Nevada Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit)

Description

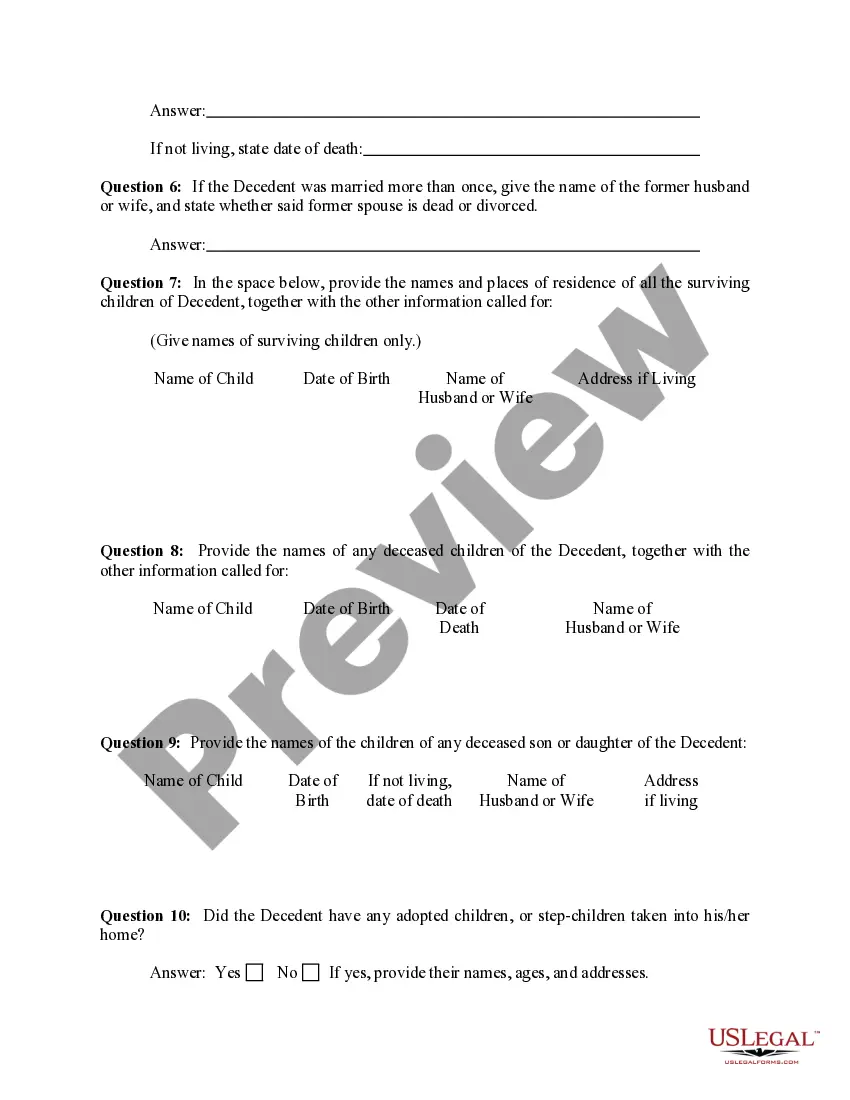

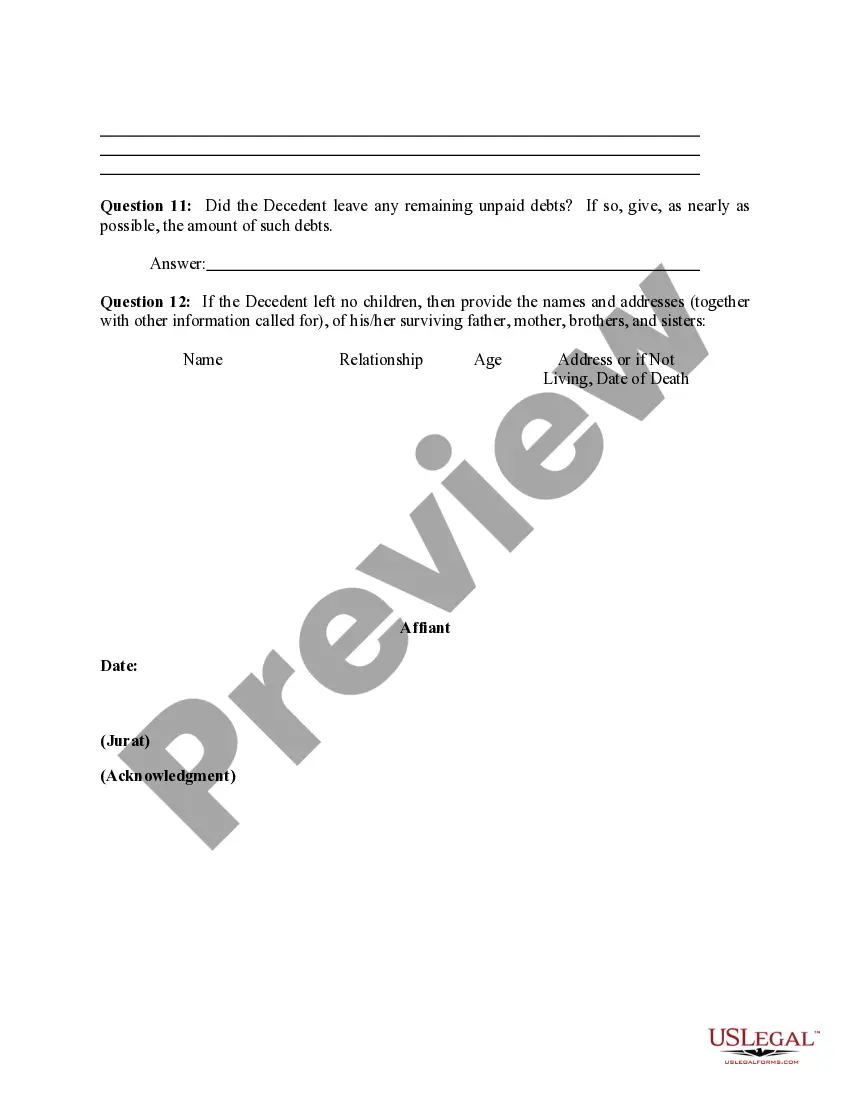

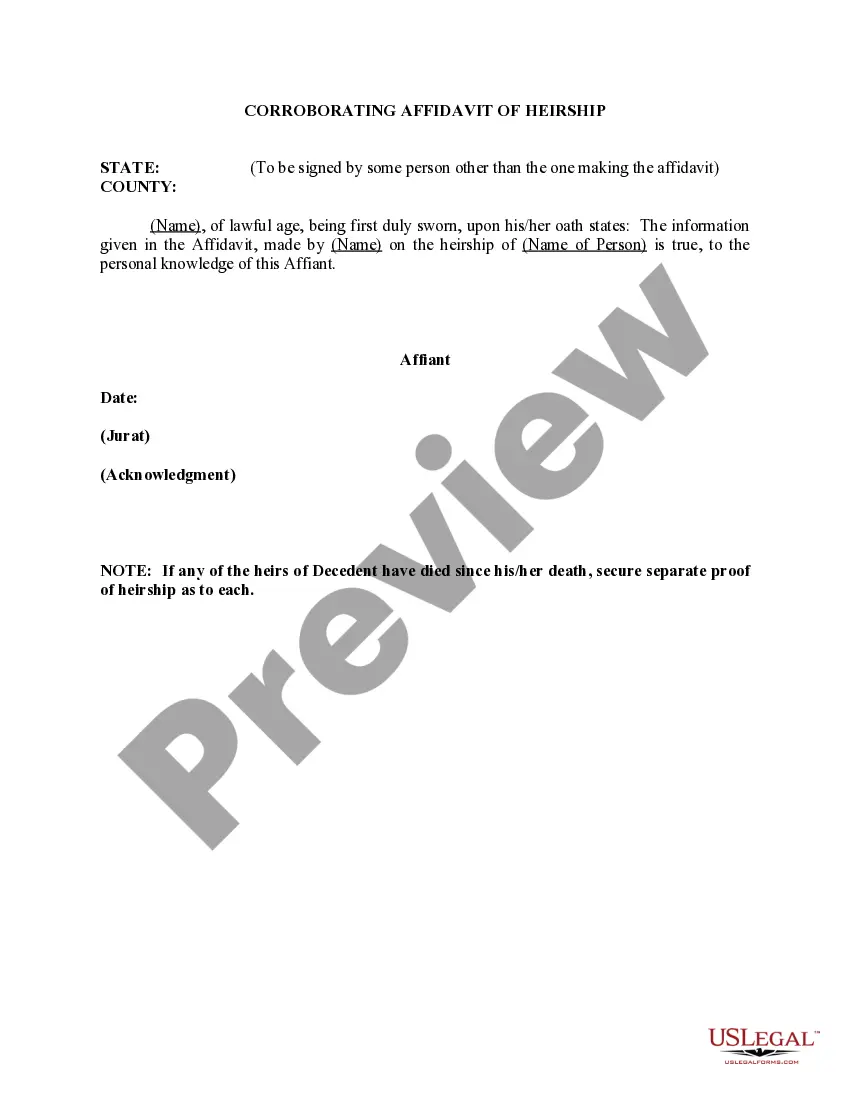

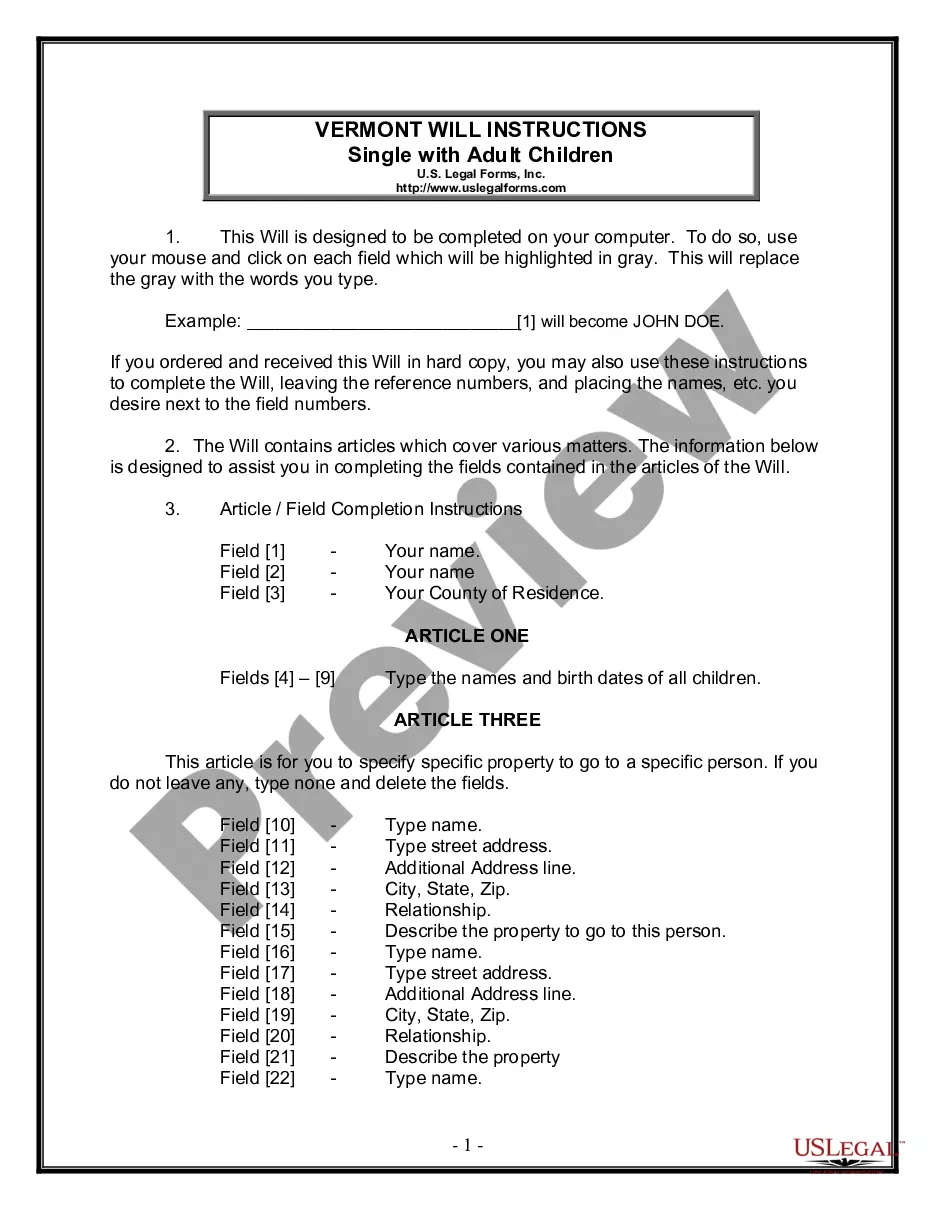

How to fill out Affidavit As To Heirship Of (Name Of Person), Deceased (With Corroborating Affidavit)?

US Legal Forms - one of the greatest libraries of legal forms in the States - gives a variety of legal document templates it is possible to down load or print. Making use of the website, you can find 1000s of forms for organization and personal purposes, categorized by groups, suggests, or keywords.You can find the most recent types of forms like the Nevada Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) in seconds.

If you already have a membership, log in and down load Nevada Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) through the US Legal Forms library. The Down load switch can look on every single type you perspective. You get access to all in the past downloaded forms in the My Forms tab of your respective accounts.

In order to use US Legal Forms initially, listed below are basic guidelines to help you began:

