New York Revocation of Living Trust

Description

Key Concepts & Definitions

Revocation of Living Trust: This is the process by which the grantor of a living trust (also known as a revocable trust) cancels or amends the terms of the trust. Typically, this action can be completely executed by the grantor as long as they are mentally competent. The revocation is crucial for addressing changes in the grantor's intentions or personal circumstances.

Step-by-Step Guide to Revoking a Living Trust

- Review the Trust Agreement: Check the original trust documents for any specific procedures required for revocation.

- Prepare a Revocation Declaration: Draft a clear statement declaring the intention to revoke the trust, including details such as the date of trust establishment and the identity of the grantor.

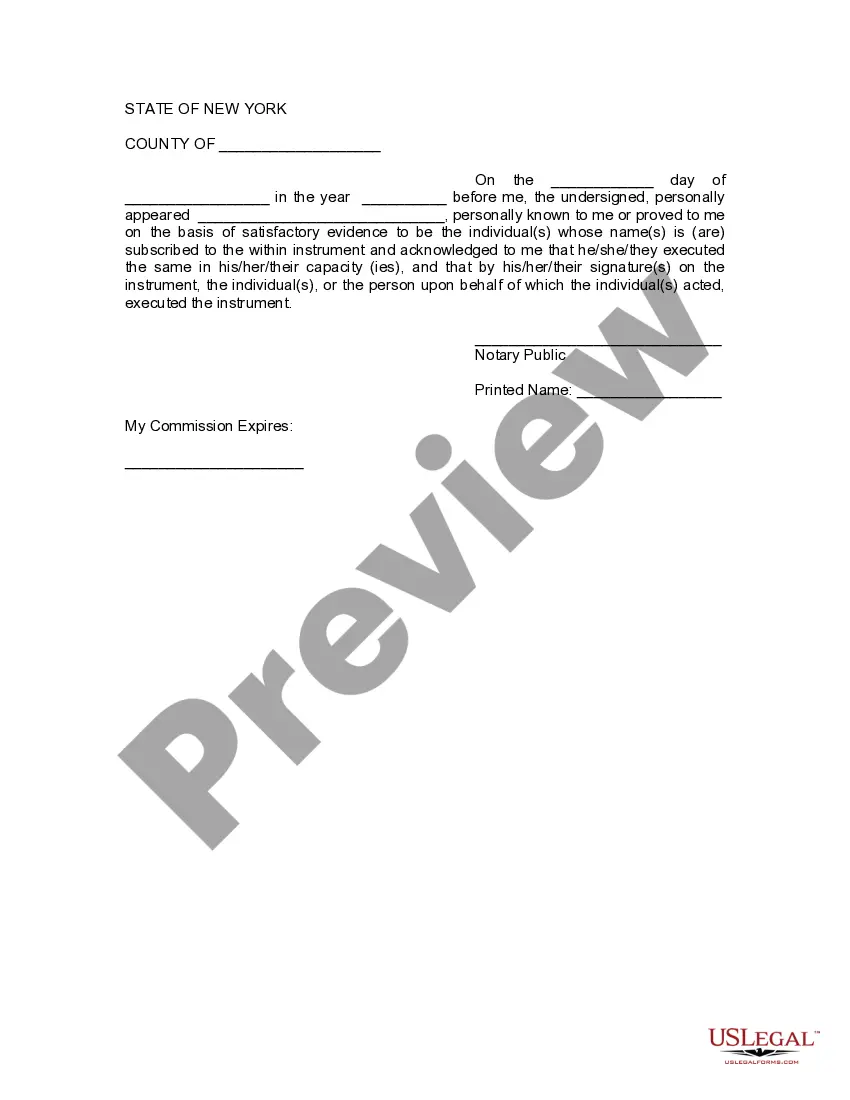

- Notarize the Document: Sign the revocation in the presence of a notary to verify your identity and intent.

- Distribute Copies: Share the notarized revocation document with any relevant parties, such as trustees and beneficiaries.

- Transfer Assets: Legally title back the assets from the trust to your personal possession or to a new trust, if needed.

