New York Affidavit of Lost Note

Definition and meaning

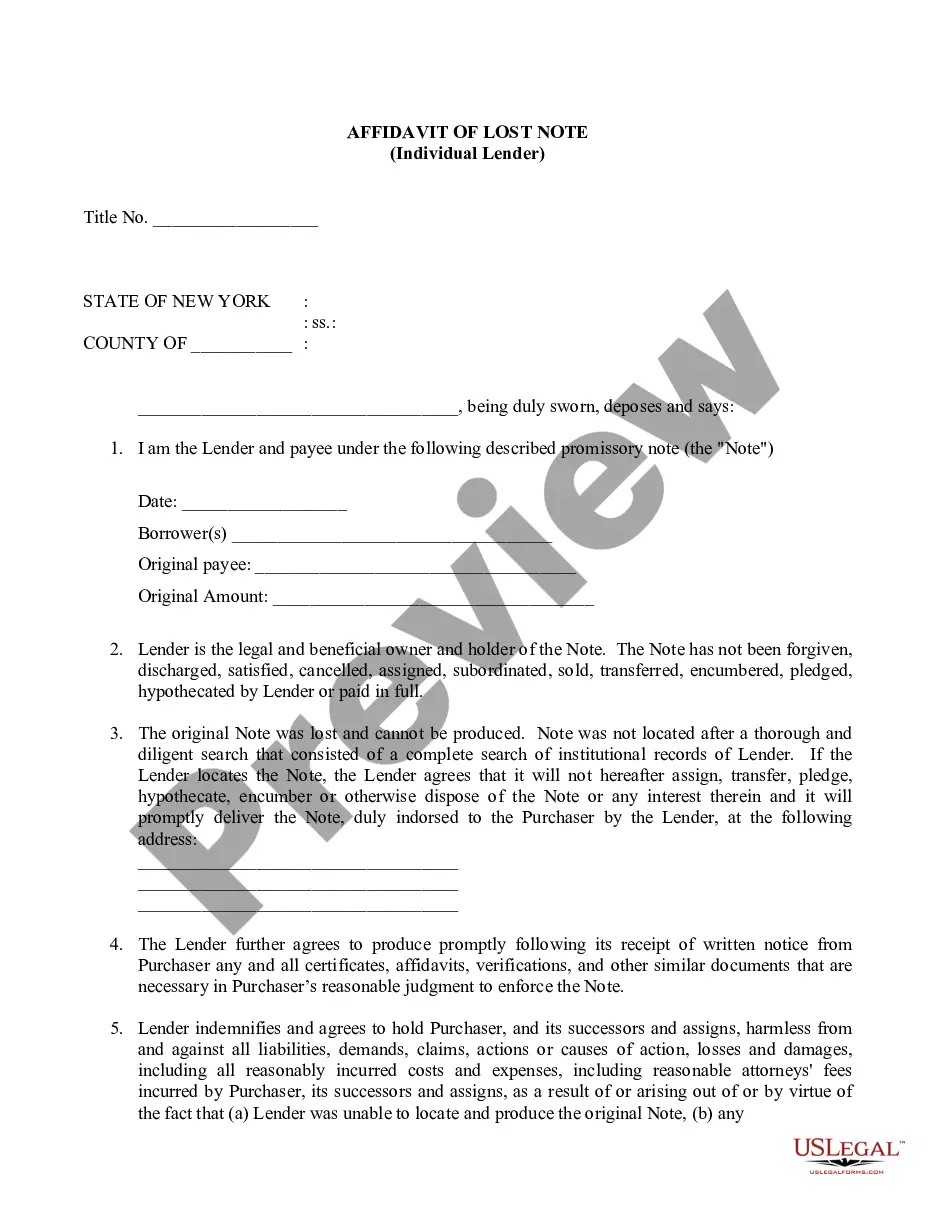

The New York Affidavit of Lost Note is a legal document utilized to declare that a promissory note has been lost and cannot be retrieved. This affidavit serves as a formal notification to relevant parties, such as lenders or purchasers, about the loss of the note. It typically includes details of the note, such as its date, the borrower's name, and the original amount, reaffirming the lender's rights to the note despite its physical absence.

How to complete a form

Completing the New York Affidavit of Lost Note requires attention to detail. Users must:

