Nevada Self-Employed Nail Technician Services Contract

Description

How to fill out Self-Employed Nail Technician Services Contract?

If you need to finish, acquire, or print authentic document templates, utilize US Legal Forms, the top selection of official forms available online.

Leverage the site's user-friendly and convenient search to locate the documents you require.

A range of templates for business and personal purposes are categorized by type and state, or by keywords.

Step 4. After you have located the form you need, click the Buy Now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can pay using your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to locate the Nevada Self-Employed Nail Technician Services Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to obtain the Nevada Self-Employed Nail Technician Services Agreement.

- You can also access forms you have previously downloaded under the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate state/region.

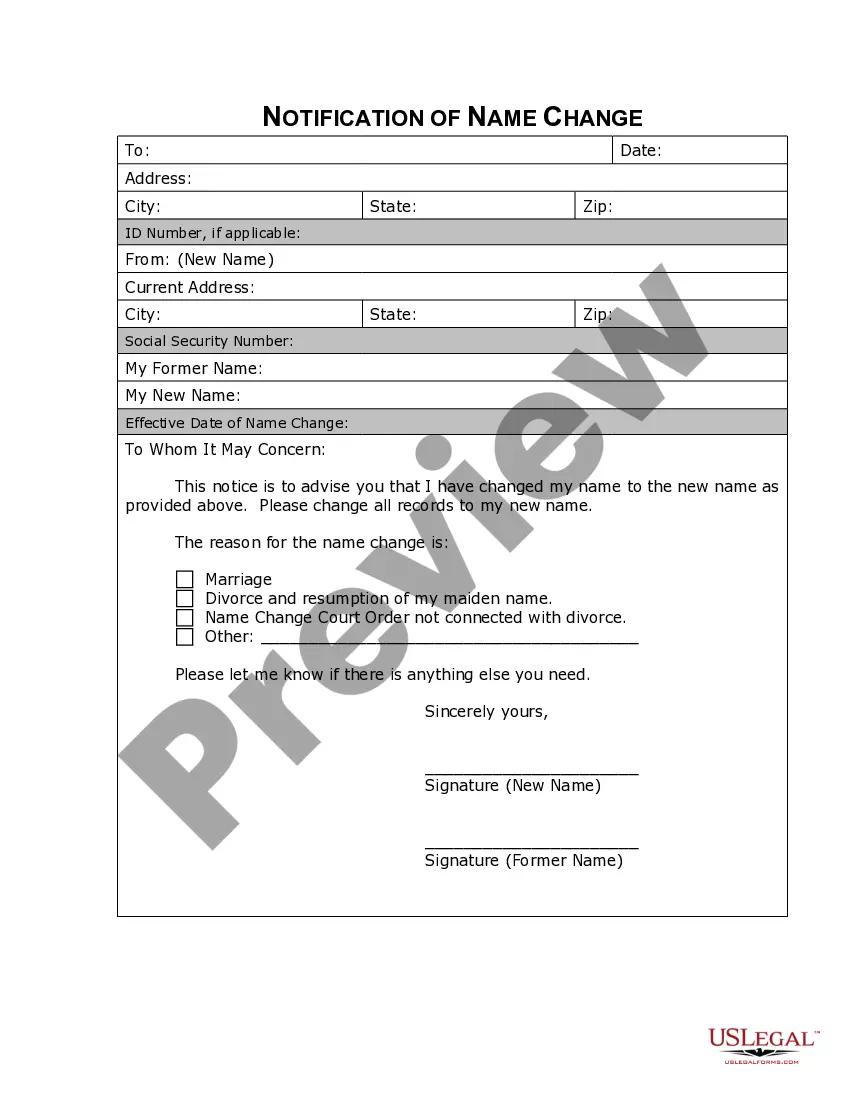

- Step 2. Use the Preview feature to review the form's contents. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative forms in the legal document format.

Form popularity

FAQ

Working for yourself as a nail technician can be rewarding, but being self-employed can also increase your tax burden. When you are self-employed, the Internal Revenue Service considers you to be both the employer and the employee, and that essentially doubles the amount of taxes you pay.

The Basic Essentials:Nail Files + Buffing Blocks. The nail files help shape, file and prepare your nails for nail polish.Nail Drill Bits.Nail system.Variety of colours (dip powders, gel polishes and nail polishes).High-quality base and top coat.Nail removal system.Nail tips and glue.Acrylic and Gel Brushes.More items...?

The Nevada definition of independent contractor The first category captures workers who have applied for a federal employer tax identification number or Social Security number, or has filed a federal income tax return for a business or earnings for self-employment, in the previous year.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

How to Start an In-Home Nail BusinessWhat's the Industry Like? Start by researching the local market.Get Educated.Obtain Licenses and Permits.Make a Business Plan.Invest in Quality Products.Buy the Right Insurance.Promote Your Business.

Using gloves is an important way to stay safe. Gloves should be used when working with clients since this could expose the technician to an assortment of bacterial and fungal infections. In addition, gloves keep solvents and other products used in the nail salon off the technician's skin.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Am I required to have a State Business License? Yes. Unless statutorily exempted, sole proprietors doing business in Nevada must maintain a State Business License. Sole proprietors may submit their State Business License application online at , by mail, or in-person.

All technicians need public and products liability insurance. This type of insurance is inexpensive and will protect you from most situations involving products, whether as a result of an accident or an allergic reaction, for example.