Risk Analysis

- Legal Disputes: Poorly executed revocations can lead to disputes among beneficiaries, possibly resulting in litigation.

- Financial Risks: Mistakes in re-titling assets can lead to tax complications or loss of asset protection.

- Personal Risks: Revoking a trust might expose assets to risks from creditors or in cases of divorce.

Key Takeaways

Understanding the Process: Comprehensive knowledge of the revocation procedure ensures legal compliance and reduces risk.

Consult Professionals: Engaging with legal or financial advisors can prevent common pitfalls associated with trust revocation.

Pros & Cons

- Pros: Flexibility to adapt to new circumstances; potential to simplify estate management.

- Cons: Can be legally complex; potential for causing conflicts or misunderstandings among trust parties.

Common Mistakes & How to Avoid Them

- Ignoring Specific Trust Terms: Always refer to the original trust documents for specific clauses relating to revocation.

- Forgetting to Re-title Assets: Ensure all assets are properly re-titled post-revocation to avoid future legal issues.

FAQ

Can a living trust be revoked without a lawyer? Yes, a grantor can revoke their trust without legal assistance; however, consulting a lawyer is recommended to ensure all legal aspects are correctly handled.

What happens to the assets in the trust upon revocation? Assets need to be re-titled back to the grantor or transferred to a new trust or other entities as per the grantor's decision.

How to fill out New York Revocation Of Living Trust?

When it comes to submitting New York Revocation of Living Trust, you most likely think about a long process that consists of choosing a perfect form among a huge selection of very similar ones and after that being forced to pay out legal counsel to fill it out for you. Generally speaking, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific template within just clicks.

In case you have a subscription, just log in and click on Download button to get the New York Revocation of Living Trust sample.

In the event you don’t have an account yet but need one, follow the step-by-step manual listed below:

- Make sure the file you’re getting applies in your state (or the state it’s required in).

- Do this by reading through the form’s description and by visiting the Preview function (if offered) to see the form’s content.

- Click on Buy Now button.

- Select the appropriate plan for your budget.

- Join an account and choose how you want to pay: by PayPal or by card.

- Save the file in .pdf or .docx file format.

- Find the file on your device or in your My Forms folder.

Professional legal professionals work on drawing up our samples to ensure that after saving, you don't need to bother about editing and enhancing content outside of your personal details or your business’s info. Join US Legal Forms and get your New York Revocation of Living Trust example now.

Form popularity

FAQ

The New York law provides for statutory mechanisms which allow for a trust creator to amend or revoke an irrevocable trust.New York law provides that if a trust settlor obtains the acknowledged, written consent of all those beneficially interested in an un-amendable, irrevocable trust, she may amend or revoke it.

You can be the trustee of your own living trust, keeping full control over all property held in trust.In contrast to revocable trusts, irrevocable trusts cannot be revoked or modified after they are signed.

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

The terms of an irrevocable trust may give the trustee and beneficiaries the authority to break the trust. If the trust's agreement does not include provisions for revoking it, a court may order an end to the trust. Or the trustee and beneficiaries may choose to remove all assets, effectively ending the trust.

A revocation of a will generally means that the beneficiaries will no longer receive the specified property or financial assets. A beneficiary may have been depending on the trust property for various reasons. If the revocation occurs at a certain time, it can cause legal conflicts in many cases.

A trust is created by a Settlor, also called a Trustor or a Grantor, who transfers property to a Trustee. The Trustee holds that property for the trust beneficiaries.An irrevocable living trust, however, cannot be modified or revoked by the Settlor at any time nor for any reason once active.

A revocable trust, or living trust, is a legal entity to transfer assets to heirs without the expense and time of probate.A living trust also can be revoked or dissolved if there is a divorce or other major change that can't be accommodated by amending the trust.

An irrevocable trust is a type of trust where its terms cannot be modified, amended or terminated without the permission of the grantor's named beneficiary or beneficiaries.Irrevocable trusts cannot be modified after they are created, or at least they are very difficult to modify.

Yes. Generally you can refinance property placed in irrevocable trust.