A New York Certificate of Registration (Domestic LLP) is a document issued by the New York Department of State that certifies the formation of a limited liability partnership (LLP) in the state of New York. This document is filed with the New York Department of State and is required to legally operate a business as an LLP in the state of New York. It includes the name of the LLP, the address of the LLP’s registered agent, and the date of formation. There are two types of New York Certificate of Registration (Domestic LLP): an initial registration and an amendment registration. An initial registration is required for any newly formed LLP, while an amendment registration is required when there are any changes to the partnership information, such as address, name, or registered agent.

New York Certificate of Registration (Domestic LLP)

Description

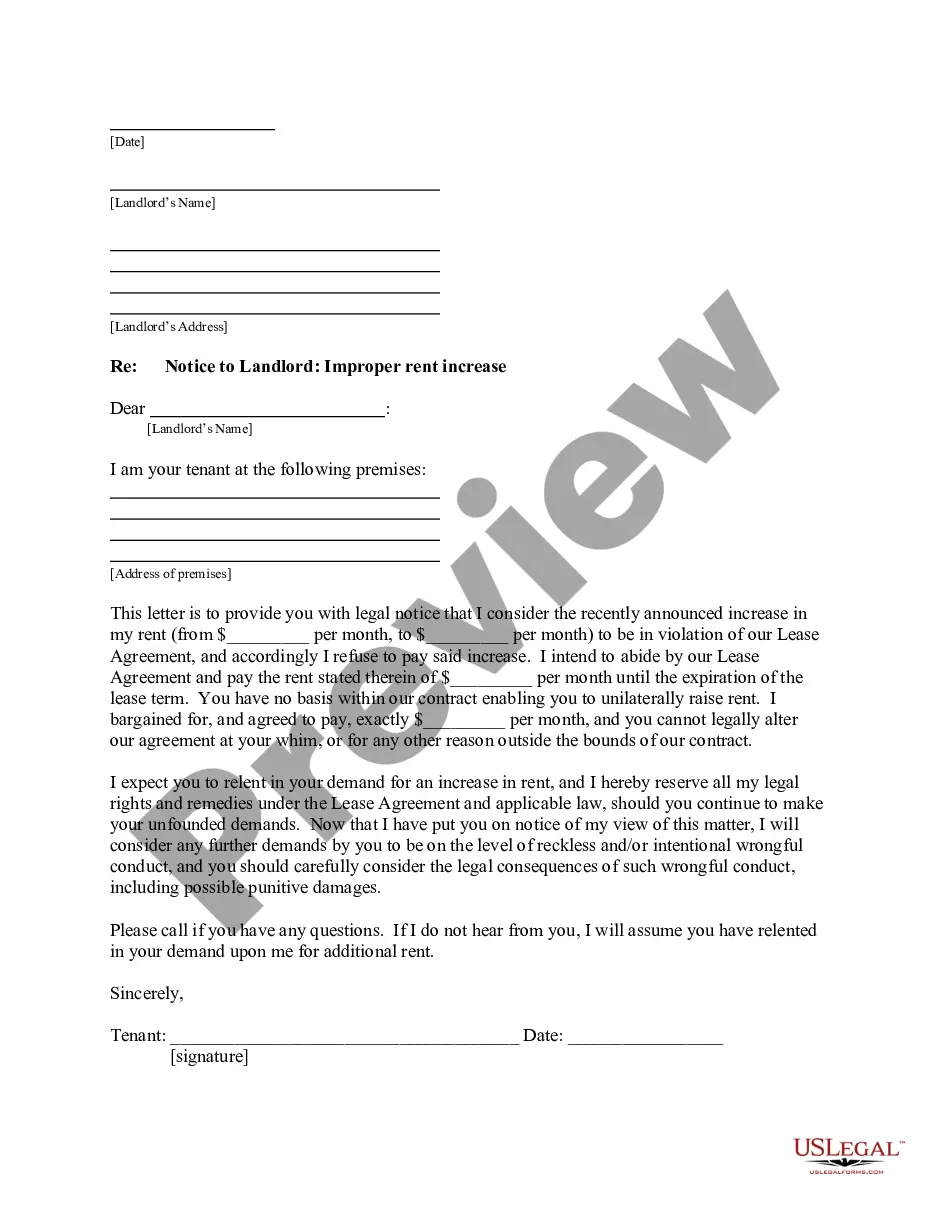

How to fill out New York Certificate Of Registration (Domestic LLP)?

Handling official paperwork requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your New York Certificate of Registration (Domestic LLP) template from our service, you can be sure it meets federal and state laws.

