Nevada Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool

Description

How to fill out Assignment Of Overriding Royalty Interest With Multiple Leases That Are Non Producing With Reservation Of The Right To Pool?

Discovering the right legitimate file design could be a battle. Naturally, there are a lot of web templates available online, but how will you get the legitimate kind you want? Use the US Legal Forms site. The assistance offers thousands of web templates, for example the Nevada Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool, which can be used for organization and personal needs. Each of the forms are checked out by specialists and meet state and federal demands.

In case you are already registered, log in in your profile and then click the Down load key to obtain the Nevada Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool. Make use of profile to check through the legitimate forms you have bought earlier. Check out the My Forms tab of your own profile and get another version of the file you want.

In case you are a brand new end user of US Legal Forms, listed below are straightforward directions for you to follow:

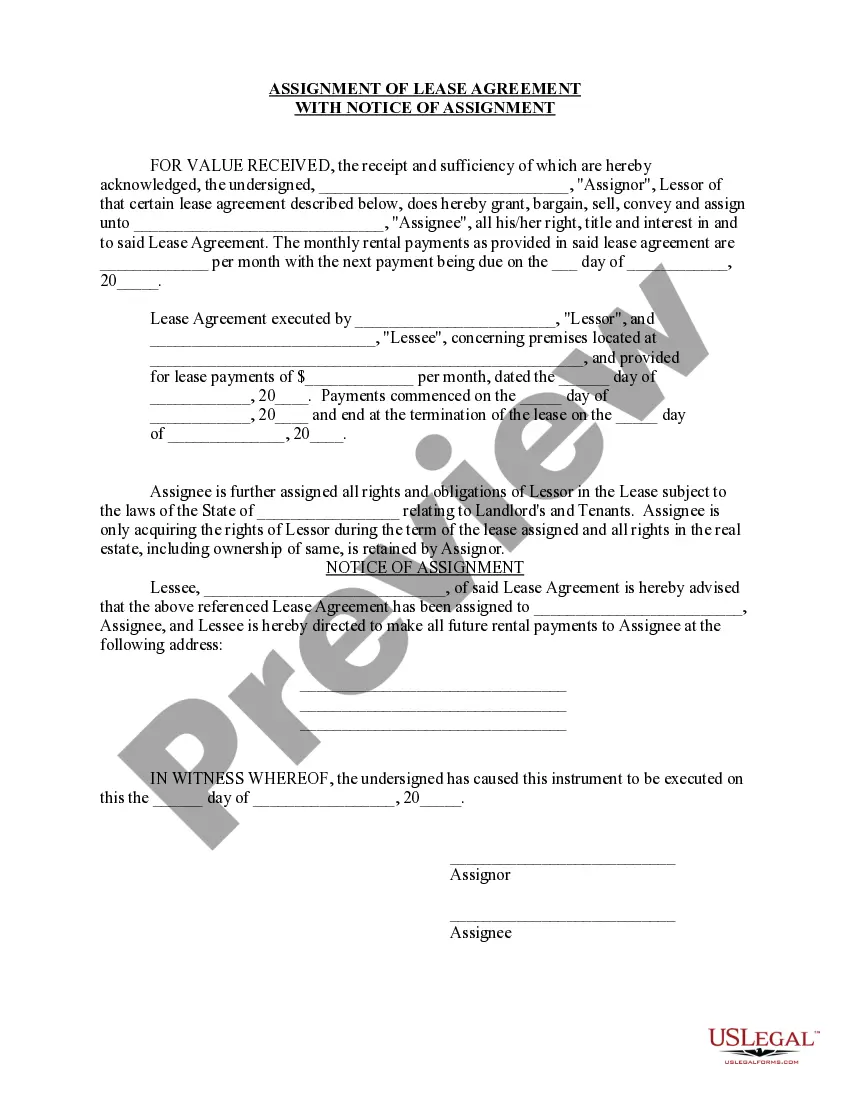

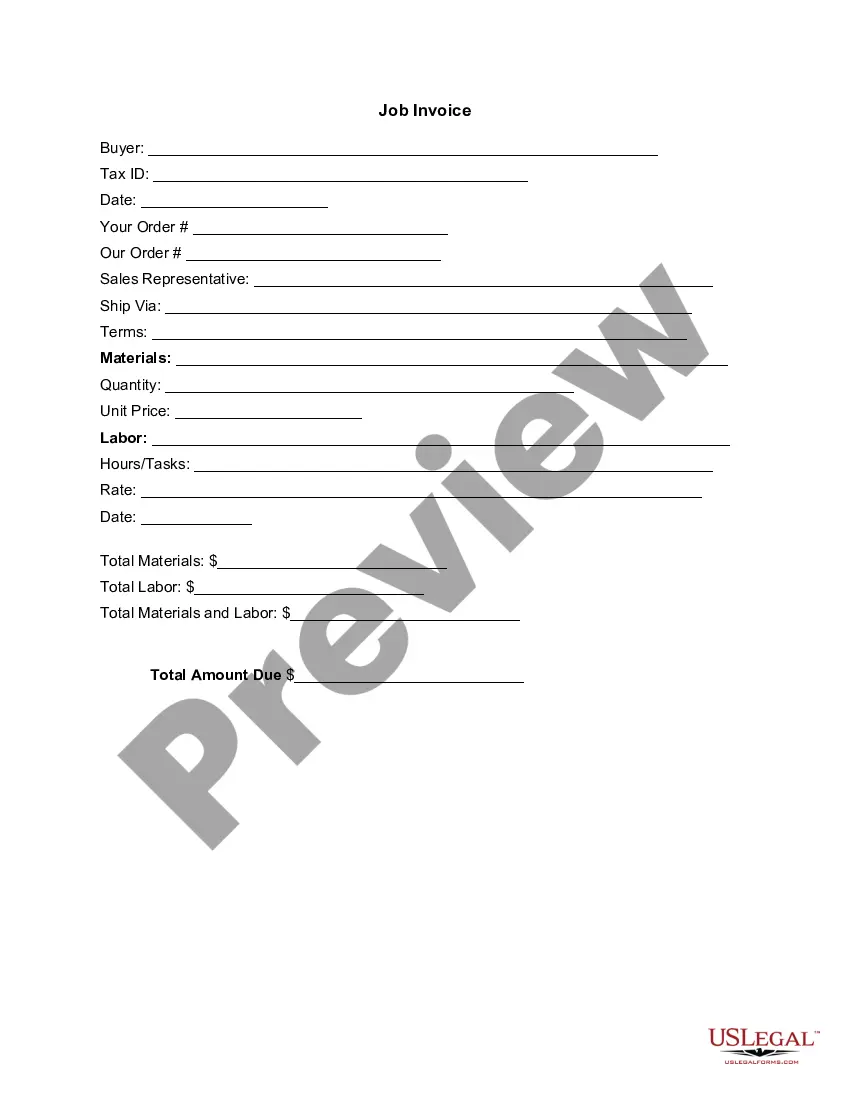

- Initial, ensure you have selected the correct kind for your metropolis/region. It is possible to check out the shape while using Review key and study the shape description to make sure it is the best for you.

- In case the kind will not meet your preferences, utilize the Seach area to get the right kind.

- When you are certain that the shape is acceptable, click on the Purchase now key to obtain the kind.

- Opt for the costs program you desire and enter the needed information. Create your profile and purchase your order utilizing your PayPal profile or charge card.

- Choose the document structure and download the legitimate file design in your product.

- Full, change and print and sign the attained Nevada Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool.

US Legal Forms is the largest collection of legitimate forms where you can see various file web templates. Use the service to download professionally-manufactured papers that follow state demands.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

Overriding Royalty Interest Conveyance means an assignment, in the form attached hereto as Exhibit F, pursuant to which Subsidiary Borrower grants to Lender a cost-free overriding royalty interest equal to a percentage determined pursuant to Section 8.5 of the Hydrocarbons and other minerals attributable to Subsidiary ...

