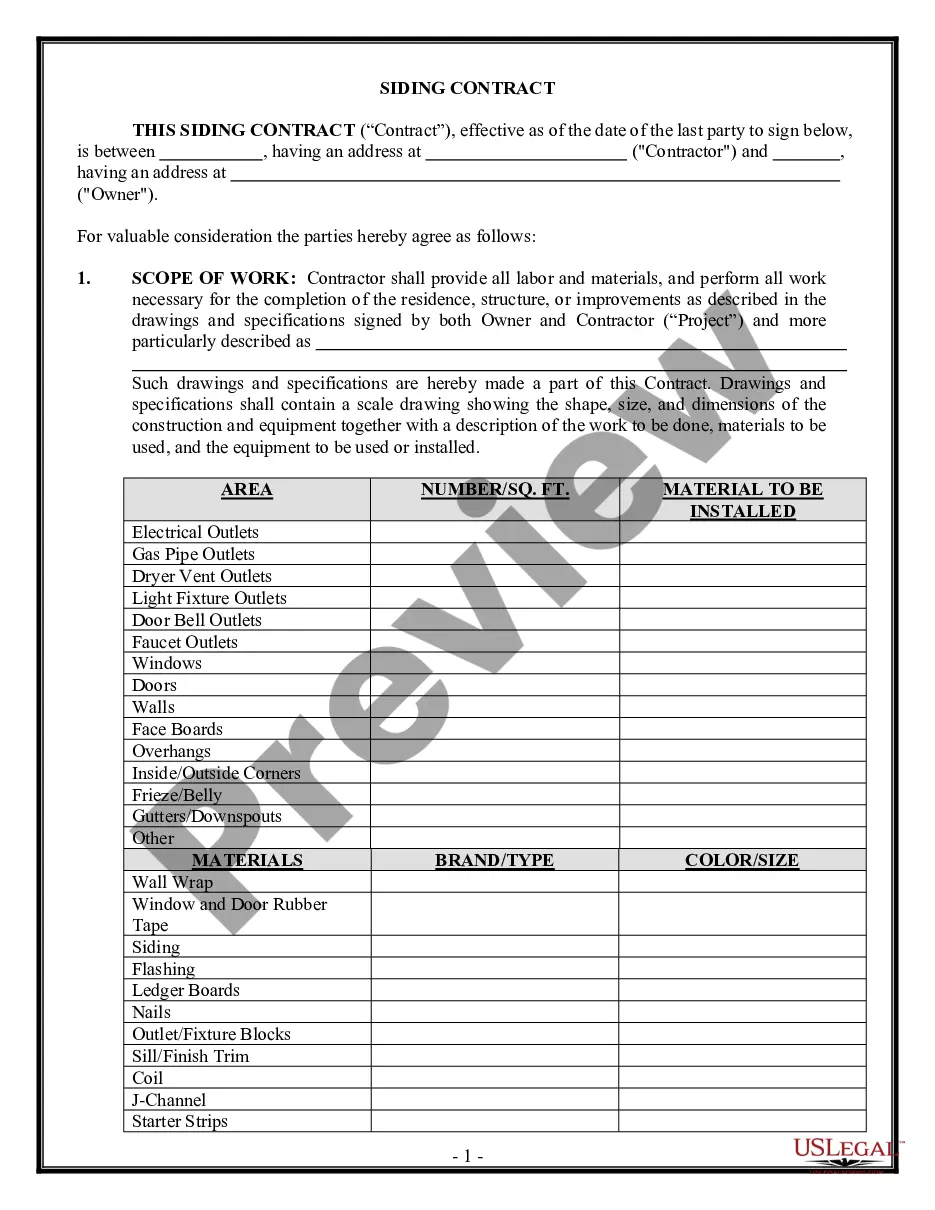

Key parts of this document

- Employee's name and ID for identification purposes.

- Old pay rates for production and non-production work, outlined clearly.

- Section for new pay rates, including detailed breakdowns of the pay structure.

- Signature lines for the employee, foreman, and owner to confirm the agreement.

- Space for date entries to ensure accurate record-keeping.

When to use this form

This form should be used whenever there is a change in an employee's pay rate, whether due to a raise, change in job responsibilities, or adjustments in bonuses. It's crucial for documenting these changes, ensuring that all parties are aware of the new terms, and maintaining compliance with relevant labor regulations.

Who this form is for

- Employers who need to formally record changes in employee compensation.

- Human resources professionals overseeing employee pay adjustments.

- Managers responsible for communicating pay changes to employees.

- Business owners wanting to ensure compliance with wage laws during pay changes.

Completing this form step by step

- Enter the employee's name and ID at the top of the form.

- List the old pay rates in the designated sections for production and non-production work.

- Provide the new pay rates based on the agreed changes.

- Sign and date the form in the appropriate signature lines for all parties involved.

- Ensure new rates are entered into the payroll system as indicated in the final section.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to fill out all required fields, leading to incomplete records.

- Not obtaining all necessary signatures before finalizing pay changes.

- Neglecting to enter the new rates into the payroll system on time.

- Using informal emails or messages instead of this formal documentation.

Benefits of completing this form online

- Convenience of immediate access and downloading whenever needed.

- Editable templates allow for customization to fit specific situations.

- Reliability of using officially drafted documents by licensed attorneys.

Looking for another form?

Form popularity

FAQ

A pay cut cannot be enacted without the employee being notified. If an employer cuts an employee's pay without telling him, it is considered a breach of contract. Pay cuts are legal as long as they are not done discriminatorily (i.e., based on the employee's race, gender, religion, and/or age).

In California, an employer can change the rate, terms and conditions of your employment relationship at any time by giving you notice as the employee.

The regular rate of pay is used as the basis for calculating overtime pay for non-exempt employees in California. Overtime is paid at 1 ½ times to 2 times the employee's regular pay. When it is not calculated correctly, the employee may not be receiving the correct overtime pay rate.

The regular rate of pay is the total earning by the employee divided by the total number of hours worked in the workweek. REGULAR RATE OF PAY = Divide the total earnings for the workweek, including earnings during overtime hours, by the total number of hours worked that workweek.

California does not have a law addressing when or how an employer may reduce an employee's wages or whether an employer must provide employees notice prior to instituting a wage reduction.of Industrial Relations states that an employer must give an employee prior notice of a change in pay periods.

Pay Rate Notice Requirements. Many states require employers to provide written notice to employees of their regular rate of pay and overtime rate, if applicable, at time of hire and when the rate of pay changes.

An employee's regular rate is the hourly rate an employee is paid for all non-overtime hours worked in a workweek.When calculating an employee's regular rate, all compensation received by the employee in a workweek must be included, including wages, bonuses, commissions, and any other forms of compensation.

Shan Evans, of People Management, explained: "Legally, an employer cannot impose a pay cut upon its employees if they have an employment contract that sets out details of their salary entitlement.This means if your employer wants to cut your pay, they have to ask for your permission first.

Regular hourly rate means hourly compensation paid to an employee outside of overtime, and includes the base wage rate and any hourly shift allowances and hourly premiums. Regular hourly rate means an amount calculated by dividing annual salary by 2080, or 2088 in the case of a leap year.