Nevada Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer

Description

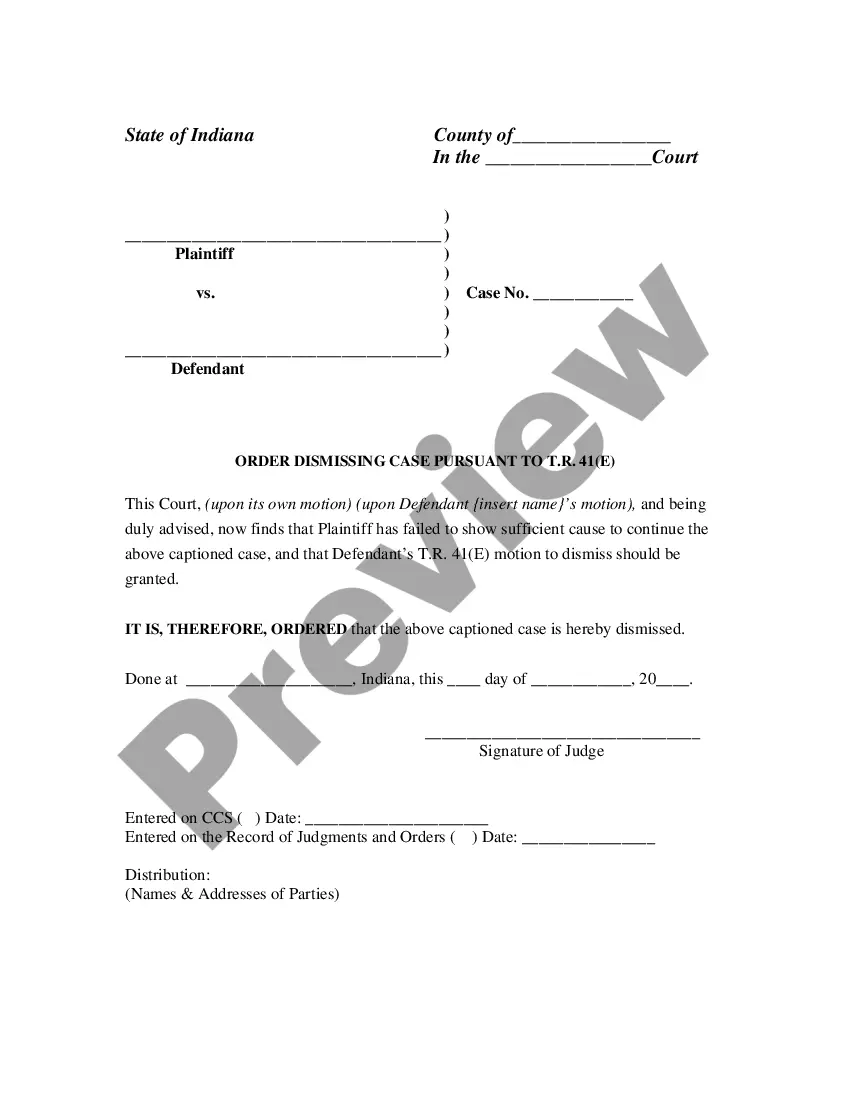

How to fill out Mineral Deed With Grantor Reserving Executive Rights In The Interest Conveyed - Transfer?

Are you presently in the placement in which you need files for possibly enterprise or individual uses almost every time? There are tons of authorized papers themes available on the net, but getting ones you can depend on isn`t simple. US Legal Forms gives thousands of type themes, like the Nevada Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer, which are composed to fulfill state and federal needs.

In case you are already knowledgeable about US Legal Forms site and also have a merchant account, simply log in. Afterward, you are able to acquire the Nevada Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer design.

Should you not provide an accounts and would like to begin using US Legal Forms, adopt these measures:

- Find the type you require and make sure it is for that appropriate town/state.

- Make use of the Review switch to examine the shape.

- Read the information to actually have selected the right type.

- In case the type isn`t what you are trying to find, make use of the Research field to obtain the type that suits you and needs.

- If you get the appropriate type, click on Acquire now.

- Choose the rates prepare you want, fill out the necessary details to make your money, and pay money for the order utilizing your PayPal or charge card.

- Decide on a convenient data file format and acquire your backup.

Discover all the papers themes you possess bought in the My Forms food selection. You can obtain a more backup of Nevada Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer any time, if necessary. Just select the necessary type to acquire or print out the papers design.

Use US Legal Forms, the most considerable variety of authorized kinds, to save some time and prevent faults. The service gives expertly manufactured authorized papers themes which can be used for a variety of uses. Produce a merchant account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

The term ?words of conveyance? refers to a clause that is included in a property's deed. This clause states that the grantor intends to convey title to the land. Words of conveyance may also be referred to as a Granting Clause.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

Check the County Clerk's Office To find information on mineral rights, you may also visit the county clerk's office in the county where the minerals are located. This office stores data, documents, and records of leases and deeds filed for mineral rights.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

A mineral interest is simply a real property interest obtained from the severance or exploitation of minerals ? say natural gas ? from the surface. On the other hand, a royalty interest is the property interest that grants an owner a portion of the production revenue generated.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.