New York Business Credit Application

What is this form?

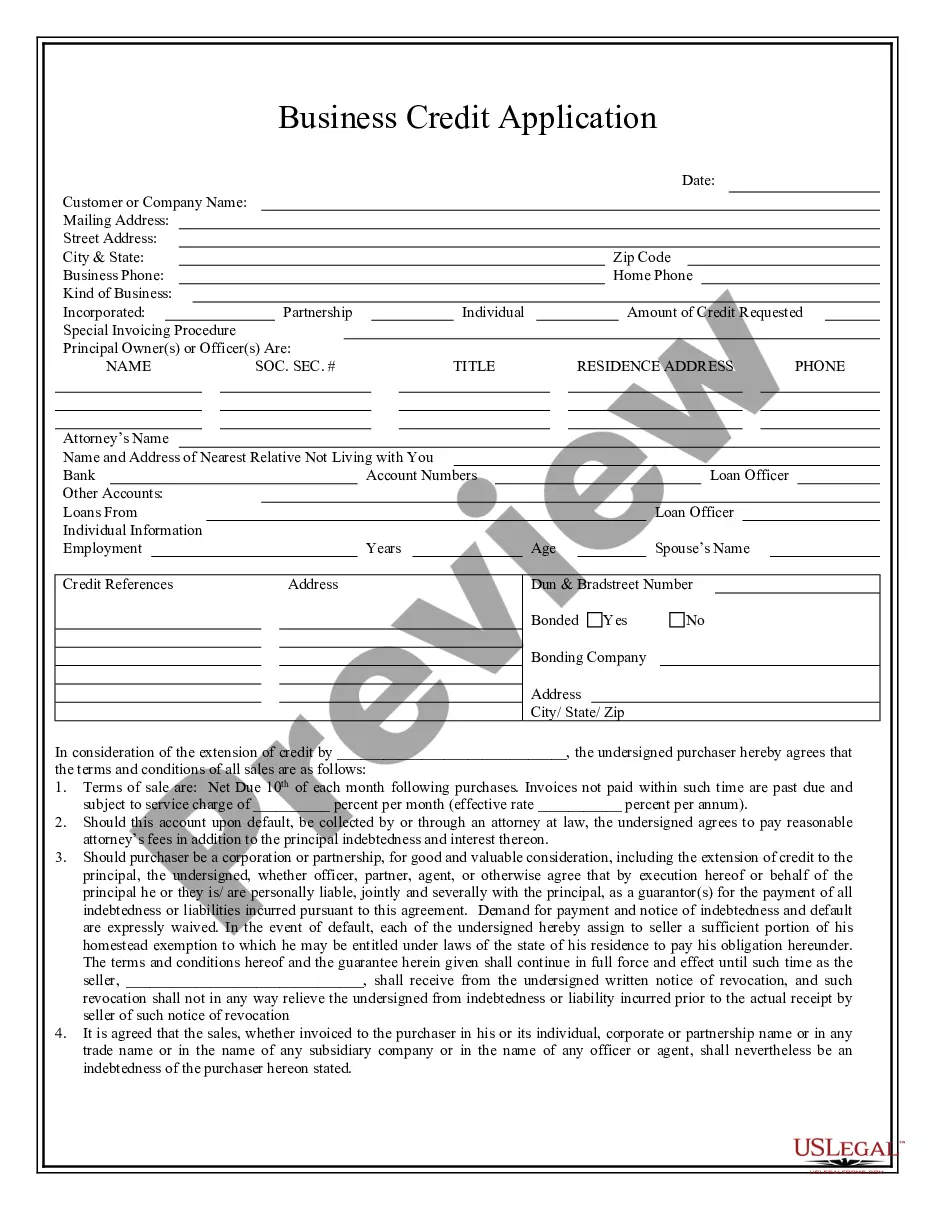

The Business Credit Application is a legal document that allows individuals or businesses to apply for credit from a seller. This form outlines the terms and conditions of repayment, ensuring that both parties understand their rights and responsibilities in the transaction. It is distinct from other forms as it includes provisions for interest, default, and the retention of title for goods sold on credit, which are essential for protecting the seller's interests.

What’s included in this form

- Terms of sale, including payment due dates and interest rates.

- Provisions for attorney fees in case of default.

- Personal liability clauses for corporate officers or partners.

