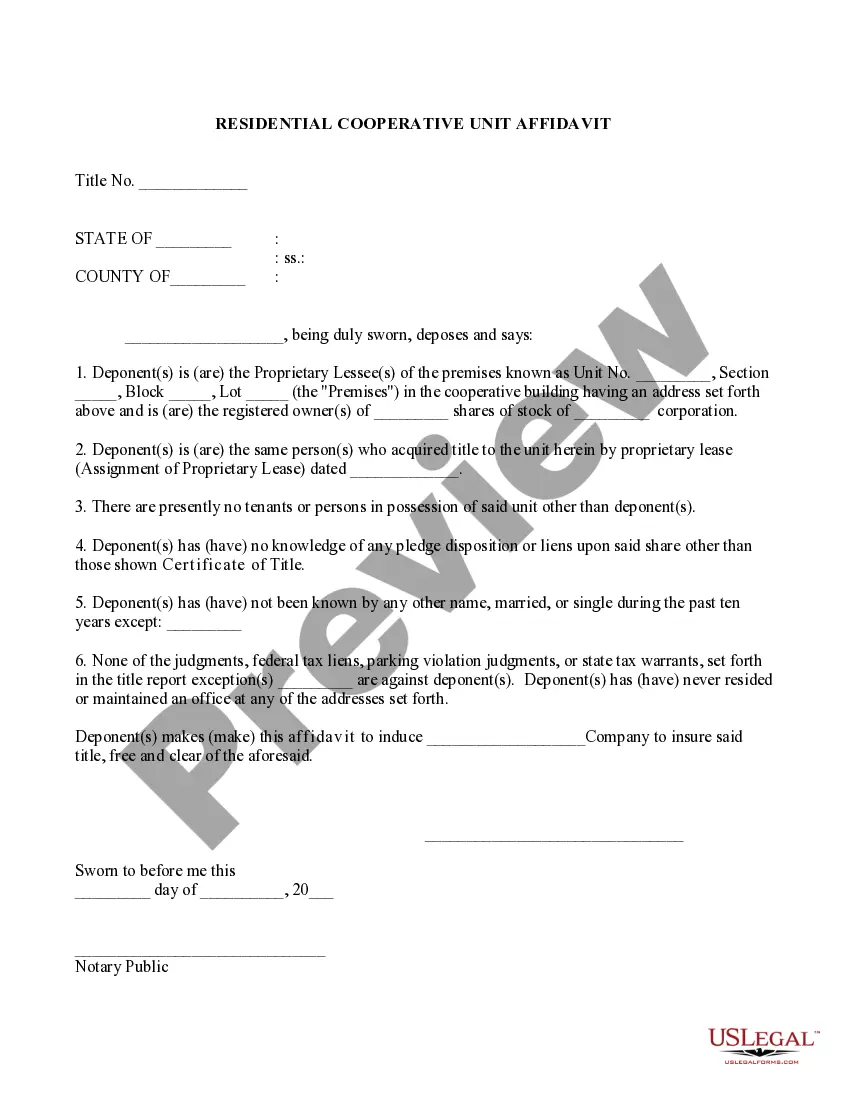

New York Leasehold Coop Questionnaire is a set of questions designed to help determine an applicant’s eligibility to purchase a cooperative apartment in New York City. The questions are generally provided by the cooperative’s board of directors and aim to assess the applicant’s financial stability, background, and commitment to living in the cooperative. Questionnaires typically revolve around topics such as personal financial information, employment history, credit score, references, and other information that may be used to determine whether the applicant is a suitable candidate. Types of New York Leasehold Coop Questionnaire may include Financial Questionnaire, Employment Verification Form, Credit Check Authorization Form, and other forms.

New York Leasehold Coop Questionnaire

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New York Leasehold Coop Questionnaire?

How much time and resources do you typically spend on composing official documentation? There’s a greater option to get such forms than hiring legal experts or wasting hours searching the web for a suitable blank. US Legal Forms is the top online library that provides professionally drafted and verified state-specific legal documents for any purpose, like the New York Leasehold Coop Questionnaire.

To get and complete an appropriate New York Leasehold Coop Questionnaire blank, follow these simple steps:

- Examine the form content to ensure it meets your state regulations. To do so, read the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your requirements, locate a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the New York Leasehold Coop Questionnaire. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Choose the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely reliable for that.

- Download your New York Leasehold Coop Questionnaire on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously downloaded documents that you securely keep in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us today!

Form popularity

FAQ

Manhattan's residential market ended 2022 with a whimper, as median sale prices for co-ops and condos fell 5.5% compared to 2021, notching the first pandemic-era decline, the Real Deal reports. Tight inventory and high mortgage rates promise little relief for buyers or sellers during the coming year.

Co-op fees can become expensive. The application process to purchase a co-op is rigorous. Some co-ops don't allow financing, and those that do may require high down payments. Co-ops are not generally considered to be investment properties as you can't rent them out, and they don't have much upside potential.

In very broad terms, we would say 20% to 30% less. This is without a doubt the #1 reason buyers end up choosing a co-op over a condo. Closing costs are much lower on co-ops because personal property is being exchanged (shares and the proprietary lease) rather than real property.

A Coop is considered personal property and not real estate. As such, a buyer who obtains a ?mortgage? for a coop does not pay a mortgage tax.

The co-op median sale price was $865,000, versus $1.9 million for condos. From 1989 to Q3 of 2022, Manhattan co-ops' median sale price increased from $200,000 to $851,000, an annualized growth rate of 4.49 percent.

A coop questionnaire is a survey that banks and mortgage lenders will request the managing agent of a cooperative apartment building to fill out in order to approve the building for financing.

Although the financial requirements for co-ops in NYC vary by building, a conservative estimate for a NYC co-op's financial requirements is as follows: 20% down, 25% debt-to-income ratio and at least one to two years of post-closing liquidity.

Co-Op Owners If you own a co-op, your co-op's managing agent, or board of directors gets the property tax bill for the entire building. You can contact them for payment and exemption information for your apartment.