- Fill in the title number at the top

- Provide the current date of the affidavit

- Include information regarding the borrower and original payee

- State the original amount of the note

- Confirm that a diligent search was conducted for the original note

- Provide an address for future correspondence

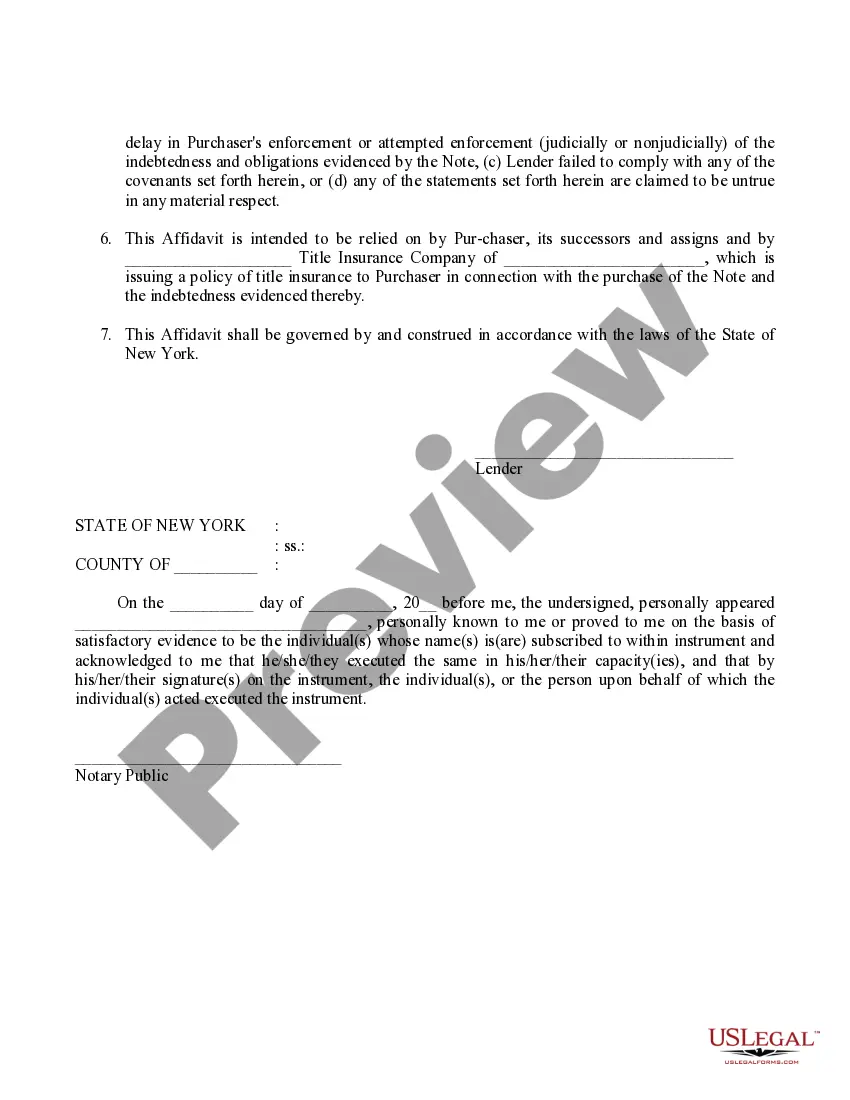

After filling in these sections, the document must be signed in front of a notary public to validate it.

Who should use this form

The New York Affidavit of Lost Note is primarily used by lenders who find themselves in possession of a loan or promissory note that has been lost. It is beneficial for individual lenders as well as financial institutions that need to provide proof of ownership and intention to recover the lost note. This form can also be used by individuals looking to clarify their position regarding a loan agreement.

Legal use and context

This affidavit is a legal instrument that provides a basis for the enforcement of the terms outlined in the lost note. It reaffirms the lender's legal ownership and serves as a protective measure. The affidavit may be necessary when a lender seeks to collect on the debt or when transferring rights related to the note. Courts typically require this document to prove the lender's good faith in resolving claims regarding the lost note.

Common mistakes to avoid when using this form

When completing the New York Affidavit of Lost Note, users should be cautious of the following common mistakes:

- Failing to provide accurate details about the original note

- Not conducting a thorough search before claiming the note as lost

- Neglecting to have the affidavit notarized

- Omitting the indemnity clause, which protects against claims related to the lost note

Being mindful of these pitfalls can prevent legal complications and ensure that the affidavit holds up in future transactions.

What documents you may need alongside this one

Along with the New York Affidavit of Lost Note, users may need to gather additional documents, such as:

- Proof of identity (e.g., driver's license, passport)

- Any existing correspondence related to the note

- Records of payments or transactions tied to the note

- Title insurance documents if applicable

Having these documents ready can facilitate smoother transactions and legal processes.

Key takeaways

The New York Affidavit of Lost Note is an essential document for lenders needing to assert ownership of a lost promissory note. Completing this affidavit requires accuracy and thoroughness, and it plays a critical role in protecting lenders’ rights. Users should be aware of common pitfalls and necessary supplemental documents to ensure compliance and validity of the affidavit in legal settings.

Form popularity

FAQ

They contain only the following details: Full legal name of the affiant; Date of birth of the affiant; Address of the affiant; Identifying details of the lost item; The date of loss or discovery of loss; An explanation of the circumstances surrounding the loss; and. The signature and notarization.

Even if a promissory note is lost, the legal obliga on to repay the loan remains. The lender has a right to ?re-establish? the note legally as long as it has not sold or transferred the note to another party.

By Practical Law Finance. A standard form of affidavit used when a promissory note has been delivered to a lender in a financing transaction and subsequently lost by that lender. This Standard Document has integrated notes with important explanations and drafting tips.

In such cases, borrowers must execute new documents, a process that starts with the completion of an affidavit of lost promissory note. It is generally accepted that the lender who loses his or her promissory note can nonetheless enforce the debt it represents by signing an affidavit of lost promissory note.

An Affidavit of Lost Note is a legal document that can be used to confirm under oath that a Promissory Note or other lending document has been lost.

A collection of the lender's promises to the borrower, which collectively form the ?indemnity.? The lender is here promising to release all claims that it might have against the borrower relating to the original note. This is another way of saying the original note will no longer be a valid instrument.