Nevada Partition Deed for Mineral / Royalty Interests

Description

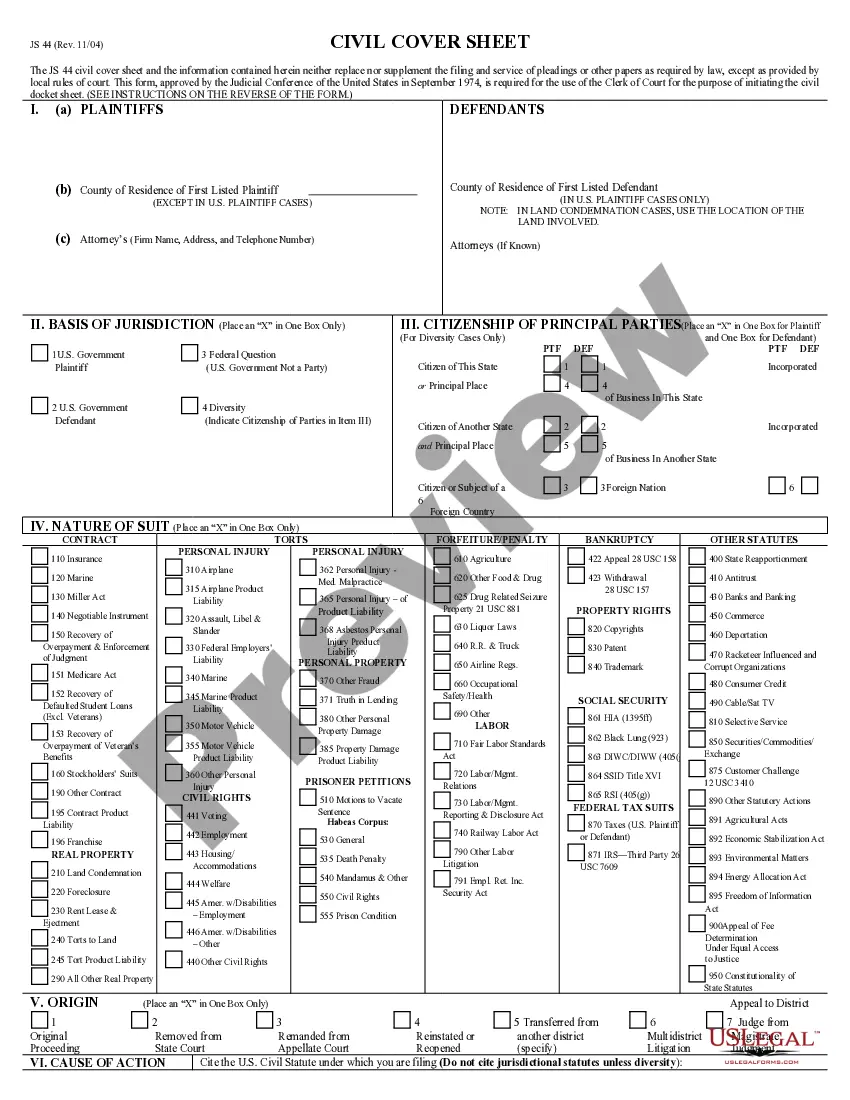

How to fill out Partition Deed For Mineral / Royalty Interests?

Are you presently within a position that you need to have paperwork for either organization or individual functions nearly every working day? There are a lot of legitimate record web templates available on the Internet, but discovering versions you can trust isn`t easy. US Legal Forms delivers a huge number of develop web templates, just like the Nevada Partition Deed for Mineral / Royalty Interests, that are published in order to meet state and federal needs.

If you are previously informed about US Legal Forms site and have a free account, merely log in. Next, you may download the Nevada Partition Deed for Mineral / Royalty Interests format.

Should you not have an bank account and need to begin to use US Legal Forms, follow these steps:

- Discover the develop you want and ensure it is for that correct metropolis/state.

- Make use of the Preview option to examine the form.

- Browse the description to ensure that you have chosen the correct develop.

- In the event the develop isn`t what you`re searching for, make use of the Search area to get the develop that fits your needs and needs.

- Whenever you find the correct develop, click on Buy now.

- Pick the prices program you desire, fill out the specified information to make your money, and purchase your order with your PayPal or charge card.

- Pick a handy data file structure and download your backup.

Discover all the record web templates you may have bought in the My Forms menu. You can aquire a additional backup of Nevada Partition Deed for Mineral / Royalty Interests any time, if possible. Just click on the necessary develop to download or produce the record format.

Use US Legal Forms, the most comprehensive assortment of legitimate kinds, in order to save time and stay away from mistakes. The service delivers appropriately produced legitimate record web templates which can be used for a range of functions. Make a free account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

To find information on mineral rights, you may also visit the county clerk's office in the county where the minerals are located. This office stores data, documents, and records of leases and deeds filed for mineral rights.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Mineral owners receive royalties from the operators as compensation for their share of all production of minerals on the property. During lease negotiations, the two parties define and record the terms of the royalty payment. Usually, the percentage of royalties ranges between 12.5% to 25%.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

How do you Stake a Mining Claim? Find an area of interest. Your first step will be to determine where to search for mineral deposits. ... Conduct a land status search. ... Map your location and determine your claim type. ... Stake the ground. ... File Notice of Location(s). ... Pay Your Fees.