Schedule D — Sales, Transfers, and Returnstampededed Cigarettes Within New York State is a form required by the New York State Department of Taxation and Finance. It is used to report sales, transfers, and returns of stamped cigarettes within the state of New York. There are three types of Schedule D forms: Schedule D-1 for reporting sales and transfers of stamped cigarettes within the state; Schedule D-2 for reporting the receipt and return of stamped cigarettes within the state; and Schedule D-3 for reporting the receipt and return of stamped cigarettes from outside the state. All Schedule D forms must be filed with the Department of Taxation and Finance and must include information such as the date, type of transaction, and amount of stamped cigarettes involved.

Schedule D - Sales, Transfers, and Returns of Unstamped Cigarettes Within New York State

Description

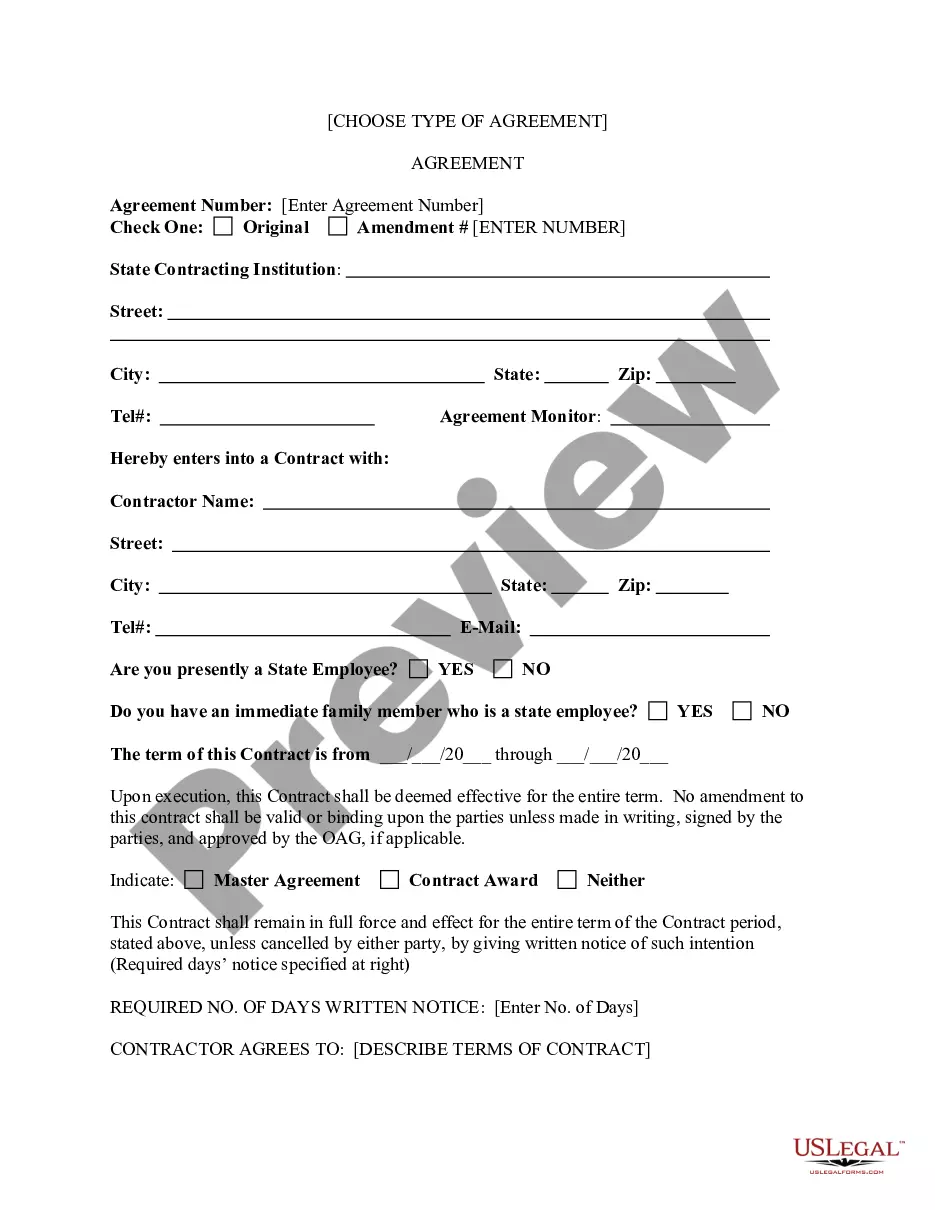

How to fill out Schedule D - Sales, Transfers, And Returns Of Unstamped Cigarettes Within New York State?

Working with legal paperwork requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Schedule D - Sales, Transfers, and Returns of Unstamped Cigarettes Within New York State template from our service, you can be certain it complies with federal and state regulations.

Dealing with our service is straightforward and quick. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your Schedule D - Sales, Transfers, and Returns of Unstamped Cigarettes Within New York State within minutes:

- Remember to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Schedule D - Sales, Transfers, and Returns of Unstamped Cigarettes Within New York State in the format you prefer. If it’s your first time with our service, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the Schedule D - Sales, Transfers, and Returns of Unstamped Cigarettes Within New York State you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

What is the tax on tobacco products? New York State imposes an excise tax on tobacco products possessed in the state for sale at the following rates: 75% of the wholesale price on cigars and tobacco products (other than little cigars and snuff);

You will have to pay a $250 surcharge for each New York State (NYS) Adolescent Tobacco Use Prevention Act (ATUPA) law violation if the violation involved a The final rule defines "tobacco use" as use of tobacco an average of four or more times per week within no longer than the past six months, including all tobacco

Sales of cigarettes, other tobacco products or electronic cigarettes to people under age 21 can result in New York City fines of up to $1,000 for the first violation and any other violation found that same day, and up to $2,000 for the second violation and any subsequent violation within three years.

To sell tobacco products and electronic cigarettes in NYC, you must have the relevant licenses and registration. To sell cigarettes and tobacco products, including heated tobacco products, you must have a City-issued tobacco retail dealer license and a State-issued valid registration.

Beware of these laws and make sure you stay under the 1 gallon limit for alcohol and the 5 carton limit for tobacco.

Cigarettes are required be sold in quantities of no less than 20. The sale of loose cigarettes was outlawed because of Loosies' potential appeal to children. Loosies are commonly found in low-income areas. The high cost of cigarettes due to increased taxation has been blamed for increased sales of loosies.

If you are unlicensed and you transport, possess, sell, or attempt to sell 30,000 or more unlawfully stamped or unstamped cigarettes, you can be charged with a Class D felony.