New York Professional Limited Liability Company PLLC Formation Package

Definition and meaning

A New York Professional Limited Liability Company (PLLC) Formation Package is a comprehensive set of legal documents specifically designed for individuals and licensed professionals seeking to form a PLLC in the state of New York. A PLLC is a type of business structure that allows professionals, such as lawyers, doctors, and accountants, to operate their practices under limited liability protections. This means that the personal assets of the owners are generally protected from business debts and liabilities.

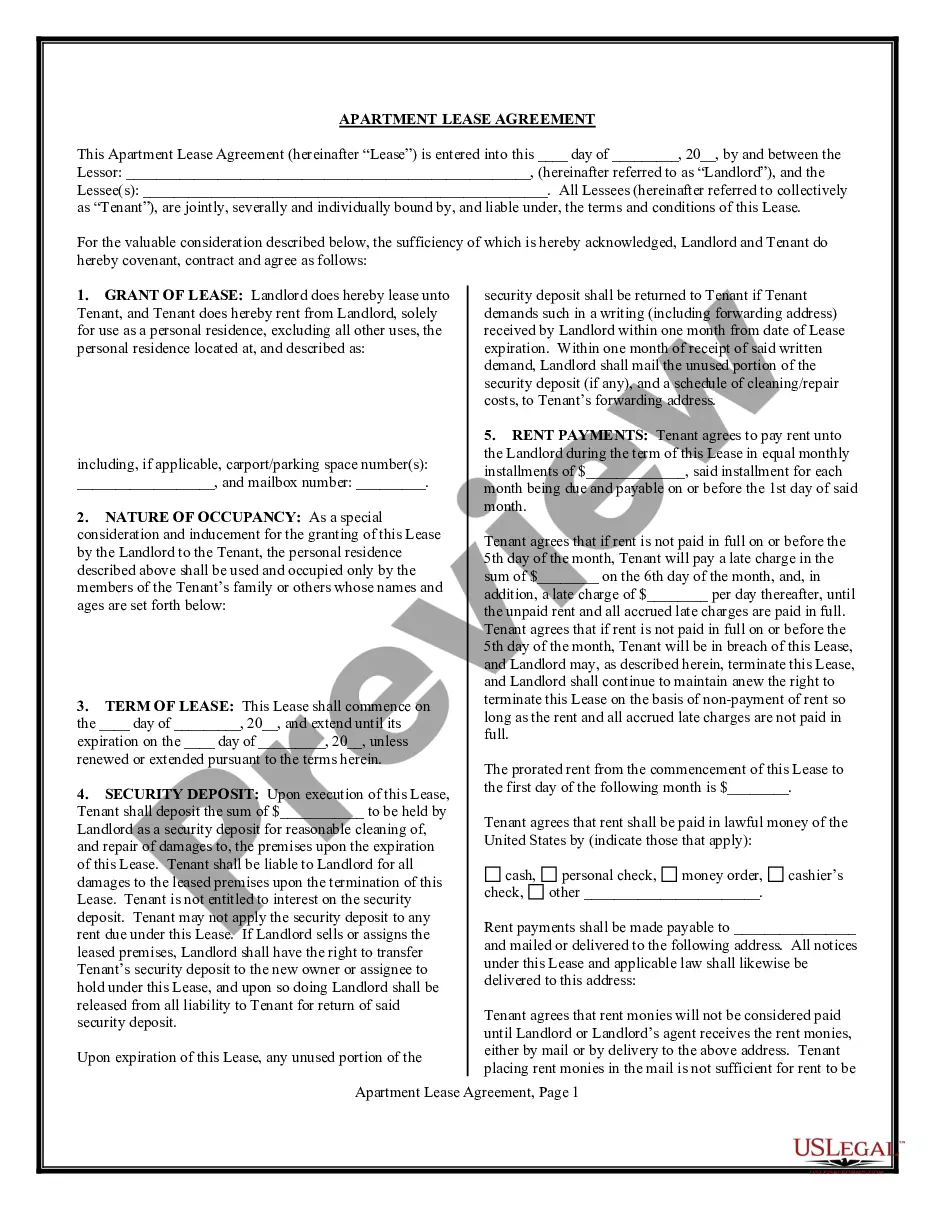

Key components of the form

The New York PLLC Formation Package includes several crucial documents and forms that need to be completed for proper registration:

- Application for Reservation of Name: A necessary form to reserve a unique name for your PLLC to avoid rejections based on name duplication.

