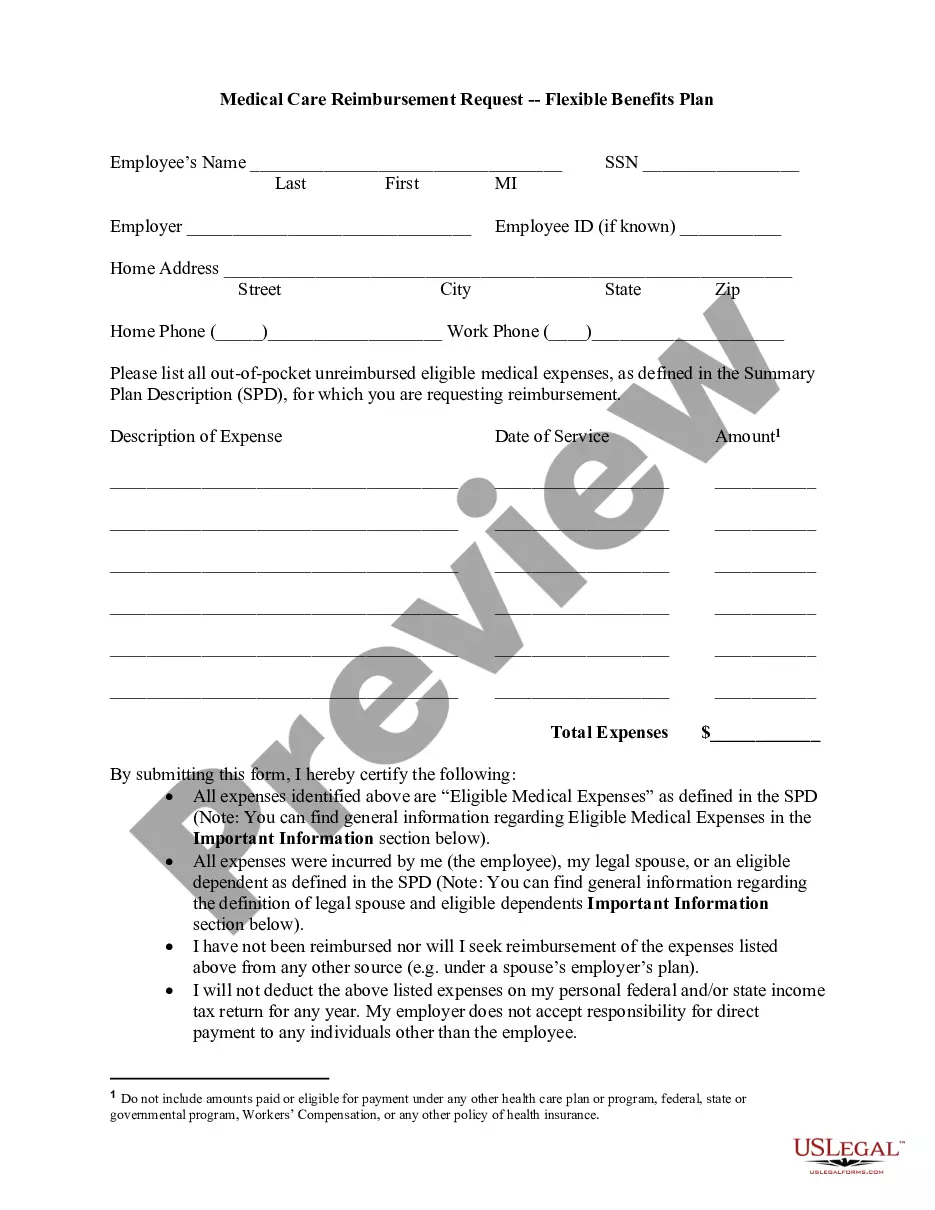

New York Health Insurers Request For Reimbursement is a process through which health insurers in New York submit claims for reimbursement from health care providers. It is a process that helps health insurers to recover costs associated with providing health care services to their members. There are two primary types of New York Health Insurers Request For Reimbursement: Fee-for-Service (FFS) and Capitation. Fee-for-Service (FFS) is a reimbursement system in which health insurers are paid for each service provided to their members. Capitation is a system in which health insurers receive a fixed amount of money per enrolled, regardless of the number of services provided. Both FFS and Capitation require health insurers to submit claims for reimbursement to health care providers in order to recover their costs. New York Health Insurers Request For Reimbursement is an important process that helps health insurers to provide quality health care services to their members.

New York Health Insurers Request For Reimbursement

Description

How to fill out New York Health Insurers Request For Reimbursement?

Working with legal documentation requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your New York Health Insurers Request For Reimbursement template from our service, you can be certain it complies with federal and state laws.

Dealing with our service is straightforward and quick. To get the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to obtain your New York Health Insurers Request For Reimbursement within minutes:

- Remember to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the New York Health Insurers Request For Reimbursement in the format you need. If it’s your first time with our website, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the New York Health Insurers Request For Reimbursement you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

The Affordable Care Act generally prevents major medical insurers from canceling plans. Insurers cannot dump you because you used too much coverage, or were rude on the phone.

Individuals. The Affordable Care Act (ACA) requires almost every individual and each of his or her dependents to have health insurance coverage. If they do not have health insurance, they must claim an exemption or pay a tax penalty on his or her federal income taxes the following year.

You don't pay your premiums. Many do not. It's a common misconception that your health insurance company can drop you if you become seriously ill. As of 2010, the Affordable Care Act made this practice illegal for all policies written after the ACA-effective date of September 2010.

Your insurance company can cancel your coverage if you fail to pay your premiums on time. Your insurance company notify you at least 30 days before they can cancel your coverage, giving you time to appeal the decision or find new coverage.

Insurers can cancel policies or choose not to renew at the end of a policy term. Non-renewal can occur after multiple accidents or filing too many claims. At the same time, more immediate cancellations can result from serious issues like loss of driving privileges or insurance fraud.

The percentage (for example, 40%) you pay of the allowed amount for covered health care services to providers who don't contract with your health insurance or plan. Out-of-network coinsurance usually costs you more than in-network coinsurance.

An insurance company can drop you for a number of reasons. Most commonly, insurers will cancel or opt not to renew coverage for drivers who file an excessive amount of claims. Drivers who are convicted of a DUI, perpetrate insurance fraud or fail to pay their insurance premium can also face being dropped.