- Make sure you have selected the right type for your area/county. Click the Preview switch to analyze the form`s articles. Look at the type information to ensure that you have chosen the correct type.

- In the event the type doesn`t fit your requirements, use the Look for area near the top of the display to get the one that does.

- When you are satisfied with the shape, validate your choice by clicking the Buy now switch. Then, opt for the costs plan you want and supply your qualifications to sign up to have an accounts.

- Procedure the purchase. Make use of Visa or Mastercard or PayPal accounts to perform the purchase.

- Find the file format and down load the shape on your own product.

- Make alterations. Fill out, change and print and signal the downloaded Nevada Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit).

Every format you put into your account does not have an expiration day and it is your own property for a long time. So, if you would like down load or print one more duplicate, just proceed to the My Forms segment and then click around the type you need.

Get access to the Nevada Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) with US Legal Forms, by far the most extensive library of legal document templates. Use 1000s of expert and condition-distinct templates that satisfy your small business or personal needs and requirements.

Form popularity

FAQ

An Affidavit of Heirship is not a formal adjudication like probate is. Rather, it is an affidavit outlining the deceased person's family history and the identity of heirs. Nothing is filed in the Probate Court. Rather, the affidavits are filed in the public records of any counties in which the decedent owned property.

A Nevada TOD deed must be executed by the property owner and subscribed before a notary. A TOD deed need not identify anything of value provided in exchange for the transfer, as Nevada law does not require TOD deeds to be supported by consideration.

DEATH OF GRANTOR AFFIDAVIT - This form is used to transfer property after a Grantor has passed away and has filed a Nevada Deed Upon Death or Transfer on Death Deed.

If you make a deed upon death on your own, without the other joint tenants, the deed will be effective only if you are the last surviving owner of the property. If you die first, the surviving co-owner(s) will own the property, and the deed upon death won't have any effect.

Forty days after their death, you can file the affidavit in the local Probate Court in the county where the deceased resided. For example, if your loved one lived or died in Clark County, you would file with the county recorder in Clark County Probate Court. You will need to pay a small fee for recording the affidavit.

Establishing a TOD provision in Nevada often involves filling out a form provided by the financial institution holding your assets. For real estate, a TOD deed must be filled out and recorded with the county recorder's office.

The Nevada Deed Upon Death is like a regular deed you might use to transfer real estate located in Nevada, but with a crucial difference: It doesn't take effect until your death. At your death, the real estate goes automatically to the person you named to inherit it, without the need for probate court proceedings.

This transfer technically happens "as a function of law" when one owner dies. Even so, surviving spouses must initiate the process by recording an affidavit of death, accompanied by a certified copy of the death certificate, to terminate all title to or interest in real property of the deceased spouse.