- Articles of Organization: This document officially establishes your PLLC and includes key information such as the name, address, and purpose of the company.

- Operating Agreement: While not mandatory, this internal document outlines the management structure and responsibilities of members within the PLLC.

- Certificate of Professional Licenses: Needed to prove that members are legally authorized to render their respective professional services.

State-specific requirements

To properly form a PLLC in New York, several state-specific requirements must be met:

- All members must be licensed professionals in the state.

- The PLLC name must end with "Professional Limited Liability Company" or the abbreviation "P.L.L.C.".

- Articles of Organization must be filed with the New York Department of State, including the appropriate filing fee.

- Within 120 days of filing, a notice must be published in two local newspapers for six consecutive weeks.

How to complete a form

Completing the New York PLLC Formation Package requires attention to detail. Here’s a step-by-step process:

- Reserve a name: Complete the Application for Reservation of Name, ensuring the chosen name complies with state regulations.

- Fill out the Articles of Organization: Provide details such as the PLLC name, purpose, and member information.

- Prepare the Operating Agreement: Draft an internal agreement that outlines management structure and member duties.

- Attach required documentation: Include professional licenses and the Certificate of Reservation.

- File the documents: Send the completed forms along with any fees to the New York Department of State.

Benefits of using this form online

Using the online platform for your PLLC formation offers several advantages:

- Convenience: Access and complete forms from the comfort of your home or office at any time.

- Time-saving: Instant access to templates and forms reduces the time spent on paperwork.

- Guidance: Online platforms often provide step-by-step instructions and customer support for completing forms.

- Secure payment options: Pay filing fees securely online, streamlining the process.

Common mistakes to avoid when using this form

To ensure a smooth PLLC formation process, be aware of these common pitfalls:

- Incorrect name reservations: Failing to check name availability can lead to rejections.

- Missing documentation: Ensure all required documents are included when submitting your formation package.

- Publication requirements: Neglecting to publish the notice within the set timeframe can hinder your ability to operate.

- Inaccurate information: Double-check all entries for accuracy to avoid delays and legal issues.

Form popularity

FAQ

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

In most cases, business owners can amend the articles of organization of an LLC to change to a PLLC. For example, the state of Arizona requires that a company complete a form to amend its articles of organization and change the name of the company from LLC to PLLC.

To form a PLLC, a licensed professional must sign all filing documents as well as include their professional license number and a certified copy of their license. Importantly, they must submit these documents for approval with their state licensing board before filing them with their state's secretary of state.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.

To form a PLLC, a licensed professional must sign all filing documents as well as include their professional license number and a certified copy of their license. Importantly, they must submit these documents for approval with their state licensing board before filing them with their state's secretary of state.

Individual Reports A partnership PLLC must file a Form 1065, Return of Partnership Income, showing income, deductions and any profit or loss. This is an informational return, and no taxes are assessed. A Schedule K-1 with the form shows each partner's share, to be reported on a personal return.

The difference between a PC and a PLLC is ultimately the same as the difference between a regular corporation and a regular LLC. One major difference is how these entities are taxed.With a PLLC, you can choose to be taxed like a C corp or an S corp, but the far more common option is taxation as a pass-through entity.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

1Step One) Choose a PLLC Name.2Step Two) Designate a Registered Agent.3Step Three) File Formation Documents with the State.4Step Four) Create an Operating Agreement.5Step Five) Handle Taxation Requirements.6Step Six) Obtain Business Licenses and Permits.