Dealing with our service is straightforward and quick. To obtain the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to get your New York Certificate of Registration (Domestic LLP) within minutes:

- Remember to attentively check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the New York Certificate of Registration (Domestic LLP) in the format you prefer. If it’s your first time with our service, click Buy now to continue.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the New York Certificate of Registration (Domestic LLP) you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

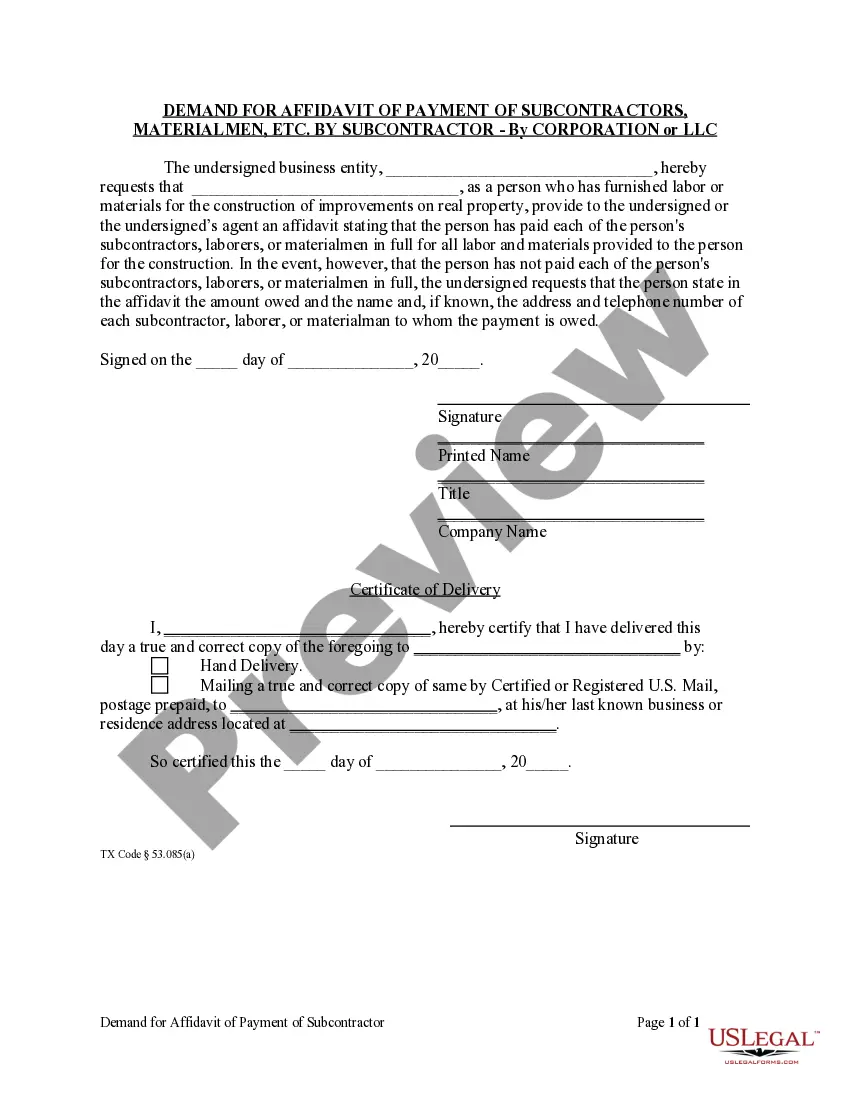

Complete and file the Certificate of Registration with the Department of State. The completed Certificate of Registration, together with the filing fee of $200, should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

Choosing to run your company as an LLC or LLP depends upon your profession and your state. If you're a professional who needs a license to do business, you're better off running your company as an LLP if your state allows it. If you are not a professional, an LLC is usually the best fit for your business.

FAQs. Do general partnerships have to register in New York? You do not need to register a general partnership in New York. However, you will need to file a Certificate of Assumed Name for any additional business names.

The LLP business form comes with a significant tax advantage over the LLC form. Under the LLP model, the partners in law firms can pass their profits or losses to their own individual tax returns come income tax time, meaning that the firm itself doesn't have to file a tax return.

The difference between LLP and LLC is an LLC is a limited liability company and an LLP is a limited liability partnership. ing to the government, specifically the IRS, an LLC is a business organization that is formed lawfully under the state by filing articles of organization.

Disadvantages of an LLP Public disclosure is the main disadvantage of an LLP. Financial accounts have to be submitted to Companies House for the public record. The accounts may declare income of the members which they may not wish to be made public. Income is personal income and is taxed ingly.

Limited Liability Partnership (LLP) A limited liability partnership is similar to a limited liability company (LLC) in that all partners are granted limited liability protection. However, in some states the partners in an LLP get less liability protection than in an LLC. LLP requirements vary from state to state.

A limited liability partnership (LLP) is a partnership whose partners are authorized to provide professional services and that has registered as a limited liability partnership under Article 8-B of the Partnership Law of New York State or under the laws of another jurisdiction.