Nevada Self-Employed Part Time Employee Contract

Description

How to fill out Self-Employed Part Time Employee Contract?

Are you facing a circumstance where you require documentation for both business or specific purposes almost every day.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, including the Nevada Self-Employed Part Time Employee Contract, designed to comply with federal and state regulations.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Nevada Self-Employed Part Time Employee Contract at any time if needed. Just select the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you will be able to download the Nevada Self-Employed Part Time Employee Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

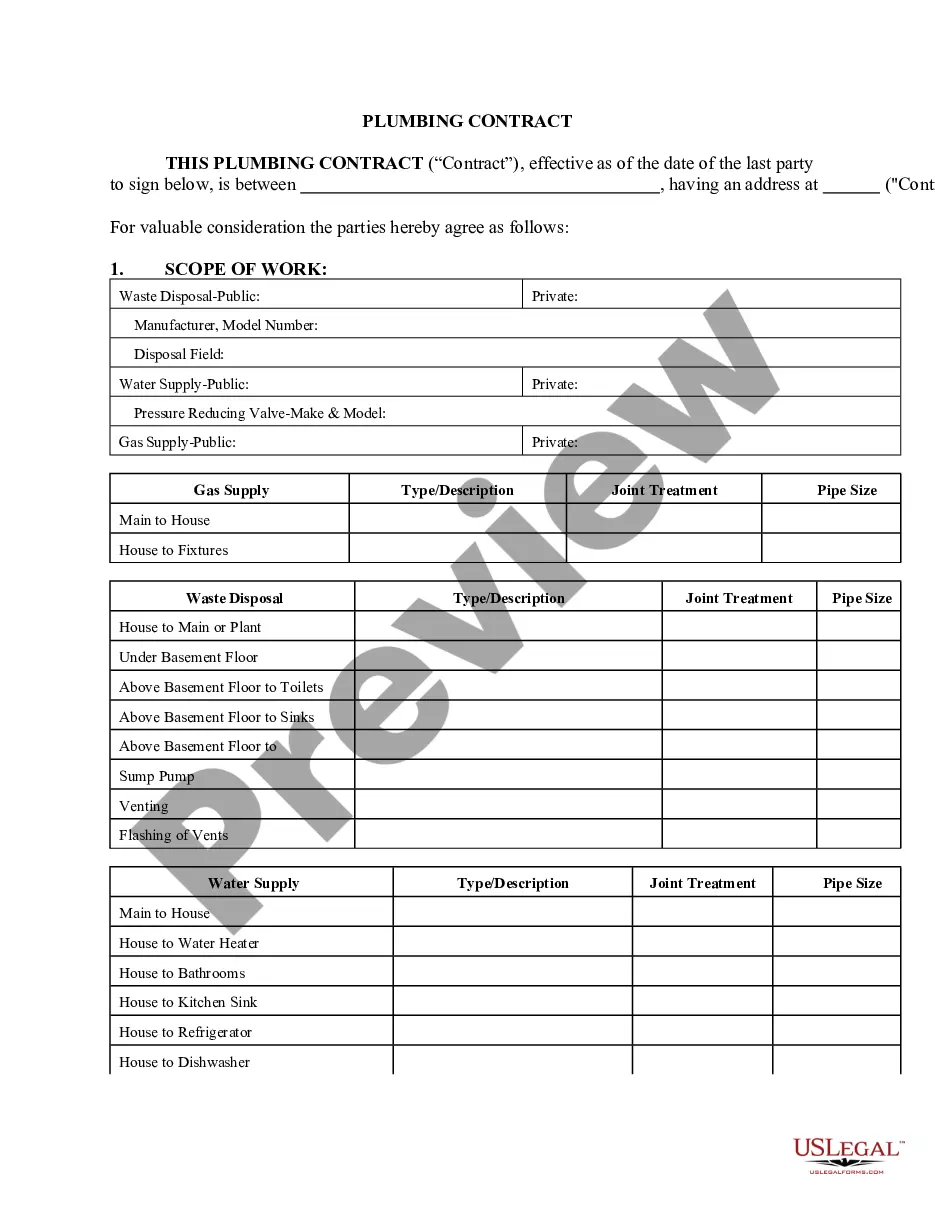

- Use the Review feature to examine the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you are looking for, utilize the Search bar to find the form that meets your needs and requirements.

- Once you find the appropriate form, click Buy now.

- Choose the pricing plan you desire, fill in the necessary information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed. For more information on your tax obligations if you are self-employed (an independent contractor), see our Self-Employed Individuals Tax Center.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Short answer: Full-time employment is usually considered between 30-40 hours a week, while part-time employment is usually less than 30 hours a week.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.