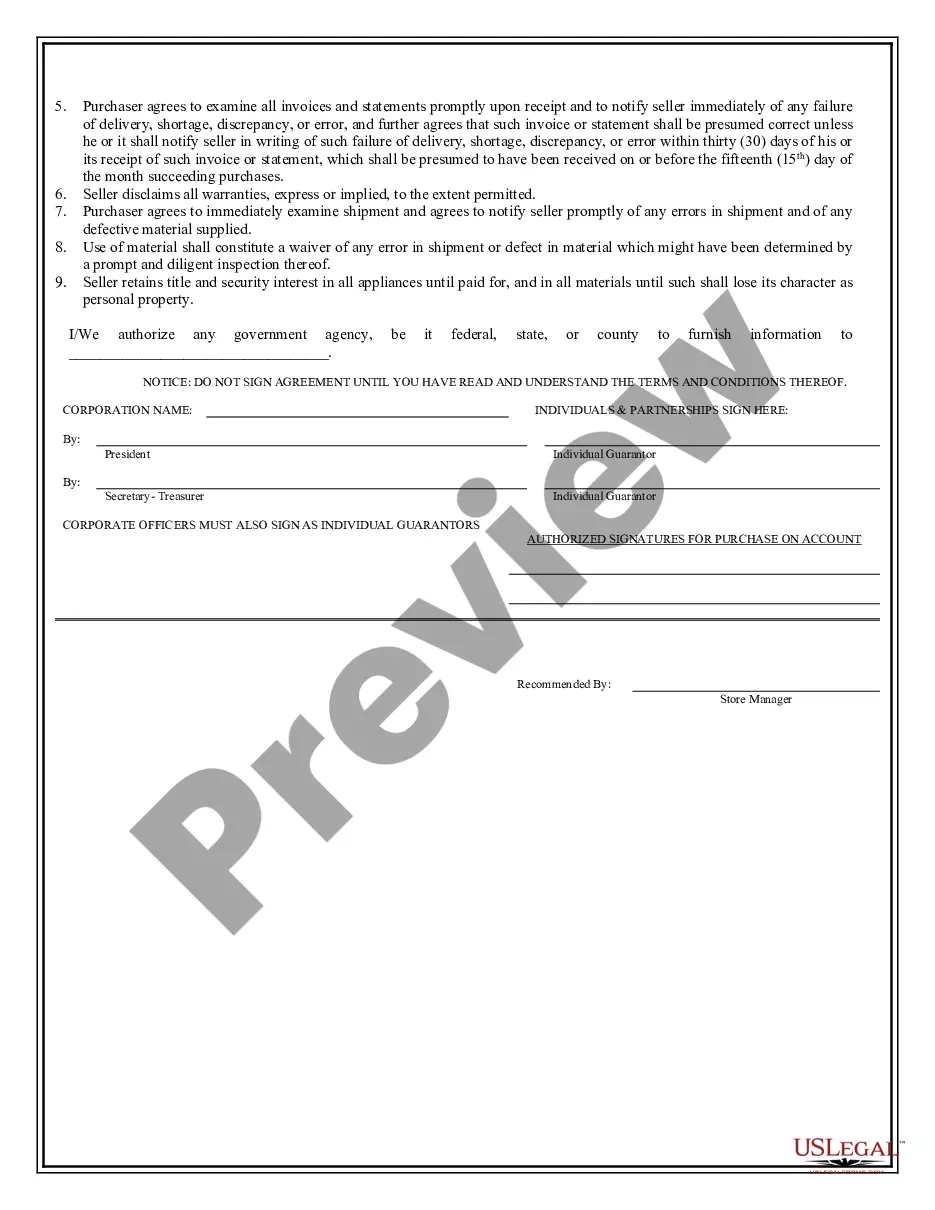

- Requirements for notifying the seller of any discrepancies in orders.

- Disclaimer of warranties and retention of title for goods sold.

When to use this document

This form should be used when a business or an individual seeks to establish a credit relationship with a seller. It is commonly needed when purchasing goods or services on credit, facilitating agreements between suppliers and buyers regarding product financing and repayment terms.

Who can use this document

- Individuals applying for credit to make purchases from a business.

- Small business owners looking to secure financing for inventory or services.

- Corporations and partnerships that require credit while managing cash flow.

- Sellers who wish to formalize the terms of credit extended to buyers.

Steps to complete this form

- Begin by entering the name of the seller extending the credit.

- Fill out the purchaser's details, including individual or business name.

- Specify the terms of sale, including due dates and interest rates.

- Review and sign as required, ensuring all applicable parties endorse the document.

- Retain a copy for your records and send the original to the seller.

Does this form need to be notarized?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to clearly enter the repayment terms and conditions.

- Not obtaining necessary signatures from all parties involved.

- Omitting important details like interest rates or fees.

- Neglecting to send a prompt notification to the seller about issues with invoices.

Why complete this form online

- Convenience of completing the form at any time, without having to visit a legal office.

- Editable format allows for easy customization to fit specific needs.

- Reliable templates drafted by licensed attorneys ensure legal compliance.

Legal use & context

- This form is legally binding once signed by all parties, creating enforceable obligations regarding repayment.

- It is important to understand that failure to comply with the agreements can lead to legal actions, including collection efforts.

Quick recap

- The Business Credit Application is essential for establishing credit relationships.

- Clear terms and conditions help prevent disputes between buyers and sellers.

- Completing the form accurately and promptly is crucial for both parties' legal protection.

Looking for another form?

Form popularity

FAQ

New York & Company Comenity Bank Approval. Congrats!

Yes, you can continue to use your RUNWAYREWARDS Credit Card for all purchases at nyandcompany.com and fashiontofigure.com.

Write a business plan. Choose a business name. Choose a business entity and register your business. Obtain your EIN and register for taxes. Obtain permits, licenses, employer information, and insurance. Secure startup funding. Get a business bank account and credit card. Kick off your marketing plan.

New York & Company Card Overall Rating: 3.5/5.0 Sporting a hefty 27.24% APR, the RUNWAYREWARDS Credit Card is not a product for people who carry a balance. Instead, the card's purchase rewards are the real draw for most shoppers, offering a $10 Reward for every $200 spent on the RUNWAYREWARDS Credit Card.

You can contact New York & Company customer service for the RunwayRewards credit card at 800-889-0494, Monday through Saturday from 8 a.m. to 9 p.m. ET. To pay your bill, follow the automated prompts by entering your credit card number or your Social Security number.

Generally, the best small-business credit cards require a score of 670 or higher. While you might be able to qualify for a card with a lower score, you'll likely pay a higher interest rate or earn fewer rewards. When it comes to getting a small-business loan, banks have higher approval requirements.

Q: What credit score do you need to get approved for a New York and Company credit card? Actually, it is believed that you must have a credit score starting with 650 (or fair) in order to get this credit card.