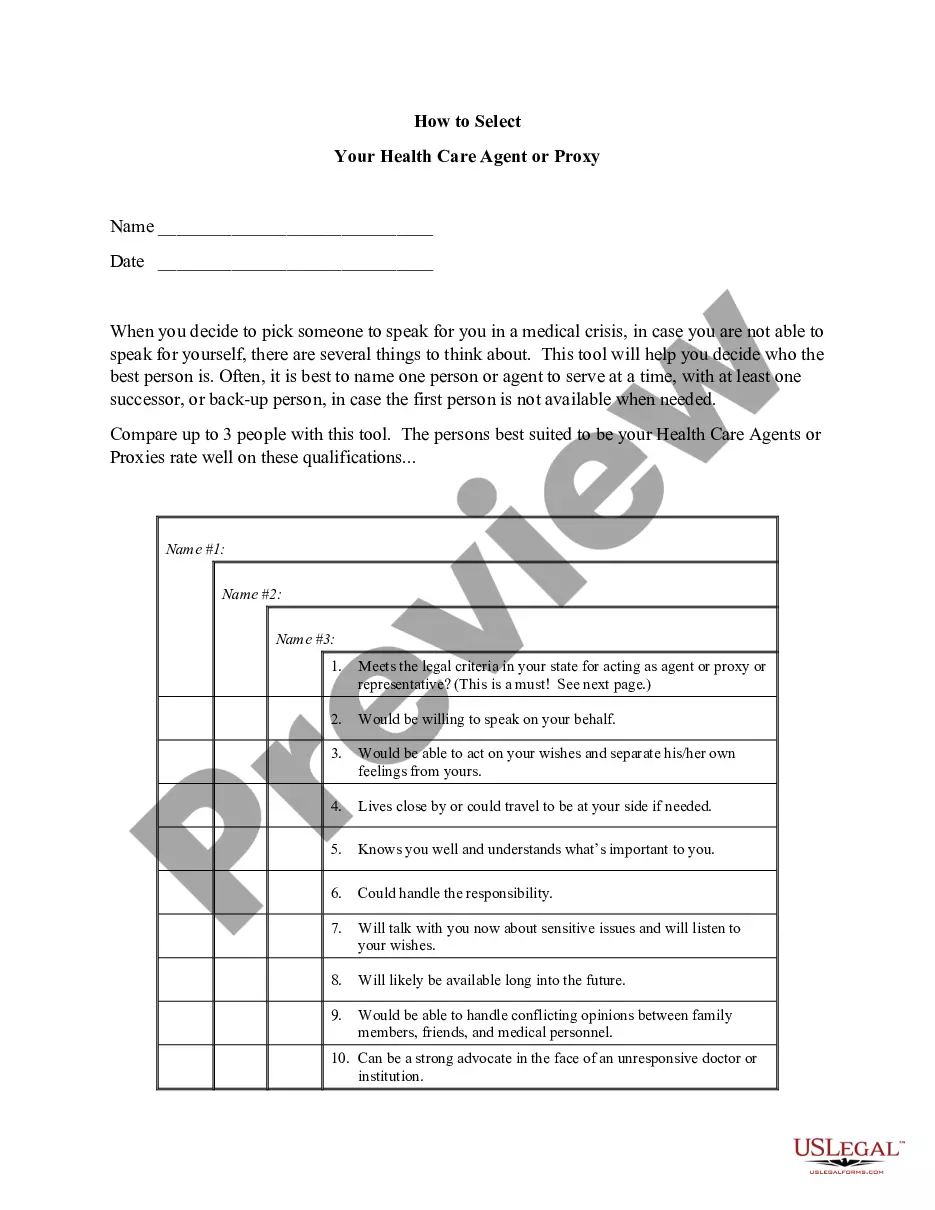

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

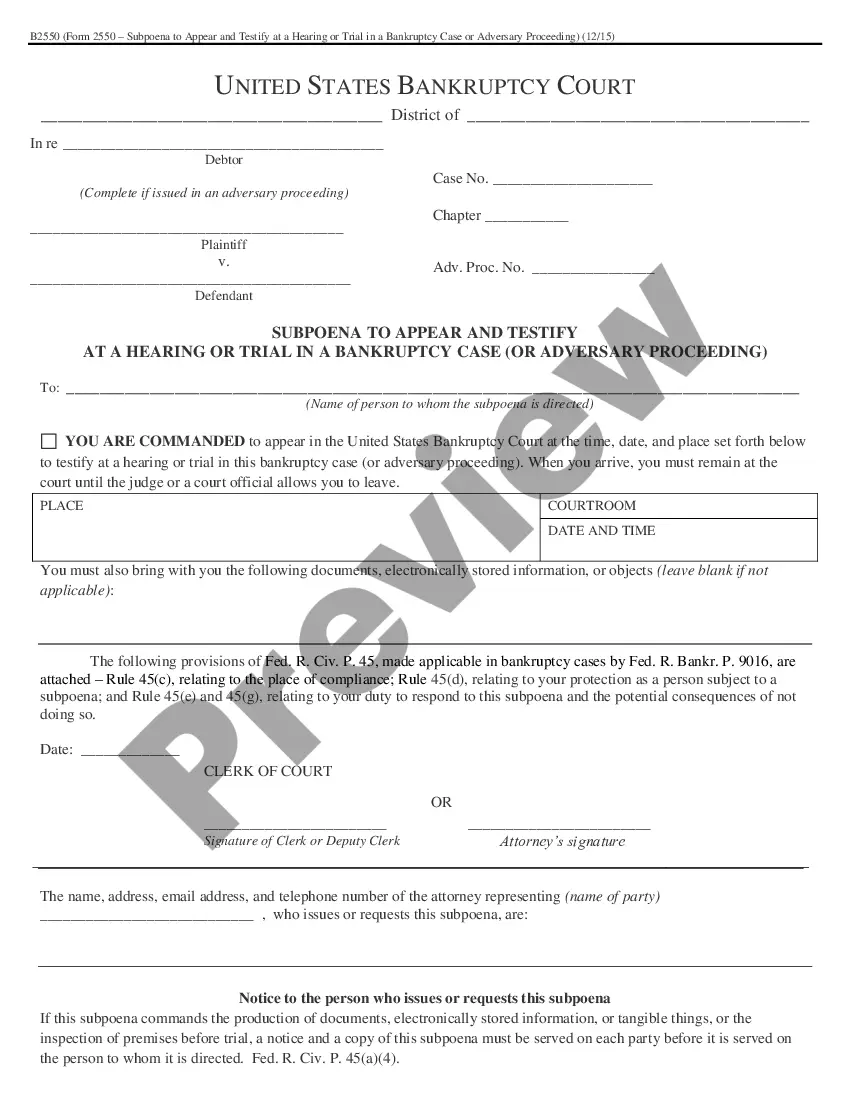

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.